Discussion of article "Combination scalping: analyzing trades from the past to increase the performance of future trades"

it seems that you can't test such strategies on generated ticks

Maxim Dmitrievsky:

It seems that you cannot test such strategies on generated ticks

I think so too, also because when searching for a pattern, absolute values of candlestick amplitude and parts of candlesticks are used. This is incorrect, as these values will naturally be different on different timeframes because of the different scale. We need to search for regularities, i.e. relative, not absolute ratios.

It seems that you cannot test such strategies on generated ticks

I liked the article, everything is competent and on the shelves, thanks to the author!

There are very few quality articles lately, short and to the point)

I agree with the previous comments, we need relative units of measurement, for example percentages or normalise the candles from 0 to 1 with a margin relative to the maximum with a margin

Then, it may be possible to find the pattern itself without being rigidly bound to the symbol and its scale.

where is the demo code?

You came very close to the ideal.

But you've gone a little bit in the other direction

But it's so well and loquaciously written.

thanks for sharing knowledge!

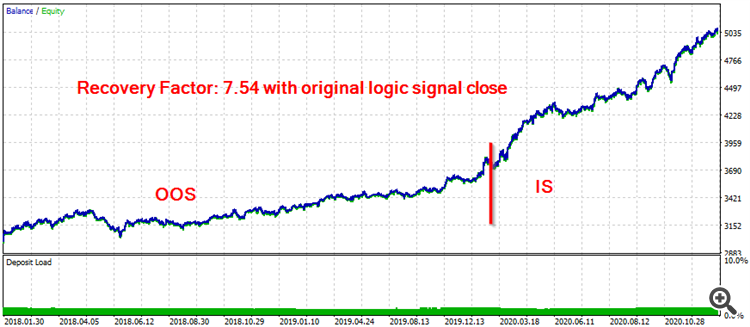

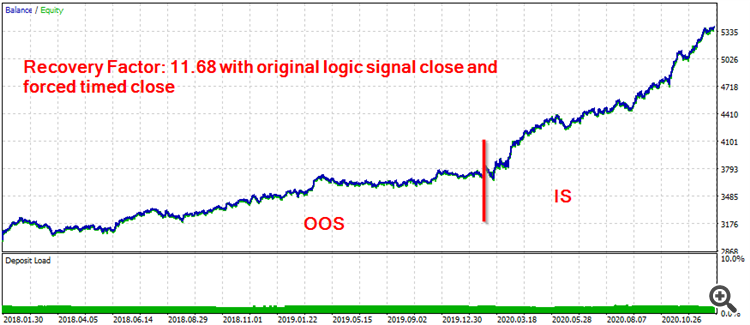

So, what you mean is that one of the way to improve a trading system, is to include some time expiration function after an opened position and then optimize this time variable?

Great contribution!

Although I'm still researching this way of finding patterns (my code is still very crude), the idea of adding specific forced timing closed on top of the original strategy closing has already added great value to a couple of my own EAs, increasing their performance even on OOS and Validation data samples.

Thank you so much!

Lenar Mansurov:

You came very close to the ideal.

If you don't go off to the side, where do you think we should look?

You came very close to the ideal.

But you've gone a little bit in the other direction

But it's so well and loquaciously written.

Do you have the example code?

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

New article Combination scalping: analyzing trades from the past to increase the performance of future trades has been published:

The article provides the description of the technology aimed at increasing the effectiveness of any automated trading system. It provides a brief explanation of the idea, as well as its underlying basics, possibilities and disadvantages.

Imagine: there is a cannon (a trading system or an algorithm) and 2 boxes of shells — one with positive (profitable) trades, and the other with negative (losing) trades. If you shoot them and study the craters on the battlefield, it turns out that some positive deals never fall into negative craters throughout the shooting history.

Visually, it might look like this:Figure 1. Digital field of trading history

Author: Oleg Besedin