GBPCAD has been very probably even profitable since 23h. But the 23-hours chart is a failure both in terms of volume and number of profitable open orders.

In general, I am interested to hear from "interval traders" (evening trading and other trading by hours of the day). How is it with you?

Unfortunately I amnot able to reply to messages in this topic, due to technical reasons of political nature I am in read-only mode.

~150 lots.

In general, interested to hear from "interval traders" (evening trading and other trading by hours of the day). How are you doing with it?

Unfortunately, I will not be able to write in the thread, because for technical reasons of a political nature, I am in read-only mode.

Someone's really playing hard to get.

But we're fine with that, we're in and out in the morning.

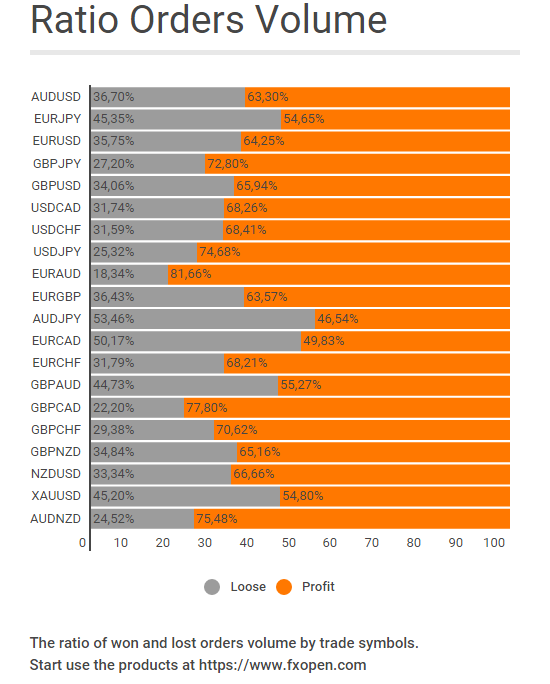

Some very strange statistics... If over 50% of trades in almost all instruments are profitable, who loses?

Actually, if it is ECN, which side of the trade is indicated in the statistics?

I can not write in the thread unfortunately, because I am in read-only mode due to technical reasons of political nature.

Creating topics is not read-only ;)

Some very strange statistics... If in almost all instruments more than 50% of deals are profitable, who loses?

Each chart is plotted by the number (a poor indicator not only because of different volumes, but also because of frequent partial executions) of executed orders (including markets) and by their total volume. For example, in your screenshot, the EURAUD line indicates that if we add up the volume of all executed EURAUD orders, 81.66% of the volume were profitable orders and the rest were losing orders.

However, it is not at all a question of the size of these profits and losses. For example, if an average loss is several times larger (which is the case) than an average profit, then even with such a skew, as shown in the diagram, the net profit may even be negative.

In general, if this is ECN, what side of the deal is specified in the statistics?

And even if the total result is positive, the earnings are not reduced to matching (clients among themselves - ECN), but to communicating with external players (STP). So there is always a profit to be taken from (including negative profits).

We will hardly wait for the net profit diagram since it will be a direct hint to the outside players when the toxic flow comes out.

Topic creation is not read-only ;)

It is extremely difficult (technically) to enter the forum, so in practice this is the case.

Anyway, interesting to hear what time we are talking about in the GMT offset.

MT4 time of the respective broker. Right now it's GMT+2. What was with the time conversion - don't know. It's easier to go to a demo account and see for yourself.

By the way, on EURAUD we can see that the number of profitable orders is 59.72% and the volume is 81.66%. It means that those who trade higher lots are more successful than those who trade smaller ones. Most likely, they are PAMM traders. Where the competence is higher and the sums allow to play larger.

Replying to the sub, it is not clear how to interpret the failure at 23 hours (opening positions in this interval). I think it would be cool if they added charts of MAE, duration and other indicators as in Signals. I.e. in fact all client accounts should be treated as one account and the status from the Signals applied to it, removing Gain and other information that might reveal toxicity.

