Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.15 12:46

Forex Weekly Outlook March 17-21The yen is the winner of a turbulent trading week which saw new highs for the euro and the kiwi. The first rate decision by Janet Yellen is the main event. Among other highlights are the German Economic Sentiment, speeches by heads of central banks, UK employment data, as well as US employment and housing data. These are the main market movers on Forex calendar. Here is an outlook on the influential events for the coming week.

- German ZEW Economic Sentiment: Tuesday, 10:00. German economic climate dropped more than expected in February, reaching 55.7 from 61.7 in the previous month, thanks to emerging market concerns. This release marked the second consecutive fall; economists expected a small decline to 61.3. Nevertheless, analysts expect Germany to continue its growth trend this year leading its Eurozone members to recovery. German economic climate is forecasted to decline further to 52.3.

- US Building Permits: Tuesday, 12:30. Building permits plunged in January to 937,000, falling 5.4% from December. The release was considerably weaker than the 980,000 expected by analysts. The unusually cold weather and snow storms stopped growth in the housing sector. On an annual basis, starts fell 2.0% from January 2013, to 898,000, the lowest level since August 2011, while building permits, were up 2.4% from a year ago. A stronger reading of 970,000 is expected this time.

- US inflation data: Tuesday, 12:30. U.S. consumer prices increased in January, thanks to a rise in demand for electricity and heating fuel, caused by the cold winter. Consumer Price Index climbed 0.1%, following a 0.3% in December. In the 12 months to January, consumer prices edged up 1.6% after increasing 1.5% in December. Meanwhile, core CPI, excluding volatile energy and food components, also rose 0.1% for a second consecutive month. In the 12 months to January, core CPI rose 1.6%, following a 1.7% increase in December. Both CPI and core CPI are expected to gain 0.1%.

- UK employment data: Wednesday, 9:30. The British unemployment rate unexpectedly climbed in the fourth quarter, reaching 7.2% from 7.1% in the third quarter a fact that compelled the BOE to keep interest rates unchanged. Meantime, jobless claims fell 27,600 in January, beating economists forecast of 18,300. However the pace of decline will moderate in the coming months due to a certain decline in economic activity. For as long as unemployment remains above the 7% threshold, monetary policy will not be changed. Jobless claims are expected to decline by 23,300 while unemployment rate is expected to remain unchanged at 7.2%.

- Fed decision: Wednesday, 18:00, press conference at 18:30. The taper train is on track and the Fed is very likely to reduce its bond buys by another $10 billion. After the Fed prepared markets for the tapering during a long period of time, only a major disaster could change the course. The recent OK NFP left little doubts. In addition, the composition of the FOMC is more hawkish, and Yellen would need to prove she is tough enough. It is her first decision and being a woman probably also plays a role. In the press conference, she is expected to show continuity, following in the footsteps of Bernanke, and in line with her recent lengthy testimonies in Washington. The move is largely priced in, and a strengthening of the dollar in the aftermath of the decision could be quite limited.

- NZ GDP: Wednesday, 12:45. New Zealand economy expanded more than expected in the third quarter, rising 1.4% following a revised 0.3% increase in the preceding quarter. The main contributors were agriculture and the dairy sector. The strong growth and rising inflation prompted the RBNZ to raise rates in March to 2.75% making New Zealand the first major developed economy to tighten in the current cycle. New Zealand economy is expected to expand by 1.0% this time,1%

- Haruhiko Kuroda speaks: Thursday, 7:15. BOE Governor Haruhiko Kuroda will speak in Tokyo. Kuroda said in a news conference in March that he rules out the need for further easing measures at this point, unless economic conditions worsen. Market volatility is expected. Analysis: Temporary Insanity and USDJPY

- US Unemployment Claims: Thursday, 12:30. The number of new claims for unemployment benefits unexpectedly dropped 9,000 last week to a seasonally adjusted 315,000.This was the best reading since November. Economists expected a rise in claims to a level of 334,000. The four-week average fell 6,250 to 330,500, the lowest since early December. Improved weather conditions have contributed to the improvement in the job data. The number of people still receiving benefits after an initial week of aid fell 48,000 to 2.86 million in the week ended March 1. That was the lowest level since December. A small rise to 327,000 is forecasted.

