Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.24 11:24

Fundamental Weekly Forecasts for Dollar Index, USD/JPY, GBP/USD, AUD/USD, USD/CNH and GOLD (based on the article)

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.30 09:22

USD/CNH Intra-Day Fundamentals: aixin Manufacturing PMI and 41 pips price movement

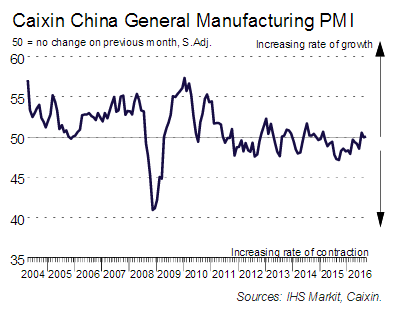

2016-09-30 01:45 GMT | [CNY - Caixin Manufacturing PMI]

- past data is 50.0

- forecast data is 50.1

- actual data is 50.1 according to the latest press release

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[CNY - Caixin Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

=========="The seasonally adjusted Purchasing Managers’ Index™ (PMI™) – a composite indicator designed to provide a single-figure snapshot of operating conditions in the manufacturing economy – rose only slightly from the no-change mark of 50.0 in August to 50.1 in September. Although this signalled only a fractional improvement in the health of the sector, it was only the second time the headline index had posted in positive territory since February 2015."

==========

USD/CNH M5: 41 pips price movement by aixin Manufacturing PMI news event

Weekly Outlook: 2016, October 09 - October 16 (based on the article)

German ZEW Economic Sentiment, US FOMC Meeting Minutes, UK Rate decision, US Unemployment Claims, US Crude Oil Inventories, US Consumer Sentiment and Janet Yellen’s speech; These are the main events on forex calendar.

- German ZEW Economic Sentiment: Tuesday, 9:00. Economic sentiment is expected to improve to 4.2.

- US FOMC Meeting Minutes: Wednesday, 18:00.

- UK Rate decision: Thursday, 11:00. The MPC expect a boost in growth during 2017 if the present economic momentum continues.

- US Unemployment Claims: Thursday, 12:30. The number of new claims is expected to reach 252,000 this week.

- US Crude Oil Inventories: Thursday, 15:00.

- US Retail sales: Friday, 12:30. Retail sales is expected to gain 0.6%, while core sakes are predicted to rise 0.4%.

- US Prelim UoM Consumer Sentiment: Friday, 14:00. U.S. consumer confidence is expected to climb to 92.1 this

- Janet Yellen speaks: Friday, 17:30. Federal Reserve Chair Janet Yellen will give a talk in Boston’s Annual Research Conference. She will talk about the US economic recovery and may give further clues regarding the expected rate hike timetable. Market volatility is expected.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.11 08:03

So why all this talk about the CNY weakness? (adapted from the article)

"In short, the Yuan weakness gives China a comparative and possibly absolute manufacturing and export advantage that could encourage the aggressive fiscal policy stimulus that would naturally align with the “yield curve control’ announced on September 21."

"On Monday, the Chinese Renminbi (off-short Yuan) fell by its largest amount in four months after China opened following National Day Golden Week holiday. The drop amounted to 0.46% for the Yuan but continues to validate the trend of a stronger USD and weaker CNH. The weakening took the Yuan to its lowest level (6.7501) since September 2010 according to Bloomberg data."

"The weakening aligns with China FX reserves shows a rising amount of

capital is leaving. The increase in capital flows could bring volatility

to global markets as the world awaits the next move by the Federal

Reserve that could bring down the Yuan and is encouraging wealthy

citizens of China to move their money overseas in yuan amid Yuan

depreciation expectations.

