EURUSD Technical Analysis 2015, December: weekly bearish pattern for breakdown, monthly breakdown with support target

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.11.29 09:14

EUR weakness: rate cuts and more easing (adapted from the article)

Morgan Stanley estimated for EUR to be in more bearish condition because of some expectation related to some main high impatected news events which will be happened in this week:

- 2015-12-03 12:45 GMT | [EUR - Minimum Bid Rate]

- 2015-12-03 13:30 GMT | [EUR - ECB News Conference]

- 2015-12-03 15:30 GMT | [USD - Fed Chair Yellen Speech]

For

example, the EUR/USD price will be in 'more bearish' market condition

with the around 1.04 level as the real target for this week.

Morgan Stanley is expected for above mentioned news events to be a key driver for the currency with further rate cuts from the ECB and increase in QE. Anyway, it will make EUR to be a more attractive for traders for this week for example.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.12.01 12:25

Waiting For The ECB Bazooka - Credit Agricole (based on the article)

- "The December ECB meeting will be the key event for EUR this week with recent speeches by various Governing Council members suggesting that the ECB will pull no punches when it comes to boosting the outlook for inflation in the Eurozone."

- "When it comes to the FX markets reaction, investors have focused on the prospects for further cuts of the deposit rates. Recent media reports have suggested that the EBC may apply a two-tier deposit charge that could allow them to cut rates more aggressively so long as they could spare banks with structurally larger excess cash holding like deposit-taking retail banks."

- "With the markets already expecting a 15bp deposit rate cut, chances are that the ECB may struggle to exceed already dovish market expectations."

- "While we cannot exclude a test of this year’s lows ahead of the ECB, we think that EUR could squeeze higher in the aftermath of the meeting."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.12.03 08:38

Trading News Events: European Central Bank (ECB) Interest Rate Decision (based on the article)

The European Central Bank (ECB) interest rate decision may fuel a

further decline in EUR/USD amid speculation for additional monetary

support but, heavy expectations for a meaningful announcement may

ultimately trigger a short-squeeze in the exchange rate should the

central bank disappoint.

What’s Expected:

Beyond bets for a meaningful adjust to the ECB’s quantitative easing (QE) program, market participants are looking for a further reduction in the central bank’s deposit-rate as the Governing Council struggles to achieve its one and only mandate for price stability. Efforts to further insulate the monetary union may push EUR/USD to give back the advance from the March low (1.0461) amid the deviating paths for monetary policy.

How To Trade This Event Risk

Bearish EUR Trade: ECB Expands/Extends QE & Cuts Deposit-Rate

- Need red, five-minute candle following the policy announcement to consider a short EUR/USD trade.

- If market reaction favors a bearish Euro trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from cost; need at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is met, set reasonable limit.

- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same strategy as the bearish euro trade, just in the opposite direction.

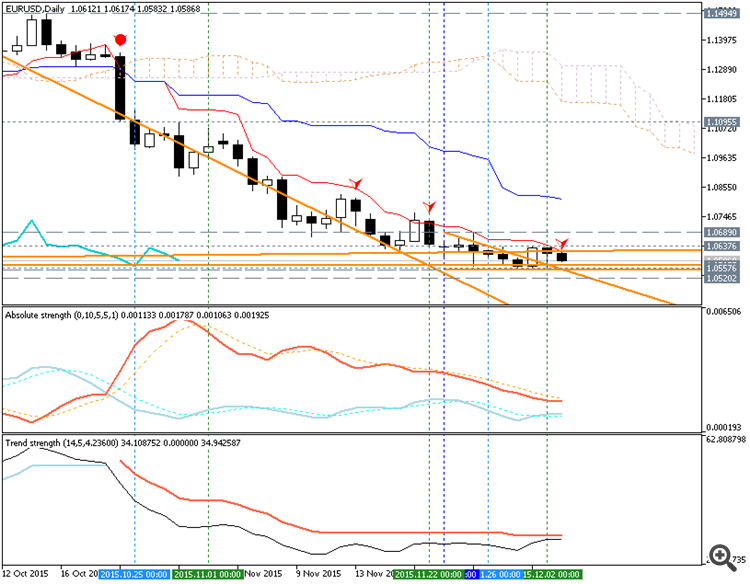

EURUSD Daily

Even though the European Central Bank (ECB) stuck to its current policy in October, the Governing Council showed a greater willingness to further embark on its easing cycle as the central bank opened the door for a further reduction in deposit-rate. As the ECB pledges to re-examine its non-standard measures, the central bank may continue to push monetary policy into uncharted territory in an efforts to further insulate the monetary union . The Euro sold off as the ECB removed the floor on interest rates, with EUR/USD breaking below the 1.1200 handle following the interest rate decision to close the day at 1.1107.Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.12.03 14:34