- US Existing Home Sales: Thursday, 14:00. U.S. existing home sales dropped more than expected in January, reaching an 18 month-low of 4.62 million unit’s annual rate following 4.87 million in the previous month. The cold weather and house shortage were behind this decline. Economists projected a higher figure of 4.73 million. A rise to 4.65 million is predicted now.

- US Philly Fed Manufacturing Index: Thursday, 14:00. Factory activity in the U.S. mid-Atlantic region contracted in February reaching -6.3 after posting 9.4 in January, amid a fall in new orders. Analysts expected a high reading of 9.2. New orders plunged to -5.2 from 5.1 increase and the employment component contracted to 4.8 from 10.0. However, economists believe manufacturing will pick-up in the coming months. Factory activity is expected to increase to 4.2.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.16 12:51

Forex Fundamentals - Weekly outlook: March 17 - 21The yen rose against the dollar and the euro on Friday as safe haven demand was bolstered by fears over an economic slowdown in China and tensions over the crisis in Ukraine, ahead of a referendum in Crimea.

Monday, March 17

- The euro zone is to release data on consumer price inflation, which accounts for the majority of overall inflation.

- Canada is to produce data on foreign investments.

- The U.S. is to publish data on manufacturing activity in the Empire State, as well as reports on industrial production and long term securities transactions.

- The Reserve Bank of Australia is to publish the minutes of its latest policy meeting, which contain valuable insights into economic conditions from the bank’s perspective.

- The ZEW Institute is to release its closely watched report on German economic sentiment, a leading indicator of economic health.

- Canada is to publish data on manufacturing sales. Later Tuesday, Bank of Canada Governor Steven Poloz is to speak, his comments will be closely watched.

- The U.S. is to produce data on consumer inflation, in addition to reports on building permits and housing starts.

- Bank of England Governor Mark Carney is to speak at an event in London.

- Japan is to publish data on the trade balance, the difference in value between imports and exports. Meanwhile, Bank of Japan Governor Haruhiko Kuroda is to speak at an event in Tokyo.

- The U.K. is to release official data on the change in the number of people unemployed and the unemployment rate, as well as data on average earnings and public sector borrowing. Meanwhile, the Bank of England is to publish the minutes of its most recent policy setting meeting.

- The ZEW Institute is to publish a report on economic expectations in Switzerland, a leading indicator of economic health.

- Canada is to release data on wholesale sales.

- The Federal Reserve is to announce its federal funds rate and publish economic forecasts for inflation and growth. The Fed statement is to be followed by a press conference with Chair Janet Yellen.

- Later Wednesday, New Zealand is to publish data on fourth quarter gross domestic product, the broadest indicator of economic activity and the leading indicator of economic growth.

- Germany is to release data on producer price inflation.

- BoJ Governor Haruhiko Kuroda is to speak at an event in Tokyo.

- The Swiss National Bank is to announce its libor rate. The bank is also to publish its quarterly monetary policy assessment.

- Political leaders and finance ministers from the EU are to hold the first day of an economic summit in Brussels.

- The U.K. is to release private sector data on industrial order expectations. The U.K. government is to make its annual budget statement.

- The U.S. is to publish the weekly report on initial jobless claims, as well as data on existing home sales and manufacturing activity in the Philadelphia region.

- Markets in Japan are to remain closed for a national holiday.

- The euro zone is to release data on the current account.

- Meanwhile, political leaders and finance ministers from the European Union are to hold the second day of an economic summit in Brussels.

- The U.K. is to produce data on public sector net borrowing.

- Canada is to produce official data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity, as well as data on consumer inflation.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.16 14:07

USD/CAD Fundamentals - weekly outlook: March 17 - 21The U.S. dollar moved higher against the Canadian dollar on Friday as investors shied away from risk sensitive currencies amid ongoing concerns over the crisis in Ukraine and slowing growth in China.

Monday, March 17

- Canada is to produce data on foreign investments.

- The U.S. is to publish data on manufacturing activity in the Empire State, as well as reports on industrial production and long term securities transactions.

