Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.02 16:47

Weekly Fundamentals by Morgan Stanley: USD, EUR, JPY, GBP, CAD (based on efxnews article)

USD: Bullish

"We expect USD

strength to be focused against EM and commodity currencies."

EUR: Bearish

"Many

investors have hedged equity positions in Europe with short EUR. This suggests that in an environment

where commodity currencies and EM may sell off, risk generally could

take a hit, adding some support to EUR in the near term. Over the medium

to longer term, however, we retain our bearish view on EUR."

JPY: Neutral

"We believe the BoJ is likely to refrain from further easing barring an

unforeseeable shock to inflation, which should offer support to JPY.

The central bank is likely focused on its new core CPI measure which

does not include energy, and has grown steadily over recent months."

GBP: Bullish

"GBP performance will unfold in three phases going

forward. First, broad-based GBP strength heading into the August 6 MPC

meeting, where we expect the first vote for a rate hike. Second, a more

selective approach after the August meeting. Finally, given the

longer-term headwinds to UK growth from fiscal tightening and political

uncertainty, the currency may lose steam after the first hike."

CAD: Bearish

"We like

buying USDCAD on this dip, believing that as oil price uncertainty

continues to mount, USDCAD will continue to head higher, testing the

levels reached at the end of last week. On top of this, the second round

impact of the lower oil price on the economy is likely to continue to

be seen, possibly in upcoming employment data."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.03 11:19

Skandinaviska Enskilda Banken: Outlooks For EUR/USD, USD/JPY, AUD/USD, SP500 (based on efxnews article)

EURUSD: rejection from the 55-day MA

'The up and

down move on Friday became the third consecutive rejection from the 55d

ma band (since the return below it a month ago). The behavior is showing

that bearish forces are at play and increasingly so given the return to

a negative slope. We are thus looking for additional selling.'

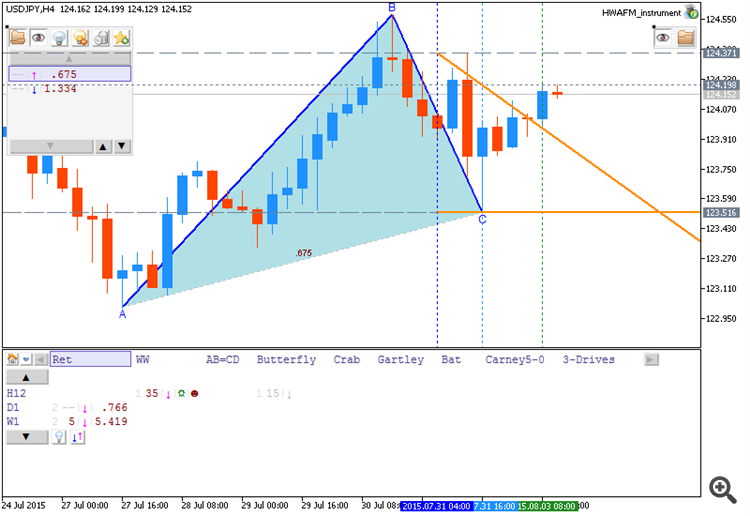

USDJPY: new attempt to be above the key level

'Given the

violation of the B-wave high (and a three wave setback from Thursday’s

peak) there’s a high probability of a soon more successful break higher

(targeting a new trend high). For today we see 124.37 as the trigger

point for the next step higher.'

