You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

beautiful )) and now just compare .Your average profit margin is 3 times worse than the average loss margin ..FB is small ..and test since 1999 with a constant lot of $1000 .

Since 1999, lot fixed 0.1 without reinvestment.

From 1999, lot 0.01 per 1000, reinvested by Williams.

.... Now, I know they want 10-13% p.a. and a drawdown of no more than 10% with recovery within 2-3 months. With figures like that, people will fall in line....

Do you take responsibility for your words? Then start arranging the queue according to the list!

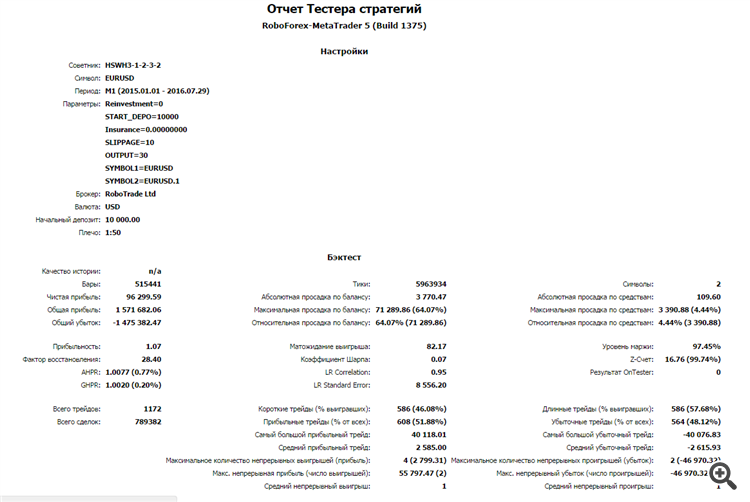

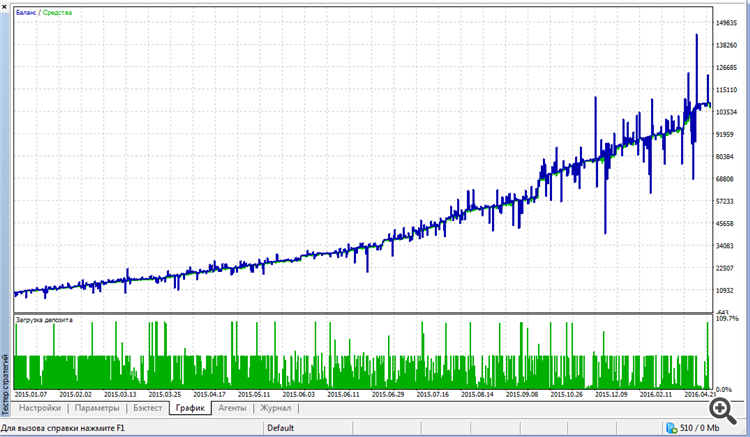

I bring to your attention the result of testing the trading algorithm on a real tick history for 1.5 years (with constant lot, without reinvestment):

All as ordered, as they say "What the doctor ordered". If you want to go deeper into detailed analysis of trades, I can post the full report on YandexDisk (a decent-sized file).

P.S. If anything, consider a commercial offer of 20% commission on the profits of the investors you bring in.

Colleagues, share your experiences. Has anyone seen any real trading advisors that are more or less stable in any type of market.

Clarification:

I'm not asking this question in search of a grail or freebie. Firstly, I want to know if we can believe in various stories about superprofitable trading robots.

Secondly, I'm interested in a very specific question for developers (don't tell me that it's a trade secret) - what parameters in ATSs are achievable and which of them can be considered good, and which are mediocre and hackwork?

A developer came to me and showed me his TS. I've looked at trade statistics and immediately realized that the system is weak. Or vice versa - the system shows fantastic results, at the level of the best of the best. It means that I am either a genius or I am being cheated.

In fact, I need an ETALON of a good system to distinguish flies from cutlets.

P.S. I would ask you to speak on the merits, without verbiage and pretty phrases. If you have nothing to say, please talk in another thread, there are many.