- Canada is to publish data on manufacturing sales. Later Tuesday, BoC Governor Steven Poloz is to speak, his comments will be closely watched.

- The U.S. is to produce data on consumer inflation, in addition to reports on building permits and housing starts.

- Canada is to release data on wholesale sales.

- The Federal Reserve is to announce its federal funds rate and publish economic forecasts for inflation and growth. The Fed statement is to be followed by a press conference with Chair Janet Yellen.

- The U.S. is to publish the weekly report on initial jobless claims, as well as data on existing home sales and manufacturing activity in the Philadelphia region.

- Canada is to round up the week with official data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity, as well as data on consumer inflation.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.17 17:19

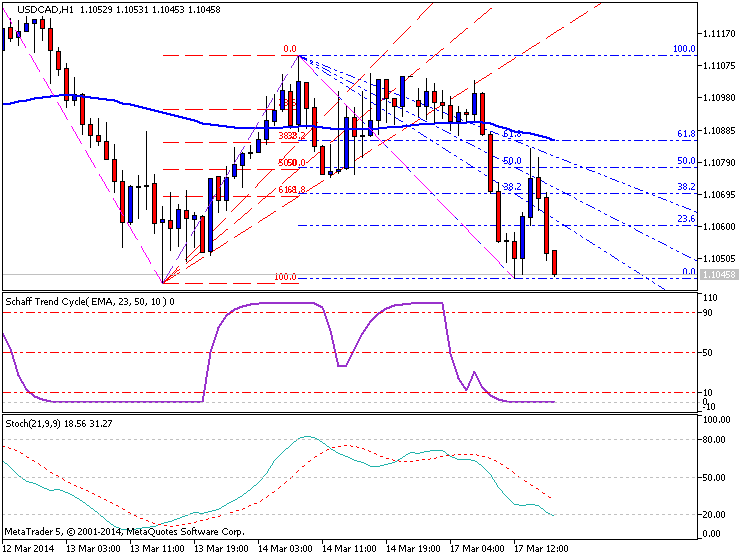

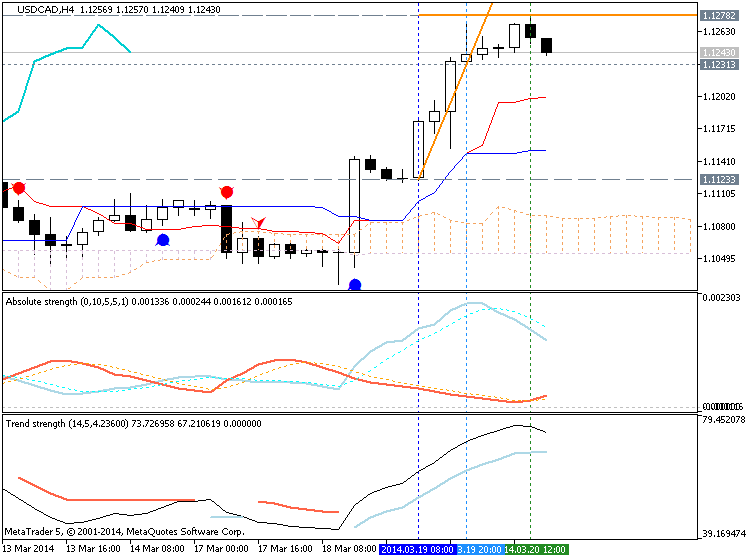

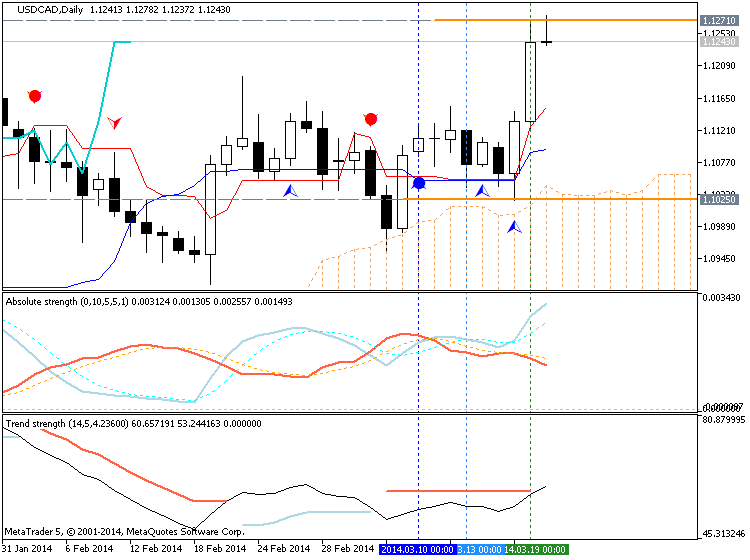

USDCAD Technical Analysis March 17 2014 (based on investing article)

The U.S. dollar was lower against its Canadian counterpart on Monday, as

disappointing U.S. manufacturing activity data weighed on the

greenback, although a downbeat economic report from Canada limited the

loonie's gains.

USD/CAD hit 1.1045 during European afternoon trade, the pair's lowest since March 13; the pair subsequently consolidated at 1.1070, shedding 0.32%.

The pair was likely to find support at 1.0980, the low of March 7 and resistance at 1.1153, the high of March 12.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.18 14:01

2013-03-18 12:30 GMT (or 13:30 MQ MT5 time) | [CAD - Manufacturing Sales]

- past data is -1.5%

- forecast data is 0.6%

- actual data is 1.5% according to the latest press release

if actual > forecast = good for currency (for CAD in our case)

==========

USD/CAD extends slide after strong manufacturing sales

The Canadian dollar continues recovering, and this time it got a boost from a stronger than expected rise in manufacturing sales for January, despite a downwards revision for December. Sales advanced by 1.5%, better than 0.6% expected. However, this came on top of a bigger drop of 1.5% in December, worse than 0.9% originally reported.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 17 pips price movement by CAD - Manufacturing Sales news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.19 16:58

