Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.31 10:11

Forex Weekly Outlook February 2-6 (based on forexcrunch article)

US ISM Manufacturing PMI, Rate decision in Australian and the UK, US Trade Balance and important employment data including the big NFP event. These are forex market movers for this week. Check out these events on our weekly outlook

Last week US jobless claims plunged 43,000 to a 15 year low indicating the labor market strides in the right direction. Economists expected claims to tick down to 301,000. Earlier that week, the Fed held its monthly monetary policy meeting, repeated the “patience” wording regarding a possible rate hike. However the policy makers were more concerned about international developments and their possible effect on US future growth. The Fed also stated that the labor market has improved further and household spending rose moderately, boosted by low energy prices. Will the US economy continue to improve?- US ISM Manufacturing PMI: Monday, 15:00. Manufacturing PMI declined in December, coming in at 55.5 following 58.7 in the previous month. Economists forecasted a higher reading of 57.6. Manufacturing output is constantly expanding; however, the rate of growth has eased in the fourth quarter. Companies express growing uncertainty about the outlook in 2015, especially regarding exports. Regarding the fall in oil prices, some ISM members think it would have a good impact on the manufacturing sector while others disagree. Manufacturing PMI is expected to reach 54.9 this time.

- Australian rate decision: Tuesday, 3:30. Australia’s central bank has kept its interest rate at a record low for 17 months amid the economic transition from mining investment. Many economists believe a rate cut is in order since the economic growth has not picked up to offset the sharp decline in mining investment. Low interest rates may boost investments in the non-mining sectors. In addition. Falling commodity prices like iron and oil will weaken export revenues. No change in rate is expected now.

- NZ employment data: Tuesday, 21:45. New Zealand’s Unemployment rate was better than expected in the third quarter, falling to 5.4% from 5.6 in the prior quarter. Employment expanded 0.8%, higher than the 0.5% gain reached in the second quarter and better than the 0.6% rise forecasted by analysts. However, on a yearly base, employment expanded 3.2%, below the 3.7% seen in the previous quarter. New Zealand’s employment market is predicted to grow by 0.8, while the unemployment rate is expected to drop to 5.3%.

- US ADP Non-Farm Employment Change: Wednesday, 13:15. U.S. private sector employment gained 241,000 jobs in December, beating forecasts of a 227,000 job addition. The increase was broad based and was not affected by oil-related companies that experienced a dramatic fall in crude prices, suggesting the US labor market is resilient and does not depend on any one industry. U.S. private employment is expected to gain 221,000 this time.

- US ISM Non-Manufacturing PMI: Wednesday, 15:00. Service sector activity expanded at the slowest pace in six months, reaching 56.2 in December, after posting 59.3 in November. Economists expected a reading of 58.2. New Orders Index was 2.5 points lower than 61.4 registered in November. Employment Index declined 0.7 points, reaching 56.0 and Prices Index plunged 4.9 points to 49.5. Service sector is forecasted to grow to 56.6.

- UK rate decision: Thursday, 12:00. The Bank of England policymakers voted unanimously to leave rates at s record-low in January amid tumbling inflation. Both Martin Weale and Ian McCafferty, formerly opposing such a move, had a change of heart as falling oil prices threatened to weaken further the already subdued inflation. The ongoing improvement in the unemployment rate and wage growth didn’t persuade MPC members to vote for a change in policy. Following this statement, economists pushed back their forecast for a rate hike to early 2016.

- US Trade Balance: Thursday, 13:30. The U.S. trade deficit contracted in November to an 11-month low reaching $39 billion, the smallest since December 2013. Falling crude oil prices helped to strengthen domestic demand, but exports fell 1.0% to $196.4 billion in November, suggesting the slowing global economy may start to affect the US market. Economists expected deficit to reach $42.3 billion. U.S. trade deficit is expected to contact further to$38 billion.

