You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

===========================

I hope everyone will find it useful! Below are excerpts from a seasonal review (for December) that I wrote for Pantheon Finance:

----------------------------------------

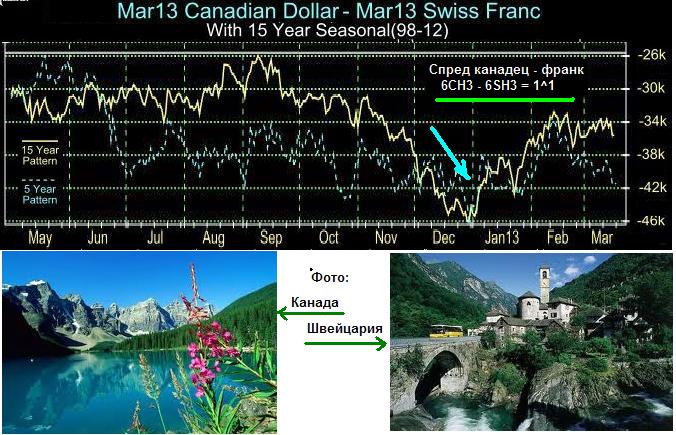

For currency trading enthusiasts, I suggest today to evaluate the prospects of selling the Canadian-Swiss franc spread. For the forex version: SELL CADCHF

First, let's look at the charts of average multiyear (5 and 15 years) seasonal spread trends 6CH3 - 6SH3 = 1^1, -

Near the end of the first decade of this month it is noticeable that demand for the Canadian dollar starts to give way to demand for the Swiss franc! And the spread line goes down until the last days of the year! (In other words, the CADCHF exchange rate declines until December 31).

Let's try to find a detailed fundamental rationale for this seasonal pattern!

---------------------------------------

Canada is an oil producing country. Significant investment in the oil industry has turned the oil-bearing areas along the Athabasca River into a symbol of Canada's energy and commodity wealth. Oil potential represents one of the main driving forces behind Canada's economy! No wonder the Canadian dollar "follows" current commodity prices. In other words, based on historical correlations, when oil prices go up, the 6C futures rate for the Canadian dollar goes up as well.

In the next few weeks, a seasonal and fundamental decline in oil demand is expected. Weak U.S. economic growth, the threat of the fiscal cliff, as well as Saudi Arabia's announcements of increased oil production, are currently pushing commodity prices lower. The high level of oil inventories in the US and Northern Europe does not add to the optimism either. Accordingly, we assume a lower demand for the Canadian national currency as well!

At the same time, European currencies received support as a result of the EU agreement on Greece, which has finally been reached. In addition, a recovery in the stock market has led to a lower demand for the Dollar, which in turn has "put pressure" on commodity prices!

Therefore, we assume that the demand for European currencies in the coming weeks will rise faster or fall slower than the demand for commodities (incl. the Canadian dollar)!

The current CADCHF situation is shown in the chart below:

Wait for the first signs of a downward reversal of the pair and assess the situation to sell the CADCHF (futures version SELL 6CH3 - BUY 6SH3 = 1:1). Hold short positions until the end of the twentieth of this month!

For currency trading enthusiasts, today I propose to evaluate the outlook for the Canadian-Swiss franc spread. For the forex version: SELL CADCHF

First let's look at the graphs of the average multi-year (5 and 15 year) seasonal spread trends 6CH3 - 6SH3 = 1^1, -

If possible, for silver-gold spread (1:2 or 2:3), TF=M30, periods 18 and 6.

For currency instruments - the spread I described above (page 215) EURUSD-EURGBP=2^3, TF=M15, periods 21 and 8

--------------------

Entry - on the next candle after the start of the convergence, i.e. :

Close - at the point of line crossing. Or (if possible) when the spread indicator line reaches the lower limit of the channel.I had a wedding and other tasks, soI was busy with programming for a while.

Ahem, finally made an EA for the forum.

Only with the conditions you described. The result is not very good - because there is not enough position control. I.e. there is some control, but only in the form of closing at crossing. And this is not enough.

The test on EURUSD vs GBPUSD 2:3 M15 since the beginning of the year:

Sharp equity collapses and underprofit when there is one is the result of insufficient control.

-------------

I am attaching the indicator and EA in MQL5.

The indicator was purposely taken from kodobase to be publicly available. It is slow so it will take a long time to test it, mind you.

The Expert Advisor is not very valuable at the moment because it is a dummy. It works in tester mode only.

----

If you want to improve your results, do some testing, look at the history of trades and write your reasonable ideas, and I will implement them in the code.

I've had a wedding, plus other tasks, soI haven't had time to program for a while.

But I'm back on track.Ahem, finally made an advisor for the forum.

Only with the conditions you described. The result is not very good - because there is not enough position control. I.e. there is some control, but only in the form of closing at crossing. And this is not enough.

Test on EURUSD vs GBPUSD 2:3 M15 from the beginning of the year:

Sharp equity collapses and underprofit when there is one is the result of insufficient control.

-------------

I am attaching the indicator and EA in MQL5.

The indicator was purposely taken from kodobase to be publicly available. It is slow so it will take a long time to test it, mind you.

The Expert Advisor is not very valuable at the moment because it is a dummy. It works in tester mode only.

----

If you want to improve your results, do some testing, look at the history of trades and write your reasonable thoughts, and I will implement them in the code.

===========

Perhaps there is a reason to take into account the seasonality of the spreads. And in different intervals to work only in sell, or only in buy!

See the post of 1 Dec. 8:54https://www.mql5.com/ru/forum/122468/page233

Seasonal spread chart GC-SI=2^1:

To try to account for the trend on the cross (eurgbp). Open only to the side above/below the MA with a longer period.

Ok, let's try.

===========

Perhaps there is a reason to take into account the seasonality of the spreads. And in different intervals to work only in sell, or only in buy!

See the post of 1 Dec. 8:54https://www.mql5.com/ru/forum/122468/page233

Seasonal spread chart GC-SI=2^1:

Yes, we can try. Anyone interested in making a seasonality indicator?OK, we'll give it a try.

You don't need to make a seasonality indicator there, but to switch on/off the trade only in buy or only in sell on the set period in the picture of Leonid and that's it!

There will be several tester reports on the number of "seasonality" directions.

The question is different - we should decide on trading criteria... number of averages, their volume + entry/exit...

On the gold-silver spread (2:1) - see the intervals directly on the chart in the post above, of course not accurate to within a day. But plus or minus 1-2 days.

As for currencies - there is no sense to use seasonality. It is almost indeterminate there, especially for using it on small timeframes.

(On silver-gold the current UP-seasonality is expected till the end of the week. And from next Monday - a reversal downwards!))