Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.01 09:07

Ahead of NFP: Fundamental Forecasts by Bank of America Merrill Lynch, Nordea Bank AB and Skandinaviska Enskilda Banken (adapted from the article)

2016-04-01 08:55 GMT | [USD - Non-Farm Employment Change]

- past data is 242K

- forecast data is 206K

- actual data is n/a according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

- BofAML:

"The March employment report likely showed another strong month for the

labor market. We anticipate a healthy 190,000 gain in nonfarm payrolls,

with the private sector contributing 185,000."

- Nordea: "We expect a 200k gain in nonfarm payrolls in March after the surprisingly strong 242k rise in February, consistent with a continued healthy labour market improvement."

- SEB: "We take the lowside on this one and forecast a 180k on the headline, 170k on private employment, 0.1% on average hourly earnings and 4.9% on the unemployment rate."

==========

GOLD (XAU/USD) M5: ranging bullish near reversal area. Intra-day price is located near and above 100/200

period SMA for the bullish market condition with the secondary ranging. if the price breaks 1235.24 resistance to above so the bullish trend will be continuing, otheerwise the price will be on secondary ranging with the possible bearish reversal by breaking 1231.65 support to below and 1229.24 target to re-enter.

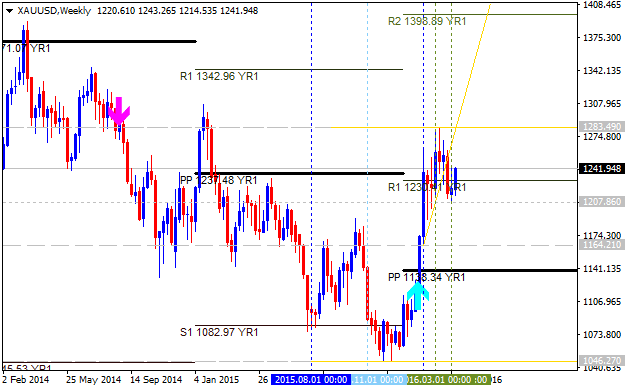

XAUUSD Pivot Points Analysis - ranging around R1 Pivot at 1230.41

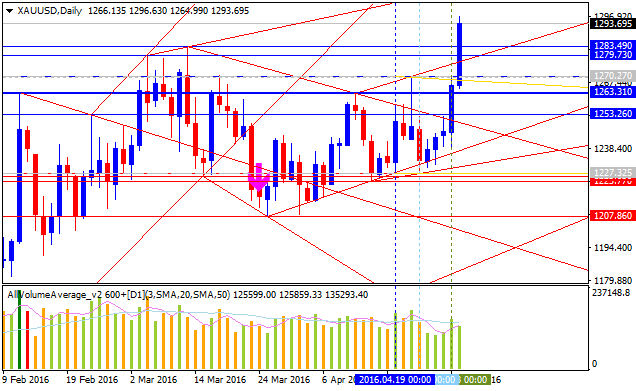

W1 price was on bullish reversal breakout since end of January this year: the price broke Central Yearly Pivot at 1138.34 to above to be reversed from the primary bearish to the primary bullish market condition. Price is ranging for now around R1 Pivot at 1230.41 just having 2 main scenarios for the movement in the future:

- if the price breaks 1283.49 resistance level on close weekly bar so the primary bullish trend will be continuing up to R2 Pivot at 1398.89,

- if the price breaks 1207.86 support level to below on close weekly bar so the local downtrend as the secondary correction will be started.

| Instrument | S1 Pivot | Yearly PP | R1 Pivot | R2 Pivot |

|---|---|---|---|---|

| XAU/USD | 969.87 | 1138.34 |

1230.41 | 1398.89 |

Trend:

- W1 - ranging bullish

Forecast for Tomorrow - levels for GOLD (XAU/USD)

