EURUSD - Trends, Forecasts and Implications (Part 3) - page 927

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

NEW YORK, May 11. /Dow Jones/. Declining commodity prices and euro zone sovereign debt concerns helped the euro fall against major currencies on Wednesday, pushing it down two cents against the U.S. dollar.

The single European currency fell below its 50-day moving average to a 3-week low against the dollar and to its lowest level against the British pound since late March.

With investors liquidating some commodity positions that are denominated in US currency and are essentially positions against the dollar, they are having to buy the dollar again to hedge deals they are giving up, said Rich Ilchishin, senior market strategist-analyst at Lind-Waldock.

"This play today is an 'exit' from 2-year positions" betting on rising commodity prices and against the dollar, Ilchishin notes, adding that "when these funds start to liquidate and level off, you will see these uncontrolled swings."

The euro fell to new session lows shortly after oil prices dipped below the $100 a barrel level in New York. The fall triggered a general aversion to risky assets, putting pressure on the euro and other risky currencies. US equities, along with silver and gold prices, also fell victim to risk aversion and were down more than 1% from the previous session's closing level.

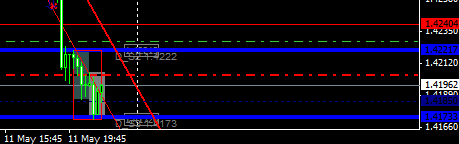

The euro/dollar pair fell to 1.4186 on EBS, reaching its lowest level since April 18, versus 1.4409 at the close of trading on Tuesday.

The euro/British pound pair reached its lowest level since March 24 at 0.8679 versus 0.8807.

The pound received additional support from the Bank of England's tighter-than-expected inflation report, which boosted market hopes for an interest rate hike later this year.

The euro also traded down more than 1% against the Japanese yen which benefited from demand for safe haven assets.

Earlier in the session protests against austerity measures in Greece triggered downward pressure on the euro. It was reinforced by Standard & Poor's warning that Portuguese banks may need more support from the government, which in turn could affect the country's credit rating.

Analysts said the euro could fall further, especially if commodity prices continue to fall and the single European currency remains under pressure from unresolved concerns about eurozone sovereign debt.

The euro's inability to recover so far "does give me the impression that the market may be expecting further corrective swings," said Karl Forcheski, director of Societe Generale's currency division.

You're doing it on the demo... I thought you were doing it on the real...

and then she'll come back and laugh at you.

Eugene Romanov 11.05.2011 - 11:46 (Time in GMT)I'm sick of the market. The eu is not going up, although the trend is clearly going to continue. The divider on the hour is debatable, because there are two closing prices at 4409 after the first one at 4410. I understand that they want to get a hold of this divider, but what can you do. The bottom will have to unhook where it's hooked, namely 4268-46. If it goes there. Your will, but the correction is already more than normal. Seven cents, what the hell. If you read, Mr. Koks wrote, if it goes higher than 4360, then the focus is 1,4946. Well went and more than once, and even to my target zone 4570-4640 no way. Dog market got it. Let's say worst, dibs us. I'll show you the week again, you see the breakdown. So from now on we have to trade for a week. You don't have a choice, we'll trade the week. We'll trade on the daily harami cross. Unless, of course, we fight and not stop cowardly and a lot, and then she will come back and laugh at you. Or at us. Blind said - we'll see.

And why did you put the line like that? And by white peaks, because it is RES, who puts resistances like that. And market puts . in the hands of . And I bet as I should, and so do other people - not grouse here. Here this whole this 1872-4946 rise is a trend. And last week is a correction. Or what, you can technically claim otherwise? Well, well, tell the tale, only I'm not willing to listen. As long as the week is above RES 6036-5144 - the trend is strong, it does not look like a false breakout. A jump in the trend - see it on the fast RES? A buy signal for several weeks in a row. Breaking through RES 6036-5144 = many patterns. For example, subtract 1872 from 5144, and if you want more, subtract 6036, ash. As long as it doesn't go, bastard.

I periodically open a real account, and on the demo I test long-term strategy (without posting screens) and trend forecasts (about which I gradually become confident in its workability). I may open a real account once a day with a lot of trades in all currencies and as a result I have 0 margin.

OK.

Don't think about the dough, think about the price... Dough (on the depo) = just numbers... look at them to estimate the lot...

The problem is something else and my hunger I'm going through is far from forex. I've had Guillermaritis for 20 years and headaches every day, I'm really sick :) and in this state, you can't make good and fast decisions. You do not use any custom indicators, but I will write. Stochastic D-13 K-21 deceleration of 8, on the minutes look at the history. It does not show a price breakdown, and I use it to look for waves.

My vision: going up...

I'm not going to guess... I've already made my predictions today ))))

But I'll open a long with a hard stop on a pullback...if I see bigger players...

It looks like it's starting to push back

OK. I see.

The ellipse is over )) wait for the blue line, I could puff on the red one in a circle )) eurjpy and usdjpy went up, alright, tomorrow we will see

and maybe on the green ones ( turtle's fin right ))))