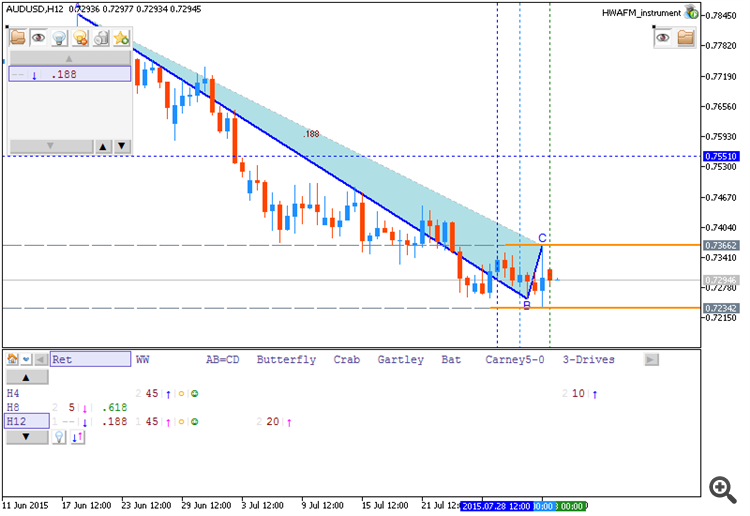

AUDUSD: Signs for sellers

'The spinning

candle (small net move and big spikes to both sides) and the spring

bottom are both signs of exhaustive sellers. There’s clearly a potential

for the pair to bounce back to retest the 2001 trend line (or even back

up to the 0.75- area) during the coming week.'

S&P 500: Higher again

'As long as the recent

correction low remains unbroken a positive view should be kept in place

(the July candle also developed into a mildly bullish piercing pattern).

The entire structure since May can also be seen as an inverted head and

shoulders formation, here seen as an upside continuation pattern.'

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.03 12:30

Societe Generale: EURUSD and Non-Farm Payrolls (based on efxnews article)

Societe Generale made some review for Non-Farm Employment Change report (Change in the number of employed people during the previous month, excluding the farming industry) which will be on Friday:

- "There’s a risk that we see edgy markets in the meantime...At the risk of sounding like a broken record, the case for raising rates to less unusually low levels does not rest on wage growth or inflation returning in earnest first. Rates are too low, and capital is misallocated as a result."

-

"More than the wage data however, we’d focus on the unemployment rate. We

look for a solid 240k increase in non-farm payrolls, a 2.2% increase in

hourly earnings and a drop to 5.2% from 5.3% in the unemployment rate."

-

"Anything that gets the front end of the curve higher in the US should

be negative for EUR/USD. A meander back above 1.10 is possible in the

early part of the week, but we’d like to sell against 1.11 and look for a

break lower in August."

Thus, I think - it may be good bearish breakdown during this high impacted news event.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.04 07:40

Bank of Tokyo-Mitsubishi - 'we target EUR/USD at parity by year-end and at 0.96 by Q1'16-end' (based on efxnews article)

Bank of Tokyo-Mitsubishi (BTMU) made their fundamental forecasts for EURUSD based on some fundamental factors:

- "The euro weakened in July with the focus in the foreign exchange market shifting away from the uncertainty related to ‘Grexit’ and back to the monetary policy divergence between the euro-zone and the US. That should mean that the euro reverts to being the funding currency of choice."

-

"We suspect there’s a lot more potential selling to come."

- "However, falling oil prices, if extended, will complicate the ECB’s achievement of its inflation target that could mean the ECB needs to extend QE while China weakness that keeps capital flowing out of China means reduced FX reserves that removes reverse recycling support for the euro as well."

-

"Despite the resolution to the crisis in Greece, at least for now, we maintain that the fundamentals point to renewed EUR weakness and a decline in EUR/USD toward parity."

Bank of Tokyo-Mitsubishi (BTMU) forecasts for EURUSD to be at parity by year-end and at 0.96 by Q1'16-end.

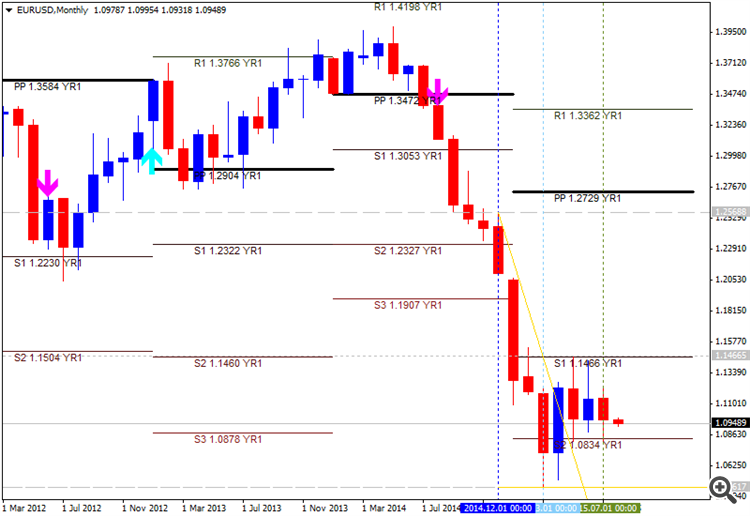

By the way, the price is located to be below yearly Central Pivot at 1.2729 for the primary ranguing between S1 Pivot at 1.1466 and S2 Pivot at 1.0834, and the next target in the case the bearish trend will be continuing is S3 Pivot at 0.9571. So, the Bank of Tokyo-Mitsubishi (BTMU) is right with their forecast.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.04 17:13