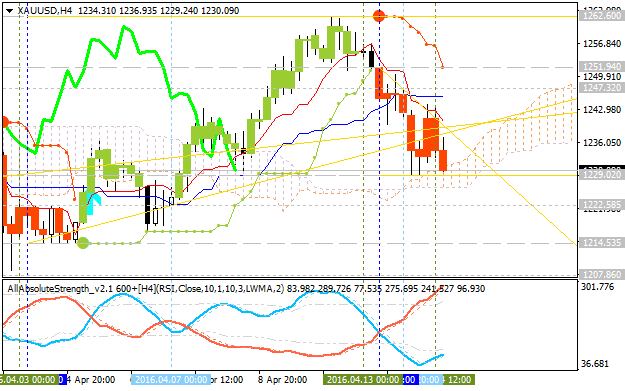

XAU/USD: intra-day breakdown with possible bearish reversal. This pair is on breakdown for crossing Ichimoku cloud to below for the reversal of the intra-day price movement from the primary bullish to the primary bearish market condition: price is testing 1229.02 support level to below for the breakdown to be continuing.

- if the price

breaks 1251.94 resistance so the bullish trend will be continuing with 1262.60 target;

- if the price breaks 1229.02 support level so the bearish reversal will be started up to 1222.58 as the next target to re-enter;

- if not so the price will be moved within the channel.

| Resistance | Support |

|---|---|

| 1251.94 | 1229.02 |

| 1262.60 | 1222.58 |

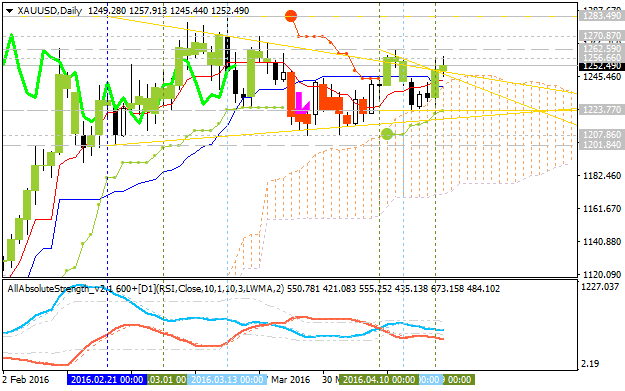

Daily Technical Analysis for GOLD (XAU/USD)

XAU/USD: daily bullish breakout to be started on open bar. The price is located near and above Ichimoku cloud in the beginning of the primary bullish area of the daily chart: price is testing 1270.87 resistance level together with Chinkou Span crossing the price to abiove on open daily bar for now for the bullish breakout to be started in the near future. Alternative, if the price breaks 1201.84 support level to below so the bearish reversal will be started. Anyway, Absolute Strength indicator is estimating the ranging condition to be continuing with the price to be located inside Ichimoku cloud in the future.

- if the price

breaks 1270.87 resistance so the bullish trend will be continuing with 1283.49 target;

- if the price breaks 1201.84 support level so the bearish reversal will be started;

- if not so the price will be moved within the channel.

| Resistance | Support |

|---|---|

| 1270.87 | 1201.84 |

| 1283.49 | N/A |

GOLD (XAU/USD) Intra-Day Price Action Analysis - bearish ranging on bullish reversal area

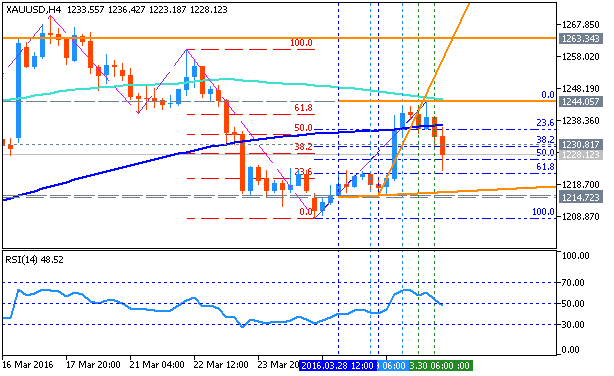

H4 price was on breakdown with the bearish reversal: price broke 100 SMA/200 SMA reversal levels for the bearish market condition with the secondary ranging to be started within the following key support/resistance levels:

- 50.0% Fibo resistance level at 1,248.79 located above 100 SMA/200 SMA in the primary bullish area of the chart, and

- Fibo support level at 1,227.32 located below 100 SMA/200 SMA in the primary bearish area.

