EURUSD Technical Analysis 2015, May: Bearish with Weekly Rally and Monthly Ranging with 1.0461 Key Support Level

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.02 12:56

Forex Weekly Outlook May 4-8 (based on forexcrunch article)

The US dollar experienced a very turbulent week, tumbling down and recovering, but not against the euro. Close elections in the UK, an important rate decision in Australia, employment data from New Zealand, Australia, Canada and the all- important US non-Farm Payrolls release are key events. These are the highlight events on Forex calendar for this week. Here is an outlook on the top events coming our way.

The Federal Reserve downgraded its economic outlook amid soft growth data. The Fed admitted recent weakness in the first quarter relating it to temporary factors. Inflation will have to climb back to 2% and the job market needs to improve further before a rate hike is announced. However, the Fed believes the US economy will rebound in the second quarter. Meanwhile, jobless claims released last Thursday, surprised markets with a 34,000 fall in the number of claims nut not all data points impressed. The biggest winner was the euro, that broke critical resistance and seems unstoppable. Poor data weighs on the pound towards the elections and central banks weigh on the kiwi and the Aussie.

- Australian rate decision: Tuesday, 4:30. The Reserve Bank of Australia kept its cash rate at 2.25% for the second consecutive month in April, as the majority of policy makers decided against another rate cut. The last rate cut in February was designed to boost growth in non-mining sectors. RBA governor Glenn Stevens notes in his rate statement that further easing measures will be announced in the next few months. No change in rate is expected this time, but there is no 100% consensus. This means that a rate cut will hit the Aussie, and another “no cut” is set to boost it.

- US Trade Balance: Tuesday, 12:30. The U.S. trade deficit narrowed in February to the lowest level since 2009, reaching $35.4 billion. Economists expected deficit will rise to $41.3 billion. However, the strong dollar, weak global demand and lower crude oil prices probably impacted trade balance in February. Despite the low deficit, economic growth slowed considerably in the first quarter. Exports declined 1.6% to $186.2 billion, the smallest since October 2012, while imports from China fell 18.1%, pushing the politically sensitive U.S.-China trade deficit down 21.2 percent to $22.5 billion. Trade deficit is expected to grow to 39.7 billion in March.

- US ISM Non-Manufacturing PMI: Tuesday, 14:00. The U.S. non-manufacturing sector continued to expand at a slower pace in March, as service companies increased their export orders. Economists expected Non-Manufacturing PMI to reach 56.6. The majority of respondents’ were positive about business conditions and the overall economy. The ISM’s new orders index increased to 57.8 in March from 56.7 in February. The export index jumped to 59.0 from 53.0. The ISM business activity index declined to 57.5 from 59.4 in February and 61.5 in January. Non-manufacturing PMI is expected to reach 56.2 in April.

- NZ employment data: Tuesday, 22:45. New Zealand’s employment market expanded 1.2% in the fourth quarter of 2014, compared to 0.8% growth in the previous quarter. Economists expected a 0.8% rise in the number of new positions. Despite the bigger than expected job gain, the unemployment rate increased to 5.7% from 5.4% in the third quarter, posting the highest unemployment rate since Q1 2014. Analysts estimate an average of 5.2% in 2015. New Zealand’s employment is expected to grow by 0.7% in the first quarter, while the unemployment rate is forecasted to decline to 5.5%.

- US ADP Non-Farm Payrolls: Wednesday, 12:15. The U.S. private sector registered the smallest job gain in more than a year, adding 189,000 positions in March. The reading was below market forecast of 227,000 jobs and weaker than the 212,000 increase in posted the previous month. Harsh winter, a strong dollar and weaker global demand were partial causes for the disappointing jobs release. ADP private sector employment is expected to grow by 185,000 in April.

- Janet Yellen speaks: Wednesday, 13:15. Federal Reserve Chair Janet Yellen will speak in Washington DC. She may speak about the recent FOMC rate decision the state of the job market. Market volatility is expected.

- Australian employment data: Thursday, 2:30. Australia’s labor market expanded by 37,000 new jobs in March, pulling the unemployment rate down to 6.1%. The majority of jobs asses were full time positions. Economists expected a lower gain of 14900 positions and forecasted unemployment of 6.3%. Productivity has climbed increasing employers’ demand for workers. Improved job prospects expected to lift household incomes and boost the economy. Australian labor market is forecasted to expand by 3,100 jobs, while the unemployment rate is expected to reach 6.2%.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing new claims for unemployment fell last week to the lowest level since 2000, indicating the weakness in the labor market during March was only temporary. The number of initial claims plunged 34,000 a seasonally adjusted 262,000, beating forecasts for 290,000 new claims. The four-week moving average declined l 1,250 to 283,750.