- US Unemployment Claims: Thursday, 13:30. The number of Americans filing initial claims for unemployment dropped sharply to a 15 year low, indicating the US labor market continues to strengthen. However, the unbelievably low figure can be also attributed to a holiday-shortened week. The 43,000decline was much better than the 301,000 addition forecasted by analysts. The four-week moving average, fell 8,250 last week to 298,500. The number of claims is expected to reach 277,000 this time.

- Canadian employment data: Friday, 13:30. Canada’s labor market had another mild setback in December, shedding 4,300 positions after contracting 10,700 jobs in November. The unemployment rate remained unchanged at 6.6%. Full-time employment in December grew by 53,500 jobs, while part-time work dropped by 57,700 indicating the overall picture is quite positive. The 12-month gain was 185,700 positions, an increase of 1.0% , while the six-month moving average for employment growth was 22,100 jobs, up from 21,300 in November.Canada’s labor market is expected to increase by 5,100 jobs, while the unemployment rate is expected to reach 6.7%.

- US Non-Farm Employment Change and Unemployment rate: Friday, 13:30. U.S. job growth edged up in December, rising 252,000 after a revised jump of 353,000 in November. Meanwhile, the jobless rate declined to a 6.5 year low of 5.6%. However, despite the positive figures, wages did not increase in December a worrisome sign which may compel the Fed to leave rates unchanged for an extended period. Us job market is expected to add 231,000 positions. The unemplolyment rate is forecsted to remain unchanged.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.31 14:43

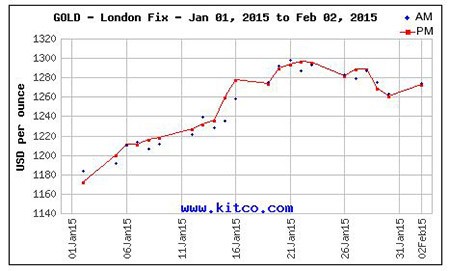

Gold forecast for the week of February 2, 2015, Technical Analysis

The gold markets fell during most of the week, but found the $1250 level to be supportive enough to turn things back around and form a hammer. That being the case, it looks like the market is fairly well supported and as a result should continue to go higher over the longer term. Because of that we are buyers of gold for longer-term moves, and believe that it’s only a matter of time before we break out to the upside and perhaps head as high as $1400 going forward.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.02 08:56

Gold To Trade Flat, Palladium To Outperform In 2015 (adapted from kitco article)

The London Bullion Market Association (LBMA) rounded up a panel of experts to forecast precious metal prices in 2015 -and while prospects may be neutral for gold they are bullish for silver, platinum and palladium

he panel, made up of analysts from various banks and research firms

worldwide, is predicting that the gold price will remain broadly flat

for the year, with an average forecast of $1,211 an ounce. Ross Norman

of Sharps Pixley is the most bullish analyst with a gold forecast of

$1,321 and Adam Myers of Crédit Agricole, London was the most bearish

with $950.

However, the market experts are forecasting silver to have an average price of $16.76/oz., platinum $1,294/oz. and palladium at $838.40 for the year. This marks a 2.1% increase for silver from last year’s price projections, a 5.6% increase for platinum and a 5.3% hike for palladium.

The reasons cited by the experts for the restrained gold price were the possible strengthening in the U.S. dollar, interest rate hikes by the Federal Reserve in the second half of 2015, quantitative easing in Europe and a weak oil price reducing gold’s attraction as a hedge against inflation.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.01 19:22

Forex - Weekly outlook: February 2 - 6 (based on investing.com article)

The U.S. dollar was mostly lower against its major counterparts on

Friday, as investors reacted to data showing the U.S. economy grew less

than expected in the fourth quarter.

The Commerce Department said

in a report that the economy expanded 2.6% in the final three months of

2014, below expectations for a 3.0% gain and slowing sharply from

growth of 5.0% in the three months to September.

