What is Moral Expectation...?

In general, it is a Prediction for the FUTURE....

I.e., we want to guess the FUTURE EVENTS, in this case, the possible profit....

But a Trader does not need guessing... He needs Confidence in his trading strategy....

If he needed fortune-telling, it would be easier to go to the Casino and check his luck there....

A trader is interested in a SCIENTIFIC and BASED approach to his trading!

What is Moral Expectation...?

In general, it is a PROGNOSIS for the FUTURE....

I.e., we want to Predict FUTURE EVENTS, in this case, possible profits.....

But a Trader does not need guessing... He needs Confidence in his trading strategy....

If he needed fortune-telling, it would be easier to go to the Casino and check his luck there....

A trader is interested in a SCIENTIFIC and BASED approach to his trading!

With a small correction - not to guess future events, but to anticipate the consequences of the occurrence of one of the options

About the scientific and substantiated approach... Any branch of knowledge becomes a science only when it has its own mathematical apparatus. Moral expectation brings trading closer to science

With a small correction - not to guess future events, but to anticipate the consequences from the occurrence of one of the options

About scientific and reasoned approach... Any branch of knowledge becomes a science only when it has its own mathematical apparatus. Moral expectation brings trading closer to science

Trader's goal is to get stable profit! Achievement of this goal is not possible in the absence of Confidence in his trading strategy.

And "foresight" or guessing has NOTHING to do with this goal... It is the same as calculating the options in the casino....

Yes, you can count on luck or "foresight", but this is not a scientific approach to this goal....

Thanks to the author, interesting article. As they say, there are nuances ))

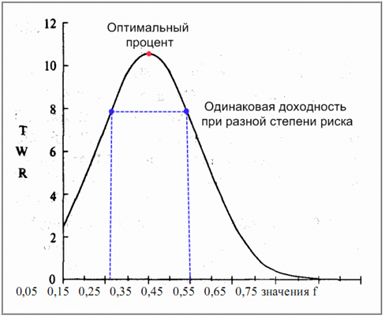

Surprisingly similar 2 of these graphs:

As far as I understand it, the second chart is Vince's "The Maths of Money Management".

They are similar because they are built on the same principle. Optimising losses causes the lot to decrease, optimising profits causes the lot to increase. And if we optimise both, we get a lot that minimises losses and maximises profits.

As far as I understand it, the second chart is Vince's "The Maths of Money Management".

They are similar because they are based on the same principle. Optimising losses causes the lot to decrease, optimising profits causes the lot to increase. And if we optimise both, we get a lot that minimises losses and maximises profits.

All these points are secondary to the strategy itself....

If the strategy is bad, then no optimisation of secondary factors will help in making profit....

What is the use of optimising the lot increase if the strategy itself is SLEEPING....

You have to start with the strategy itself... And the main parameters of the strategy itself are the minimum drawdown and the maximum number of profitable trades....

These two parameters will automatically ensure your profitability...

All of these points are secondary to the strategy itself.....

If the strategy is bad, no amount of optimisation of secondary factors will help in making a profit....

What is the use of optimising lot increase, if the strategy itself is SLEEPING....

You have to start with the strategy itself... And the main parameters of the strategy itself are the minimum drawdown and the maximum number of profitable trades....

These two parameters will automatically ensure your profitability...

Balabolabol, read the title of the article, you can read it 10 times...

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

New article Moral expectation in trading has been published:

This article is about moral expectation. We will look at several examples of its use in trading, as well as the results that can be achieved with its help.

This was a theory. Now let's see what we can do in practice. To do this, write a script that simulate the execution of trades. We will check three options at the same time - with a fixed stop loss and take profit, with a floating stop loss and with a floating take profit.

At first glance, the option with the fixed stop loss and take profit (blue line) wins.

However, it should be remembered that we used the maximum stop loss and the minimum take profit possible. What will happen if we move away from these boundaries by slightly reducing the stop loss and increasing the take profit? Then the situation may change.

Author: Aleksej Poljakov