- UK elections: Thursday, initial results expected late in the US session. After 5 years of a Conservative-LibDem coalition, incumbent David Cameron boasts an recovering economy while Labour leader Ed Miliband points to deteriorating standards of living. The markets would prefer a Conservative government, the current coalition or at least an outright majority for Labour. However, things look much more complicated, with both leading parties expected to fall short of a majority and a hung parliament also on the cards – an uncertain situation with negative ramifications for the pound. Polls are too close to call, making it an interesting event indeed.

- Canadian employment data: Friday, 12:30. The Canadian economy unexpectedly added 28,700 jobs in March, beating forecasts of jobs contraction. The majority of jobs were part-time positions, but employers also cut 28,200 full-time jobs. The main gain was detected in the service sector. RBA Governor Stephen Poloz stated that first quarter growth will be badly affected by the recent oil price collapse. The labor participation rate edged up to 65.9% from 65.7%. The unemployment rate remained at 6.8% while expected to tick up to 6.9%.

- US Non-Farm Payrolls: Friday, 12:30. US non-farm payrolls disappointed in March showing job growth of 126,000 positions, far below the 246,000 gain expected by analysts and following 295,000 job addition in February. Meanwhile the unemployment rate remained stable at 5.5% in line with market forecast. The employment-population ratio remained at 59.3%, while the participation rate edged down to 62.7% in March from 62.8% in the prior month. US private sector is expected to gain 231,000 jobs, lowering the unemployment rate to 5.4%.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.02 12:59

US Dollar Fundamentals (based on dailyfx article)

Fundamental Forecast for Dollar: Neutral

- The Dollar dropped to a two-month low this past week and closed out April with its first monthly decline in 10 months (DXY)

- Will this week’s NFPs offer a clearer signal on rate expectations than this past week’s GDP/FOMC combo?

This past week, the USDollar posted its first drop on a monthly basis in 10 consecutive months. At the same time, the week ended on a rally that closed out the period little changed. We are in a phase of technical and fundamental limbo. A correction for the Greenback is not without its merits: the Dollar’s exceptionally consistent run can be overinflated by trend-following speculative interests that need to retrench and rate speculation has softened alongside the quality in data. Then again, the currency’s and economy’s ‘relative’ appeal is still exceptionally strong. With the Dollar transitioning from a steady bull trend to a period of consolidation and now suffering its most painful slide in a year, the burden to generate momentum on this week’s fundamental themes will be more evenly distributed.

For fundamental traders, the most recognizable catalyst in the week ahead will be the April labor statistics due on Friday. It is not unreasonable to peg the NFPs the week’s top event risk. It is an easy-to-interpret indicator and taps directly into what has driven the Dollar and FX market generally through the past year: monetary policy expectations. However, there will be hurdles to overcome for this data to lock in a definitive currency move. The most prominent obstacle for the report will be its Friday release. There will be plenty of anticipation, but confirmation comes late in the week.

In the data itself, the elements that cut closest to the key determinants for monetary policy will carry the most weight. The unemployment rate is already well beyond levels previously set as targets, so its up- or downtick will generate lower amplitude waves. The missing element in the timing of the Fed’s liftoff is tangible inflation pressure. For that reason, the earnings data will likely prove the most important update. The current consensus is for a 2.3 percent increase in wages year-over-year, which would match the strongest pace since 2009. Should the data meet or ‘beat’ this forecast, it would tip the uneasy equilibrium in rate speculation that we were left with following this past week’s poor 1Q GDP reading and the FOMC’s suspiciously status quo statement. Alternatively, a ‘miss’ is likely to carry less weight as it fighting a current whereby the Fed remains well ahead of the policy curve.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.03 08:30

EUR/USD Retains Bullish Pattern Despite Thin Market Participation (based on dailyfx article)

- Euro Resilience Pushes Retail Positions to Extremes- 1.1300 Still in Focus.

AUD/USD Outlook Mired by Speculation for Reserve Bank of Australia (RBA) Rate Cut.

