The main purpose of this topic is for the general discussion of the synthetic symbols Boom & Crash.

In order to adhere to the forum rules, I respectfully request that there be no discussion about brokers, market products, signals, nor any 3rd party references.

You are free to discuss how these markets behave, your observations, or general impressions. You can discuss outlooks, strategies, Indicators or Expert Advisors, but if you do, they should be open source, either available in the CodeBase or the source provided in the forum.

Please don't discuss forecasts or predictions, or your trade journals. The thread is just a general discussion for those that wish to know more about these two symbols or wish to share their observations about the behaviour of the symbols.

As for my own observations, I have on and off read or heard people talking about it, but usually just ignored considering it some “fad”. But about a month ago, I decided I should look into it instead of just remaining ignorant about such matters.

Initially, a just applied for a demo account and just observed them, and found the behaviour at the tick level or on the M1 chart quite peculiar. After reading up a bit more on them, I then opened a live account with 1:30 leverage and a small deposit of €120.

My aim was just to manually trade it, while observing its behaviour. So, I focused on the “Boom 300” on an M1 chart, while also observing its market nature on the higher time-frames.

I found them quite refreshing, given that there are no fundamentals to worry about or news events to cause sudden changes in their nature. On the higher time-frames, they can be traded purely based on technical analysis. It is very easy to spot trends, as they are usually well defined and last a respectable amount of time.

On the M1 chart, however, it can be tricky because of their sudden spikes (“Boom”) or drops (“Crash”), making it very difficult if not impossible to use stops because of the slippage that will occur if the stops are too tight. One requires a unique approach to scalp the M1 or the tick chart, but on a whole I totally enjoyed myself trading manually, which I have not done for a long time.

From my observations, I believe the higher time-frames can be traded with traditional or known strategies with reasonable success, given that trends are well formed and easy to follow. It is only at the very lowest of time-frames that things work completely different to how forex type symbols behave.

I plan to continue playing and enjoying myself with these two interesting synthetic symbols, observing them further and maybe creating some new strategies for them, especially for the M1 or tick chart.

So, if you want something free from fundamentals and news events, try playing a bit with them. They can be quite fun. But remember — be responsible and don’t be greedy. Take your time to learn to trade properly and responsibly.

I will continue to add my observations and progress as I play and have fun with “Boom” and “Crash”!

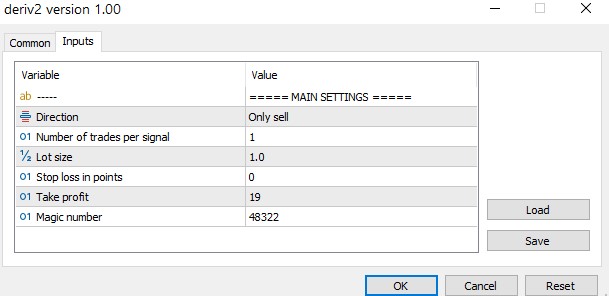

Thank you for the post i do have vast experience trading boom and crash indexes i have gone at length to create trading robots based on several ideas i mastered, closing trades based on time ,close trades based on ticks etc. Attached is some idea i am working this is not a complete version hence i will ask you to try it on your demo account. I prefer all boom and crash pairs on 5 minutes ,i trade the reverse of each pair, that is to say for boom i focus on sells only and crash i focus on buy only trades. The take profit is based on time to avoid being hit by spikes or drops. If there are any other developers with ideas i will be happy to understand their thought and ideas. For instance on Boom 1000 set to 5 minutes time frame, just for demonstration purposes, I trade every candle based on time

the bigger the take profit number the likelihood you will be in a loss if you play with small time frames, hence i stick to bigger time frames on my live account.

A quick research showed me there is only 1 broker offering this. Is this correct or is the info outdated?

Also, who takes the other side of the trade?

- There is more than one broker, but they are related.

- The other side is taken by the broker. In other words, it's a dealing-desk situation.

There is most probably some manipulation and stop-hunting taking place, but not enough to cause it from deviating noticeably from it's fundamental nature. By my observation thus far, it is rather stable and trends quite well on higher time-frames. and at the tick level, it adheres quite well to it's statistical nature. For example, the Boom 300 has one spike every 300 ticks on average, and each M1 bar has approximately 60 ticks per bar. It's spread is also quite stable.

There are other metrics and statistics that I have been analysing, that tend to be quite stable too, even if stop-hunting and manipulation is taking place. Another good thing, is that the brokers in question, are all regulated. In my case, it is the first broker I use that is registered with CMVM here in Portugal (and in each respective European country too), and they were very rigorous with my documentation and fiscal responsibilities. So, from this I can only conclude that they are also closely monitored to make sure that they operate properly in order to maintain their reputation with each of the regulating bodies they are registered with.

In my view you are trading against this one broker when trading these instruments and that makes me feel uncomfortable.

Yes, that is correct! You are trading mostly against the broker but also their customer base. What percentage is the broker and what percentage is the customer base, is unknown.

At the moment, I'm still just trading it for the fun (with a very small account), but at the same time I am also studying its behaviour. So far, I have not yet detected any "funny business", and things are reacting in accordance with the expected probabilities.

As time goes by, and I gain more experience with it, I might increase my capital and trade more rigorously. But for now, I am only in "research mode"!

Yes, that is correct! You are trading mostly against the broker but also their customer base. What percentage is the broker and what percentage is the customer base, is unknown.

At the moment, I'm still just trading it for the fun (with a very small account), but at the same time I am also studying its behaviour. So far, I have not yet detected any "funny business", and things are reacting in accordance with the expected probabilities.

As time goes by, and I gain more experience with it, I might increase my capital and trade more rigorously. But for now, I am only in "research mode"!

I would be interested to read your findings Fernando, I know that whatever you do, you do it methodically.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use