Thanks for the update about EUR USD forecasting and news events. This is really helpful for the traders.

Thanks & Rgds, Pankaj

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.14 11:19

Forex Weekly Outlook March 16-20The dollar stormed the board, with the euro and the pound standing out as the biggest losers. The Fed decision is the key event in a week that also features rate decision in Japan and Switzerland, employment data from the UK and the US and many more. These are the major events on FX calendar. Join us as we check on the highlights of this week.

The US job market demonstrated renewed strength with a 36,000 fall in the number of jobless claims, reaching 289,000. However, retail sales disappointed, dropping 0.6% in February as harsh weather reduced sales and affected growth in the first quarter. Also consumer confidence slipped. Will the US economy shake off winter slowdown? For the US dollar it did not really matter. EUR/USD reached levels last seen over 12 years ago, with parity seeming closer and also the previously strong pound gave in. The Aussie was supported by jobs data, the kiwi by an upbeat central bank and the loonie was hit by oil. Let’s start,

- Mario Draghi Speaks: Monday, 18:45. ECB President Mario Draghi is scheduled to speak in Frankfurt. He may talk to the ECB’s new QE plan aimed to spur growth in the euro member countries by injecting 1.1 trillion euros ($1.2 trillion) into the economy. Market volatility is expected. In his previous speech, Draghi hurt the euro: he reiterated that reaching the stronger growth forecasts depends on implementation of current programs.

- Japan rate decision: Tuesday. The Bank of Japan (BoJ) voted to maintain its monetary policy in its February meeting and continue implementing its plan to increase monetary base to an annual pace of JPY 80 trillion. This step will help ensure the Central Bank’s inflation target of 2.0%. The BOJ noted the economy continued its moderate recovery with a pickup in exports. Consumer spending also remained strong due to rising employment and better wages. Inflation expectations remain positive despite the decline in oil prices. Rates are expected to remain unchanged this time.

- German ZEW Economic Sentiment: Tuesday, 10:00. German analyst and investor sentimentjumped in February its highest level in a year, reaching 53, following 48.4 in January boosted by the European Central Bank’s bond-buying program. However, the Greek debt problem and the Ukraine crisis weighed on the economic outlook. Economists expected a higher leap to 55. The German government forecasts growth of 1.5% in 2015. Sentiment among German analysts and investors is forecasted to improve to 58.9 in March.

- US Building Permits: Tuesday, 12:30. Building Permits weakened further in January reaching 1.053 million, dropping 0.7% form the rate of 1.07 posted in December. Economists expected a rise to 1.08 million. Other housing figures were also disappointing such as a 2% decline in housing starts and low homebuilder sentiment. Housing recovery remains slow and prices outpace wage growth. The number of permits is expected to grow to1.07 million.

- UK employment data: Wednesday, 9:30. Britain’s labor market continued to improve in Januarywith a bigger than expected decline in the number of jobless applications. The number of unemployed declined by 38,600 in January after a 35,800 drop in December, indicating job creation is rising. Economists expected a smaller decline of 25,200 in January. According to the ILO measure, unemployment fell by 97,000 in the three months to December, lowering the unemployment rate to 5.7%. Another decline of 31,000 is expected in the number of jobless applications.

- US rate decision: Wednesday, 18:00, press conference at 18:30. The Federal Reserve maintained their monetary policy in January, leaving the door open for a rate hike around June 2015, after more than six years of near zero rates. The Fed admitted that inflation weakened considerably due to the recent drop in oil prices. The members are watching for economic developments to see what happens. Job gains continue to grow and the unemployment rate has also declined closing in on its prerecession level, however, wage growth remains subdued as companies continue to find an abundant supply of potential employees. The rate is expected to remain at 0.25%.

- NZ GDP: Wednesday, 21:45. New Zealand economy boosted growth in the third quarter expanding 1.0%, the strongest gain in 15 years. This impressive figure was preceded by a 0.7% expansion in the second quarter. Economists expected a growth rate of 0.7%. On a yearly base, growth remained unchanged from the second quarter reaching 3.2%. New Zealand is expected to expand by 0.8% in the fourth quarter of 2014.