RSI indicator is estimating the ranging bearish market condition to be continuing.

If the price will break Fibo support level at 1,227.32 so the primary bearish trend will be continuing without secondary ranging.

If the price will break 50.0% Fibo resistance level at 1,248.79 from below to above so we may see the reversal of the price movement from the ranging bearish to the primary bullish market condition.

If not so the price will be ranging within the levels.

| Resistance | Support |

|---|---|

| 1,248.79 | 1,227.32 |

| 1,270.27 | N/A |

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.30 08:58

Fundamental Weekly Forecasts for Dollar Index, EUR/USD, GBP/USD, USD/CNH, USD/CAD, AUD/USD and GOLD (based on the article)

GOLD (XAU/USD) - "Will the US economy add jobs as expected? That is a question to be answered on Friday May 6. US Non-Farm Payrolls are set to be released and the market is anticipating that 215k jobs were added. If the market sees the jobs report as an inflationary number, then we may see gold price sell off. This, in my opinion, would be the resulting recognition that inflation is trying to bubble up and rate hikes may come sooner. If the market sees the jobs report as a disinflationary figure, Gold prices may continue to bump higher."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.05.07 09:45

Forex Weekly Outlook May 9-13 (based on the article)

Graeme Wheeler’s speech, US Crude Oil Inventories, rate decision, Mark Carney’s speech, US Unemployment Claims, Retail sales, Producer Prices and consumer sentiment. These are the main events on Forex calendar.

- Graeme Wheeler speaks: Tuesday, 22:05. RBNZ Governor Graeme Wheeler will speak in Wellington to elaborate on the economic factors which prompted the last cash rate decision towards the end of April.

- US Crude Oil Inventories: Wednesday, 15:30.

- UK Rate decision: Thursday, 12:00. The Bank of England decided to keep rates unchanged at its April meeting aiming to reach the 2% inflation target and maintain growth and employment. The MPC members forecast the Bank rate will rise to ensure inflation returns to the target in a sustainable fashion. However, the EU referendum effects may spoil forecasts.

- Mark Carney speaks: Thursday, 12:45. The Bank of England governor Mark Carney will speak in London about the Inflation.

- US Unemployment Claims: Thursday, 13:30.

- German GDP data: Friday, 7:00.

- US retail sales: Friday, 13:30.

- US PPI: Friday, 13:30.

- US Prelim UoM Consumer Sentiment: Friday, 15:00. Consumer confidence declined for the fourth straight month in April registered 89.7 from 91 posted in March amid growing concerns about weaker economic growth. Analysts expected a positive reading of 91.9.

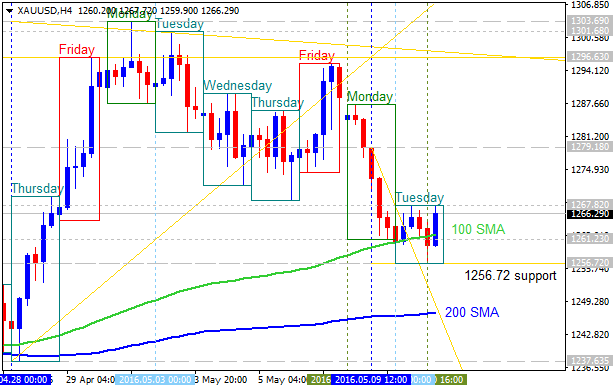

GOLD (XAU/USD) daily price is on bullish market condition located above 200 SMA/100 SMA: the price is started for the bullish trend to be continuing (on open daily bar for now) after the ranging condition. The resistance level at 1,303.69 is going to be broken by the price to above for the possible breakout to be started.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.05.10 20:39