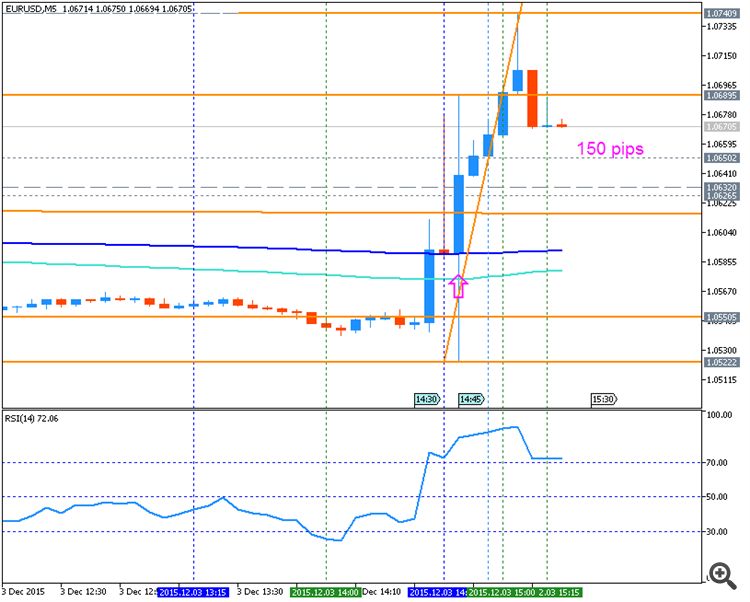

2014-12-03 12:45 GMT | [EUR - Minimum Bid Rate]- past data is 0.05%

- forecast data is 0.05%

- actual data is 0.05% according to the latest press release

[EUR - Minimum Bid Rate]= Interest rate on the main refinancing operations that provide the bulk of liquidity to the banking system.

Short term interest rates are the paramount factor in currency valuation

- traders look at most other indicators merely to predict how rates

will change in the future.

==========

==========

EURUSD M5: 150 pips price movement by EUR - Minimum Bid Rate

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.12.04 12:14

Intra-Day Fundamentals - Non-Farm Payrolls: scenarios and trading ideas (adapted from the article)

As we are going to have USD - Non-Farm Employment Change news event today so The Royal Bank of Scotland made fundamental forecast related to this news event with the connection with the most attractive pairs to trade in any situation concerning the actual data for NFP for example. And just to remind: if actual data for NFP > forecast (200K for now) so it will be good for currency (US dollar will become more stronger).

The are 3 main scenarios for NFP:

1. Actual

data is 225k and above (with 200K forecasting ones): The most

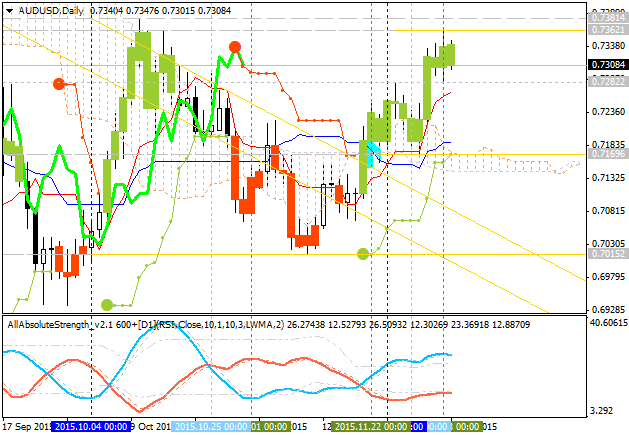

attractive pair to trade in this case is AUD/USD: the strong case with Australian dollar will be finsihed and we can consider for this pair to be in more bearish market condition.

Sell AUD/USD.

