You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

[USD - FOMC Member Fischer Speech] = Due to deliver a speech titled "Monetary Policy Lessons and the Way Ahead" at the Economic Club of New York. Federal Reserve FOMC members vote on where to set the nation's key interest rates and their public engagements are often used to drop subtle clues regarding future monetary policy.

==========

"As the FOMC responds to incoming information, it will continue to be absolutely transparent in explaining its decisions and how and why they contribute to meeting the legally mandated dual goals of monetary policy. That transparency serves three purposes: First, it is required if we are to be accountable to the public; second, it is the best way of ensuring that monetary policy decisionmakers continue to follow sensible and rational policies; and third, it is the best way of informing the private sector of the basis on which monetary policy decisions are made and will continue to be made.

With respect to forward guidance: its role has been and continues to be important in the long period in which eventual liftoff has been the key interest rate decision confronting the FOMC and the focus of market expectations. However, as monetary policy is normalized, interest rates will sometimes have to be increased, and sometimes decreased. Market participants will be able to form their expectations of future interest rates on the basis of three elements: first, the policy record of the FOMC, which might be approximated as a reaction function; second, their analysis of the current economic and financial situation and outlook; and, third, whatever guidance the FOMC will provide as to how it sees monetary policy decisions likely to unfold given the economic situation and outlook. It is likely that explicit long-term forward guidance will play less of a role in monetary policy after liftoff than it has during the past few years.

Policymakers' behavior is sometimes summarized as a reaction function, which can be an algebraic description of how the interest rate is set--for instance, a Taylor-type rule in which the federal funds rate reacts simultaneously to the rate of inflation and expectations of inflation as well as to the rate of unemployment and expected changes in the level of unemployment.21 However, a simple rule of that sort will, by necessity, leave out many factors that appropriately influence monetary policy, such as financial developments, temporary divergences in relationships between different measures of economic activity or inflation, and the like. A simple rule can provide the starting point for the decisions made by the FOMC, but in reaching their interest rate decision, members of the Committee will always have to use their judgment to identify the special circumstances confronting the economy, and how to react to them.

To ensure that monetary policy operates in as stabilizing a way as possible, the FOMC will continue to set out, as clearly as it can, the basis of every decision that it makes, and to provide guidance on its expectations of future decisions. And on the basis of the information provided by the FOMC, of their understanding of the historical record of Fed policy decisions, and of their analysis and expectations of the state of the economy and, particularly, the financial markets, market participants will make the best decisions they can"

EUR/USD Clears Bearish RSI Momentum- GBP to Face Slowing UK Inflation (based on dailyfx article)