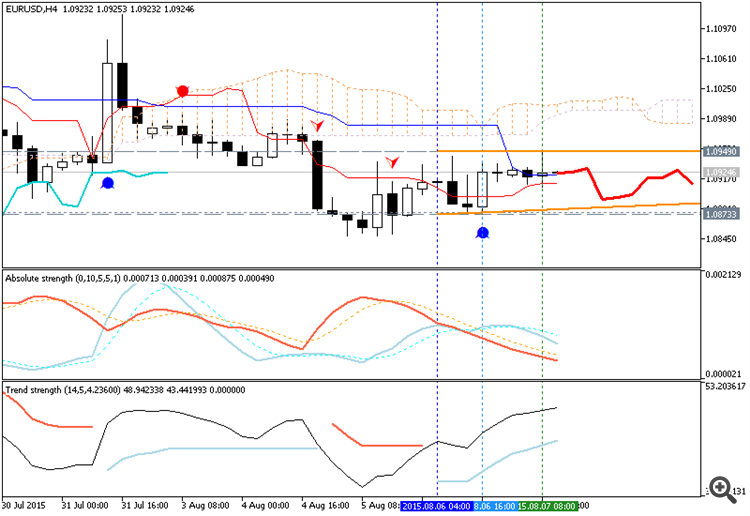

EURUSD Breakout Fails (based on dailyfx article)

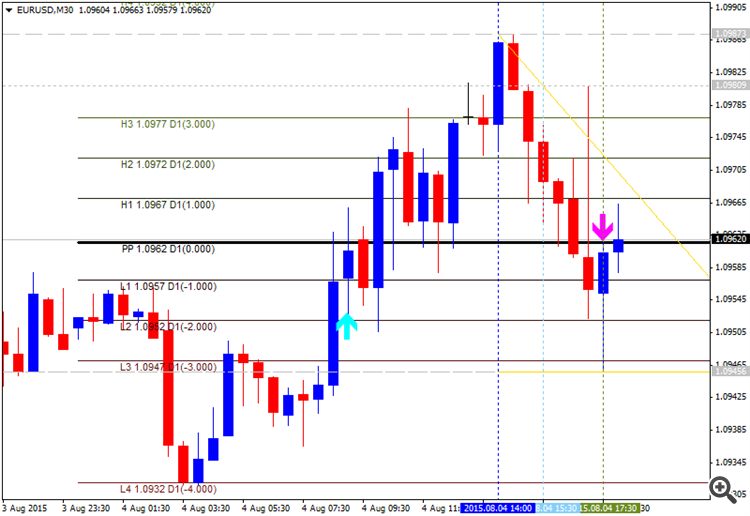

- An Initial bullish breakout fails for the EURUSD

- Range reversals begin at 1.0964

- Range support starts at 1.0934

After traversing its daily 30 pip range, the EURUSD has opened the US trading session with a false breakout. Prices attempted a move above today’s R4 Camarilla pivot at 1.0979, but this bullish breakout quickly reversed. Prices are currently tradingback inside of today’s pivot range. As seen below, the EURUSD’s trading range begins at resistance found at the R3 pivot, at a price of 1.0964. If price continues to decline through values of support, traders will begin to look for price to target the S3 pivot found at a price of 1.0934.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.05 15:23

SEB - Outlooks For EUR/USD, EUR/JPY, AUD/USD, NZD/USD (based on efxnews article)

EUR/USD: "Continued losses yesterday brought the prices down through the 1.0921 support an event that adds additional bearishness to our outlook. The next and stronger support is located in the 1.0819-1.0808 range (May and July lows) and should be thoroughly tested within shortly."