2. Actual data is 150-225k. This data is something to be around 200K

forecasting so we should consider the ranging market condition for most

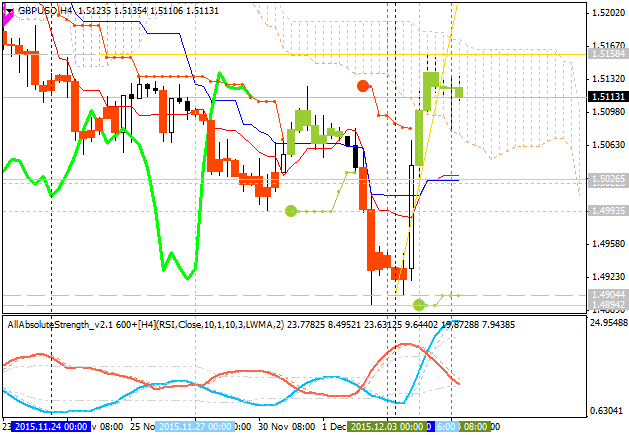

of the pairs. The only pair may be attractive to trade is GBP/USD which

will be stapped with secondary ranging in intra-day for good breakdown

possibilities.

Sell GBP/USD.

3. 150k and below. As we know - the long-term projections for EUR/USd is

the bearish market condition. But this is the opposite short- term

situation when actual data for NFP is less than forecasting 200K:

EUR/USd price will be going to be more bullish in intraday basis.

Short-term: Buy EUR/USD.

Long-term: Sell EUR/USD.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.12.04 15:10

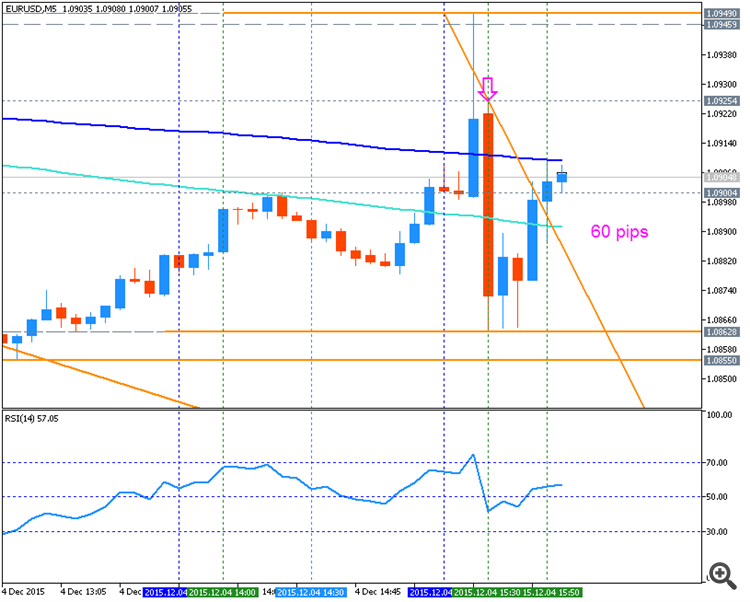

2014-12-04 13:30 GMT | [USD - Non-Farm Employment Change]- past data is 271K

- forecast data is 200K

- actual data is 211K according to the latest press release

[USD - Non-Farm Employment Change]= Change in the number of employed people during the previous month, excluding the farming industry.

Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity.

==========

==========

EURUSD M5: 60 pips range price movement by Non-Farm Employment Change news event:

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.12.05 09:23

Forex Weekly Outlook December 7-11 (based on article)

The euro surged on Draghi’s disappointment and it also had some

collateral damage for the dollar against other currencies. What’s next?

The highlights of the week before the rate decision are: rate decisions

in Switzerland, New Zealand and the UK, employment data in Australia,

retail sales Producer Prices and Consumer sentiment from the US. These

are the main events on forex calendar. Join usas we explore the

highlights of this week.

The Draghi Decision was dramatic as always, but not in the expected

direction: the ECB made the minimal rate cut, the minimal QE extension

and no increase in monthly buys. Despite the option to do more and and

reinvesting proceeds, the ECB just failed on its own expectations,

sending EUR/USD over 400 pips higher. In the US, the job market posted a

solid gain in November adding 211,000 jobs, beating market forecast.

This positive reading was preceded by a 298,000 job addition in October,

paving the way for a rate hike this month. This release comes a day

after Fed Chair Janet Yellen stated that the conditions for a first rate

hike have been met.