- EUR/USD outperforms against its major counterparts, but lack of momentum to break/close above the 1.1300 handle (78.6% retracement) raises the risk for former support to turn into new resistance; need a break of the bullish RSI momentum for conviction/confirmation a near-term top is in place.

- With the narrowing risk for a Greek default/exit, positive data prints paired with the upbeat tone from the European Central Bank (ECB) may spark a ‘taper tantrum’ in the euro-area over the near to medium-term.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.03 08:39

Monthly Forex Forecast: May 2015 (based on dailyforex article)

The USD has fallen meaningfully in value over the past 1 month and 3 month periods. This is a significant quantitative change in the market and is suggestive of continuing USD weakness over the coming month. Next, it should be noted that both the GBP and the JPY have been enjoying steady movement overall for many months, with the GBP rising and the JPY falling. Over the past 3 months, we are also seeing strong turnarounds from bearish to bullish in CAD and NZD, and in AUD to a lesser extent. This suggests that the current month will see rises in GBP, CAD, NZD and AUD, and falls in USD and JPY – in these orders of preference.

Many traders believe fundamental factors should either be ignored completely, or taken as the primary factor to consider in entering or exiting a trade. Fundamental analysis is best used as a final filter in deciding whether to take a trade that already looks good from a technical perspective.

Therefore let’s consider the aforementioned currencies from a fundamental perspective. Both the GBP and the CAD have higher base rates than the USD. Of the three currencies, the market probably sees the next rate rise as most likely to come in the GBP, closely followed by the USD. The USD is seen as having the strongest economy, but that perception is arguably under threat now. The CAD may be impacted by the price of oil with a positive correlation, and the price of oil is bouncing back and rising strongly. Overall it seems that the fundamental factors are mixed and questionable enough to probably not be a block in the direction of the trades discussed.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.03 10:42

EUR/USD Weekly Fundamental Analysis, May 4-8, 2015 – Forecast (based on fxempire article)

The EUR/USD closed the week at 1.1199 after touching a two month high. The dollar extended its gains against the pound from Thursday’s session after weaker-than-expected manufacturing report. It has recovered most of its losses from earlier in the week.

Economic data released Thursday showed Chicago-area manufacturing activity expanding for the first time in three months, weekly jobless claims falling to their lowest level in 15 years, and a larger-than-expected increase in a closely watched measure of wage inflation. That data helped support the argument, advanced by Federal Reserve policy makers, that weak first-quarter growth was primarily due to transient factors, including bad weather and labor disputes at western seaports.

While not spectacular, Friday’s data didn’t provide a strong signal to the contrary.

Strong economic data increases the possibility that Fed policy makers will raise interest rates at their June meeting, a move that would benefit the dollar.

The euro posted its biggest monthly gain in 4 1/2 years in April as speculators pared record bearish bets. Positive economic reports suggest the European Central Bank’s asset-purchase program is working, while U.S. growth remains uneven. Markets in Europe, including Germany and France, were closed for national holidays, leading to thin trading.

The euro is still forecast to fall by year-end. The median estimate of more than 60 economists compiled by Bloomberg News sees the euro at $1.04 on Dec. 31, more than 7 percent lower than yesterday’s closing price.

“We’ve seen an improvement in European fundamentals, which has translated into support for the euro,” said Joe Manimbo, an analyst at Western Union Business Solutions, a unit of Western Union Co. in Washington. “For the most part, it’s just the euro’s ability to steal the dollar’s lost thunder on the low pulse for the U.S. economy in the first quarter.”

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.03 10:57

EUR/USD Monthly Fundamental Forecast May 2015 (based on fxempire article)

The EUR/USD had a stellar month in April closing in the 1.12 level after the ECB kicked off its stimulus program and data started printing a bit better than in previous months. Greece continued being a thorn in everyone’s side. The euro is expected to trade flat or a bit weaker in April as US data should start to print a bit stronger. In Spain and Italy, the export-led recovery has boosted industrial production and is starting to spill over into the broader economy, while deflationary tailwinds and rising consumer confidence in France have coincided with higher household spending.