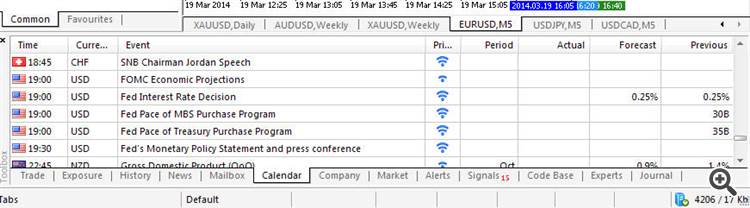

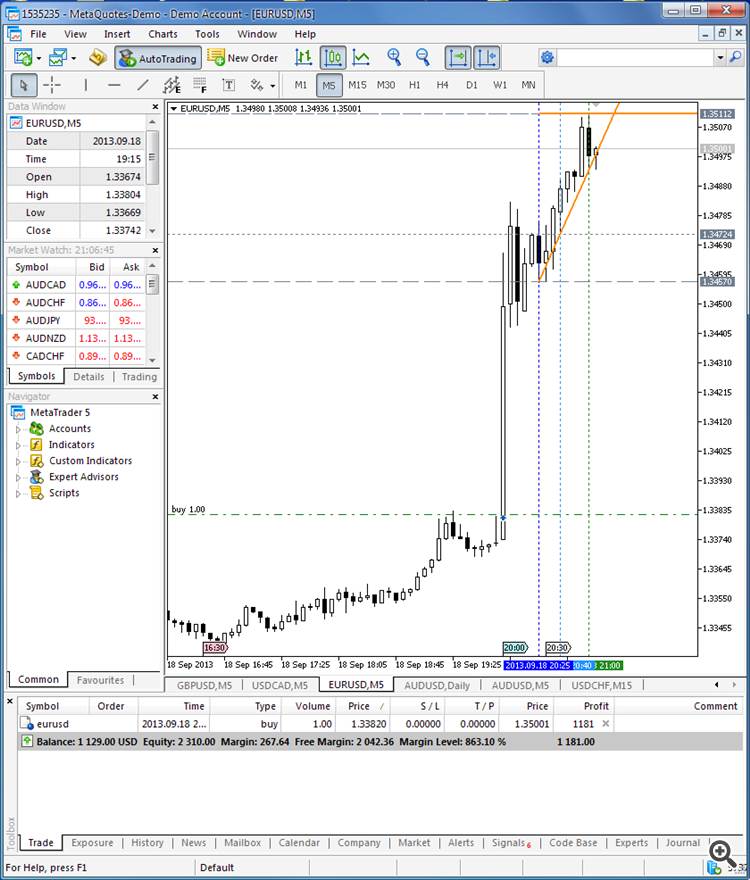

EURUSD Fundamentals 19.03.2014 (based on dailyfx article)

Trading the News: Federal Open Market Committee Meeting

- Federal Open Market Committee (FOMC) to Deliver Another $10B Taper.

- Fed Chair Janet Yellen to Hold Press Conference at 18:30 GMT.

Indeed, the Federal Open Market Committee (FOMC) is

widely anticipated to reduce its asset-purchase by another $10B in

March, but the market reaction may not be as clear cut as the previous

rate decisions as market participants expect a material shift in the

policy outlook.

Why Is This Event Important:

Indeed, a growing number of Fed officials have

highlight a new ‘qualitative’ approach for monetary as the jobless rate

approaches the 6.5% threshold for unemployment, while a dovish twist to