- Switzerland rate decision: Thursday, 8:30. The Swiss National Bank rocked markets on January, while deciding to abandon its three-year-old currency cap of 1.20 Swiss francs to the euro, sending the currency high against the euro sending stocks down. Being an export reliant, 40% of which going to the euro zone endangered many Swiss companies. To balance the Swiss franc, the SNB cut its interest rate taking it further down into negative territory of -0.75% following -0.25% in the previous month. No change in rates is expected.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing initial claims for unemployment benefits declined more than expected last week, reaching 289,000. The 36,000 fall offers further evidence that the labor market is strengthening. Economists expected a higher figure of 306,000. The four-week moving average fell 3,750 to 302,250 last week. The NFP report showed a 295,000 job gain in February and a 6-1/2-year low of 5.5% unemployment rate. February marked the 12th straight month that employment gains have been above 200,000, the longest such run since 1994. The number of new claims for unemployment benefits is predicted to rise to 297,000 this week.

- US Philly Fed Manufacturing Index: Thursday, 14:00. Manufacturing activity in the Philadelphia area fell to 5.2 in February, following 6.3 in January, while economists expected a rise to 8.8. However, despite the three months of decline, manufacturing activity still remains positive pointing to growth. The outlook showed 55% of companies were optimistic regarding future demand, while 20% reported a decline. Economists believe the Philly Fed is affected by seasonal adjustment factors in winter and in fall. Expecting a boost in the spring and summer seasons. Manufacturing activity is expected to7.3 in March.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.16 07:31

EURUSD Daily Pivot Point Support / Resistance (based on dailyfx twitter account)

| Resistance | Support |

|---|---|

| 1.0600 | 1.0428 |

| 1.0703 | 1.0359 |

| 1.0875 | 1.0187 |

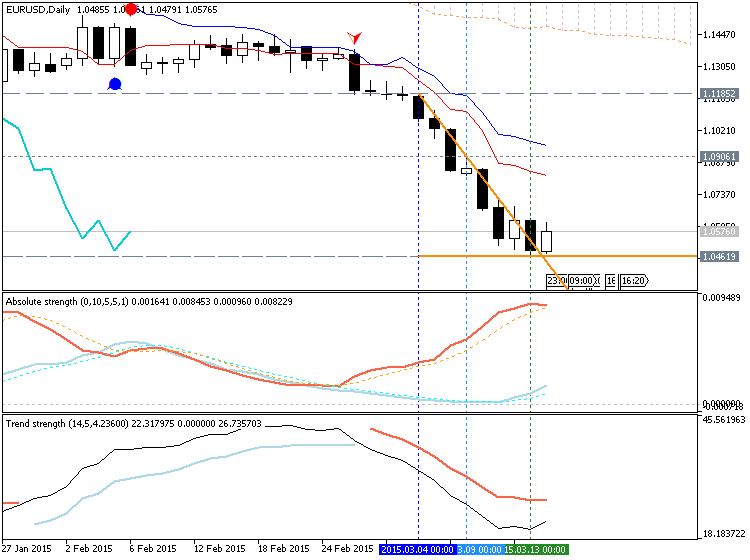

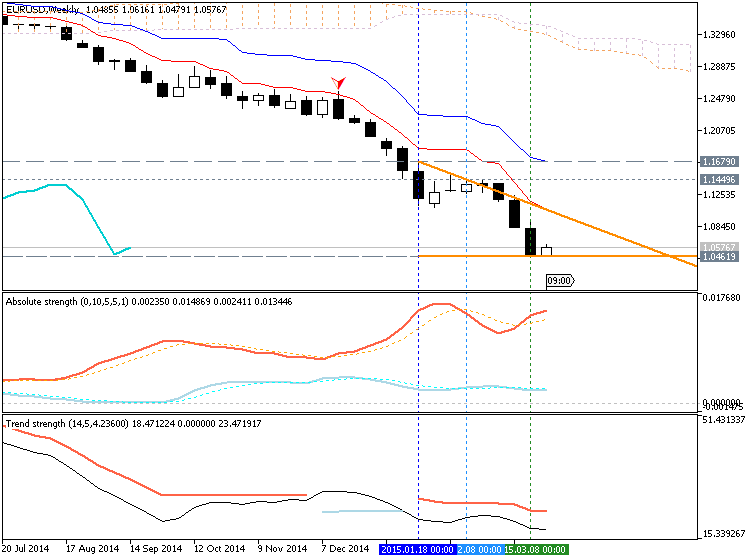

If D1 price will break 1.0494 support level on close D1 bar so the primary bearish breakdown will be continuing (good to open sell trade for example)