EUR/JPY: "Repeatedly rejected from the combined 55/233d ma bands the pair again seems to be making way for a test of the utterly important 133.30/10 support. So remaining below 136.17 should keep us in the bear camp looking for additional losses near term."

AUD/USD: "The primary correction target, the rechecking of the previously broken trend-line, was fulfilled yesterday with the pair moving up to 0.7428 before stalling and rolling over to the downside. A move below yesterdays mid body point, 0.7322, will further enhance downside forces and below 0.7260 new trend lows will be confirmed."

NZD/USD: "Underpinned by another poor dairy auction yesterday (index down -9.3%) the Kiwi continued its decline. A completed three wave pattern (a-b-c) correction does also weigh on prices making a new trend low look like a done deal."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.06 12:35

UBS - Trade Ideas For EUR/USD, USD/CHF, AUD/USD (based on efxnews article)

EUR/USD: "Stay flexible ahead of the US payrolls with a slight bias to sell rallies. Watch support at 1.0880/1.0820 and resistance at 1.0940-50/1.0990."

USD/CHF: "Only a shocking US NFP tomorrow can change

this dollar bullish tone. We still like buying on dips to 0.9740-60 as

long as USDCHF trades above 0.9720."

AUD/USD: "had a rollercoaster ride during trading in

Asia on Australian jobs data. Stick to playing the pair from the short

side, adding on rallies with a stop above 0.7430 and targeting an

eventual move towards 0.7000."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.07 09:19

The Royal Bank of Scotland - USD Into Payrolls (based on efxnews article)

The Royal Bank of Scotland (RBS) made forecast concerning the following coming high impacted news events:

- Non-Farm Payrolls (or Non-Farm Employment Change) - they made a forecast for non-farm payroll growth of 250K in July, above the listed consensus of 225K.

Just to remind that previous NFP data was 223K,

and forecasting for now is 225K for example, so if RBS is looking for

250K as an actual data - it

means to be more bearish for EURUSD. Because in case of NPF: actual >

forecast = good for currency (for US Dollar in our case). So, it means:

more bearish for EURUSD with some key support levels to be broken.

- "After 2Q growth in the Employment Cost Index (ECI, a broad measure of compensation) underwhelmed sharply, we think the monthly average hourly earnings growth could look more positive, as even a trend like gain would boost the y/y rate. (RBSe 2.2% y/y vs. consensus 2.3%). While we think the employment report will be broadly positive, our economists think a pickup in the labour force could push the unemployment rate up from 5.3% to 5.4%."

- "We think strong payroll gain should support the USD, particularly after FOMC officials have placed a much greater focus on the cumulative recovery in the labour market than on concerns emanating from abroad."

And just about the levels:

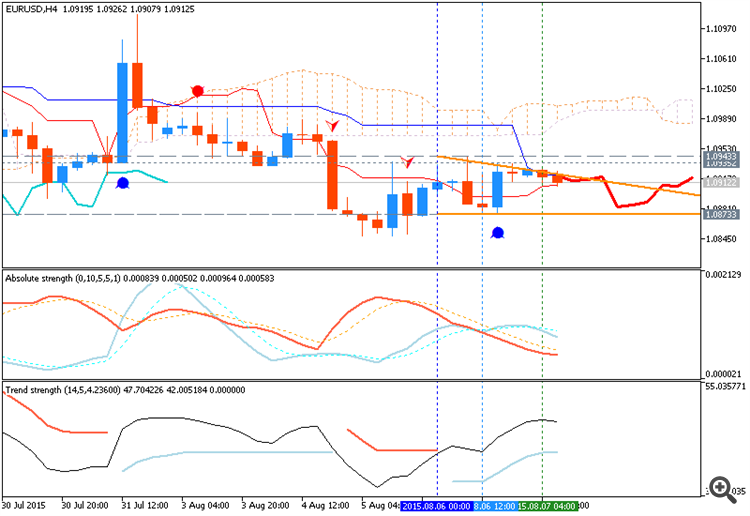

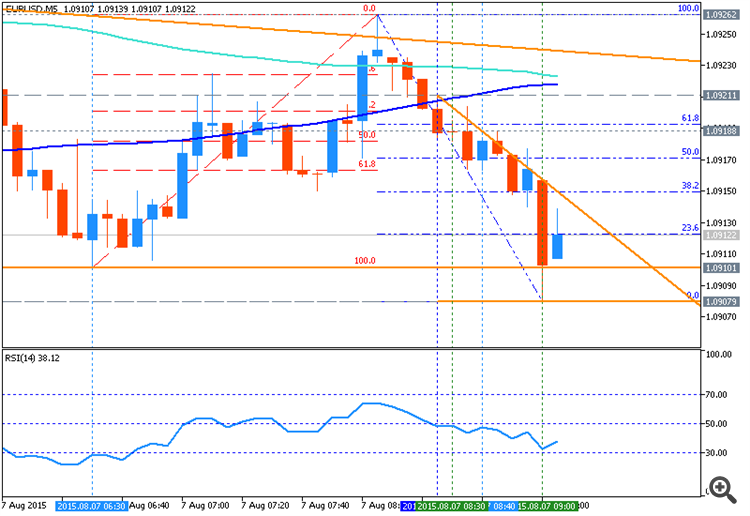

- if we look at H4 Ichimoku chart so we see that the price is on ranging bearish with 1.0873 support level;

- if we look at M5 price action chart - the support level to be brokeb by price will be 1.0910.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.07 11:00

Trading News Events: U.S. Non-Farm Payrolls (based on dailyfx article)

Another 225K expansion in U.S. Non-Farm Payrolls (NFP) may spur greater demand for the greenback and spark a near-term sell-off in EUR/USD should the fresh batch of data heighten speculation for a Fed rate hike at the September 17 meeting.

What’s Expected:

Why Is This Event Important:

Despite the unanimous vote to retain the zero-interest rate policy (ZIRP) at the July 29 meeting, signs of a stronger recovery may generate a greater dissent within the Federal Open Market Committee (FOMC), and we may see a growing number of central bank officials talk up bets for a September liftoff should the employment report boost the outlook for growth and inflation.

However, waning business sentiment along with the ongoing weakness in

private-sector spending may drag on job growth, and a dismal employment

report may encourage the Fed to further delay its normalization cycle

especially as Chair Janet Yellen looks for a further improvement in

labor dynamics.

How To Trade This Event Risk

Bullish USD Trade: U.S. Employment Increases 225K or Greater

- Need red, five-minute candle following the NFP print to consider a short trade on EUR/USD.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same setup as the bullish dollar trade, just in reverse.