the central bank’s forward guidance may heighten the bearish sentiment

surrounding the greenback as it drags on interest rate expectations.

How To Trade This Event Risk

Bullish USD Trade: FOMC Cuts Another $10B & Sees Greater Scope to Normalize

- Need red, five-minute candle following the release to consider a short EUR/USD trade

- If market reaction favors a long dollar trade, short EUR/USD with two separate position

- Place stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish USD Trade: Fed Implements Dovish Twist to Forward Guidance

- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in opposite direction

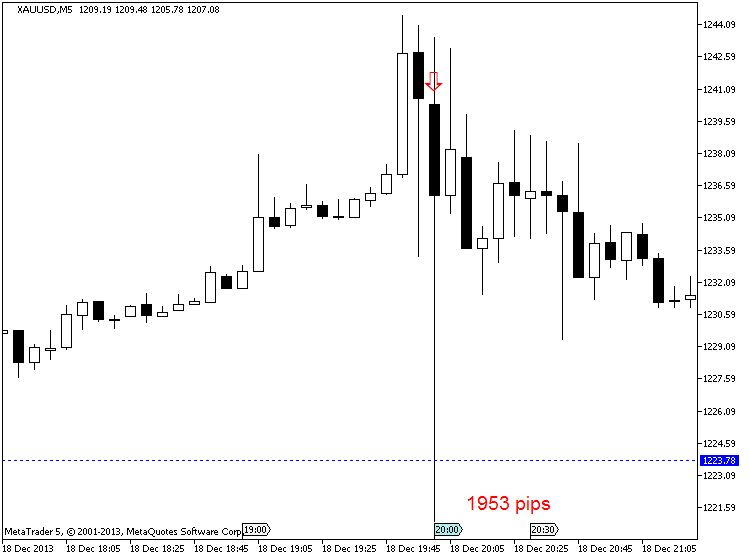

XAUUSD M5 : 1953 pips price movement by USD - Federal Funds Rate news event :

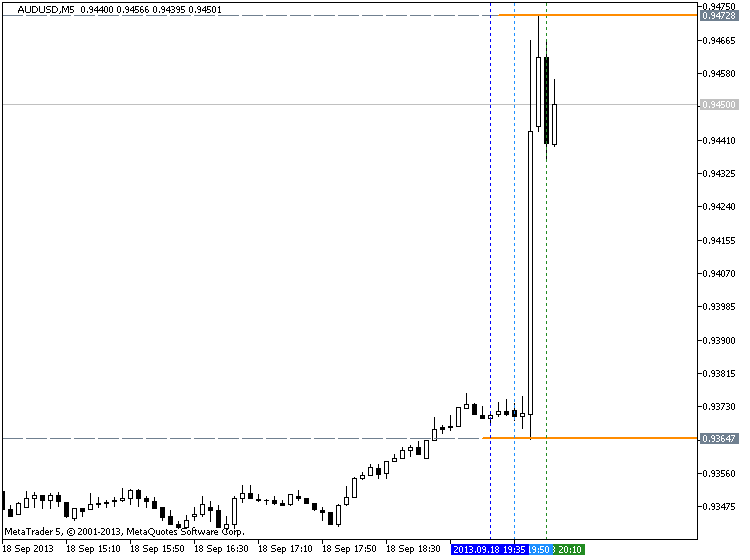

AUDUSD by USD - Federal Funds Rate news event :