So why all this talk about the CNY weakness? In short, the Yuan weakness

gives China a comparative and possibly absolute manufacturing and

export advantage that could encourage the aggressive fiscal policy

stimulus that would naturally align with the “yield curve control’

announced on September 21."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.13 15:45

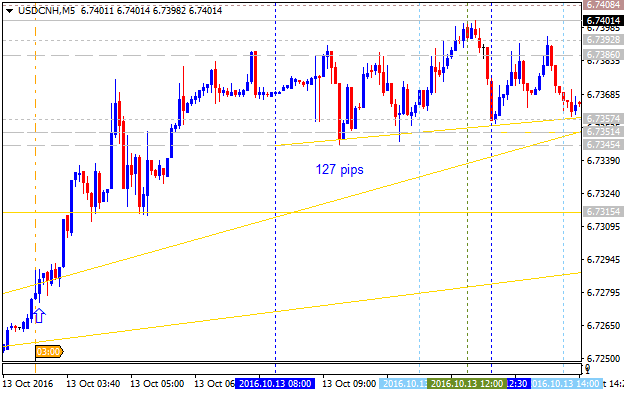

USD/CNH Intra-Day Fundamentals: China Trade Balance and 127 pips price movement

2016-10-13 02:00 GMT | [CNY - Trade Balance]

- past data is 346B

- forecast data is 365B

- actual data is 278B according to the latest press release

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Trade Balance] = Difference in value between imported and exported goods during the previous month.

==========From Forex Live article:

- "China continues to face relatively large difficulties."

- "China will implement policies to stabilise foreign trade growth."

- "Leading indicators show that pressure on exports is likely to ease in Q4."

==========

USD/CNH M5: 127 pips range price movement by China Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.14 09:48

USD/CNH Intra-Day Fundamentals: China Consumer Price Index and 42 pips price movement

2016-10-14 01:30 GMT | [CNY - CPI]

- past data is 1.3%

- forecast data is 1.6%

- actual data is 1.9% according to the latest press release

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - CPI] = Change in the price of goods and services purchased by consumers.

==========From RTT News article:

- "Consumer prices in China were up 1.9 percent on year in September, the National Bureau of Statistics said on Friday."

- "On a monthly basis, consumer prices gained 0.7 percent after gaining 0.1 percent a month earlier."

- "Producer prices were up 0.1 percent on year - turning positive after more than four years of contraction. That compared to forecasts for a 0.3 percent decline following the 0.8 percent contraction in the previous month."

==========

USD/CNH M5: 42 pips range price movement by China Consumer Price Index news event

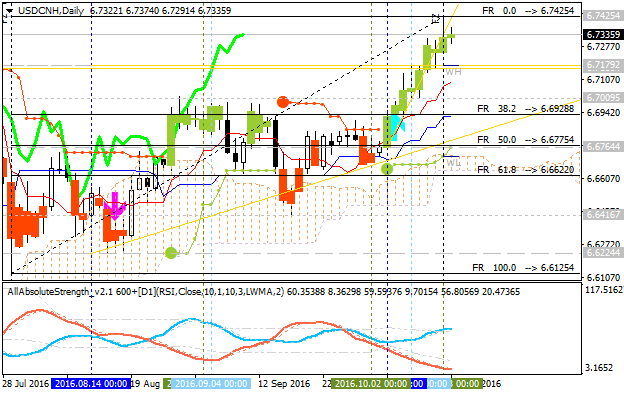

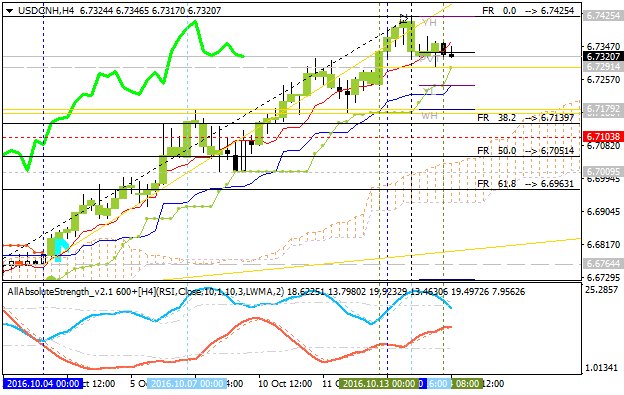

USD/CNH: End Of Week Technicals - Bullish Continuation Or Correction To Be Started

This

trading week is ended with some results concerning USD/CNH: the price was started with the bullish breakout last Friday and it was stopped by 6.7425 resistance level. For now, the price is still on testing with this 6.7425 resistance for the bullish trend to be continuing.