The U.S. dollar index,

which measures the greenback’s strength against a trade-weighted basket

of six major currencies, ended the week at 95.00, down 0.01% for the

day and 0.33% lower on the week.

The dollar slid lower against the safe haven yen, with USD/JPY down 0.69% to 117.50 in late trade, amid weakness in U.S. equities following the lackluster GDP data.

The Dow Jones fell 251.90 points, or 1.45%, while the S&P 500 declined 26.26 points, or 1.3%.

Meanwhile, the euro

was under pressure after data showed that deflation in the single

currency bloc deepened in January and amid growing concerns over

Greece's future in the euro zone.

Eurostat said that the annual

rate of euro zone inflation fell by 0.6% in January, after a 0.2% slip

in December. Economists had expected an annual decline of 0.5%.

Greece’s

new government said it will not cooperate with the International

Monetary Fund and the European Union and will not seek an extension to

its bailout program, underlining fears over a clash with its

international creditors.

The Canadian dollar

was also hard-hit after Statistics Canada said the country's gross

domestic product fell 0.2% in November, compared to expectations for a

0.1% downtick and after a 0.3% gain in October.

The Australian dollar

weakened to a five-and-a-half year low against the greenback amid

growing expectations for an interest rate cut in Australia next week.

Elsewhere,

the Swiss franc strengthened against the other major currencies on

Friday, amid heightened expectations for further intervention by the

Swiss National Bank in the currency market (USD/CHF, EUR/CHF).

Meanwhile, the dollar rallied 1.74% against the Russian rouble

to end at 70.05 after Russia's central bank unexpectedly cut its

benchmark interest rate to 15.0%, one month after surprising markets by

hiking rates to 17.0%.

In the commodities market, oil prices

scored their biggest one-day gain since June 2012 amid indication that

U.S. producers may be pulling back on new production in response to low

prices.

Nymex oil futures surged $3.71, or 8.33%, to $48.24 a barrel, while London-traded Brent prices soared $3.86, or 7.86%, to $52.99.

Gold

was also well-supported, with prices tacking on $23.30, or 1.86%, to

close at $1,279.20 following the release of weaker than expected U.S.

GDP data.

In the week ahead, investors will be turning their

attention to Friday’s U.S. nonfarm payrolls report for further

indications on the strength of the recovery in the labor market.

Central bank policy meetings in the U.K. and Australia will also be in focus.

Monday, February 2

- China is to release a report on the HSBC manufacturing index.

- In the euro zone, Spain is to release data on the change in the number of people employed.

- The U.K. is to publish its manufacturing index.

- In

the U.S., the Institute of Supply Management is to release data on

manufacturing activity. The country will also produce a report on

personal income and spending.

Tuesday, February 3

- Australia is to release data on building approvals and the trade balance. Later in the day, the Reserve Bank of Australia is to announce its benchmark interest rate and publish its rate statement, which outlines economic conditions and the factors affecting the monetary policy decision.

- The U.K. is to publish a report on construction sector activity.

- The U.S. is to release data on factory orders.

Wednesday, February 4

- New Zealand is to release data on the change in the number of people unemployed and the unemployment rate.

- Elsewhere, China is to publish its HSBC service sector index.

- The euro zone is to publish a report on retail sales.

- The U.K. is to publish a report on service sector activity.

- The U.S. is to release a report on ADP nonfarm payrolls. Later in the day, the Institute of Supply Management is to release data on non-manufacturing activity.

- Canada is to publish its Ivey PMI.

Thursday, February 5

- Australia is to publish data on retail sales.

- The Bank of England is to announce its monetary policy decision.

- The U.S. is to produce its weekly report on initial jobless claims in addition to data on the trade balance.

- Canada is also to report on its trade balance.

Friday, February 6

- The RBA is to publish its monetary policy statement.

- The Swiss National Bank is to publish a report on foreign currency reserves.

- The U.K. is to produce a report on the trade balance.

