You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

...

what is the mathematical twist on bringing one graph to another (overlapping)?

Read the basics and it will reveal itself. Read "Spread Trading School" ALL the way through!

rentik, again I don't understand both the reference (which is multiplying) and the overlap.

Explain, what do you mean by "bringing one graph to another"?

If it's not the spread, then what is? http://www.procapital.ru/showpost.php?p=1334989&postcount=858

I describe the seasonal entrances there, including the spreads. Which there are even more of! Because mid- and long-term spreads are not traded in any other way than seasonally.

----------------

pump up your history/ - What exactly is not working on your indices?

So if we make 1 trade on 1 commodity, is it also a spread (temporary?)?

It is not a spread - it is a single seasonal transaction. And the spread is two opposite positions in related instruments.

-----------------------

Basically, I show current examples - in mt4 DC Grandcapital. See there account typestandard.

I understand about grandcapital. But I wonder if there are other DTs that allow you to trade futures with a small deposit, maybe with a different terminal. It is bad that there is only one option. Naturally, there should be plenty of instruments.

Maybe there are, with futures at a small depo it's a deal breaker.

I understand about grandcapital. But I wonder if there are other docs that allow you to trade futures with a small depo, maybe with a different terminal. It is bad that there is only one option. Naturally, there should be plenty of instruments.

ExnESS has a very good quotation on commodities (oil-gasoline-oil-gas) in mt4. And there are 2 contracts for each commodity!

By the way, about commodities :

--------------------------------------------------------------

___________ Commodities ____________

(fragments of a seasonal review by Pantheon-Finance)

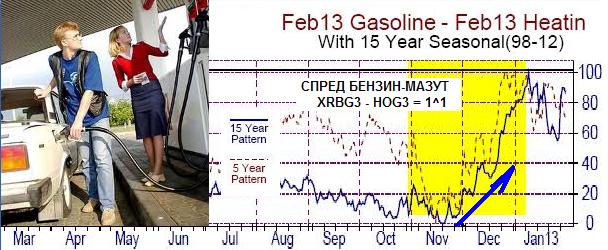

In the last days of November, there is a reasonable time to pay attention to the intermarket spread of gasoline-oil (1:1). On the basis of multi-year seasonal averages (5 and 15 years), this spread starts to widen until the first days of January of the following year, 2013:

. The chart shows the February contracts for fuel oil and gasoline: XRBG3 - HOG3 = 1:1. Fundamentally, the growth of the spread can be explained by the fact that wholesale consumers of "heating oil" have already purchased for the winter heating period and there is not much demand for fuel oil. While demand for petrol will increase in the run-up to Christmas, New Year's Eve and New Year's Day!

We can see on the seasonal chart that there is a down-correction from around 10 to 15 December . After that, there is a sharp rise in the spread line all the way through Christmas! Let's keep this point in mind!

Here is the current chart for the spread of gasoline-oil:

Check the situation to buy the spread (you can use the more liquid nearby F-contracts): BUY XRB - SELL HO = 1^1

The spread can be "insidious" and highly volatile, so it is better not to be "greedy" with the size of the positions! It is better to enter/exit during the American commodities session, to minimize losses on the asc-last-bid when opening/closing positions.

Good luck to everyone ! ________________________________ leonid553