---------

D1 price is located to be above Ichimoku cloud for the primary bullish market condition with the ranging within the following s/r levels:

- 6.7425 resistance level located far above Ichimoku cloud in the bullish area of the chart, and

- 6,7179 support level located in the beginning fo the secondary correction to be started.

H4 price is on bullish trend with 6.7425 resistance level to be broken for the primary bullish condition to be continuing:

- Chinkou Span line is located above the price for the ranging bullish trend by the direction.

- Absolute Strength indicator is estimating the ranging condition to be started.

- Descending triangle pattern was formed by the price to be broken to below for the correction to be started.

- The nearest resistance level for the bullish trend to be resumed is 6.7425.

- Nearest support level for the secondary correction to be started is 6,7179.

- The nearest support level for the bearish reversal is 6,7051.

If H4 price breaks 6.7425 resistance level so the primary bullish trend will be resumed.

If H4 price breaks 6,7179 support so the local downtrend as the secondary ranging correction within the primary bullish trend will be started.

If H4 price breaks 6,7051 support so we may see the bearish reversal to be started for this intra-day price movement.

If not so the price will be on bullish ranging within the levels.

| Resistance | Support |

|---|---|

| 6.7425 | 6,7179 |

| N/A | 6,7051 |

SUMMARY : bullish

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.19 08:16

USD/CNH Intra-Day Fundamentals: China Real GDP and 77 pips range price movement

2016-10-19 02:00 GMT | [CNY - GDP]

- past data is 6.7%

- forecast data is 6.7%

- actual data is 6.7% according to the latest press release

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========From reuters article: China third quarter GDP grows 6.7 percent as expected as construction booms, debt rises

- Some economists believe Beijing has had to "double down" on stimulus this year to meet its official growth range of 6.5 to 7 percent, and say the government's obsession with meeting hard targets may hurt both planned reforms and the long-term health of the world's second-largest economy. "So far this year they have clearly chosen to do everything they can to meet the growth targets, and now there is a little bit of an upward surprise from the housing market which actually will help them with GDP growth this year," said Louis Kuijs, head Of Asia economics at Oxford Economics in Hong Kong.

- "The question really is, is the leadership willing to move to somewhat lower growth targets in order to put growth on a more sustainable footing, or will it feel obliged to continue to hang on to those very high growth targets."

==========

USD/CNH M5: 77 pips range price movement by China Real GDP news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.27 14:58

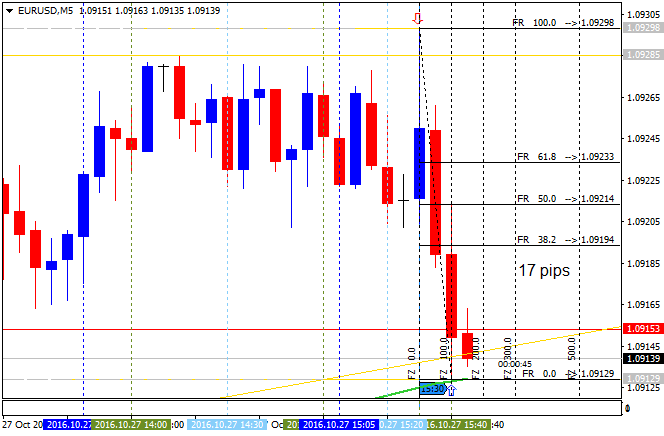

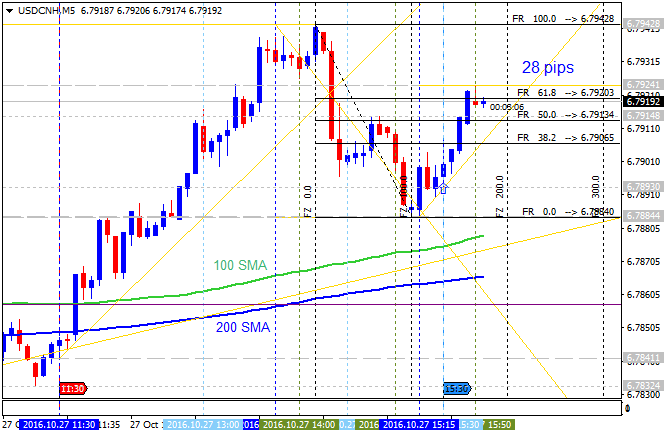

Intra-Day Fundamentals - EUR/USD and USD/CNH : Durable Goods Orders

2016-10-27 12:30 GMT | [USD - Durable Goods Orders]

- past data is 0.1%

- forecast data is 0.1%

- actual data is -0.1% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Durable Goods Orders] = Change in the total value of new purchase orders placed with manufacturers for durable goods.