If D1 price will break 1.1217 resistance level so we may see the secondary market rally with the possibility to the reversal of the price movement from bearish to the bullish market condition

If not so it will be bearish ranging between 1.0494 and 1.1217 levels

- Recommendation for long: watch D1 price to break 1.1217 for possible buy trade

- Recommendation to go short: watch D1 price to break 1.0494 support level for possible sell trade

- Trading Summary: bearish

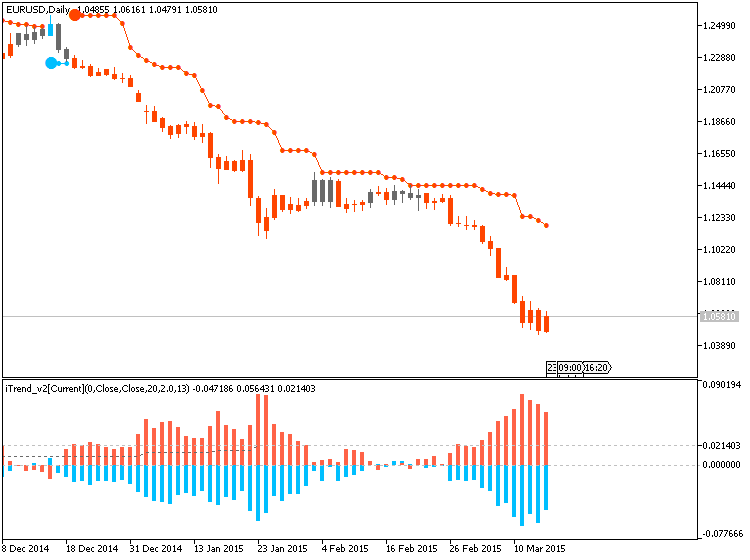

But it is still the primary bearish concerning Ichimoku system (see charts above), Parabolic system and Brainwashing system (all those systems are elaborated on this forum with free to download):

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.17 05:57

EUR/USD rallies slightly on Monday, ahead of critical Fed meeting (based on nasdaq article)

The euro edged slightly higher on Monday, slamming the brakes on its rapid depreciation against the U.S. dollar ahead of a highly-anticipated Federal Reserve meeting later this week.

EUR/USD gained 0.70% or 0.0073 to 1.0569 in U.S. afternoon trading. The pair fell below 1.05 at last week's close, as the start of the European Central Bank's €60 billion a month quantitative easing program coincided with expectations of an interest rate hike from the Fed. Since the start of the year, the pair is down roughly 10%.

Last week analysts from Deutsche Bank (XETRA:DBKGn) and Goldman Sachs (NYSE:GS) both revised their timetables on when the euro could reach parity against the dollar, moving up the dates from previous forecasts. Deutsche Bank even predicted that the euro could fall to 0.85 against the dollar by 2017. On Monday, Alan Ruskin head of foreign exchange strategy for Deutsche Bank, went one step further.

Speaking with CNBC's Power Lunch, Ruskin said he thinks it is possible the euro could reach a historic low against the dollar of 0.82. The euro hasn't reached a level that low since 2002.

"If you think of what's driving the euro, a lot of this has been hedging from foreigners who've held euro bonds and euro equities," Ruskin told CNBC. "I think that it will slow somewhere near parity."

The Fed could remove its reference to "remaining patient," from its minutes when the Federal Open Market Committee stages a two-day meeting this week, beginning on Wednesday. The reference typically indicates that it will start raising interest rates at either of its next two meetings. It has been six years since the U.S. central bank has increased rates, which have remained near zero since the Financial Crisis.

