Machine learning in trading: theory, models, practice and algo-trading - page 3516

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

So your brain doesn't turn to jelly.

The world's a big place, much bigger than a sausage. Sausage is one day sausage and the next day a pile of shit if you're not constipated.

PS.

To add.

In the USSR, the overwhelming majority of the population knew the answer to your question without any sausage.

The brain evolved through what processes? Before it turned into jelly, it had to emerge.

The USSR was a political system, not a way to develop the brain. They had great marketing. And they had great designers. That's why the atmosphere itself is associated with something grandiose. It was a well thought out project.

PS.

What about the queues for sausage?

Can someone tell me what this idle chatter has to do with machine learning? This thread is dead.

It's the weekend. It'll all come back))))

I came across something completely different, but it may be useful for the regulars of the thread: https: //arxiv.org/pdf/1808.03668 and https://dm13450.github.io/2022/02/02/Order-Flow-Imbalance.html.

at least it is relevant to the topic of the thread and those interested in using NN DL here.

I came across something completely different, but it may be useful for the regulars of the threads: https: //arxiv.org/pdf/1808.03668 and https://dm13450.github.io/2022/02/02/Order-Flow-Imbalance.html.

at least it is relevant to the topic of the thread and those interested in using NN DL here.

If I understood correctly, the first paper trained on:

134 million rows (10 instruments, every tick) and 4000 columns (40 columns with prices and volumes * 100 previous values) = 536 billion cells in a matrix/array. If it is a Float data type, *4 bytes = 2144 gigabytes.

Then the time sequences are somehow compressed and filtered.

MA is mentioned as one of the compression options. I.e. to submit not 100 sequential values in time, as 100 separate features, but one MA (100).

Has anyone figured out what convolutions and filters are?

Has anyone figured out what the convolutions and filters are?

AI faces an insurmountable ceiling

https://dzen.ru/a/ZkLZRGaQUXtVCKjH

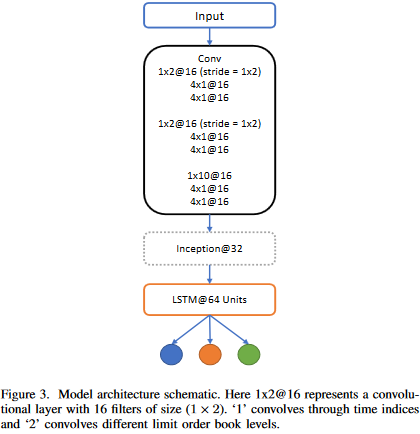

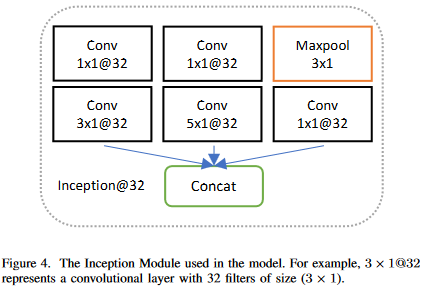

The convolution layer and the lstm layer. Stride (filter) is a move step in the convolution

.

Why you shouldn't trade this model

So at the first glance, the OFI signal looks like a profitable strategy. Now I will highlight why it isn't in practice.

I've not taken into account any slippage, probability of fill, or anything that a real-world trading model would need to be practical. As our analysis around the Sharpe ratio has shown, it wants to trade as much as possible, which means transaction costs will just destroy the return profile. With every trade, you will pay the full bid-ask spread in a round trip to open and then close the trade.

Biggest omission