You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Daily price broke 48.25 resistance on close daily bar: 49.44 is the target, and 53.95 level for the bullish reversal.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.18 16:41

U.S. Commercial Crude Oil Inventories news event: intra-day ranging bullish within narrow levels

2016-05-18 14:30 GMT | [USD - Crude Oil Inventories]

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.3 million barrels from the previous week."

==========

Crude Oil M5: ranging. The price is ranging around 100 SMA/200 SMA area from 49.53 Fibo bullish level to Fibo bearish support level at 48.90.

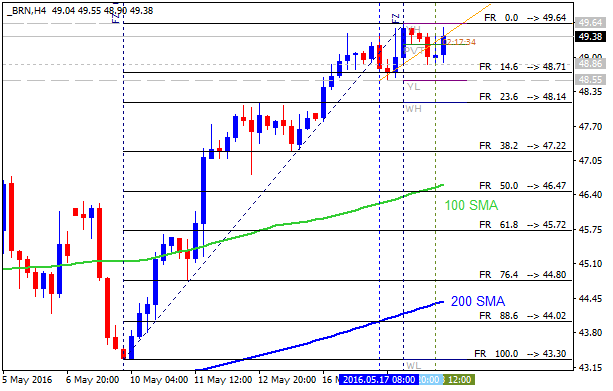

Crude Oil H4: bullish ranging within narrow s/r levels. The price is located above 100 SMA/200 SMA area on the ranging within 49.64 resistance and 46.47 support levels.

If the price breaks 49.64 level to above so the bullish trend for intra-day price movement will be continuing.

If the price breaks 46.47 support level to below so the reversal of the price movement to the primary bearish condition will be started.

If not so the price will be moved within the channel for ranging bullish.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Forex Video May 2013

Sergey Golubev, 2013.05.27 16:57

Trading the Oil Price

Crude oil can be effected by political tensions and people's views on the economy; it is a very volatile market and can easily move 200 to 400 points a day. It is as such one of the more volatile markets out there.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.25 09:25

Technical Analysis for Brent Crude Oil: key resistance level at 49.82 to be broken for the bullish trend to be continuing; 53.95 is the next target (adapted from the article)

Daily price is on primary bullish market condition located above 100-day SMA/200-day SMA reversal area: the price is on ranging within the following key narrow s/r levels:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.25 16:42

U.S. Commercial Crude Oil Inventories news event: bullish ranging above bearish reversal

2016-05-25 14:30 GMT | [USD - Crude Oil Inventories]

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 4.2 million barrels from the previous week."

==========

Crude Oil M5: bullish ranging above bearish reversal. The price is on ranging to be above 200 period SMA within 49.65 resistance and 49.14 support levels.

If the price breaks 49.65 resistance level so the intra-day primary bullish trend will be continuing.

If the price breaks 49.14 support so the reversal of the M5 price movement from the primary bullish to the primary bearish market condition will be started.

If not so the price will be on ranging within the levels.

Crude Oil M5: bullish ranging above bearish reversal. The price is on ranging to be above 200 period SMA within 49.65 resistance and 49.14 support levels.

If the price breaks 49.65 resistance level so the intra-day primary bullish trend will be continuing.

If the price breaks 49.14 support so the reversal of the M5 price movement from the primary bullish to the primary bearish market condition will be started.

If not so the price will be on ranging within the levels.

The price broke 49.14 support level to below on open M5 bar, and 48.88 support level is testing for now.

Intra-day M5 bearish reversal is going on for now.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.01 11:03

Brent Crude Oil 4-month high at 50.83 to be testing to above for the bullish trend to be continuing (adapted from the article)

Daily price is located above 100 SMA/200 SMA reversal area for the bullish market condition. The price is testing 4-month high at 50.83 for the bullish trend to be continuing. Alvernative, if the price breaks 47.56 support level to below so the secondary correction will be started up to 43.30 support level as the bearish reversal target.

- Recommendation

to go short: watch the price to break 43.30 support level for possible sell trade

- Recommendation

to go long: watch the price to break 50.83 resistance level for possible buy trade

- Trading Summary: bullish

TREND : daily bullishForum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.02 17:40

U.S. Commercial Crude Oil Inventories news event: bullish ranging above bearish reversal

2016-06-02 15:00 GMT | [USD - Crude Oil Inventories]

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.4 million barrels from the previous week."

==========

Crude Oil H4: bullish ranging within 4-month high at 50.83 and 10-day low at 47.56. The price is on ranging to be above 200-period SMA and 100-period SMA for the bullish market condition within the following support/resistance levels:

If the price breaks 50.83 resistance level so the intra-day primary bullish trend will be continuing.If the price breaks 47.56 support so the reversal of the H4 price movement from the primary bullish to the primary bearish market condition will be started (in case of daily price - the secondary correction within the primary bullish trend will be started).

If not so the price will be on ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.08 16:49

U.S. Commercial Crude Oil Inventories news event: intra-day ranging within narrow levels; daily bullish trend to 6-month high at 53.95 as a target

2016-06-08 14:30 GMT | [USD - Crude Oil Inventories]

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 3.2 million barrels from the previous week."

==========

Crude Oil M5: ranging within 52.51 resistance and 51.98 support. The price is on ranging within narrow levels located to be above 100 SMA/200 SMA reversal area for the bullish market condition.

If the price breaks 52.51 resistance on close M5 bar so the primary bullish trend will be continuing.

If the price breaks 51.98 support level to below on close M5 bar so the reversal of intra-day price movement to the primary bearish trend will be started on the secondary ranging way.

Crude Oil Daily: bullish trend to 6-month high at 53.95 as a target. The price is located above 100 SMA/200 SMA reversal area for the primary bullish market condition: price is breaking 51.51 resistance level to above for 6-month high at 53.95 as a nearest bullish target to re-enter.

If the price breaks 53.95 level to above so the bullish trend will be continuing with 55.54 possible target for breakout.

If the price breaks 44.60 support level to below so the reversal of the price movement to the ranging bearish condition will be started.

If not so the price will be moved within the channel for ranging bullish.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.15 17:08

U.S. Commercial Crude Oil Inventories news event: intra-day ranging bullish within 100 SMA/200 SMA reversal area

2016-06-15 14:30 GMT | [USD - Crude Oil Inventories]

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 0.9 million barrels from the previous week."

==========

Crude Oil M5: ranging bullish. The price broke 100 SMA/200 SMA area to above to be reversed to the primary bullish market condition. The price was bounced from Fibo resistance at 49.64 for the ranging to eb started within the following support/resistance levels:

Crude Oil H4: ranging within narrow 100 SMA/200 SMA levels. The price is located within 100 SMA/200 SMA area and near above 200 SMA for the ranging bullish market condition.

If the price breaks Tuesday high at 50.02 to above so the bullish trend for intra-day price movement will be resumed.

If the price breaks 48.80 support level to below so the reversal of the price movement to the primary bearish condition will be started.

If not so the price will be moved within the channel for ranging.