Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.26 18:45

Forex Weekly Outlook Sep 29-Oct 3Canadian GDP, US Consumer confidence, ISM Manufacturing PMI, Rate decision in the Eurozone and important employment figures from the US including the all-important NFO report. These are the major events on Forex calendar. Here is an outlook on the main market-movers ahead.

Last week, the Scottish referendum threatening to quit the UK, resulted in a vote against independence pushing the pound higher after sharp drops. Likewise, the US dollar gained momentum as ECB Chairman Mario Draghi, RBA’s Stevens and Chinese policy makers considered using the Fed’s tactics to fight downturn economic trends. Finally the US GDP release showed the economy expanded at an annual rate of 4.6% in the second quarter, better than the 4.2% estimate made a month ago, providing momentum for strong growth the rest of the year. Will the US continue its growth trend?

- Eurozone Inflation data: Tuesday, 9:00. Euro zone inflation edged up in August 0.3% after posting 0.4% rise in the previous month. The increase was in line with market forecast. The main price increase occurred in rents and car-repair. The Euro area remained in the “danger zone” of below 1% for 11 straight moths. The recent rate cuts and asset purchases are expected to stimulate the economy and boost inflation. ECB next step may involve a more massive bond-buying program. Euro zone inflation is expected to gain 0.3% this time.

- Canadian GDP: Tuesday, 12:30. Canadian economy expanded 0.3% on a monthly base in June, following a 0.5% gain in May. The reading was better than the 0.2% expansion anticipated by analysts. The increase was driven by an increase in mining and oil and gas extraction offsetting the fall in the manufacturing sector. On a yearly base, GDP edged up 3.1% in June the highest growth rate since September 2011. The Central Bank expects that the economy will expand 2.2% in 2014 and 2.4% in 2015. GDP is forecasted to increase by 0.2% in July.

- US CB Consumer Confidence: Tuesday, 14:00. US consumer confidence picked up in August, reaching 92.4 from a downwardly revised 90.3 the prior month. The reading was higher than the 89.1 reading projected by analysts and posted the fourth straight rise. Better business conditions and strong job growth boosted consumer’s moral. Consumers also forecasted an inflation rise of 5.5% in the coming 12 months. Consumer confidence is expected to reach 92.2 this time.

- US ADP Non-Farm Employment Change: Wednesday, 12:15. ADP payroll numbers plunged in August to 204,000, from 212,000 in the previous month. However the ADP figures have proved to be volatile, showing only the general trend of the Non-Farm payrolls coming later that week. Economists expected a stronger release of 218,000. Overall, employment figures remained high, posting the fifth straight month of job gains above 200,000. US job market is expected to expand by 206,000 positions in September.

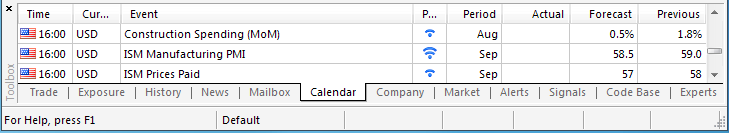

- US ISM Manufacturing PMI: Wednesday, 14:00. U.S. manufacturing activity edged up to its highest level in nearly 3-1/2 years in August, rising to 59, after a 57.1 release in July, amid a strong jump of a 3.4% in consumer spending during July, indicating a growth trend in the US economy. Economists expected a reading of 57 points. Private construction, the largest portion of construction spending, rose 1.4%, its highest level since November 2008. U.S. manufacturing is predicted to reach 58.6.

- Eurozone rate decision: Thursday, 11:45. The European Central Bank cut its benchmark rate to 0.05% in September from 0.15% in August. ECB President Mario Draghi noted the rate cut reached the lower bound following a downturn trend in the Eurozone economy with low inflation, sinking deeper below the ECB’s target of just under 2 %. The ECB also lowered the rate on bank overnight deposits to -0.20%. No change in rates is expected now.

- US Unemployment Claims: Thursday, 12:30. The number of people filing initial claims for unemployment benefits increased by 12,000 last week to 293,000, after contracting sharply two weeks ago. However despite the sharp rise, the level of applications remains near pre-recession levels, indicating that hiring remains strong. Over the past year, the four-week average for applications has fallen 7.1%. The total number of people receiving benefits ticked up by 7,000 to 2.4 million. He number of claims is expected to rise to 299,000.