- Haruhiko Kuroda speaks: Tuesday, 9:06. BOE Governor Haruhiko Kuroda is scheduled to speak in Tokyo. Kuroda has dismissed calls to go slow on hitting the central bank’s 2% inflation target. Some policy makers warned that pushing up prices too quickly could hurt consumption and have called for the central to give itself more time to achieve its inflation target. Kuroda told business leaders that a slower process would also hurt wage adjustments. Only a bold move could fight deflation. Market volatility is expected.

- US JOLTs: Tuesday, 15:00. This measure of the jobs market is eyed by the Fed, despite being a lagging one. It provides a broader picture of the economy. A level of 5.59 million is expected in October after 5.39 in September.

- New Zealand rate decision: Wednesday, 20:00. The Reserve Bank of New Zealand maintained its Official Cash Rate at 2.75%, amid concerns for slower growth in China and in East Asia. A steep decline in diary prices since early 2014 continues to weigh on domestic income. However, inflation is expected to get back on track by early 2016. To ensure that future average CPI inflation settles near the middle of the target range, some further reduction in the OCR seems likely. The central bank is expected to cut rates to 2.50% this time.

- Australian employment data: Thursday, 0:30. Australia’s unemployment rate declined unexpectedly to 5.9% in October, its lowest reading since May beating forecasts for 6.2%. The job market added 58,600 new positions nearly four times more than expected. The majority of new jobs (40,000) were full time positions, while part time jobs increased by 18,600. The participation rate rose to 65.0% from 64.9% in September. The strong reading suggest the Australian labor market rebounded after the shift from mining to services sector, personal and business services. The labor market is expected to lose 10,000 jobs while the unemployment rate is predicted to rise to 6.0%.

- Switzerland rate decision: Thursday, 8:30. Switzerland’s central bank continued its policy of negative interest rates on its September meeting, leaving rated at minus 0.75%. The bank sought to devaluate the unjustifiably strong Swiss franc, but predicted a deflation due to low oil prices. The Swiss National Bank stated that, despite a slight depreciation, the Swiss franc is still too strong and Switzerland’s export-reliant economy has had to adjust to a surge in the franc’s value this year after the SNB abruptly abandoned its 1.20 francs per euro cap on Jan. 15.

- UK rate decision: Thursday, 12:00. Bank of England governor Mark Carney stated in November that interest rates will not be raised in the UK before the end of the year and the majority of policy makers believe the bank should wait a few months before the hike. However, borrowing costs may well be changed affecting mortgages for second homes or other loans. Carney warned about the growth in personal loans and the boom in buy-to-let lending driving up property prices.

- US Unemployment Claims: Thursday, 13:30. The number of applications for unemployment benefits in the U.S. increased last week by 9,000 to 269,000, maintaining a four-decade lows in the number of claims. There are fewer layoffs and a sense of Job security, enabling stronger consumer spending during the holidays. The four-week average of claims dropped to 269,250 from 271,000 the week before. The number of jobless claims for this week is expected to reach 266,000.

- US Retail sales: Friday, 13:30. U.S. retail sales inched up 0.1% in October amid an unexpected decline in automobile purchases, showing a slowdown in consumer spending. Economists expected retail sales would increase 0.3% after a previously reported 0.1% rise in September. Sales at automobiles fell 0.5% after rising 1.4% in September. Meanwhile, retail sales excluding automobiles rose 0.2% after posting minus 0.3% in the previous month. Economists forecasted core retail sales would rise 0.4 %. Retail sales are expected to gain 0.2% and Core sales are predicted to rise 0.3%.

- US PPI: Friday, 13:30. U.S. producer prices declined in October for a second straight month down 0.4% after registering minus 0.5% in the previous month, the poor readings suggest subdued inflation pressures that might postpone the Federal Reserve raising interest rates in December. In the 12 months through October, the PPI declined 1.6% t, the largest drop since the series started in 2009. Producer inflation is likely to remain weak in the coming month. Producer prices are expected to remain flat this time.