Efforts by France and Italy to push through much needed structural reforms, as well as the Greek government’s decision to reshuffle its negotiating team to broker an extension to its current bailout program also bode well for stronger consumer and business confidence and longer-term growth. Headline deflationary pressures in the euro zone have also eased from -0.6% y/y in January to the most recent release of 0% in April, underpinned by rising energy and food prices. This, combined with monetary stimulus, is forecast to gradually drive the headline print up to a year-end rate of 0.6% y/y in 2015 and 1.3% in 2016. The ECB intends to fully implement its roughly €1.1 trillion QE program and has no plans to alter its policy stance unless the higher inflation trend is firmly anchored. With euro zone inflation forecast to be in line with the ECB’s target of close to, but below, 2% by 2017, we believe that QE will run its full course through September 2016.

Soft economic data for Q1, still-low inflation prints, and overall USD strength were cited by the FOMC at its March meeting as the overall rationale for delaying interest rate hikes into the later part of 2015 and moderating the extent of hikes to be delivered. An April FOMC statement that pointed to a number of economic positives but failed to mention constructive stirrings on the inflation front didn’t change our view that the FOMC is likely to engage in so-called ‘liftoff’ at its September meeting. A hawkish interim surprise would require extraordinarily strong data between now and the June or July FOMC meetings – not our base case.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.04 18:36

ECB's Constancio Convinced Greece Worst-case Scenario Will Be Avoided (based on rttnews article)

European Central Bank Vice President Vitor Constancio said that he was certain that Greece's exit from the euro area will be avoided.

In an interview to the Dutch daily Het Financieele Dagblad, which was published on the ECB website on Monday, Constancio said, "Like everyone else, I am concerned. But I am also absolutely convinced that the worst-case scenario will be avoided."

"At the same time, everyone acknowledges that the degree of stress and vulnerability in the euro area has totally changed. There are no signs of contagion."

Even if a Grexit materializes, the ECB is sufficiently protected from huge losses as the risk of emergency lending to Greek banks is shared with the national central bank, the Portuguese banker said.

"We jointly bear the risk on the rest of the amount. But bear in mind that collateral has been provided. We are talking about securities that are not linked to the Greek sovereign and which, on top of that, are subject to a "haircut". This should offer sufficient protection," Constancio said.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.03 20:05

Forex Forecast – Quant vs Chart Reading (based on dailyforex article)

Quantitative Forecast- If the price is higher, the statistical edge is in trading that pair long.

- If the price is lower, the statistical edge is in trading that pair short.

On this basis, the quantitative momentum forecast for the edge during the coming week is as follows:

![]()

On this basis, my technical analysis forecast for the edge during the coming week is as follows:

![]()

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.04 22:44

Forex technical analysis: EURUSD peeks below a support level (based on forexlive article)

So it is a slow grind and may just rebound off the next support, but the

EURUSD has touched (and is taking a peek below) the 100 hour MA (blue

line in the chart below) at the 1.1135 level currently.

There are reports that the IMF will cut off support for Greece. IMF Lagarde and Greece's Tsipras are holding a telephone conference.

European commission president Juncker says Greece exit for Euro area is no option and that Europe must show solidarity with Greece.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.05 08:53

EUR/USD Technical Analysis: Short Position Now in Play (based on dailyfx article)

- EUR/USD Technical Strategy: Short at 1.1148

- Support: 1.0982, 1.0793, 1.0487

- Resistance:1.1271, 1.1517, 1.1766

The Euro put in a bearish Evening Star candlestick pattern, hinting a move lower against the US Dollar may be in the cards. A daily close below the 14.6% Fibonacci expansion at 1.0982 exposes the 23.6% level at 1.0793. Alternatively, a push above the 38.2% Fib retracement at 1.1271 opens the door for a challenge of the 50% threshold at 1.1519.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

