Hello,

I wanted to know if there is a difference between the sharpe ratio given on the matatrader software when we do a test and the one given in the signals?

Curiously, it seems that the value of the sharpe ratio is not the one generally known?

Thanks.

Hmm - what about searching before asking?

This gives almost 100*10 links about this topic with the documentation how MQ is using is in its strategy tester right at the top: "Mathematics in trading: Sharpe and Sortino ratios"

Hmm - what about searching before asking?

This gives almost 100*10 links about this topic with the documentation how MQ is using is in its strategy tester right at the top: "Mathematics in trading: Sharpe and Sortino ratios"

Really glad you're here.

Good .... It seems that the sharpe ratio generally used is the one used in test reporting. This is the one we find when we look at the mql doc at this link: https://www.metatrader5.com/en/terminal/help/algotrading/testing_report

However for the signal it seems that it is not the same and we see it on the help page for the search for an mt5 signal at this link: https://www.metatrader5.com/en/terminal/help/signals/signal_monitoring

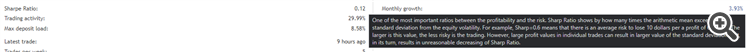

We notice that in the statistical explanations of a signal the unit of the sharpe ratio is in "%"??

A Google search does not direct me to a sharpe ratio in percentage, so I come to ask my question here.

Will you answer it? Thanks

- www.metatrader5.com

Really glad you're here.

Good .... It seems that the sharpe ratio generally used is the one used in test reporting. This is the one we find when we look at the mql doc at this link: https://www.metatrader5.com/en/terminal/help/algotrading/testing_report

However for the signal it seems that it is not the same and we see it on the help page for the search for an mt5 signal at this link: https://www.metatrader5.com/en/terminal/help/signals/signal_monitoring

We notice that in the statistical explanations of a signal the unit of the sharpe ratio is in "%"??

A Google search does not direct me to a sharpe ratio in percentage, so I come to ask my question here.

Will you answer it? Thanks

I mean: same Sharpe calculation for strategy tester and for the signal page.

Je pense - c'est une erreur car ce n'est pas dans "%".

Je veux dire : même calcul de Sharpe pour le testeur de stratégie et pour la page de signal.

I find it strange that despite a lot of research I can't find a signal with a sharpe ratio greater than 1. It just seems that the calculation is different. I compared backtests between some trading systems and their online signal, it's not the same ratio at all. The difference is not minimal and is great I am talking about a signal where the ratio is 0.25 in signal and in back test I have a ratio greater than 3! that's a big difference.

- www.mql5.com

* { WORD-WRAP: break-word; FONT-FAMILY: "Segoe UI" } I find it strange that despite a lot of research I can't find a signal with a sharpe ratio greater than 1. It just seems that the calculation is different. I compared backtests between some trading systems and their online signal, it's not the same ratio at all. The difference is not minimal and is great I am talking about a signal where the ratio is 0.25 in signal and in back test I have a ratio greater than 3! that's a big difference.

There are Sharpe Ratio, Modified Sharpe Ratio and Annual Sharpe Ratio, and this all is described in the following:

The Sharpe Ratio

William F. Sharpe

Stanford University

Reprinted fromThe Journal of Portfolio Management, Fall 1994

I do not know which Sharpe Ratio is used for the signal.

But the Sharpe ratio is mostly used for porfolio trading/estimation, and this is not a portfolio (we can subscribe to one signal only by one trading account).

And that is why the users are not looking at Sharpe Ration in most of the cases.

Most likely a different risk free rate is used, hence a different ratio.

Frankly, I don't mind, but normally there should be a signal where the sharpe ratio is greater than 1? But hey, it seems that there is none... even trading solutions which in backtest have a ratio of 40 are below 1 on their signal.

If a different calculation is used, I would just like to succeed in transcribing it into what we know to find limits that speak to me, in particular having a signal greater than 2... which is normally the minimum to have for us to be interested in it.

There are Sharpe Ratio, Modified Sharpe Ratio and Annual Sharpe Ratio, and this all is described in the following:

The Sharpe Ratio

William F. Sharpe

Stanford University

Reprinted fromThe Journal of Portfolio Management, Fall 1994

I do not know which Sharpe Ratio is used for the signal.

But the Sharpe ratio is mostly used for porfolio trading/estimation, and this is not a portfolio (we can subscribe to one signal only by one trading account).

And that is why the users are not looking at Sharpe Ration in most of the cases.

Study the formula. The calculation is the same, the risk free rate is different. There is no point in sharpe ratio on the website, tester etc. Your risk free rate might be different from mine.

Because the risk free rate change over time, there is no such thing as "should be this or that value".

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hello,

I wanted to know if there is a difference between the sharpe ratio given on the matatrader software when we do a test and the one given in the signals?

Curiously, it seems that the value of the sharpe ratio is not the one generally known?

Thanks.