Not the Grail, just a regular one - Bablokos!!! - page 388

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

You can't place deals on the news - they will always requote - and sometimes they rush by +-80 pips at a time with slippage... Nah - we don't need that kind of hockey :)

go for a simple portfolio movement without backtracking :) and then you'll finally quit the factory :)

How do you imagine a no-rebound movement of the portfolio if there is no no no-rebound movement of its components? - better go straight to the factory...

You can't place trades on the news - they will always requote - and sometimes it's +-80 pips at a time with slippage.

Well, define requotes or slippages. You cannot have requotes and slippages on one account.

This guy has obviously never traded. There are no requotes on market equity. And now 95% of the accounts are market.

Nah - we don't need that kind of hockey :)

We don't need hockey. Football is everything.

Duck, make up your mind about requotes or slippage. You can't have requotes and slippage in the same account.

The fellow has obviously never traded. There are no requotes on market equity. And now 95% of the accounts are market.

No need for hockey. Football is everything.

I guess you never caught a -10,000,000 in the alps... I'm sorry...

ZS - I'm waiting for a video of your trades in the first 10 minutes of the nonfarms...

And how do you envisage a non-rebounding portfolio movement if there is no non-rebounding movement of portfolio components? - better go straight to the factory...

come back from the gate :) we don't need thousands of points without backtracking = enough from 50 without 10 or further proportional - 100 without 20, 150 without 30....

if you get at least 1 out of 20 attempts at such a move - then you'll be in the maldives looking for a seven-room loft :)

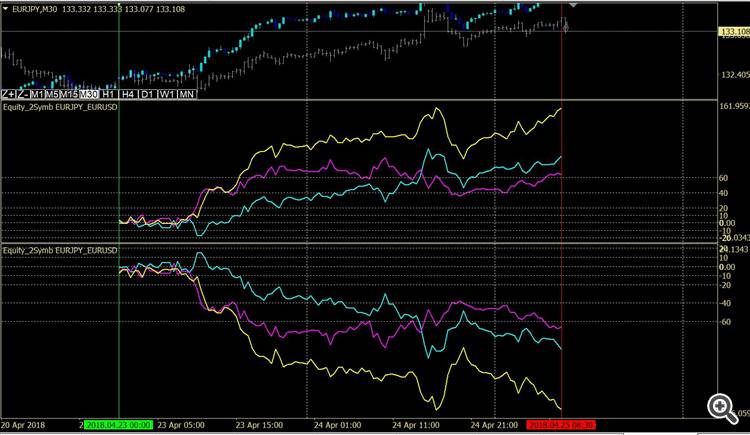

get the most volatile pairs...On the top Equity chart the divergence trade, on the bottom the convergence trade. Here you draw conclusions as to which is better.

On the top Equity chart the divergence trade, on the bottom the convergence trade. So you draw conclusions as to which is better.

Not very correct of course - because your convergence has no second leg :) which is where the divergence occurs :)

yeah - and it's weird - are your charts absolutely mirror-like? - it's not the rule :) - Well, it does not apply to my system - therefore I will not answer for the results obtained using such methods :)

Not very correct of course - because your convergence has no second leg :) which is where the divergence occurs :)

Yeah - and it's weird - are your charts absolutely mirror-like? - it is not by the rules :) - or rather, it does not apply to my system - therefore I will not answer for the results obtained by such methods :)

Here is the second leg. Similarly: there is a divergence trade on the upper Equity chart and a convergence trade on the lower one .

TheEquity indicator has the following approach: if let's assume that symbol 1 is higher than symbol 2, then in the divergence trade strategy we buysymbol 1 andsell symbol 2, and vice versa.Of course it is not your strategy, neverthelesswe can see that the average profit in both legs in this area when using the divergence is higher.

I think the convergence makes sense if both symbols are clearly flat in a horizontal (or slightly sloping) channel. And divergence is more profitable with a trend. This confirms that trend trading (divergence) is more profitable than counter-trend trading (convergence). The trend is your friend).

I thought there was something wrong with the indicator. But it turned out that in the main chart window in the Instrumment indicator I didn't change USDJPY to EURUSD.application of the pyramid MM on the portfolio. The portfolio is trend-following, with a 9:00 a.m. forward start. Not every day of course, but I think in 30 trading days one time it will work out in full movement without any pullback, which means just that the dough is in place.

application of the pyramid MM on the portfolio. The portfolio is trend-following, with a 9:00 a.m. forward start. Not every day of course, but I think in 30 trading days one time it will work out in full movement without pullbacks, which means just that the dough is in place.

i.e., 10 Knees is certainly cool - but not necessarily - after all, 10 Knees are 1 to 10.391 (i bet 100 quid, and i got 1.039.1001.1 million GEL!!!) - you can do 4 and 5 or 6 knees maximum - the tracks will be wider - and the rollback is less likely...

For 10 Knees is certainly cool - but not necessarily - because 10 Knees are the output 1 to 10.391 (bet 100 quid and got 1.039.1001.1 million zeal!!! - You can also do 4 and 5 or 6 knees maximum - the tracks will be wider - and the rollback is less likely...

I put 5 knees, just where 1/31 , and $ 200 here for an even account, the pledge goes to 1000 and the target is let's say 1000 and divided this 1000 by 5 levels.played a little try to put on different days at 9 am, not often work out. I guess there's an important rule that few people follow. If the system says to go out drinking or fishing after the stop, then don't trade, the next day will come and you'll trade.)