==========

From Market Watch article: Durable-goods orders soften in September

- "Orders for long-lasting goods made in the U.S. fell slightly in

September, largely because of lower demand for military hardware and

computers."

- "Core orders slumped 1.2% last month and they are down 4.1% over the past year."

- "Weak business investment has contributed to slower U.S. growth in 2016

and there’s little sign that a pickup is around the corner. Inventories

did rise for the third straight month, however, after a slump earlier in

the year."

==========

EUR/USD M5: 17 pips range price movement by Durable Goods Orders news events

==========

USD/CNH M5: 28 pips price movement by Durable Goods Orders news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.28 09:51

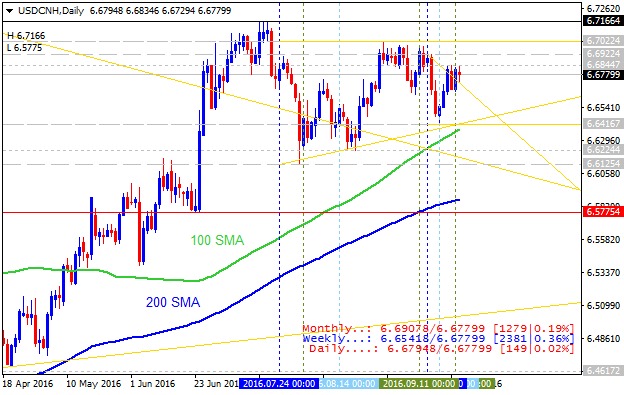

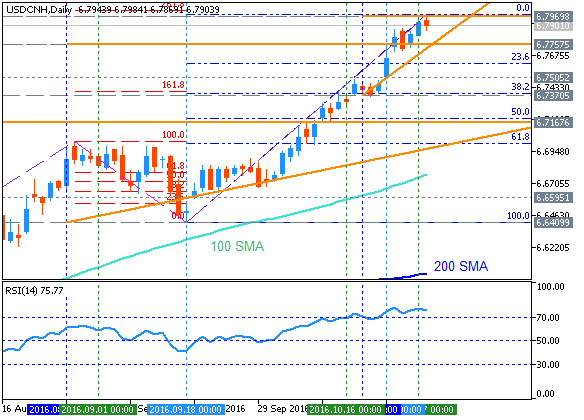

USD/CNH Ahead of US 3Q GDP (based on the article)

Daily price is on primary bullish market cndition located above 100 SMA/200 SMA: the price broke 6.7757 level to above on clos daily bar for 6.7969 resistance level to be broken for the bullish trend to be continuing.

- "The pair surged higher after breaking resistance around the 6.7 handle followed by the 2016 January high around 6.7584."

- "Indeed, momentum still looks strong as we head into today’s key US 3Q GDP numbers, which could prove influential for the pair’s direction in the near term."

- "As it were, price is now sitting in close proximity to the 6.8 handle, and a break higher seems an important milestone for further gains."

- "If the pair reverses course, downside moves might still be interpreted as corrective as long as buyers can keep price above the 6.7 level."

The most likely scenario for the daily price movement is the following: the price breaks 6.8 resistance level to above for the bullish trend to be resumed, otherwise - ranging bullish.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

USD/CNH October-December 2016 Forecast: ranging within narrow s/r levels for the bullish trend to be continuing or to the correction to be started

W1 price is located above Ichimoku cloud in the bullish area of the chart for the ranging within the narrow support/resistance levels:

Chinkou Span line is located above the price indicating the ranging condition, Tenkan-sen line is above Kijun-sen line for the bullish trend to be continuing, and Absolute Strength indicator is estimating the trend to be ranging in the future.

Trend:

W1 - ranging bullish