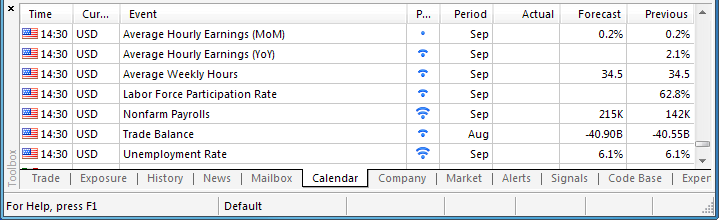

- US Non-Farm Employment Change and Unemployment rate: Friday, 12:30. The US economy added 142,000 jobs in August, the lowest figure this year after a 212,000 rise in July. The sharp fall came as a surprise to analysts, expecting a gain of 226,000. However, the unemployment rate declined to 6.1% from 6.2% in the previous month, in line with market forecast. The US had added an average of 212,000 jobs each month over the prior 12 months. While the monthly release was weaker than anticipated, the longer-term trend remains positive. Gains now average 207,000 over the last three months. A gain of 216,000 jobs is expected in the NFP report.

- US Trade Balance: Friday,

12:30. The U.S. trade deficit narrowed in July to its lowest level

since January, reaching to a seasonally adjusted $40.5 billion, from

$40.8 billion in June.

Exports of automobiles, telecom equipment, industrial machines and semiconductors increased. Imports of oil products increased, but rising domestic production reduced the trade deficit in petroleum to its lowest in more than five years. The decline in trade deficit reinforces views that the US economy continues to strengthen. The U.S. trade deficit is expected to decline further to $41.0 billion in July. - US ISM Non-Manufacturing PMI: Friday, 14:00. The U.S. service sector continued to expand in August, reaching 59.6 after gaining 58.7 in July, beating forecast of 57.3. The majority of responders were optimistic regarding business conditions. The business activity index showed a reading of 65, up from July’s reading of 62.4; the new orders index hit 63.8, down from the previous reading of 64.9 and the employment index rose to 57.1, from July’s reading of 56. Overall, the ISM manufacturing and non-manufacturing reports suggest a continued improvement in the U.S. economy. US ISM Non-Manufacturing PMI is forecasted to reach 58.5.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.29 16:24

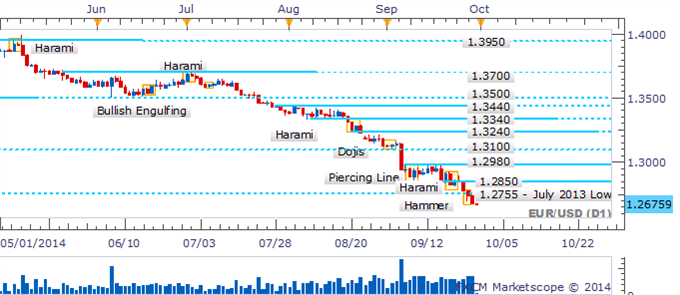

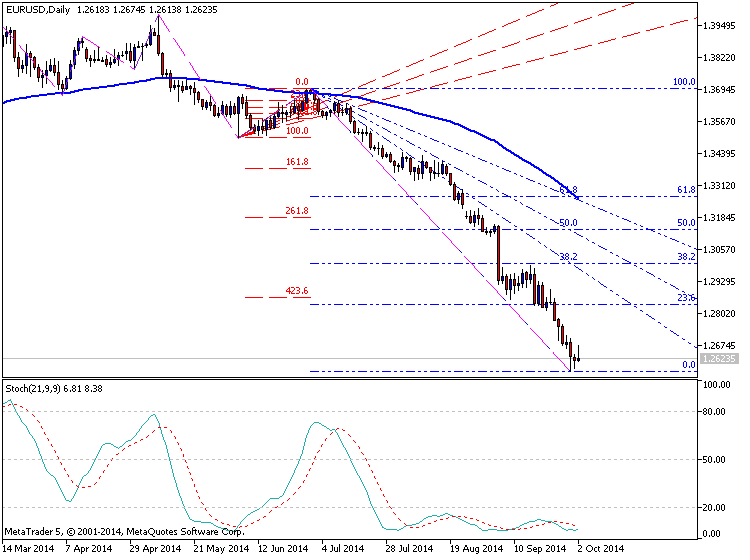

EUR/USD May Extend Declines Amid Void Of Reversal Candles (based on dailyfx article)

