Thank you very much. This is in the plans There will be also an analysis of traders' sentiment in one of the next articles, obtained from MFXBook, but for now there are some problems with it, I didn't find where they store the history of sentiment).

What I don't understand is, what does MQ even do?

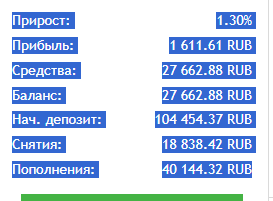

That's the author's signal above.

As an argument - in the text, you can't tell whose code is whose...

"In our code, the forecast function works on probabilities."

"Unfortunately, your code doesn't have an explicit visualisation of the results yet."

And there were a lot of strange things there, I've already got it out of my head, I won't read it again now.

Of course, the topic is interesting, but the text seemed strange in the wording of the thought.

Since we have taken up this issue, I will propose in the next article to check the usefulness of macroeconomic data in general, by training a model using them before their publication. That is, if we were insiders. It is possible to shift in different ways before the beginning of the month for which the analyst.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Check out the new article: Economic forecasts: Exploring the Python potential.

Financial markets are a good barometer of the economy. They react to the slightest changes. The result can be either predictable or unexpected. Let's look at examples where readings cause this barometer to fluctuate.

When GDP grows, markets usually react positively. When inflation rises, unrest is usually expected. When unemployment falls, this is usually seen as good news. However, there might be exceptions. Trade balance, interest rates - each indicator affects market sentiment.

As practice shows, markets often react not to the actual result, but to the expectations of the majority of players. "Buy rumors, sell facts" - this old stock market wisdom most accurately reflects the essence of what is happening. Also, the lack of significant changes can cause more volatility in the market than unexpected news.

Author: Yevgeniy Koshtenko