- US Consumer Sentiment: Friday, 13:30. U.S. consumer optimism edged up to 93.1 in November, rising for the second straight month, a good sign before the holiday season. Economists predicted the index would rise to 91.3. The outlook index rose to 85.6 from 82.1 in October, up 7.1% from a year ago. The positive reading suggests consumers are feeling reassured by low gas prices, an improving labor market. Consumer’ inflation expectations were low for the near and long term. The National Retail Federation expects holiday sales will rise 3.7%, only slightly less than last year’s 4.1% gain. Consumer sentiment is expected to reach 92.3 in December.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.12.08 11:42

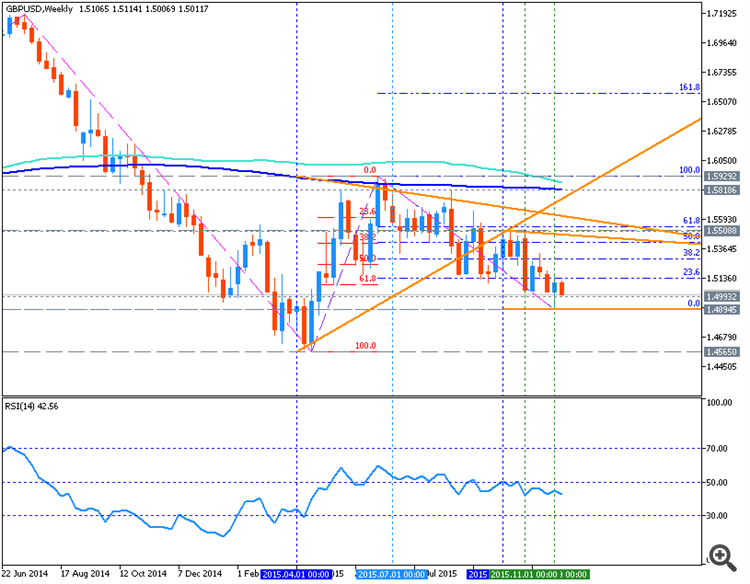

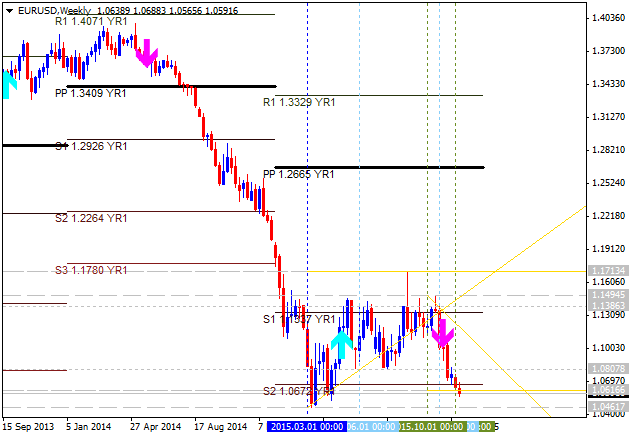

We like short GBP/USD more than short EUR/USD in Q1'16 - Societe Generale (adapted from the article)

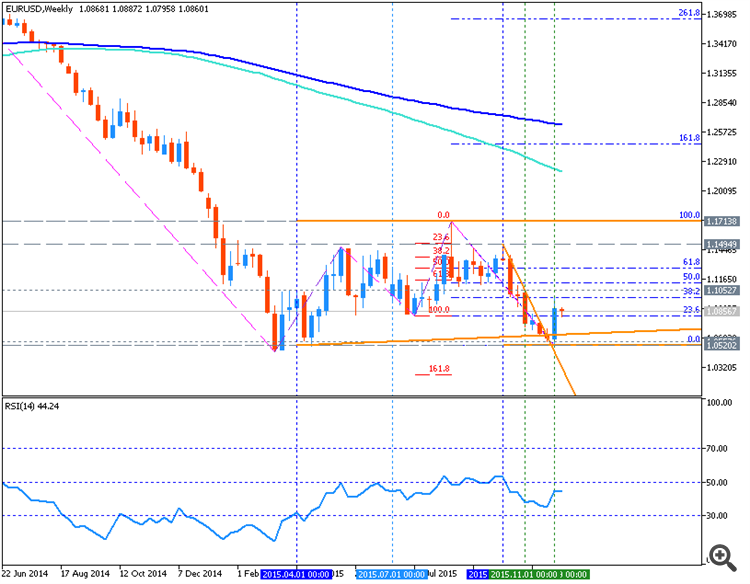

Societe Generale made a forecast for EUR/USD compare with GBP/USD telling that both the pairs will be on bearish condition for Q1'16. And GBP/USD will be in more bearish related to EUR/USD. Let's review this forecast with technical point of view.

