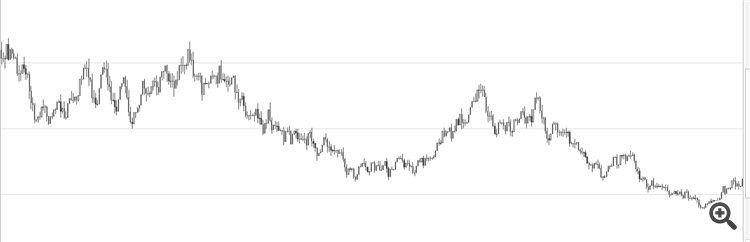

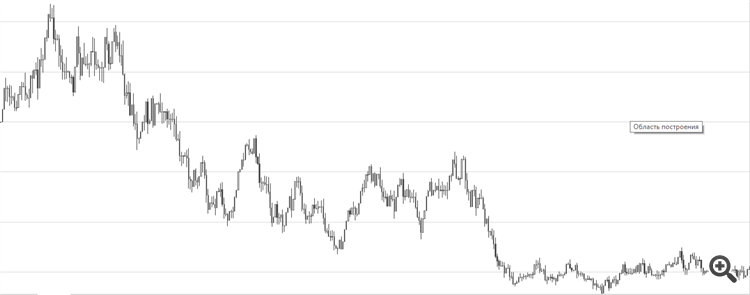

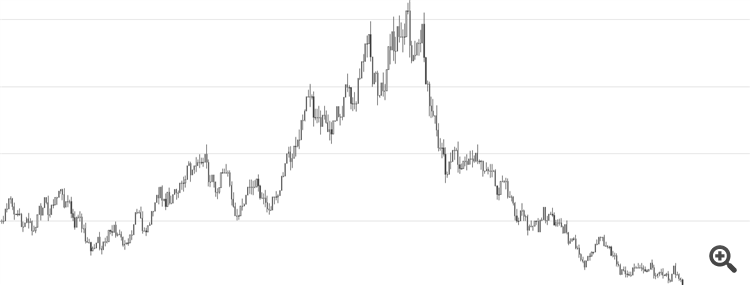

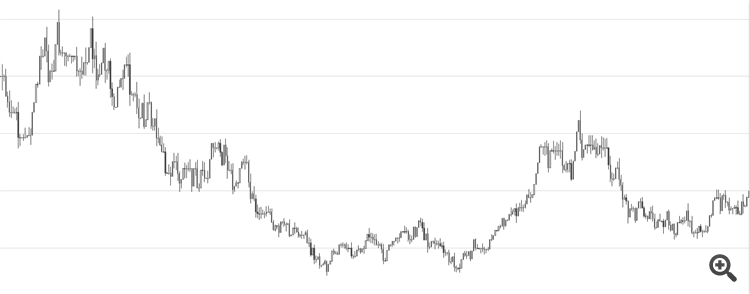

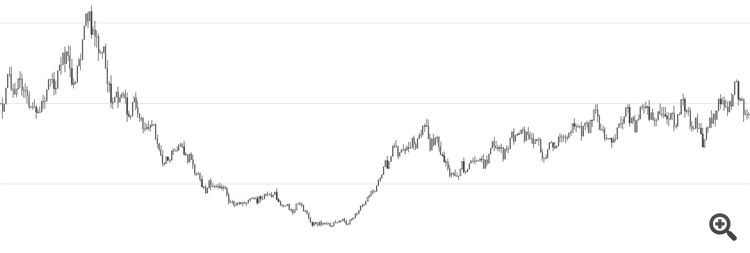

here's the file.... it's a random graph generator.... and they are completely indistinguishable from the real ones...whoever finds a single difference can throw a stone at me)

i would love to hear people's opinion on this....

Is it an Excel file? At least you could have attached a picture to it out of respect for your interlocutors.

fuck it... get into the wilderness of VBA

at a guess - <H4 charts are easily distinguishable by most instruments. in reality just volume and volatility drops regularly, once every 24 hours :-)

by the way Mandelbrot has good methods of generating "fractal pseudo-random quotes"

here's the file.... it's a random graph generator.... and they are completely indistinguishable from the real ones...whoever finds a single difference can throw a stone at me)

would love to hear people's opinions on this....

now put a Ma scale on it and compare the deviation of haves and losers from your MA line and the real one

so what? .... the same thing will happen....

in short, people don't like it.... you don't like the sub... but this is the most perfect market model... it's not completely accurate, but there are no other more accurate models... and there is no model - there is no scientific (logical, rational, reliable... choose any word) justification of traders' moves.... and the game of luck is equated with the case...

that's why options are valued based on this simple model...there were attempts to consider volatility clustering like GARCH models and it all fizzled out and despite these attempts to make something more accurate in option valuation went back to sb....

ps: ok don't like this model, give me an alternative.... do you gentlemen traders? at least one model is more accurate than the theory of the efficient market...

Is it Excel?? At least you could have attached a picture to it out of respect for the other people involved.

I have Excel asking for activation...shit...and it blocks all functions including saving as a picture....

ps: ok don't like this model, give me an alternative model.... do you gentlemen traders? at least one model is more accurate than the theory of the eff...

I like the model. Only - so what? What's new? What conclusions?

We also heard something about the efficient market somewhere). And we have not only seen such graphs, but also constructed them.

And do you have any reason why the sl. wandering graph will not resemble the quotation charts? there are only 2 directions up and down. If the layman is unprepared, everything is random, no matter what he/she tries to do).

But if think for a moment and dig a bit deeper - any generator of casual wandering is not the same at all. It will always be subject to certain patterns. Let's say there's a f-i that randomly gives you 1 or 0. And here we're pretty sure that the choice is random. But you don't know how the function works, how the platform works, how it is affected by the operating system, computer hardware, voltage fluctuations, planetary gravity, neutrino flight through a processor transistor... relic radiation, space warp, multiverse, quantum entanglement... if it exists in real life, why not in the virtual world

And do you have any reason why the sl. wander graph will not be similar to the quotation charts? there are only 2 directions up and down. From the point of view of the untrained layman everything is random wandering for him, whatever he goes for )

Actually, random walks and the market are really statistically indistinguishable. However, statistics assumes a large sample size. TS do not work (or try to work)) on statistics, but rather on deviations from them.

In fact, randomness does not exist in any form and a random number generator generates them not randomly, but in a regular way, but we do not understand how

There is a certain event horizon within which randomness occurs, e.g. for forex it is the US default after which markets may go down for a long time, for gcx it may be some software or technical limitations of the environment

I added more nonsense above ) randomness is always something we don't understand yet... in fact, there is no such thing as randomness, and a random number generator gener ates random numbers, but we don't understand how

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

here's the file.... it's a random graph generator.... and they are completely indistinguishable from the real ones...whoever finds one difference can throw a stone at me)

would love to hear people's opinions on this....