Elsewhere, Greece and its euro zone creditors appeared to be far apart in negotiations concerning the reform measures Athens must employ to extend a critical bailout package. Greece prime minister Alexis Tsipras appears unwilling to agree to some of the austerity measures required by the euro zone in order to strike a deal.

"Whatever obstacles we may encounter in our negotiating effort, we will not return to the policies of austerity," Tsipras told Greece newspaper Ethnos.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.17 18:20

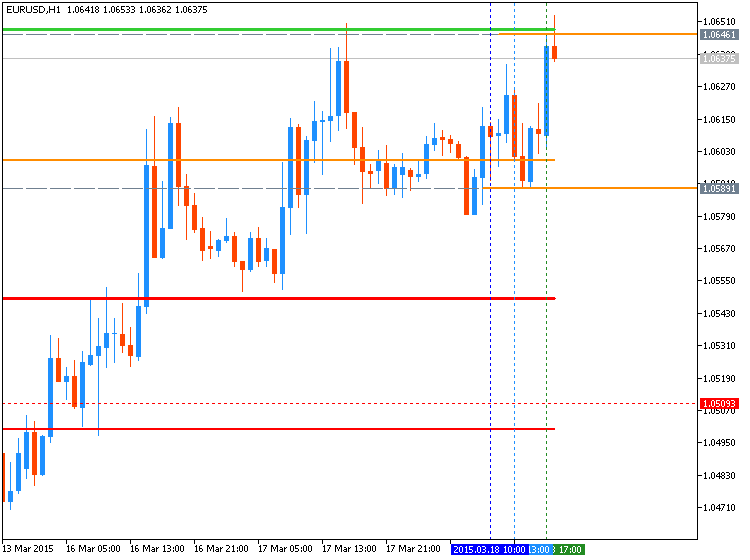

EURUSD Uptrend Continues As Dollar Retreats

- EURUSD rebounds, trades above 1.06.

- Eurozone core CPI confirmed at 0.7% YoY in February.

- ZEW German investor confidence climbs to 13-month high in March.

The EURUSD advanced for a second consecutive day on Tuesday, as core Eurozone inflation was confirmed higher in February, while German investor confidence soared to a 13-month high in March.

The EURUSD

climbed 0.45 percent to 1.0617, easing off an intraday high of 1.0651.

The pair is testing the initial resistance at 1.0636. A clean break

above this level would lead to 1.0704. On the downside, near-term

support is at 1.0484.

In economic data, Eurozone consumer prices declined in February, the European Commission confirmed on Tuesday. Annual CPI in the 19-member currency zone fell 0.3 percent, compared to 0.6 percent in January.

Energy prices increased 1.6 percent in February but were down 7.9 percent compared to year-ago levels. Global crude prices are forecast to remain under pressure in the short-run as the supply glut intensifies.

So-called core inflation, which strips away volatile goods such as food and energy, rose at an annual rate of 0.7 percent in February, compared to 0.6 percent the previous month.

The European Commission also said Eurozone employment rose 0.1 percent in the fourth quarter and 0.9 percent year-on-year, adding further evidence the currency region was slowly gaining momentum.

In a separate report on Tuesday the Centre for European Economic Research (ZEW) said investor sentiment in Germany reached a 13-month high in March, a sign Europe’s largest economy had turned a corner.

The closely monitored investor confidence index rose 1.8 points to 54.8 in March. That was the fifth consecutive monthly gain and the highest level since February 2014. The euro-wide investor sentiment index surged nearly ten points to 62.4.

“Economic sentiment in Germany remains at a high level. In particular, the continuing positive development of the domestic economy confirms the expectations of the experts,” said ZEW president Clemens Fuest in a statement.

He added, “At the same time, limited progress is being

made with regard to solving the Ukraine conflict and the sovereign debt

crisis in Greece. This has a dampening effect on sentiment.”

“It’s now, first of all, about what the Greek government will implement

in the necessary reform steps that it has promised,” said Michael

Grosse-Brömer, who serves as the parliamentary whip of Chancellor Angela

Merkel. “They must now finally deliver and not make a new proposal

every other week.”