EURUSD by USD - Federal Funds Rate news event :

Federal Open Market Committee Meeting :

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.20 15:24

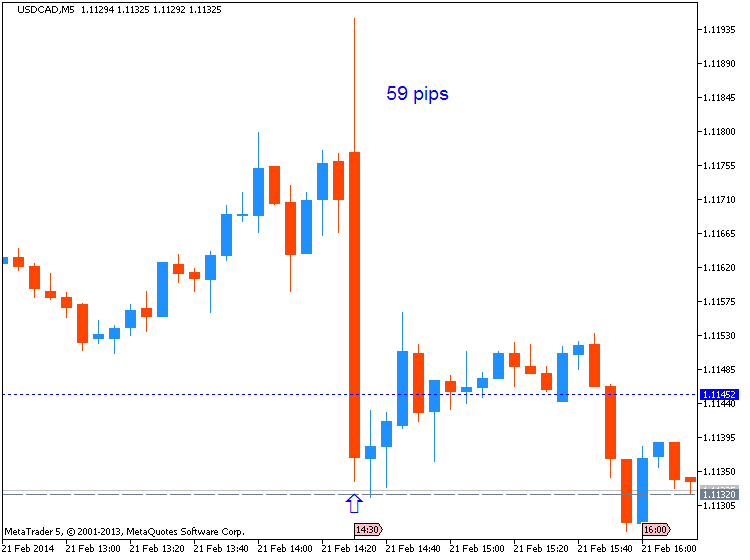

2013-03-20 14:00 GMT (or 15:00 MQ MT5 time) | [USD - Philadelphia Fed Manufacturing Survey]

- past data is -6.3

- forecast data is 4.0

- actual data is 9.0 according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

Philly Fed Index Bounces Back Into Positive Territory In March

Manufacturing activity in the Philadelphia-area rebounded in March, according to the firms responding to the Federal Reserve Bank of Philadelphia's Business Outlook Survey.

The Philly Fed released a report Thursday showing that its diffusion index of current activity jumped to a positive 9.0 in March from a negative 6.3 in February. A positive reading indicates an increase in regional manufacturing activity.

Economists had been expecting the Philly Fed index to show a much more modest rebound to a positive reading of 3.2.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 22 pips price range movement by USD - Philadelphia Fed Manufacturing Survey news event

newdigital:

If D1 price will break 1.1153 resistance on close bar together with Chinkou Span line to be crossed historical price on close bar as well so we may see good breakout (bullish trend to be continuing - good for buy trade).

If not so we will see the ranging market condition within primary bullish on D1.

- Recommendation for short: n/a

- Recommendation to go long: watch the price for breaking 1.1153 resistance on D1 timeframe and 1.1110 resistance on H4 timeframe for possible buy trade

- Trading Summary: possible breakout

UPCOMING EVENTS (high/medium impacted news events which may be affected on USDCAD price movement for this coming week)

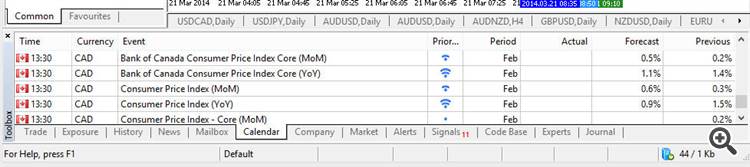

2013-03-21 12:30 GMT (or 13:30 MQ MT5 time) | [CAD - CPI]

2013-03-21 12:30 GMT (or 13:30 MQ MT5 time) | [CAD - Retail Sales]

Updated situation for now.