- EUR/USD Technical Strategy: Shorts Preferred

- Absence Of Bullish Candles Opens Further Declines

- Close Below 1.2660 To Open Run On 1.2250

EUR/USD may be set to continue its slide amid an absence of candlestick reversal signals for the pair. Some buying interest appears evident near the November 2012 low at 1.2660. If broken the stage would be set for an extended decline to the late August 2012 low at 1.2250.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.28 17:22

EUR/USD forecast for the week of September 29, 2014, Technical AnalysisThe EUR/USD pair initially tried to rally during the week, but as you can see ended up falling and slicing through the 1.28 level like it wasn’t even there. Because of this, we believe that the euro continues to offer selling opportunities on rallies, but at this point in time we think that the market is probably aiming for the 1.25 handle. Be aware though, this is a market that is certainly oversold by any stretch of imagination and a snapback rally could happen at any point. Ultimately though, we have no plans on buying.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.01 12:34

Trading the News: U.S. ISM Manufacturing (based on dailyfx article)

- U.S. ISM Manufacturing Survey Expected to Fall Back from Highest Reading Since March 2011.

- Even Though Employment Component Narrowed in August, Still Marked the Second-Highest Print for 2014.

A downtick in the ISM Manufacturing survey may generate a bearish dollar reaction (bullish EUR/USD) should the data print dampen the outlook for growth and inflation.

What’s Expected:

Why Is This Event Important:

At the same time, we will need to keep a close eye on the employment

component as the highly anticipated Non-Farm Payrolls (NFP) report is

expected to show the U.S. economy adding another 217K jobs in September,

and a material downward revision in the key metrics may undermine the

bullish sentiment surrounding the greenback as it drags on interest rate

expectations.

The dollar may face a near-term correction should the ongoing slack in

the real economy spur a marked slowdown in manufacturing, and a dismal

ISM print may prompt the Fed to further delay its normalization cycle as

Chair Janet Yellen remains reluctant to move away from the

zero-interest rate policy (ZIRP).

Nevertheless, the resilience in private sector consumption may foster

another unexpected uptick in the manufacturing survey, and a

better-than-expected release may heighten the bullish sentiment

surrounding the dollar as it raises the Fed’s scope to implement a rate

hike sooner rather than later.

How To Trade This Event Risk

Bearish USD Trade: ISM Survey Narrows to 58.5 or Lower

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a short EURUSD trade

- Implement same setup as the bearish dollar trade, just in the opposite direction

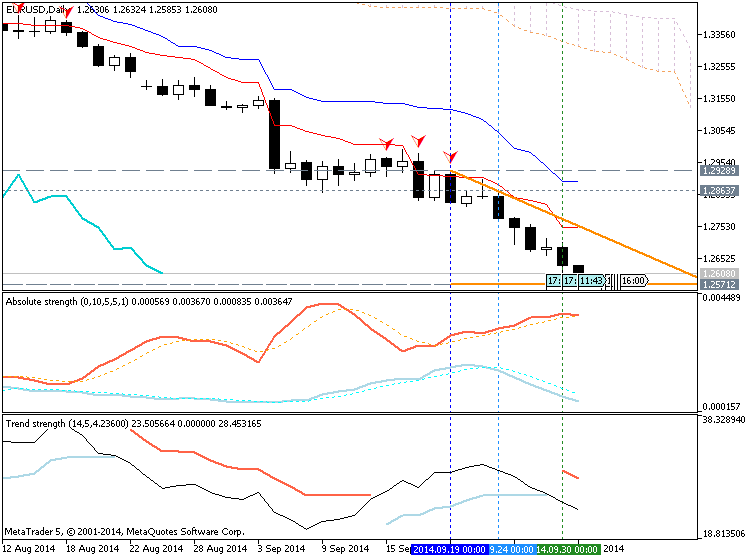

EUR/USD Daily

- Remains vulnerable to a further decline as near-term bearish RSI momentum remains in play

