These are the results of my strategy, both use data based on real ticks of the same currency pair and the same strategy with the same inputs and conditions, the only difference is that the real tick data from one is from Pepperstone broker and the other is from Dukascopy. Would anyone know why they show different results despite opening exactly the same positions?

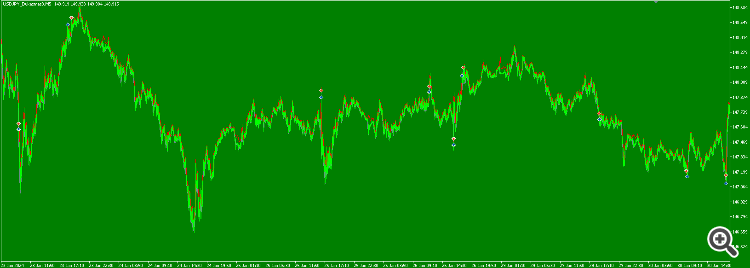

This one is from Pepperstone

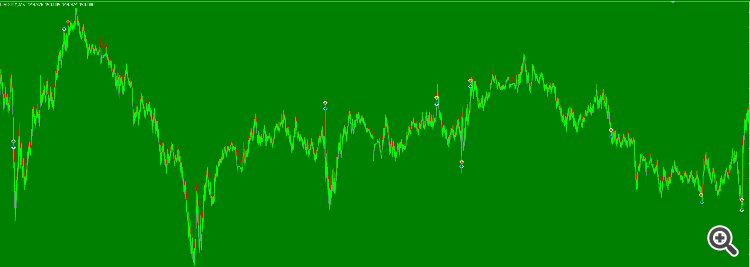

This one from Dukascopy

And as you can see, the positions are the same, yet the results in balance are different.

From dukascopy:

From Pepperstone:

help :(

Forex and CFD's are over-the-counter (OTC) markets where each broker-dealer is its own captive market. Different prices = different results.

...and this is why 2 traders using the same ea can have very different results: 1 can make millions, while the 2nd trader will lose everything, even when trading the same period of time. This is nothing new.

the take away from this? always test an ea on your own broker before you put it live on your account; no matter if another trader made millions; your broker may have these same differences shown above, and you will blow your account.

...and this is why 2 traders using the same ea can have very different results: 1 can make millions, while the 2nd trader will lose everything, even when trading the same period of time. This is nothing new.

the take away from this? always test an ea on your own broker before you put it live on your account; no matter if another trader made millions; your broker may have these same differences shown above, and you will blow your account.

Thank you for responding, I agree that testing with the broker's data is the most accurate approach. The issue is that I downloaded data from Dukascopy to evaluate the strategy over longer time periods (5 years) since with Pepperstone, using the "Every tick based on real ticks" model gives me more accurate results with a demo account I have, but I can only test one year back with that model. The further back I go, the lower the history quality percentage becomes. That's why I downloaded ticks from Dukascopy, but I found that even though both execute exactly the same trades, the balances are different.

sounds like good reasoning; i am sure that i would have done the same thing, however, that only makes our point (punn intended haha), that like RYan said, a broker is its own market with its own price feed; and that that this is a normal issue, and that results on different brokers dont mean much, other than that the ea is obviously better run on 1 broker than the other.

Thank you for responding, I agree that testing with the broker's data is the most accurate approach. The issue is that I downloaded data from Dukascopy to evaluate the strategy over longer time periods (5 years) since with Pepperstone, using the "Every tick based on real ticks" model gives me more accurate results with a demo account I have, but I can only test one year back with that model. The further back I go, the lower the history quality percentage becomes. That's why I downloaded ticks from Dukascopy, but I found that even though both execute exactly the same trades, the balances are different.

Compare spreads tick by tick (or at least, second by second).

Large markup (plus swaps, comissions, fee, etc.) can kill every strategy.

If the EA makes use of really tight trailing stops then this is probably what's causing the difference. Also different datasets usually have different spreads which also affects how trailing stops function since they are also executed at bid and ask prices. Also at times where news events occur I get completely different high and low values for the same candles when comparing dukascopy and my broker and this is by hundreds of pips. So if you want something to be stable across all brokers then you need to learn to code a specific news filter for the strategy tester and one for a live account. The spread differences also apply to right after market close at 5pm EST. Dukascopy will have comparably smaller spreads than my broker so I take that into account by not trading until like 9pm EST.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

These are the results of my strategy, both use data based on real ticks of the same currency pair and the same strategy with the same inputs and conditions, the only difference is that the real tick data from one is from Pepperstone broker and the other is from Dukascopy. Would anyone know why they show different results despite opening exactly the same positions?

This one is from Pepperstone

This one from Dukascopy

And as you can see, the positions are the same, yet the results in balance are different.

From dukascopy:

From Pepperstone:

help :(