Some very strange statistics... If over 50% of trades in almost all instruments are profitable, who loses?

The majority lose. I guess this statistic is correct in the sense that most traders are right in short-term trading and the number of trades made is very large. But the profit from such trades is minimum as not many pips/ money are earned. And those deals that bring much losses are few, as a rule, they are held on for a long time after opening till the last one, i.e. till the complete sinking.

The main reason of this is the following statistics - there are a lot of those who win in the short term, which brokers show on their websites, and thus show the truth, which is profitable for them and hides the truth expressed in money.

zaskok3:

...In general, interested to hear from "interval traders" (evening trading and other trading by hours of the day). How are you doing with it?

I think that profitable trading after 23:00 has already been implemented - in Signals the Expert Advisor trades on a similar principle.

It does not matter for me when to trade - for some reason I enter the market in the evening and exit every other day or week.

Some very strange statistics... If over 50% of trades in almost all instruments are profitable, who loses?

Actually, if it is ECN, which side of the trade is indicated in the statistics?

Creating topics is not read-only ;)

The MT4 time of the relevant broker. It is now GMT+2. I don't know what happened with the time conversion. It's easier to go to a demo account and see for yourself.

Each chart is plotted by the number (a poor indicator not only because of different volumes but also because of frequent partial executions) of executed orders (including market orders) and by their total volume. For example, in your screenshot, the EURAUD line indicates that if we add up the volume of all executed EURAUD orders, 81.66% of the volume were profitable orders and the rest were losing orders.

However, it is not at all about the size of those profits and losses. For example, if an average loss is several times larger (which is the case) than an average profit, then even with such a slope as shown in the diagram, the net profit can even be negative.

And even if the total is positive, the earnings are not reduced to matchmaking (clients among themselves - ECN), but to the communicating with external players (STP). So there is always where to take profits from (including negative ones).

Well, then the statistics should be interpreted differently.

What does this figure even mean? If during this 23rd hour 100 times less trades were opened (by volume) than during any other hour, what difference does it make if 85% of them were losing? What does that figure even tell us?

I do not know a broker with the name "appropriate". I guess you are not a programmer, unlike aunties, we try to express ourselves precisely ))

hrenfx programs normally and does not name the broker so as not to get the 25th account banned.

But not to find the name, following the link from the first post, not even a very far from programming person can't ;)

hrenfx is programming normally, but does not name the broker, so as not to get the 25th account banned.

But not to find the name by following the link from the first post, not even a very distant person from programming can not ;)

I'm glad he's programming normally and didn't notice the link )))) But I would still point out the time, it's not difficult. But to go to the site and find out the time of the broker... I wouldn't even bother.

I limited my order open time in scalper to 22:00:01:00 (GMT+2), I selected it purely empirically, i.e. from the ball). I have a 24/7 support and closing by the signals.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The question is inspired by the charts from here. The most profitable ones are EURAUD, GBPCAD and AUDNZD.

These symbols are traditionally flat in the evening session.

GBPCAD is very probably even profitable from 23h onwards. But in terms of volume and number of profitable open orders the 23-hours chart shows a dip.

The stats are actually quite interesting if we suppose it to be correct. It is also clear that PAMMs are much more profitable than the average user.

There are hours, which are off the scale of profitability (21, for example). And in second place is the loser hour with 7.

I am monitoring a little bit all my bets. The toolkit is not very good yet. But the same Limit orders are not so much traded (lot < 0.5 for the most part). However, in the evening more professionals become active; among them there are a lot of PAMM and ATS traders. Limiters are considerably enlarged. For example, since midnight someone reduces ~150 lots on many symbols. It seems that due to the lack of margin they remove the limit (when the price is far away from it) and put it back (when it is close to it). This manipulation allows opening for a larger lot.

Generally, I am interested to hear "interval traders" (evening trade and other trades by hours of day). How's that working out for you?

Unfortunately, I will not be able to write in the thread, because for technical reasons of a political nature, I am in read-only mode.