EURUSD Technical Analysis 2015, 09.08 - 16.08: ranging bearish to key targets to be broken - page 2

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.08.13 14:20

UBS AG: short-term strategies for EUR/USD, USD/JPY, AUD/USD (based on efxnews article)

UBS AG is a Swiss global financial companymaking currency forecasts and some prediction for EUR/USd and some other pairs. They are often publishing some trade ideas and reviews concerning technicals and fundamentals.

For example, this is their well-known prediction for USDCNY immediate after first CNY devaluation: "We now expect USDCNY trading at about 6.5 by end 2015E instead of 6.3 as previously envisaged, and 6.6 at end 2016E."

So, please find below very short ideas from UBS concerning EUR/USD, USD/JPY and AUD/USD. Those idea can be valid for tomorrow and for coming week as well:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.08.14 07:46

EUR/USD key levels for the bulls from JP Morgan (based on forexlive article)

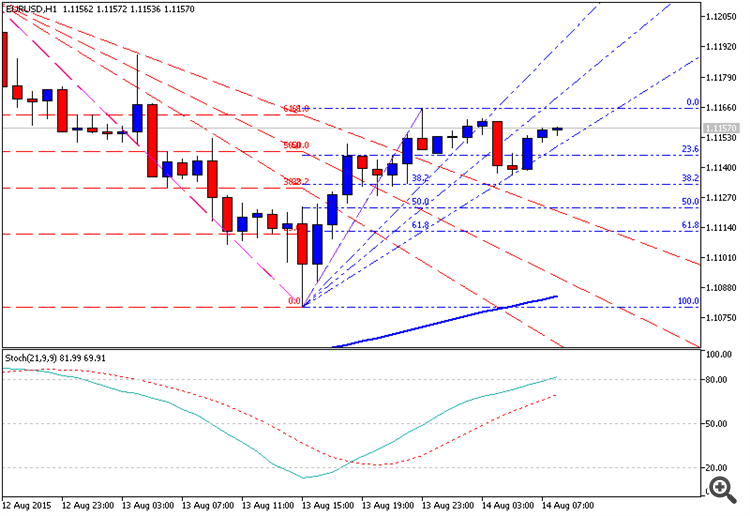

JP Morgan publish the next technical analysis for EURUSD, and for now - about the key levels for the bullish trend to be continuing in intra-day and day trading:

As we see from intra-day H1 chart - the EUR/USD is traded between Fibo resistance at 1.1160 and 23.6% Fibo support at 1.1145 for possible breakout of the price movement of the key resistance levels. Thus, forecast made by JP Morgan may be the rrue in this case.Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.08.14 11:28

EUR/USD, USD/JPY, EUR/GBP, AUD/USD - Intraday by SEB (based on efxnews article)

Skandinaviska Enskilda Banken (SEB) made some intra-day analysis for few pairs whch may be used for the next week for example. Those pairs are the following: EUR/USD, USD/JPY, EUR/GBP and AUD/USD. This is very short technical analysis for good s/r levels and for the direction to be followed:

EUR/USD: "The failed move below 1.1126 (and the created downside spike) keeps the short term wave pattern unclear. As long as 1.1190 remains unbroken there’s still a possibility that an upward correction ended the other day but if making way above the resistance new highs should be penciled in."

USD/JPY: "With the pair still below the mid body resistance downside risks are increasing. If also today manages to stay below 124.68 then downside risks will be even further enhanced going into next week. A move below 124.07 will likely lead to a loss of the 123.79 key support."

EUR/GBP: "The ongoing correction has still room to move a bit further north. The primary target for the move is 0.7176 with a possible extension towards the trend line at 0.7200. Once there look for offers to be returning."

AUD/USD: "After the latest rejection from the 2001 trend line the pair fell down but only to a marginally new low. Price action with no follow through selling together with a bullish divergence hints of an overly oversold market and therefore also an increasing reaction risk. Shorts should be very cautious should we break above 0.7440 (if such a move takes place today it will also create a bullish key week reversal)."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.08.14 19:00

Forex Weekly Outlook August 17-21 (based on forexcrunch article)

Japan GDP data, Inflation in the UK, the US and Canada, FOMC Meeting Minutes, US Unemployment Claims and Philly Fed Manufacturing Index. These are our market movers for this week. Join us as we explore the highlights on Forex calendar.

U.S. data released last week raises hopes for a Fed rate hike by the end of the third quarter. Retail sales rebounded in July amid a rise in purchases of automobiles and other goods, suggesting growth rate is positive in the second and third quarters. Retail sales edged up 0.6%, in line with market forecast, while core sales, excluding automobiles gained 0.4%. The robust release added to a strong employment data, suggesting the US economy is on solid footing. Will this trend continue?