Gold Lower On Follow-Through Selling and Profit Taking (based on the article)

"Gold prices ended the U.S. day session modestly lower Tuesday, on some follow-through selling from the shorter-term futures traders, after the solid losses seen Monday. Some profit taking was also featured. The recent rebound in the U.S. dollar index has also been a bearish “outside market” force working against the precious metals bulls the past few sessions. June Comex gold futures were last down $4.80 an ounce at $1,261.90. July Comex silver was last down $0.009 at $17.08 an ounce."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.05.14 10:11

Forex Weekly Outlook May 16-20 (the source)

The US dollar had another positive week, enjoying some good data. UK and US inflation data, housing figures and most importantly the FOMC Meeting Minutes stand out. These are the highlights of this week.

- UK inflation data: Tuesday, 8:30. CPI in the UK is expected to rise by 0.5% in April.

- US Building Permits: Tuesday, 12:30. The number of building permits is expected to rise to 1.13 million-unit pace.

- US inflation data: Tuesday, 12:30. CPI is forecasted to rise 0.4% while core prices are estimated to climb 0.2% this time.

- UK employment data: Wednesday, 8:30. The amount of people receiving jobless benefits is expected to rise by 4,100 in April.

- US Crude Oil Inventories: Wednesday, 14:30. The EIA expects Brent to trade at $76 a barrel in the next year on continued increase in demand.

- US FOMC Meeting Minutes: Wednesday, 18:00. These are the meeting minutes from the April decision, in which the Fed left policy unchanged, acknowledged some improvement but did provide any hike hints. The chances for a rate hike in June dropped after that meeting but since then, data has improved. So, this is an opportunity for the Fed to hint about raising rates in June, if this is indeed the case, and it’s quite unclear that this a real option for the doves that control the Fed. It is important to remember that the minutes are edited until the last moment, allowing the Fed to sharpen any message.

- Australian employment data: Thursday, 1:30. Australia’s job market is expected to register 12,300 jobs addition, while the unemployment rate is expected to rise to 5.8% this time.

- US Philly Fed Manufacturing Index: Friday, 12:30. The ndex is expected to improve to 3.2 in May.

- US Unemployment Claims: Thursday, 12:30. Jobless claims are estimated to reach 276,000 this week.

- US Existing Home Sales: Friday, 14:00.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.05.21 10:35

Fundamental Weekly Forecasts for Dollar Index, GBP/USD, USD/CNH, AUD/USD, USD/CAD, NZD/USD and GOLD (based on the article)

GOLD (XAU/USD) - "Looking ahead to next week, traders will be closely eyeing the release of U.S. Durable Goods as well as the second read on 1Q GDP. Note that growth in the first quarter was disappointing (just 0.5% q/q), with consensus estimates calling for an upward revision to 0.8% q/q. Of particular interest will be the release of the Personal Consumption Expenditure (PCE) which is the Fed’s preferred gauge on inflation and a stronger print could further stoke expectations for a June rate hike. We’ll also be looking for a fresh batch of central bank rhetoric with speeches from St Louis Fed President James Bullard, Governor Jerome Powell and Chair Janet Yellen on tap. If expectations for a June hike continue to be brought forward, look for gold remain on the defensive. Although the technical picture remains bleak, the decline is coming into near-term support targets which may offer prices a near-term reprieve from the recent downside pressure."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Forum on trading, automated trading systems and testing trading strategies

Market Condition Evaluation based on standard indicators in Metatrader 5

Sergey Golubev, 2016.03.30 18:50

GOLD (XAU/USD): ranging on reversal. Intra-day H4 price is located near and below 100/200 SMA ranging area waiting for direction: price is ranging within the following key reversal s/r levels:

RSI indicator is estinating the bearish trend to be started.