- Interim Resistance: 1.3010 (50.0% retracement) to 1.3020 (23.6% expansion)

- Interim Support: 1.2450 (78.6% retracement) to 1.2500 pivot

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| AUG 2014 |

9/02/2014 14:00 GMT | 57.0 | 59.0 | -4 | -2 |

August 2014 U.S. ISM Manufacturing

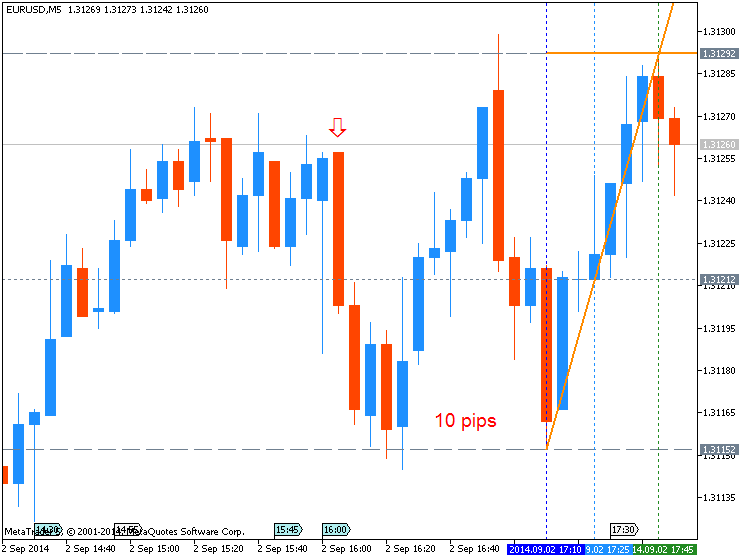

EURUSD M5 : 10 pips price movement by USD - ISM Manufacturing PMI news event:

Manufacturing activity in the U.S. unexpectedly picked up in August as the ISM survey rose to 59.0 from July’s 57.1 print; reaching the highest level since March 2011. The expansion was fueled by a surge in orders for plastics and metals, and highlights the scope for a stronger U.S. recovery in the second half of the year. The market reaction to the positive ISM print was limited and short-lived as the EUR/USD chopped around 1.3128, with the pair closing the day at 1.3122.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 18 pips price movement by USD - ISM Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.01 15:56

2014-10-01 12:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]- past data is 202K

- forecast data is 210K

- actual data is 213K according to the latest press release

if actual > forecast (or actual data) = good for currency (for USD in our case)

[USD - ADP Non-Farm Employment Change] = Estimated change in the number of employed people during the previous month, excluding the farming industry and government. Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activityю

==========

U.S. Private Sector Job Growth Exceeds Economist Estimates In September

Employment in the U.S. private sector increased by more than expected in the month of September, according to a report released by payroll processor ADP on Wednesday, with employment rising by more than 200,000 jobs for the sixth straight month.

ADP said private sector employment jumped by 213,000 jobs in September following a downwardly revised increase of 202,000 jobs in August.

Economists had been expecting an increase of about 205,000 jobs compared to the addition of 204,000 jobs originally reported for the previous month.

The stronger than expected job growth was partly due to a notable increase in goods-producing employment, which rose by 58,000 jobs in September following an increase of 42,000 jobs in August.

The construction industry added 20,000 jobs, while employment in the manufacturing industry climbed by 35,000 jobs, the biggest increase in that sector since May of 2010.

Meanwhile, ADP said service-providing employment rose by 155,000 jobs in September, reflecting a modest slowdown compared to the addition of 160,000 jobs in August.

