You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.09.05 09:55

Trading the News: U.S. Non-Farm Payrolls (adapted from dailyfx)

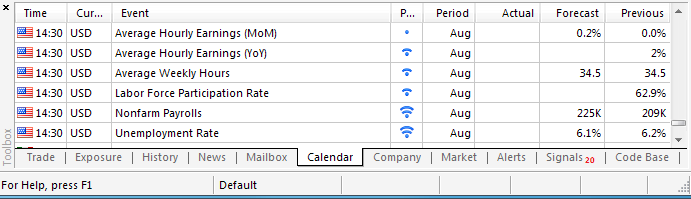

The EUR/USD may face a further decline over the next 24-hours of trade as the U.S. Non-Farm Payrolls (NFP) report is expected to show the world’s largest economy adding another 230K jobs in August while the jobless rate is expected to narrow to an annualized 6.1% from 6.2% the month prior.

What’s Expected:

Why Is This Event Important:

Signs of a more robust recovery may further boost interest rate expectations as the Federal Open Market Committee (FOMC) is expected to halt its asset-purchase program at the October 29 meeting, and the bullish sentiment surrounding the U.S dollar may gather pace throughout the remainder of the year as a growing number of central bank officials show a greater willing to normalize monetary policy sooner rather than later.

The pickup in economic activity paired with the highest ISM employment prints for 2014 may highlight a further expansion in job growth, and an above-forecast NFP figure may spur fresh monthly lows in the EUR/USD amid the deviation in the policy outlook.

On the other hand, the recent slowdown in private-sector consumption - one of the leading drivers of growth - may generate another weaker-than-expect print, and a soft employment reading may spur a more meaningful pullback in the greenback as it dampens the outlook for the world’s largest economy.

How To Trade This Event Risk

Bullish USD Trade: NFPs Climb 230K or Greater While Jobless Rate Slips to 6.1% or Lower

- Need red, five-minute candle following the release to consider a short trade on EUR/USD

- If market reaction favors a long dollar trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: Job Growth Falls Short of Market Forecast- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- Downside targets remain favored as RSI pushes deeper into oversold territory.

- Interim Resistance: 1.3350 (61.8% expansion) to 1.3370 (50.0% retracement)

- Interim Support: 1.2870 (50.0% expansion) to 1.2900 (1.618% expansion)

Impact that the U.S. Non-Farm Payrolls report has had on EUR/USD during the previous month(1 Hour post event )

(End of Day post event)

EURUSD M5 : 44 pips price movement by USD - Non-Farm Payrolls news event:

AUDUSD M5 : 46 pips price movement by USD - Non-Farm Payrolls news event:

The U.S. economy added 209K jobs in July, following a revised 298K increase the month prior. The print was below the average estimate of 230K. The jobless rate unexpectedly rose to 6.2% from 6.1% in June as discouraged workers returned to the labor force. Nevertheless, the greenback lost ground following the below-forecast print, with the EUR/USD rallying to a high of 1.3443 going into the European close.

MetaTrader Trading Platform Screenshots

AUDUSD, M5, 2014.09.05

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 36 pips price movement by USD - Non-Farm Employment Change news event