Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.20 17:40

Forex Weekly Outlook March 23-27Inflation data in the UK and the US, housing data from the US, German Ifo Business Climate, US Core Durable Goods Orders, Us Unemployment Claims and Stephen Poloz’ speech. These are the highlights of this week. Follow along as we explore the Forex market movers.

Last week, The Federal Reserve removed the word “patient” from its policy statement, increasing the odds for a rate hike in the coming months. However, the Fed also downgraded its economic growth and inflation projections. The Policy makers’ rate hike decision depends on mixed economic data, on one-hand strong job gains and robust consumer demand, while on the other hand, falling oil prices and a strong dollar, reducing exports and lowering inflation. Will the Fed raise rates on its June meeting?

- Mario Draghi speaks: Monday, 14:30. ECB President Mario Draghi will testify before European Parliament’s Economic and Monetary Affairs Committee, in Brussels. He may talk about the new QE program aimed to boost growth in the euro countries and about his growth prospects for the bloc. Market volatility is expected.

- UK inflation data: Tuesday, 9:30. UK inflation declined to the lowest level on record, reaching 0.3% in January, compared to 0.5% in December 2014, amid a sharp depreciation in global oil prices as well as falling food costs. Most economists were not concerned about this drop since core CPI excluding the more volatile prices such as food and energy actually rose to 1.4% in January. Inflation is expected to decline further to 0.1%.

- US inflation data: Tuesday, 12:30. US consumer price index declined 0.7% in January after dropping 0.3% in November and December. Energy prices shed 9.7% while the gasoline index plunged 18.7%. However, excluding the volatile food and energy sectors, core inflation increased 0.4% in January and over 2% on a yearly base. However, economists believe the subdued inflation is temporary held down by the sharp fall in oil prices. Analysts expect consumer prices to gain 0.2%, while core prices to increase by 0.1%.

- US New Home Sales: Tuesday, 14:00. New U.S. single-family home sales declined only mildly in January, reaching 481,000 from 482,000 in December, despite bad weather conditions in winter. Economists expected a decline to 471,000 in January. Analysts believe the housing market will continue to recover in the coming months due to stronger employment data. US new home sales are expected to reach 475,000 in February.

- Eurozone German Ifo Business Climate: Wednesday, 9:00. German business sentiment improved in February to 106.8 from 106.7 in January. The reading was below market expectations, but the continuous growth suggests rising confidence in light of economic growth and optimism over European Central Bank stimulus. German growth was boosted by lower oil prices as well as a weaker euro. However, the Greek ordeal still clouds business sentiment. Business climate is expected to rise further to107.4.

- US Core Durable Goods Orders: Wednesday, 12:30. Orders for durable goods edged up in January for the first time in three months, rising 2.8% suggesting the manufacturing sector is stabilizing. The reading was higher than the 1.7% increase forecasted by analysts and was preceded by a 3.3% fall in December 2014. Meanwhile Core durable goods orders excluding transportation items increased 0.3%. Durable goods orders are expected to gain 0.6%, while core orders are predicted to rise 0.5%.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing new claims for unemployment benefits increased by 1000 last week, reaching 291,000, indicating the job market remains strong. The four-week moving average, rose 2,250 to 304,750 last week. Despite some volatility, the number of claims still indicate a growth trend in the US labor market. The number of jobless claims is expected to reach 295,000 this week.

- Stephen Poloz speaks: Thursday 13:30. BOC Governor Stephen Poloz is scheduled to speak at a press conference in London. Poloz may refer to the recent BOC surprising rate cut decision, following the global oil price crush and its possible effect on the Canadian economy.

- US Final GDP: Friday, 12:30. Following an incredible growth rate of 5% in the third quarter of 2014, the last three months of 2014 are expected to be much weaker. According to the preliminary GDP reading for the fourth quarter, growth reached 2.2%. Analysts expect the final reading to be 2.4%.

- Janet Yellen speaks: Friday, 19:45. Federal Reserve Chair Janet Yellen will speak in San Francisco and talk about the Fed’s monetary policy. On the last policy meeting the Fed omitted the word “Patience” from the statement, preparing markets for a near rate hike despite lowering its forecast on growth and inflation. Market volatility is expected.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.06 18:38

What is the Pip Cost for Gold and Silver?