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.18 07:40

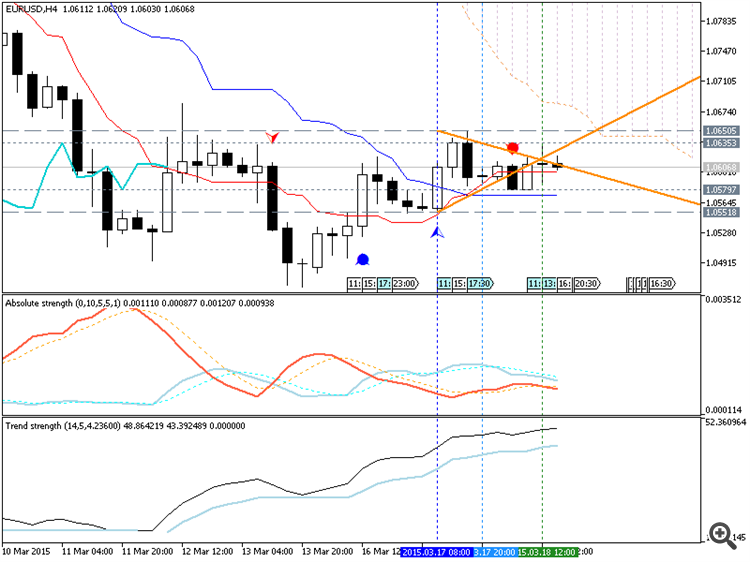

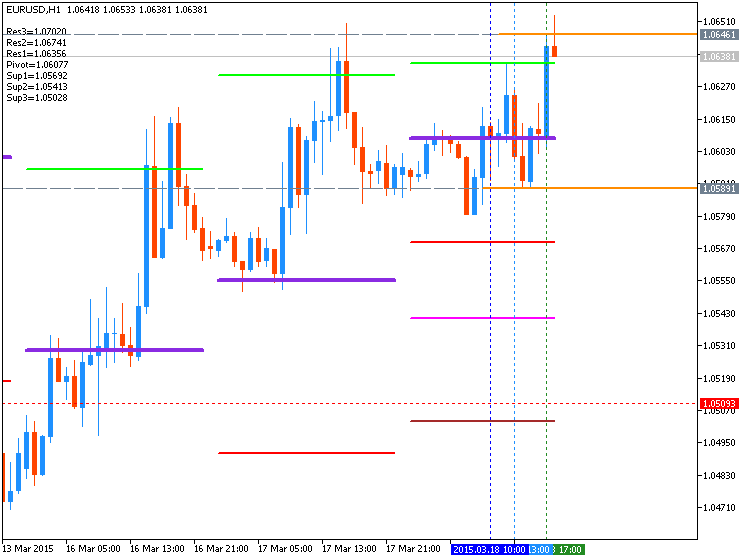

EUR/USD Technical Analysis: Short Entry Sought on Bounce (based on dailyfx article)

- EUR/USD Technical Strategy: Flat

- Support: 1.0408, 1.0060, 0.9713

- Resistance:1.0623, 1.0796, 1.0970

A Euro recovery against the US Dollar may be brewing against the US Dollar after prices formed a bullish Piercing Line candlestick pattern. Positive RSI divergence bolsters the case for an upside scenario. Near-term resistance is at 1.0623, the 61.8% Fibonacci expansion, with a break above that on a daily closing basis exposing the 50% level at 1.0796. Alternatively, a drop below the 76.4% Fib at 1.0408 opens the door for a challenge of the 100% expansion at 1.0060.

Our long-term outlook envisions Euro weakness. With that in mind, we will treat any on-coming upswing as corrective and look to enter short once signs of a renewed turn lower emerge. In the meantime, we will remain on the sidelines.