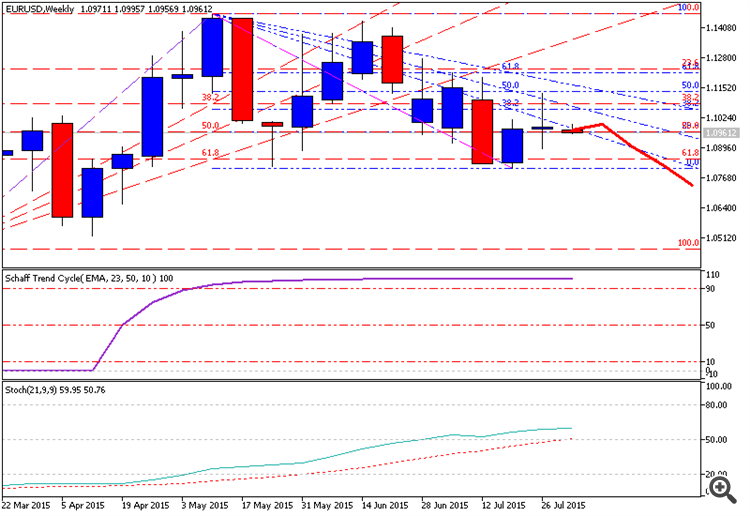

EURUSD

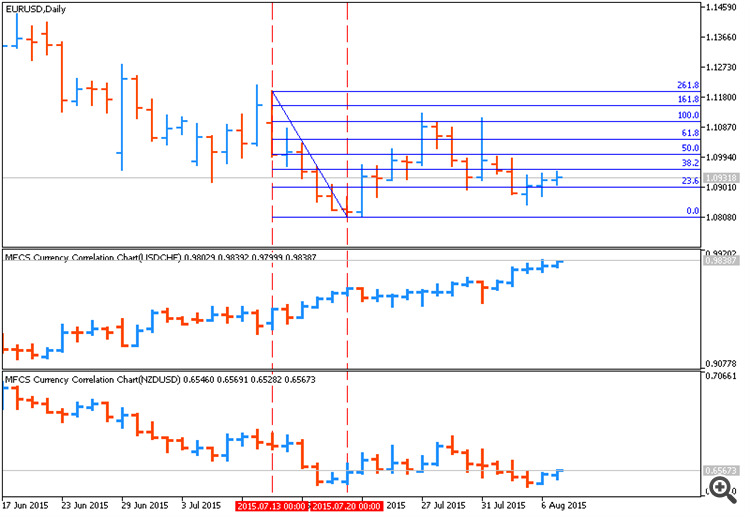

- Long-term outlook for EUR/USD remains bearish amid the divergence in the policy outlook, but the pair may continue to consolidate over the near-term as it remains stuck in the wedge/triangle formation from earlier this year.

- Interim Resistance: 1.1180 (23.6% expansion) to 1.1210 (61.8% retracement)

- Interim Support: 1.0790 (50% expansion) to 1.0800 (23.6% expansion)

June 2015 U.S. Non-Farm Payrolls

EURUSD M5: 66 pips price movement by USD - Non-Farm Payrolls news event:

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.07 13:25

Société Générale - What's Best To Sell Against The Dollar (based on efxnews article)

- "The case for being long dollars is now mostly about the US. That is relevant in the case of the Australian dollar. The RBA this week removed the reference to wanting a weaker currency from its monetary policy statement."

- "There’s a bit of upside in USD/JPY given its correlation with US rates, but if the driver of dollar strength is risk aversion and capital repatriation, the yen won’t be the biggest loser."

- "At the other extreme, the most obvious short is still the Chinese Renminbi, but that it is not a freely floating currency. Its strength is a reason to be wary of commodities, rather than a trade in itself."

- "And a reason to be short at least one of the commodity currencies: I choose NZD in G10."

- "But the stand-out overvalued currency on this chart is the Swiss Franc, and EUR/CHF is finally edging the SNB’s way. The technical analysis section of this weekly suggests longs in GBP/CHF."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

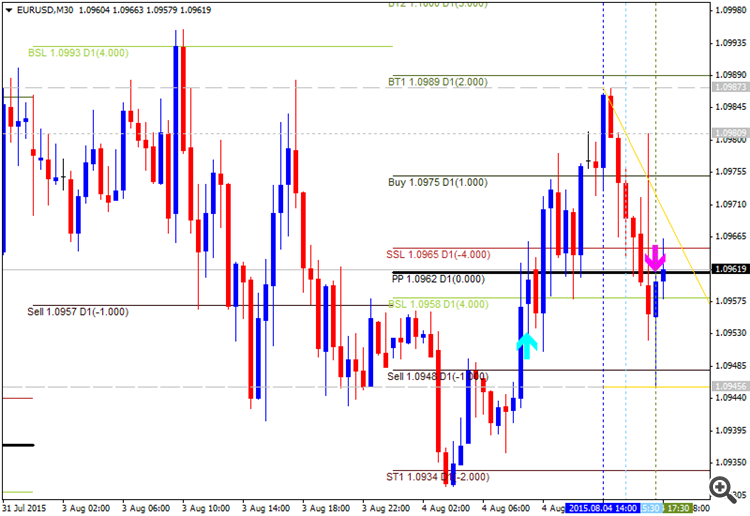

Daily price is on bearish market condition for ranging between the following s/r levels:

Chinkou Span line is indicating the ranging market condition by direction.

D1 price - ranging:

W1 price is on bearish market condition with secondary ranging between 1.0807 (W1) support level and 1.1436 (W1) resistance level.

MN price is on ranging bearish with 1.0461 support level.

If D1 price will break 1.0807 support level on close D1 bar so the bearish trend to be continuing for the week up to 1.0461 as a next target.

If D1 price will break 1.1436 resistance level so the price will be on strong bullish market condition with next target as 1.1533.

If not so the price will be on ranging between 1.0807 and 1.1436 levels.

SUMMARY : bearish

TREND : ranging bearish