EURUSD M5 : 34 pips range price movement by USD - ADP Non-Farm Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.02 06:19

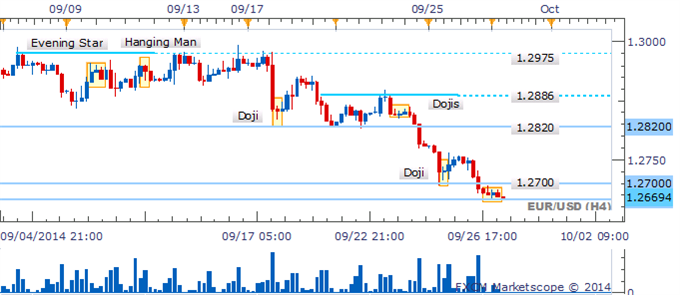

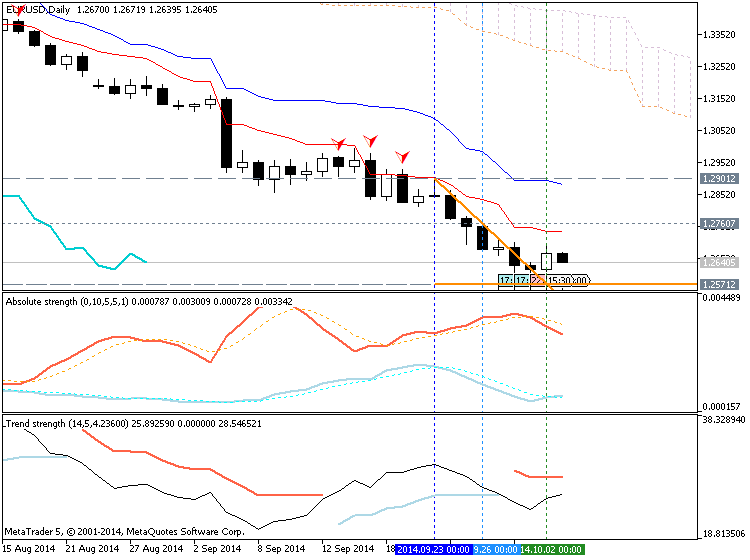

EUR/USD Technical Analysis: Euro Ready to Move Higher? (based on dailyfx article)

- EUR/USD Technical Strategy: Short at1.2644

- Support: 1.2602, 1.2532, 1.2445

- Resistance:1.2673, 1.2760, 1.2858

The Euro put in a Hammer candlestick, hinting a bounce against the US Dollar

may be around the corner. Near-term resistance is in the 1.2659-73 area

marked by the November 2012 low and the 38.2% Fibonacci expansion, with

a break above that exposing the 1.2754-60 zone bracketed by the July

2013 bottom and the 23.6% level. Alternatively, a drop below the 50% Fib

at 1.2602 opens the door for a test of the 61.8% expansion at 1.2532.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.02 09:52

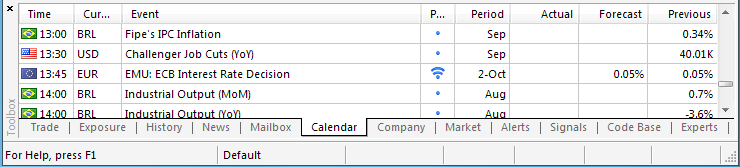

Trading the News: European Central Bank (ECB) Interest Rate Decision (based on dailyfx article)

- European Central Bank (ECB) to Announce Further Details Surrounding Non-Standard Measures.

- Will ECB President Mario Draghi Talk Down the Euro?

Further details surrounding the European Central Bank’s (ECB) asset-back

securities (ABS) and covered-bond purchase program may heighten the

bearish sentiment surrounding the Euro, but we may see a relief rally in

the EUR/USD should the Governing Council use the interest rate decision

as an attempt to buy more time.

What’s Expected:

Why Is This Event Important:

The ECB may refrain from addressing the unanswered questions surrounding

the non-standard measures as President Mario Draghi waits for the

results of the second targeted long-term refinancing operation (T-LTRO),

and the EUR/USD may face a near-term correction should the fresh

developments dampen bets for more easing.

The ECB may sound increasingly dovish amid the growth threat for deflation, and the EUR/USD may face a further decline should the council keep the door open for more non-standard measures, which may quantitative easing (QE).

Nevertheless, the ECB may scale back its dovish outlook amid the

improvements in the monetary union, and the Euro may face a near-term

bounce should the central bank adopt a wait-and-see approach.