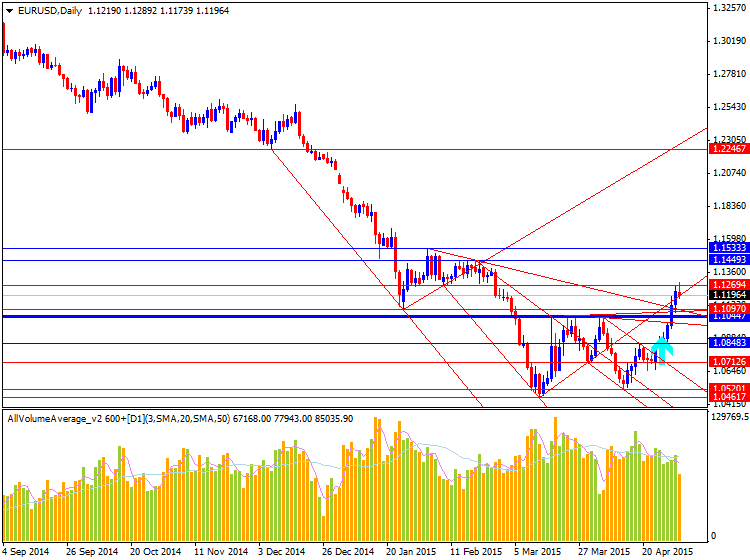

W1 price is is located on the primary bearish with the market rally and 1.1240 resistance level for trying to be broken on open W1 bar for now:

- Ichimoku cloud/kumo with Sinkou Span A line (which is the virtual border between the primary bullish and the

primary

bearish on the chart) are above the price and too far from it for any possible reversal of the price movement from the primary bearish to the bullish market condition in May 2015.

- Tenkan-sen line is below Kijun-sen line of Ichimoku which is indicating the primary bearish.

- The price is ranging between 1.1240 resistance and 1.0461 support level

- The local uptrend as the secondary market rally is going to be started: the triangle pattern was broken by the price from below to above with 1.1240 resistance level for trying to be crossed on open W1 bar.

- Chinkou

Span line is below the price and showing the local uptrend by the direction

- Nearest support levels are 1.0520 (W1) and 1.0461 (W1)

- Nearest resistance levels are 1.1051 (W1) and 1.1240 (W1)

If W1 price will break 1.0461 support level on close W1 bar so the primary bearish will be continuingIf W1 price will break 1.1240 resistance level so we may see the local uptrend as the secondary market rally to be started

If not so the price will be ranging between 1.0461 and 1.1240 levels with primary bearish

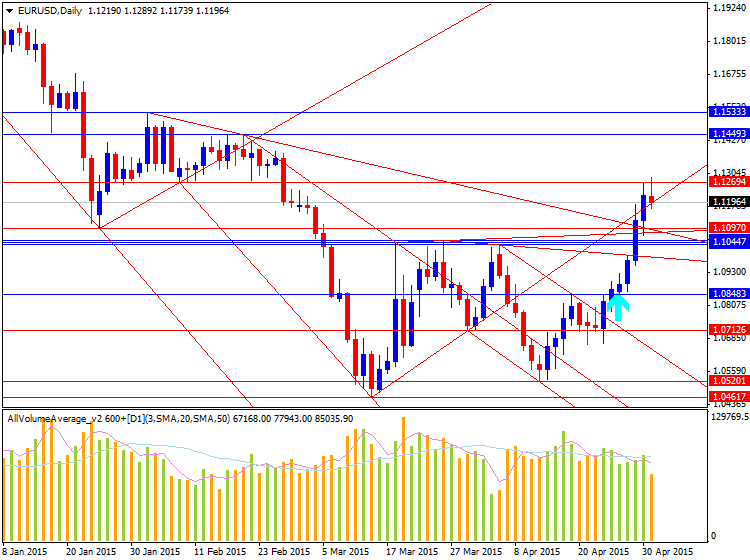

MN price is on primary bearish with the secondary ranging which was started in April by close MN bar:

- Ichimoku cloud/kumo with Sinkou Span A line (which is the virtual border between the primary bullish and the

primary

bearish on the chart) are above the price and too far from it for any

possible reversal of the price movement from the primary bearish to the

bullish market condition in 2015.

- Tenkan-sen line is below Kijun-sen line of Ichimoku which is indicating the primary bearish for this timeframe.

- AbsoluteStrength and TrendStrength indicators are estimating the primary bearish with the secondary ranging to be started for now.

- Chinkou

Span line is below the price and and too far from it for any breakout of the price movement in 2015

- Nearest support level is 1.0461 (MN)

- Nearest resistance levels are 1.2569 (MN) and 1.3160 (MN)

If MN price will break 1.0461 support level on close W1 bar so the primary bearish will be continuingIf MN price will break 1.2569 resistance level the local uptrend as a market rally will be going to be started within the primary bearish market condition

If MN price will break 1.3160 resistance level so we may see the reversal of the price movement from bearish to the primary bullish on MN timeframe

If not so the price will be ranging between 1.0461 and 1.2569 levels with primary bearish

SUMMARY : ranging

TREND : bearish