As we see from the charts above - both pairs are located below 100 period SMA and 200 period SMA in the primary bearish area of the chart ranging within key support/resistance levels:

| Instrument | Bearish Target | RSI | Chinkou Span | Absolute Strength |

|---|---|---|---|---|

| EUR/USD | 1.0520 | ranging bearish | ranging bearish | ranging |

| GBP/USD | 1.4565 | strong bearish | strong bearish | ranging for direction |

The price for GBP/USD is having more signs to be bearish in Q1/16 than EUR/USD, and that is why Societe Generale is expecting more bearish for GBP/USD compare with EUR/USD for example.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

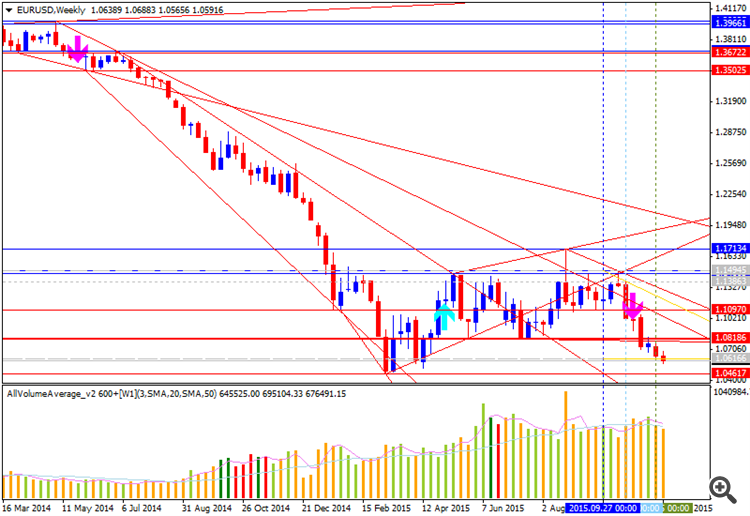

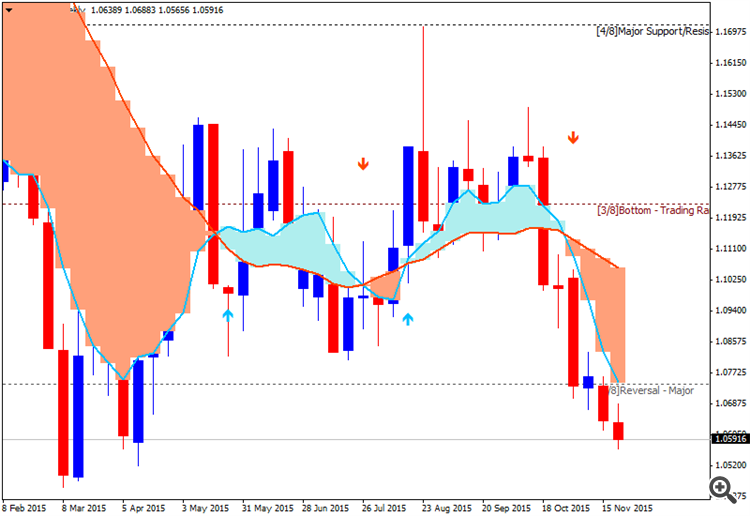

The price is on bearish breakdown for crossing 1.0616 support level of descending triangle pattern for the bearish tren to be continuing with 1.0461 level as the nearest real bearish target.

W1 price is on primary bearish market condition:

MN price is on bearish breakdown with 1.0461 level as the next bearish target.

If W1 price will break 1.0461 support level so the primary bearish trend will be continuing with psy level at 1.0400 as the next target.If W1 price will break psy support level at 1.0400 so we may see the bearish breakdown with S3 Pivot at 0.9344 as the bearish target in thi case.

If W1 price will break psy resistance at 1.0800 so the local uptrend as the bear market rally will be started.

If W1 price will break 1.1713 resistance level from below to above so the reversal of the price movement from the primary bearish to the primary bullish market condition will be started.

If not so the price will be ranging within the levels.

TREND : breakdown of support levels