Good afternoon. I have not read the whole branch, but what I see does not seem a very correct question. The more correct question is the maximal drawdown of the Expert Advisor with 0.1 lot and its annual profit (maximum, minimum). Then you can evaluate the Expert Advisor by the ratio of profit per year to the maximal drawdown. My Expert Advisor shows 60 to 150 percent per year according to this criterion. If we are talking about a 10% drawdown, then the bank should be 10 times the maximum drawdown. We have 6-15% per year.

My Expert Advisor worked on the FxPro investment program on five currency pairs. It didn't lose on others, but the market pattern kept it near zero. Advisors should be tested from 2001 to 2016. In 2005-2006 the markets pattern changed from flat to trend, and since good owls should hold both patterns, this is the only way to test. Mine is holding confidently. Now participation in investment programs is closed for Russians, so I don't participate any more, I can only trade for my own money).

Good afternoon. I haven't read the whole thread, but what I see doesn't seem to me to be the right question. It would be more correct to ask what is the maximal drawdown of the Expert Advisor with 0.1 lot and what is its profit for the year (maximum, minimum). Then you can evaluate the Expert Advisor by the ratio of profit per year to the maximal drawdown. My Expert Advisor shows 60 to 150 percent per year according to this criterion. If we are talking about a 10% drawdown, then the bank should be 10 times the maximum drawdown. We have 6-15% per annum.

My Expert Advisor worked on the FxPro investment program on five currency pairs. It didn't lose on others, but the market pattern kept it near zero. Advisors should be tested from 2001 to 2016. In 2005-2006 the markets pattern changed from flat to trend, and since good owls should hold both patterns, this is the only way to test. Mine is holding confidently. Now participation in investment programs is closed for Russians, so I don't participate any more, I can only trade for my own money).

I have a table for properly testing the major currency pairs. It is given by Englishmen from FxPro for pre-selection of advisors to investment programs. If the owls are losing on these parameters, they will not even talk about it. And then they calculate the profitability as I wrote above, drawdown time and something else for themselves. I have not clarified.

Good afternoon...If you can put a table in my personal or here please and link to the program's invest...

https://1drv.ms/f/s!Am3679CGgAPPhaUMyGNtVdoH7sr-YA

For Russians, the programme is closed. I no longer have the link to the programme from Russia but it did from Holland.

If we flip a coin for a long time, we will go far away from the starting point in +, or in -. And we will probably never get back to that starting point. This is a medical mathematical fact. In this case the average (and not only average)) profitable trade will be not even approximately, but simply equal to a losing trade.

An automaton with these parameters can be built simply by flipping a coin long-short at random points in time. I assure you there will be 50/50 losses and gains. And since in the market we do not have to wait for a coin to fall and can close a trade without waiting for it, such an automaton will always be profitable.

You may try it on your own, with cats of course. It is not difficult. The result is guaranteed. We set the right stop, do not limit take.

I do not agree. If we close the sdp at equal time intervals, and neglect the spread, then in case of random entry there will indeed be 50% of winning trades and 50% of losing trades. If you introduce a spread, the losing trades will immediately outweigh the losing ones. If you allow manager or advisor to wait and close a trade at his discretion, there will be much more losing trades (saw a profit, did not close, got SL). Moreover, if the manager is allowed to wait out any losses, then there will be much less loss-making trades (all martingel strategies work on this), but there is another problem, the probability of a catastrophic loss (the so-called tail risk).

So you are in a hurry to guarantee a result. I have personally tried it. There is no guarantee. If a trade goes to zero and does not come back - no matter how you look at it, it will be loss-making. If a trade went to profit, I didn't close it, and it came back and went into minus, then my waiting skills are working against me. The statistics can be anything.

There is such a result, the quality of modelling corresponds to the advisor's logic, the decision to open and close is made on the first tick of a new candle. No market forecasting is used as it is essentially impossible. Work with mathematical probability so that about 75% of trades are profitable.

Do you take responsibility for your words? Then start organizing your queue according to the list!

I bring to your attention the result of testing the trading algorithm on a real tick history over 1.5 years (with a fixed lot, without reinvestment):

All as ordered, as they say "What the doctor ordered". If you want to go deeper into detailed analysis of trades, I can post the full report on YandexDisk (a decent-sized file).

P.S. If anything, you can consider a commercial offer of 20% commission on the profits of the investors you bring in.