How To Trade This Event Risk

Bearish EUR Trade: ECB Keeps Door Open for More Non-Standard Measures

- Need red, five-minute candle following the updated foreward-guidance to consider a short EUR/USD trade

- If market reaction favors a short Euro trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same strategy as the bearish euro trade, just in the opposite direction

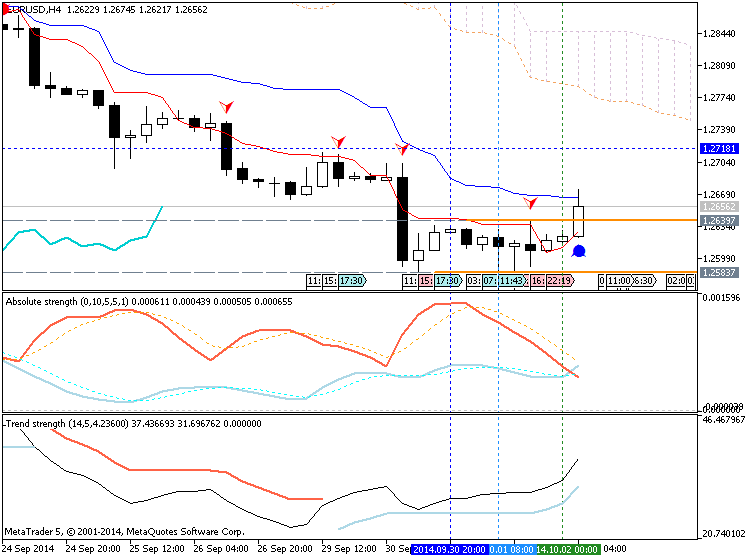

EUR/USD Daily

- Interim Resistance: 1.3010 (50.0% retracement) to 1.3020 (23.6% expansion)

- Interim Support: 1.2450 (78.6% retracement) to 1.2500 pivot

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| SEP 2014 | 09/04/2014 11:45 GMT | 0.15% | 0.05% | -107 | -197 |

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.02 15:54

ECB Leaves Rates Unchanged After September Cut

The European Central Bank on Thursday left its key interest rates unchanged at a record low, in line with economists' expectations, after reducing them in a surprise move last month.

The Governing Council, led by President Mario Draghi, held the refinancing rate at a record low 0.05 percent, following its policy meeting in Naples, Italy.

The bank today kept the deposit rate at -0.20 percent and the marginal lending rate was maintained at 0.30 percent.

The three main interest rates were lowered by 10 basis points in September as euro area inflation is set to slow in the coming months.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.03 09:27

EUR/USD Technical Analysis: Euro May Be Ready to Recover (based on dailyfx article)

- EUR/USD Technical Strategy: Short at 1.3644

- Support: 1.2602, 1.2532, 1.2445

- Resistance:1.2673, 1.2760, 1.2858

The Euro may be preparing to launch a recovery against the US Dollar

after prices put in a bullish Morning Star candlestick pattern. A daily

close above the 1.2659-73 area marked by the November 2012 low and the

38.2% Fibonacci expansion exposes the 1.2754-60 zone bracketed by the

July 2013 bottom and the 23.6% level. Alternatively, a reversal below

the 50% Fib at 1.2602 clears the way for a challenge of the 61.8%

expansion at 1.2532.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.03 10:41

Trading the News: U.S. Non-Farm Payrolls (based on dailyfx article)

- U.S. Non-Farm Payrolls (NFP) to Pick Up From Lowest Print Since .

- Jobless Rate to Hold at 6.1% for Second Consecutive Month.

A pickup in U.S. Non-Farm Payrolls (NFP) may spur a further decline in

the EUR/USD as the Federal Reserve is widely expected to halt its

quantitative easing (QE) program at the October 29 policy meeting.

What’s Expected:

Why Is This Event Important:

The deviation in the policy outlook certainly casts a long-term bearish

outlook for the EUR/USD, but a further slowdown in job growth may

generate a larger pullback in the dollar as it would allow the Federal

Open Market Committee (FOMC) to further delay the normalization cycle.

The ongoing decline in planned job-cuts along with the pickup in private

sector activity may spur a meaningful uptick in job growth, and a

positive print may spur another round of dollar strength as it boosts

interest rate expectations.