- Gold: Symbol XAU/USD

The pip cost for 1 ounce of Gold (minimum trade size) is $0.01 per pip. - Silver: Symbol XAG/USD

The pip cost for 50 ounces of Silver (minimum trade size) is $0.50 per pip

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.23 16:28

2015-03-23 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Existing Home Sales]- past data is 4.82M

- forecast data is 4.90M

- actual data is 4.88M according to the latest press release

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Existing Home Sales] = Annualized number of residential buildings that were sold during the previous month, excluding new construction. It's a leading indicator of economic health because the sale of a home triggers a wide-reaching ripple effect. For example, renovations are done by the new owners, a mortgage is sold by the financing bank, and brokers are paid to execute the transaction.

==========

U.S. Existing Home Sales Climb 1.2% In February

After reporting a steep drop in existing home sales in the U.S. in the previous, the National Association of Realtors released a report on Monday showing a rebound in existing home sales in the month of February.

NAR said existing home sales rose 1.2 percent to an annual rate of 4.88 million in February after tumbling 4.9 percent to a rate of 4.82 million in January. Economists had expected existing home sales to climb to a rate of 4.90 million.

With the monthly increase, existing home sales are up by 4.7 percent compared to a rate of 4.66 million in the same month a year ago.

Lawrence Yun, NAR chief economist, said, "Insufficient supply appears to be hampering prospective buyers in several areas of the country and is hiking prices to near unsuitable levels."

"Stronger price growth is a boon for homeowners looking to build additional equity, but it continues to be an obstacle for current buyers looking to close before rates rise," he added.

The report said housing inventory climbed 1.6 percent to 1.89 million existing homes available for sale at the end of February but were down 0.5 percent year-over-year.

The homes for sale at the end of the month represent 4.6 months of supply at the current sales pace, unchanged from the previous month.

Tuesday morning, the Commerce Department is scheduled to release a separate report on new home sales in the month of February.

Economists expect new home sales to drop to a rate of 462,000 in the month of February from a rate of 481,000 in January.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

XAUUSD M5: 6.03 dollars (603 pips) price movement by USD - Existing Home Sales news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.21 08:33

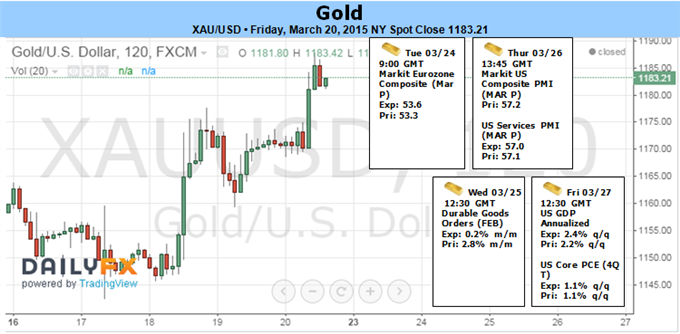

GOLD Fundamentals (based on dailyfx article)

Fundamental Forecast for Gold: Bullish

- Bullish USD Outlook Mired Post FOMC- JPY, GBP & Gold in Focus

- Gold 1200 Would be a Big Test

Gold prices are sharply higher this week with the precious metal advancing 2.14% to trade at 1183 ahead of the New York close on Friday. The advance comes on the back of the FOMC policy meeting where Yellen and company talked down expectations for a mid-2015 rate hike with the central bank lowering expectations for growth and inflation.

Even though the FOMC removed the ‘patience’ language from the forward-guidance, the updated projections coming out of the central bank dragged on the dollar as Fed officials pushed back their interest rate forecast. Indeed, the downward shift in the interest rate dot-plot raises the risk of seeing the Fed retain the zero-interest rate policy (ZIRP) into the second-half of the year, with the normalization cycle likely be on a more gradual trajectory. Accordingly, the USD may get a brief respite from its recent rally with gold set to stage a near-term recovery amid softer interest rate expectations and a subdued outlook for inflation.

