Crude oil shows a tight correlation with many currency pairs for three reasons. First, the contract is quoted in U.S. dollars so price changes have an immediate impact on related forex currency crosses. Second, high dependence on crude oil exports levers national economies to uptrends and downtrends in the energy markets. And third, collapsing crude oil prices will trigger sympathetic declines in industrial commodities, raising the threat of worldwide deflation, forcing currency pairs to reprice relationships.

- effects of OPEC decision on CAD

- ISAKAS ashi by Kuskus_Osentogg

- Forecast and levels for Oil

Correlation

The beginning

- Correlation indicators: very good thread with some systems, explanations and good usefull indicators.

- Chart Transposition Indicator: original thread.

- FINEXX Correlation System and EA - the thread

- Currency corelation - the thread.

- trend corelation - discussion thread.

- Correlation Index - small thread with indicator

- complimentary pairs thread

- Cross-Currency Strength: good thread with indicators.

- Pearson correlation thread

- Correlations revisited ... - the thread with interpretations and detailed explanation of 3 prevailing correlations methods with all the particularities and images: Pearson (linear) correlation, Kendall's tau and Spearman's rank correlation

- Cluster Indicators thread.

- Correlation candles indicator (MT5) - the post. Two possible types of correlation used: Pearson correlation and Spearman correlation

- Rank correlations (Pearson and Spearman) indicator (MT5) - the post with original version, the post with fixed version. This indicator is using Pearson correlation and Spearman correlation, besides, it has an option to use some of the 22 price types as well as using floating levels

After

- Correlation system thread

- Currency Correlations, Part I - the video

- Currency Correlations, Part II - the video

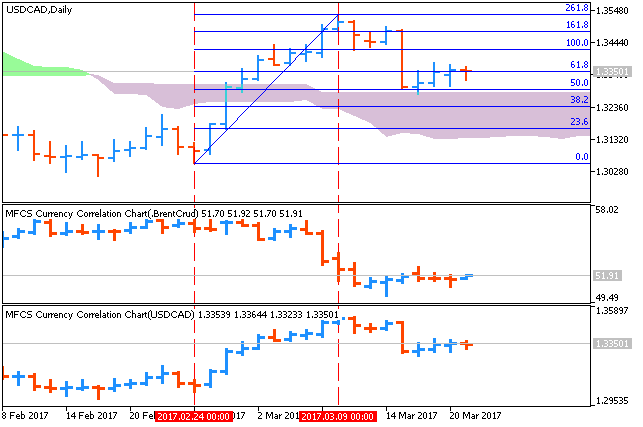

- MFCS Currency Correlation Chart - MT5 CodeBase indicator

- MT5 CodeBase on HowTo - post with the articles

- Multi currency EA ideas - the thread

- Forex Correlation Theory thread

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.03.21 08:33

Crude Oil and the correlation in trading: Crude Oil and the Canadian Dollar (based on the article)

Daily USD/CAD priceis on secondary correction within the primary bullish market condition: the price is testing 50% Fibo level at 1.3291 to below for the reversal of the price movement from the correctional bullish to the ranging bearish market condition.

- "That there is a correlation between the prices of the Canadian dollar and crude oil. Using the same weekly historical data discussed previously, there is a correlation coefficient between the two of 0.34. This is a reasonably high level of correlation considering the high time frame used in the calculation (weekly) and the 13-year back test period. That means that the prices tend to move the same way, which is not surprising, as Canada is a major oil producer (ranked 5th in the world) and exporter (ranked 4th in the world). There are only two countries with larger known oil reserves than Canada. These facts make the “Loonie” (as the Canadian dollar is widely known) a major “petro-currency” whose relatively value is highly dependent upon the price of oil."

- "The relatively high correlation offers more opportunity than substitution: it can also be a basis for trading strategies. If we assume that the correlation is due to the price of crude oil acting as a kind of leading indicator of the future price of the Canadian dollar, then we could wait for oil to get significantly ahead or behind and be ready to trade the Canadian dollar in the same direction."

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register