However, the slowdown in building activity paired with the persistent

weakness in the housing market may drag on hiring, and another

disappointing employment report may trigger a near-term decline in the

greenback as it dampens bets of seeing the Fed normalize policy sooner

rather than later.

How To Trade This Event Risk

Bullish USD Trade: Job & Wage Growth Picks Up

- Need red, five-minute candle following the release to consider a short trade on EUR/USD

- If market reaction favors a long dollar position, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

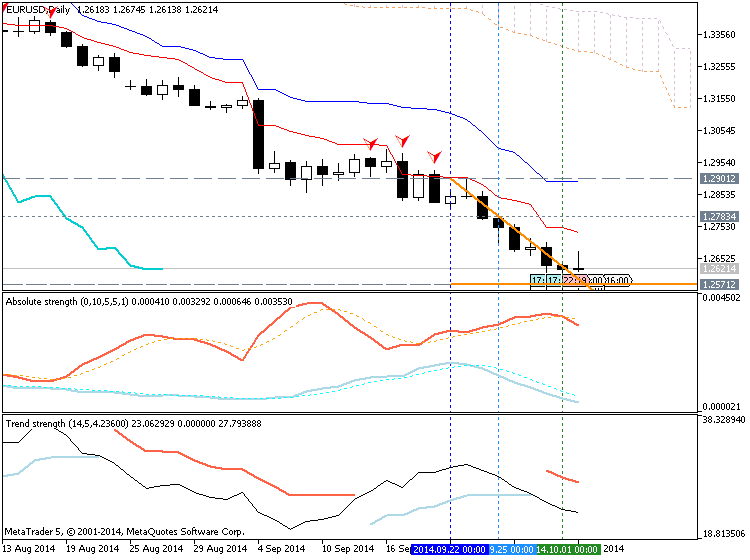

EUR/USD Daily

- As Relative Strength Index (RSI) comes off of oversold territory, break of near-term bearish momentum should highlight a larger topside correction.

- Interim Resistance: 1.3010 (50.0% retracement) to 1.3020 (23.6% expansion)

- Interim Support: 1.2450 (78.6% retracement) to 1.2500 pivot

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| AUG 2014 | 09/05/2014 12:30 GMT | 230K | 142K | +15 | +3 |

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 68 pips price movement by USD - Non-Farm Employment Change news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on bearish market condition with the neatest 1.2696 support level.

H4 price is on bearish as well for trying to break 1.2680 support level for the bearish to be continuing.

W1 price is on primary bearish for breaking 1.2827 support level.

MN price is on bearish too. The price is located below Ichimoku cloud/kumo, and Chinkou Span line of Ichimoku indicator is trying to break the price from above to below for good breakdown. if it happened so this pair will be on bearish market condition for the rest of 2014 (and for 2015 too). This is key event for EURUSD for this and coming years.

If D1 price will break 1.2696 support level so the primary bearish will be continuing.

If not so we may see the ranging market condition within bearish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-09-29 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - Spanish CPI]

2014-09-29 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Personal Consumption Expenditure]

2014-09-29 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Pending Home Sales]

2014-09-30 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

2014-09-30 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Retail Sales]

2014-09-30 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - CPI Flash Estimate]

2014-09-30 13:45 GMT (or 15:45 MQ MT5 time) | [USD - Chicago PMI]

2014-09-30 14:00 GMT (or 16:00 MQ MT5 time) | [USD - CB Consumer Confidence]

2014-10-01 01:00 GMT (or 03:00 MQ MT5 time) | [CNY - Manufacturing PMI]

2014-10-01 07:15 GMT (or 09:15 MQ MT5 time) | [EUR - Spanish Manufacturing PMI]

2014-10-01 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - Manufacturing PMI]

2014-10-01 12:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

2014-10-01 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

2014-10-02 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - Spanish Unemployment Change]

2014-10-02 11:45 GMT (or 13:45 MQ MT5 time) | [EUR - Minimum Bid Rate]

2014-10-02 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

2014-10-03 07:15 GMT (or 09:15 MQ MT5 time) | [EUR - Spanish Services PMI]

2014-10-03 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - Retail Sales]

2014-10-03 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

2014-10-03 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]

2014-10-03 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movement

SUMMARY : bearish

TREND : bearish

Intraday Chart