The price broke 1.1110 resistance on H4 timeframe and 1.1153 on D1 timeframe. Chinkou Span line crossed the price for good breakout.

- If you are trading on H4 timeframe and placed buy stop order at 1.1110 so it should be 133 pips in profit for now with 1.1278 as the first target.

- If you are using D1 timeframe and placed buy stop at 1.1153 so it should be 90 pips in profit for now with 1.1271 as the first target (first level of take profit).

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.21 10:07

Trading the News: Canada Consumer Price Index (based on dailyfx article)

- Canada Consumer Prices to Slow for First Time Since October.

- Core Inflation to Slips to 1.1%- Matching Lowest Reading for 2013.

A marked decline in Canada inflation may prompt a further advance in the

USD/CAD as it raises the Bank of Canada’s (BoC) scope to revert back to

its easing cycle.

What’s Expected:

Why Is This Event Important:

Indeed, BoC Governor Stephen Poloz showed a greater willingness to lower the benchmark interest rate further in an effort to encourage a ‘soft landing’ for the region, and the ongoing threat for disinflation may continue to dampen the outlook for the Canadian dollar as the central bank adopts a more dovish tone for monetary policy.

Nevertheless, higher home prices along with rising input costs may limit

the downside risk for price growth, and a positive development may

generate a near-term rebound in the loonie as it raises the fundamental

outlook for the Canadian economy.

How To Trade This Event Risk

Bearish CAD Trade: Price Growth Slips to 1.0% or Lower

- Need green, five-minute candle after the CPI report to consider long USD/CAD entry

- If the market reaction favors a bearish Canadian dollar trade, establish long with two position

- Set stop at the near-by swing low/reasonable distance from cost; use at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

- Need red, five-minute candle following the release to look at a short USD/CAD trade

- Carry out the same setup as the bearish loonie trade, just in the opposite direction

Potential Price Targets For The Release

- Looking for Higher High Following Breakout of Triangle/Wedge Formation

- Relative Strength Index Retains Bullish Trend Carried Over from 2013

- Interim Resistance: 1.1310 Pivot to 1.1320 (61.8% expansion)

- Interim Support: 1.1050 (50.0% retracement) to 1.1070 (23.6% expansion)

January 2014 Canada Consumer Price Index :

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The price is on ranging market condition within primary bullish on D1 timeframe floating between Sinkou Span A line (the border of Ichimoku cloud/kumo) and 1.1153 resistance level. Chinkou Span line crossed historical price on open bar for possible breakout in the near future.

Chinkou Span line of Ichimoku indicator is very near to be crossed with the price on H4 timeframe with possible breaking 1.1110 resistance for good bullish breakout.

If D1 price will break 1.1153 resistance on close bar together with Chinkou Span line to be crossed historical price on close bar as well so we may see good breakout (bullish trend to be continuing - good for buy trade).

If not so we will see the ranging market condition within primary bullish on D1.

UPCOMING EVENTS (high/medium impacted news events which may be affected on USDCAD price movement for this coming week)

2013-03-17 12:30 GMT (or 13:30 MQ MT5 time) | [CAD - Foreign Securities Purchases]

2013-03-18 12:30 GMT (or 13:30 MQ MT5 time) | [CAD - Manufacturing Sales]

2013-03-18 12:30 GMT (or 13:30 MQ MT5 time) | [USD - Building Permits]

2013-03-18 15:55 GMT (or 16:55 MQ MT5 time) | [CAD - BOC Gov Speech]

2013-03-19 12:30 GMT (or 13:30 MQ MT5 time) | [CAD - Wholesale Sales]

2013-03-19 18:00 GMT (or 19:00 MQ MT5 time) | [USD - Federal Funds Rate]

2013-03-20 14:00 GMT (or 15:00 MQ MT5 time) | [USD - Philadelphia Fed Manufacturing Survey]

2013-03-21 12:30 GMT (or 13:30 MQ MT5 time) | [CAD - CPI]

2013-03-21 12:30 GMT (or 13:30 MQ MT5 time) | [CAD - Retail Sales]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on USDCAD price movement

SUMMARY : bullish

TREND : breakout

Intraday Chart