- Canada is to report on building permits and the change in the number of people employed and the unemployment rate.

- The U.S. is to round up the week with the closely watched nonfarm payrolls report, and data on wage growth.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.02 18:55

Gold Slips as Crude Oil Prices Rebound (based on wsj article)

Gold futures eased Monday as higher oil prices tempered investor appetite for haven assets.

The most actively traded gold contract, for April delivery, was recently down $4.50, or 0.4%, at $1,274.70 a troy ounce on the Comex division of the New York Mercantile Exchange.

Gold has drawn support from tumbling crude-oil prices in recent weeks, as concerns about the impact on the wider energy market sent investors in search of ways to protect their wealth. Some traders view gold as a haven from political and economic turbulence, believing it will keep its value better than other assets.

On Monday, oil prices rebounded, with the U.S. benchmark recently trading up 36 cents, or 0.8%, at $48.60 a barrel on the Nymex.

“The rally in oil took some of the pressure off the reasons to buy gold,” said Ira Epstein, a broker with the Linn Group in Chicago.

Mr. Epstein added that the recent surge in gold prices, which took futures up 8% in January, made the market vulnerable to correct lower as investors move to lock in profits.

“This is a necessary pullback, but it’s not showing any signs that the rally is over,” he said.

Still, gold’s slide was limited by weaker U.S. economic data. The ISM manufacturing purchasing managers’ index fell to 53.5 in January from 55.1 in December, and missed forecasts of 54.3. A reading above 50 points to expansion in factory activity, while a print below that level indicates contraction.

The data underscore the uneven nature of the U.S. economic recovery, which has struggled to fire on all cylinders since the 2008 financial crisis.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.03 05:46

Chinese banks to join new gold fix from March (based on ft article)

The replacement for the near-century-old London gold fix will start in March, with the hope of attracting at least 11 members, including Chinese banks for the first time.

UK financial authorities are undertaking an

assessment of financial benchmarks in the wake of a series of scandals,

including over the gold fix.

The presence of Chinese banks would give the world’s second-largest consumer of the precious metal a greater say in the global gold price. Participants in the fix aggregate orders from clients on to a platform to determine the price.

“Interest has been very positive and creates a more diverse pool of participants, which includes Chinese banks,” said Ruth Crowell, chief executive of the London Bullion Market Association, a trade body for London’s gold and silver markets.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.03 10:15

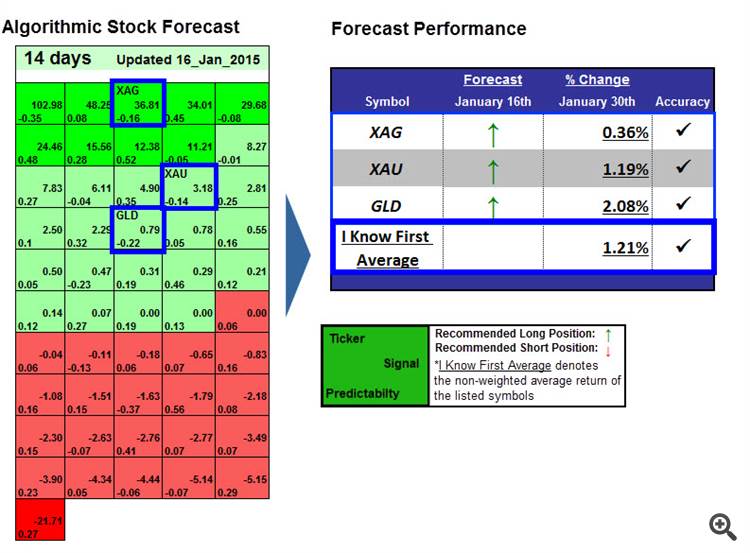

Gold Price Forecast Based on Algorithms: An Average Return Of 1.23% In 14 Days (based on gold-prediction article)

Short:

- Physical Silver Forecast (XAG) direction

- Physical Gold Forecast (XAU) direction

- Gold ETF Forecast (GLD) direction

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.04 06:53

Gold Miners Are Off To A Hot Start In 2015 -- But That's Just The Beginning (based on forbes article)

The story has a lot less to do with the printing of money and money supply that traditionally drives gold and gold miners and more with the fact that the mineral in and of itself has not been found despite all the billions of dollars that have been put into discovery of gold over the last ten years.