Looking into next week, traders will be closely eyeing key US data points with the Consumer Price Index (CPI), Durable Goods Orders & the final read on the 4Q Gross Domestic Product (GDP) report on tap. Despite the cautions tone laid out by Chair Yellen, stickiness in the core rate of inflation along with an upward rising in the growth rate may cap dollar-losses in the days ahead as market participants now anticipate the central bank to take a softer approach in the normalization cycle.

From a technical standpoint, gold has now rebounded off the key support region we’ve been noting over the past few weeks at 1150/51. Price action this week completes a sizeable key outside reversal candle off of a critical support region with the rally taking prices briefly through the 23.6% retracement of the decline off the January highs at 1181 before settling just below. Look for near-term support at 1167/68 which is defined by the March 18th reversal-day close & the January stretch low.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.21 14:29

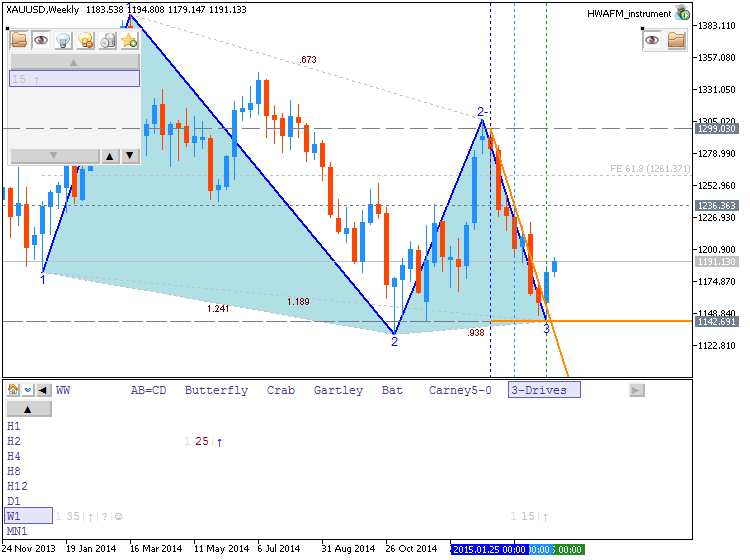

Gold forecast for the week of March 23, 2015, Technical Analysis

The gold markets

as you can see initially fell during the course of the week but found

enough support at the 1140 level to turn things back around and break

out to the upside. Now that we have cleared the 1180 level, we feel that

this market will more than likely head to the $1200 level. However, we

recognize that you will have to be able to deal with quite a bit of

volatility. Regardless though, we have no interest in selling for the

longer-term until we break down below the 1140 level, which is something

that we haven’t done quite yet.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.24 13:40

2015-03-24 12:30 GMT (or 14:30 MQ MT5 time) | [USD - CPI]- past data is -0.7%

- forecast data is 0.2%

- actual data is 0.2% according to the latest press release

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers. Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate.

==========

Consumer Price Index Summary

"The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in February on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index was unchanged before seasonal adjustment.

The seasonally adjusted increase in the all items index was broad-based, with increases in shelter, energy, and food indexes all contributing. The energy index rose after a long series of declines, increasing 1.0 percent as the gasoline index turned up after falling in recent months. The food index, unchanged last month, also rose in February, though major grocery store food group indexes were mixed.

The index for all items less food and energy rose 0.2 percent in February, the same increase as in January. In addition to shelter, the indexes for used cars and trucks, apparel, new vehicles, tobacco, and airline fares were among those that increased. The medical care index was unchanged, while the personal care index declined.

The all items index was unchanged over the past 12 months, after showing a 0.1-percent decline for the 12 months ending January. Over the last 12 months the food index rose 3.0 percent and the index for all items less food and energy increased 1.7 percent. These increases were offset by an 18.8-percent decline in the energy index."

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

XAUUSD M5: 483 pips ($4.83) price movement by USD - CPI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.25 04:21

Gold set for fifth day of gains on U.S. rate speculation (based on reuters article)

Gold hits 2-1/2 week high above $1,190/oz

Euro zone data helps euro strength vs dollar

$1,200/oz seen as major resistance level (Updates prices, adds comment)

Gold rose to a 2-1/2 week high on Tuesday, rising for the fifth straight session on growing expectations that a U.S. interest rate increase could be pushed to September.