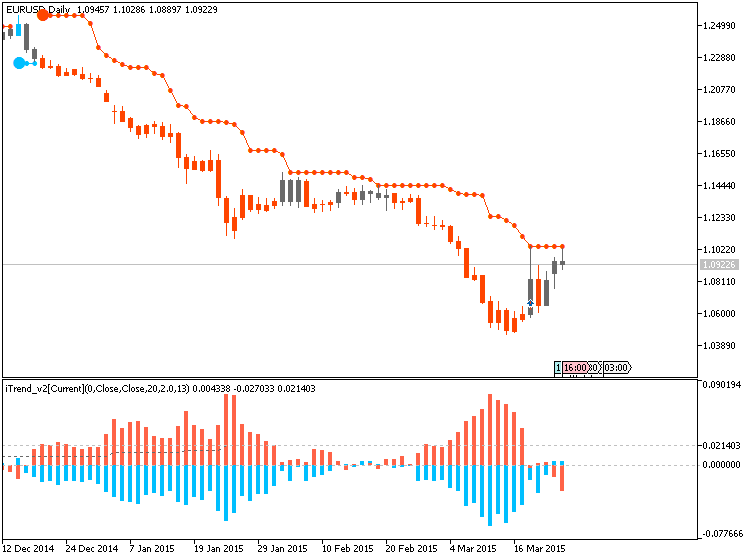

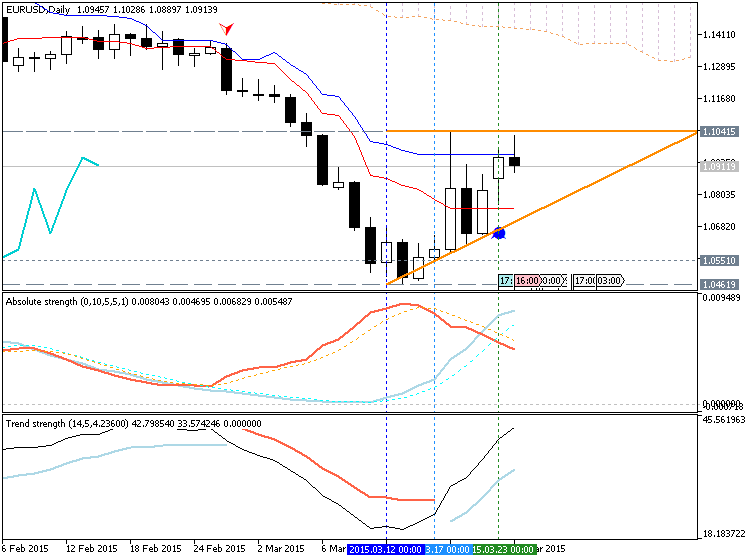

EUR/USD Threatens Bearish RSI Momentum Despite Dovish ECB Draghi.

EUR/USD continues higher (based on finances.com article)

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers. Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate.

==========

Consumer Price Index Summary

"The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in February on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index was unchanged before seasonal adjustment.

The seasonally adjusted increase in the all items index was broad-based, with increases in shelter, energy, and food indexes all contributing. The energy index rose after a long series of declines, increasing 1.0 percent as the gasoline index turned up after falling in recent months. The food index, unchanged last month, also rose in February, though major grocery store food group indexes were mixed.

The index for all items less food and energy rose 0.2 percent in February, the same increase as in January. In addition to shelter, the indexes for used cars and trucks, apparel, new vehicles, tobacco, and airline fares were among those that increased. The medical care index was unchanged, while the personal care index declined.

The all items index was unchanged over the past 12 months, after showing a 0.1-percent decline for the 12 months ending January. Over the last 12 months the food index rose 3.0 percent and the index for all items less food and energy increased 1.7 percent. These increases were offset by an 18.8-percent decline in the energy index."

Euro gains against dollar on robust PMI surveys (based on reuters article)

Robust French, German PMIs help euro

Fed's Williams repeats mid-year rate rise may be appropriate

Dollar still feeling impact of last week's dovish Fed statement

The euro rose for the third day running against the dollar on Tuesday, bolstered by better-than-expected euro zone business surveys that pointed to a broader recovery taking place in the currency bloc.

The dollar was under pressure, with investors awaiting consumer price inflation data later in the day. A softer number, as was registered earlier on Tuesday in Britain, could boost expectations that the Federal Reserve will be in no hurry to raise interest rates.

San Francisco Fed chief John Williams weighed in on the debate over the dollar's gains, saying the U.S. economy could handle a stronger currency and pointing to the chance of an interest rate rise in June.

Other Federal Reserve officials, and new forecasts from the U.S. central bank, have cast doubt on how much more appreciation of the dollar the Fed will easily tolerate and raised speculation it will push back any tightening of monetary policy.

"The bigger question of whether the economic recovery has any legs remains unanswered," Societe Generale analysts said in a note.

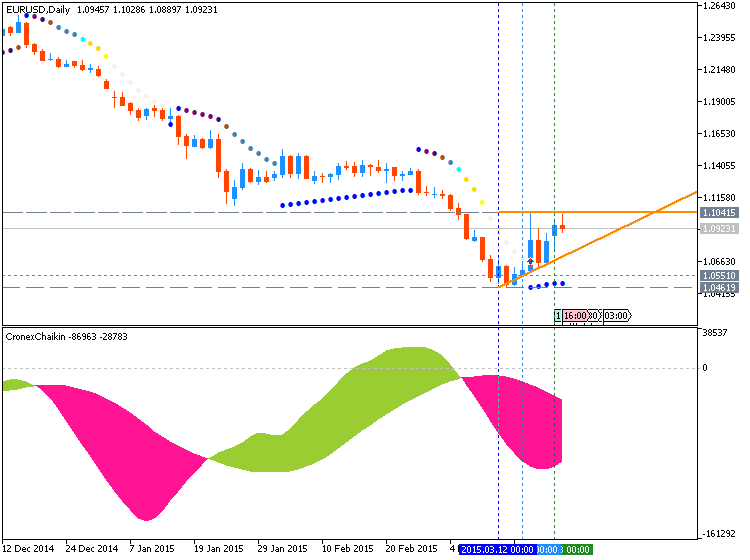

"In the meantime, after breaking above key resistance at $1.0940 yesterday, the euro's next technical target is $1.1070 and we'd be more interested in re-selling there than in looking for much follow-though from this morning's initial weakness."