In fact, the number of working mines is down to almost zero from 20 to 25 in 1995. So the real story is the fact that you’re not finding any new supply. Cash costs are high now, because you’re trying to extract the greatest grades. The industry in and of itself has done an extraordinarily poor job of asset allocation over the years with misallocation of capital and losing money on mines.

They seem to buy high, sell low and dilute their shareholders. They hedge at the wrong times. For all those reasons, these companies have been put at massive discounts to what I think is any kind of rational value. So the net sum of those dynamics that I just described leads me to believe that the question an investor needs to ask is, “How is a gold miner going to replenish their reserves?”

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.05 05:41

Gold Price Today Sees Modest Gains – Higher Move on the Horizon (based on moneymorning article)

The gold price jumped $10, or 0.80% to $1,271 an ounce in morning trading. The gains came despite typical headwinds for the yellow metal: a stronger dollar and slipping oil prices.

The yellow metal gave back some of those gains in the afternoon session. Just before 1 p.m., gold was hanging on to a $2.70 rise at $1,263.80. This follows gold's sharp decline on Tuesday. Gold slumped $18.80, or 1.3%, yesterday as investors' appetite for riskier assets, including stocks, increased. The Dow Jones Industrial Average added $305.36, or 1.8%, Tuesday as oil continued to march over $50 a barrel

There were three factors boosting gold prices:

- The Chinese New Year: TD Securities said in a report released today that gold prices are up in China. That trend is expected to remain in place ahead of the Chinese New Year, which begins Feb. 19. Gold is frequently given as a gift during the festivities. "We could very well see $1,300 gold in the coming weeks," Steve Scacalossi of TD Securities, wrote in the report.

- China's Central Bank: The People's Bank of China eased its monetary policy Wednesday. It trimmed the reserve requirement ratio for domestic banks by 50 basis points to 19.5%. It's the PCOB's latest move to goose China's slowing economy. China's economic growth slowed to 7.4% in 2014, hitting a level not seen in a quarter century and firmly marking the end of a high-growth heyday. The move is also bullish for gold, as well as the overall commodity sector. China is a major raw commodity importer and consumer.

- Increasing Imports in India: India imported nearly 50% more gold in the first 10 months of its current fiscal year than the year before, up to 945 tons already. The import surge came after India's government eased curbs on how much gold was allowed in to the country. India's gold import totals are the second largest in the world, behind only China. India accounted for 25% of global gold demand in 2013, according to the World Gold Council. "Imports may be around 1,000 tons this fiscal year and remain stable next year unless we see any fresh government regulations coming in," Madhavi Mehta, an analyst at Kotak Commodity Services, told Bloomberg.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on primary bullish with secondary ranging:

W1 price is on primary bearish with trying to break 1306.82 resistance level for the price to be reversed from bearish to the primary bullish market condition on weekly timeframed chart

MN price is on bearish with secondary market rally which was started on open monthly bar:

If D1 price will break 1251.80 support level on close bar so the secondary correction will be started within the primary bullish

If D1 price will break 1306.82 resistance level so the bullish trend will be continuing

If not so the price will be ranging between 1251.80 and 1306.82 levels

UPCOMING EVENTS (high/medium impacted news events which may be affected on XAUUSD price movement for this coming week)

2015-02-02 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

2015-02-02 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - Spanish Unemployment Change]

2015-02-05 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Trade Balance]2015-02-06 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on XAUUSD price movement

SUMMARY : bullish

TREND : ranging