Spot gold climbed to its highest level since March 6 at $1,195.30 an ounce before paring gains to trade up 0.4 percent at $1,193.70 by 2:26 p.m. EDT (1826 GMT).

U.S. gold futures for April delivery rose $3.70, or 0.3 percent, to settle at $1,187.70 an ounce.

Prices were on course to post their longest winning streak since January last year, with investors favoring bullion over the past few days because of a slump in the dollar after the Federal Reserve's cautious stance on the U.S. economy and diminishing likelihood of an early rate increase.

The metal, which does not pay any interest, had suffered from earlier speculation of higher U.S. rates as early as June.

"Since the Fed (statement), we've seen a pretty solid uptrend under the premise that the dark cloud of a rising interest rate environment has been pushed further off in the distance and there's some clear sailing ahead in the near term," said David Meger, director of metals trading for High Ridge Futures in Chicago.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.25 10:33

GOLD TECHNICAL ANALYSIS (based on dailyfx article)

Prices look poised for another move above the $1200/oz figure. A break above the 38.2% Fibonacci retracement at 1205.58 exposes the 50% level at 1225.04. Alternatively, a turn below the 23.6% Fib at 1181.51 targets the 1166.67-1170.09 area (channel top resistance-turned-support, 14.6% retracement).

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.25 14:09

2015-03-25 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Durable Goods Orders]- past data is 2.0%

- forecast data is 0.4%

- actual data is -1.4% according to the latest press release

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Durable Goods Orders] = Change in the total value of new purchase orders placed with manufacturers for durable goods. It's a leading indicator of production - rising purchase orders signal that manufacturers will increase activity as they work to fill the orders.

==========

U.S. Durable Goods Orders Show Unexpected Decrease In February

With orders for transportation equipment showing a notable pullback, the Commerce Department released a report on Wednesday showing that new orders for U.S. manufactured durable goods unexpectedly decreased in the month of February.

The report said durable goods orders fell by 1.4 percent in February following a downwardly revised 2.0 percent increase in January.

The drop in orders came as a surprise to economists, who had expected orders to climb by 0.7 percent compared to the 2.8 percent jump that had been reported for the previous month.

Excluding a 3.5 percent drop in transportation orders, durable goods orders still fell by 0.4 percent in February after sliding by 0.7 percent in January. Ex-transportation orders had been expected to rise by 0.3 percent.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

XAUUSD M5: 356 pips ($3.56) price movement by USD - Durable Goods Orders news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

W1 price is on bearish with market rally started on open W1 bar; Chinkou Span line of Ichimoku indicator came to be very close to the price for possible breakout of the price movement (good to open buy trade in the future)

MN price is on bearish ranging market condition

If D1 price will break 1142.69 support level on close D1 bar so the primary bearish will be continuing (good to open sell trade)

If D1 price will break 1177.81 resistance level so we will have the secondary market rally within the primary bearish with the possibility of the reversal of the price movement from bearish to bullish condition

If not so it will be bearish ranging between 1142.69 and 1177.81 levels

UPCOMING EVENTS (high/medium impacted news events which may be affected on XAUUSD price movement for this coming week)

2015-03-23 14:00 GMT (or 16:00 MQ MT5 time) | [EUR - ECB President Draghi Speech]

2015-03-23 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Existing Home Sales]

2015-03-23 15:45 GMT (or 17:45 MQ MT5 time) | [USD - FOMC Member Fischer Speech]

2015-03-24 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

2015-03-24 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - Manufacturing PMI]

2015-03-24 12:30 GMT (or 14:30 MQ MT5 time) | [USD - CPI]

2015-03-24 14:00 GMT (or 16:00 MQ MT5 time) | [USD - New Home Sales]

2015-03-25 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Durable Goods Orders]

2015-03-27 12:30 GMT (or 14:30 MQ MT5 time) | [USD - GDP]

2015-03-27 19:45 GMT (or 21:45 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on XAUUSD price movement

SUMMARY : bearish

TREND : market rally