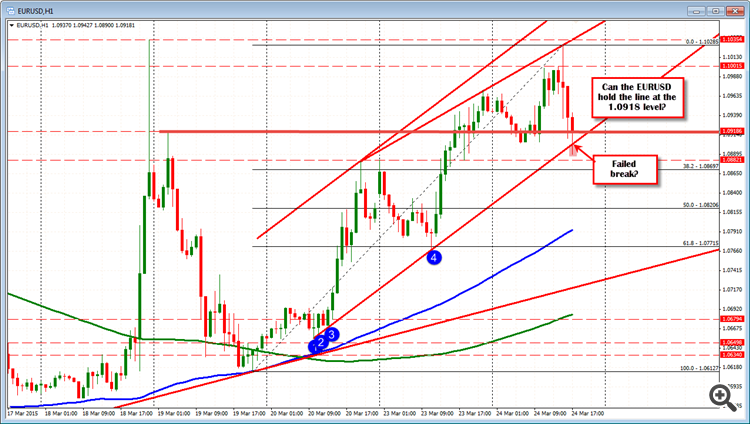

I don't trust the market, but EURUSD at a key test (based on forexlive article)

"There was talk of a large 1.0900 strike option expiry. That expired and opened the door for further freedom.The price moved below the lower trend line on the hourly chart and made new lows. The price correction higher has taken the pair back toward the high corrective price from the day after the FOMC spike at the 1.0918 (see red horizontal line). If the rally can stall here, the seller may have more control. If it does not, the bias should reverse."

Gold set for fifth day of gains on U.S. rate speculation (based on reuters article)

Gold hits 2-1/2 week high above $1,190/oz

Euro zone data helps euro strength vs dollar

$1,200/oz seen as major resistance level (Updates prices, adds comment)

Gold rose to a 2-1/2 week high on Tuesday, rising for the fifth straight session on growing expectations that a U.S. interest rate increase could be pushed to September.

Spot gold climbed to its highest level since March 6 at $1,195.30 an ounce before paring gains to trade up 0.4 percent at $1,193.70 by 2:26 p.m. EDT (1826 GMT).

U.S. gold futures for April delivery rose $3.70, or 0.3 percent, to settle at $1,187.70 an ounce.

Prices were on course to post their longest winning streak since January last year, with investors favoring bullion over the past few days because of a slump in the dollar after the Federal Reserve's cautious stance on the U.S. economy and diminishing likelihood of an early rate increase.

The metal, which does not pay any interest, had suffered from earlier speculation of higher U.S. rates as early as June.

"Since the Fed (statement), we've seen a pretty solid uptrend under the premise that the dark cloud of a rising interest rate environment has been pushed further off in the distance and there's some clear sailing ahead in the near term," said David Meger, director of metals trading for High Ridge Futures in Chicago.

GOLD TECHNICAL ANALYSIS (based on dailyfx article)

Prices look poised for another move above the $1200/oz figure. A break above the 38.2% Fibonacci retracement at 1205.58 exposes the 50% level at 1225.04. Alternatively, a turn below the 23.6% Fib at 1181.51 targets the 1166.67-1170.09 area (channel top resistance-turned-support, 14.6% retracement).

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video March 2015

newdigital, 2015.03.25 10:53

Video: Euro Traders Should Watch Greece’s Financial Health Closely

The Euro has tumbled on the sharp move towards accommodation from the ECB. While a dovish policy trend from the central bank will keep the pressure on the currency, another round of panicked selling behind the currency is unlikely to occur on a monetary policy basis. Rather, it is likely to come through financial trouble. And, Greece is staring at imminent trouble. The country's leaders are scrambling to come up with reforms that would open up funds from its creditors to offer a medium-term chance to pay down its debts while also supporting growth. However, the risk may be more severe and imminent than many expect. A financial crisis may explode before officials come up with a solution. We discuss the risk Greece poses to the Euro and what to watch in today's Strategy Video.

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Durable Goods Orders] = Change in the total value of new purchase orders placed with manufacturers for durable goods. It's a leading indicator of production - rising purchase orders signal that manufacturers will increase activity as they work to fill the orders.

==========

U.S. Durable Goods Orders Show Unexpected Decrease In February

With orders for transportation equipment showing a notable pullback, the Commerce Department released a report on Wednesday showing that new orders for U.S. manufactured durable goods unexpectedly decreased in the month of February.

The report said durable goods orders fell by 1.4 percent in February following a downwardly revised 2.0 percent increase in January.

The drop in orders came as a surprise to economists, who had expected orders to climb by 0.7 percent compared to the 2.8 percent jump that had been reported for the previous month.

Excluding a 3.5 percent drop in transportation orders, durable goods orders still fell by 0.4 percent in February after sliding by 0.7 percent in January. Ex-transportation orders had been expected to rise by 0.3 percent.