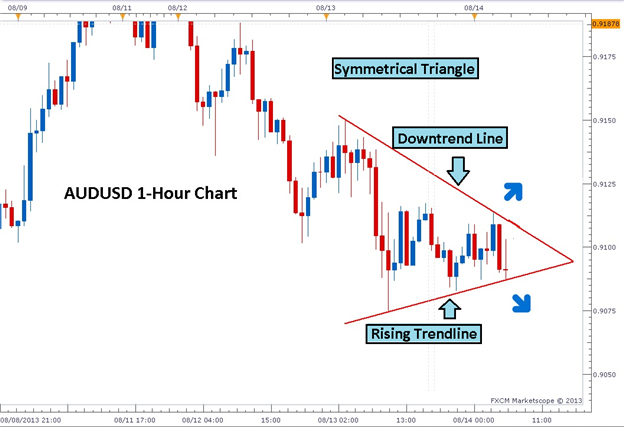

This is triangle price pattern for EURUSD H4 timeframe:

Forum on trading, automated trading systems and testing trading strategies

Market Condition Evaluation based on standard indicators in Metatrader 5

newdigital, 2013.09.05 09:53

3 Easy Triangle Patterns Every Forex Trader Should Know - Symmetrical Triangle

The first type of pattern is the symmetrical triangle pattern. It is

formed by two intersecting trendlines of similar slope converging at a

point called the apex.

In the above example of a symmetrical triangle you can easily see on the AUDUSD 1-Hour chart the intersection of a rising trendline and a downtrend line at the bottom of a larger trend. Sellers are unable to push prices lower and buyers can’t push price to new highs.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.18 16:49

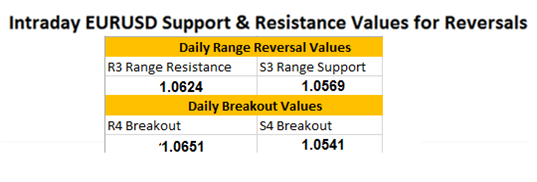

EURUSD Pre-FOMC Pivot Values - Breakouts Occur Above R4, and Below S4 Pivots (based on dailyfx article)

The EURUSD has opened Wednesdays trading range

bound, trading between pivot support and resistance. Current range bound

conditions are not surprising as many traders are waiting on today’s

FOMC even prior to taking positions on markets. Currently price has

traded off pivot resistance at 1.0624, but has yet to test range support

found at 1.0569. These values complete the current range valued at 55

pips.

During the FOMC event, any surprises may cause the EURUSD to breakout. Traders should watch the S4 pivot at 1.0541. This would signal a potential return to USD strength and a resumption of the pair’s current long term trend. Conversely if price breaks above the R4 pivot at 1.0651, it would suggest price is beginning a larger counter trend move, creating a new higher high.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

W1 price is on bearish breakdown for breaking trendline and 1.0838 support level

MN price is on bearish breakdown as well with trying to break 1.1097 support level on open MN1 bar

If D1 price will break 1.0494 support level on close D1 bar so the primary bearish breakdown will be continuing (good to open sell trade for example)

If D1 price will break 1.1217 resistance level so we may see the secondary market rally with the possibility to the reversal of the price movement from bearish to the bullish market condition

If not so it will be bearish ranging between 1.0494 and 1.1217 levels

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2015-03-16 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Empire State Manufacturing Index]

2015-03-16 18:45 GMT (or 20:45 MQ MT5 time) | [EUR - ECB President Draghi Speech]

2015-03-17 10:00 GMT (or 12:00 MQ MT5 time) | [EUR - German ZEW Economic Sentiment]

2015-03-17 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Building Permits]

2015-03-18 10:00 GMT (or 12:00 MQ MT5 time) | [EUR - Trade Balance]

2015-03-18 18:00 GMT (or 20:00 MQ MT5 time) | [USD - Federal Funds Rate]

2015-03-18 18:30 GMT (or 20:30 MQ MT5 time) | [USD - FOMC Press Conference]

2015-03-19 10:15 GMT (or 12:15 MQ MT5 time) | [EUR - ECB Long Term Refinancing Option (LTRO)]

2015-03-19 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

2015-03-19 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Philly Fed Manufacturing Index]

2015-03-20 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - Current Account]

2015-03-20 14:20 GMT (or 16:20 MQ MT5 time) | [USD - FOMC Member Lockhart Speaks]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movement

SUMMARY : bearish

TREND : breakdown