Hi there,

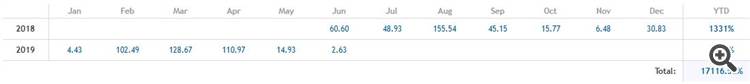

I would appreciate if anybody can explain the mechanism of the attached Growth rate.

How is it derived and calculated?

Is the attached 17116% growth rate is accurate?

Thank you

I would be very suspicious of any figures when there are are many unnecessary deposits and withdrawals. It suggests that the growth rate is manipulated.

I would be very suspicious of any figures when there are are many unnecessary deposits and withdrawals. It suggests that the growth rate is manipulated.

This is the total YTD growth were the sums are a mess.

for 2018 the YTD growth is 1331%, after manually adding the monthly growth I get 363.3%

for 2019 the YTD growth is 1103%, after manually adding the monthly growth I get 364.12%

further more, the total is shown as 17116.52%, if we add the MQL5 YTD for 2018+2019 it should be 2434%.

A big question mark goes to the MQL5 community's way of calculating.

This is a very miss leading data and an action needs to be taken to protect the member.

See the attached

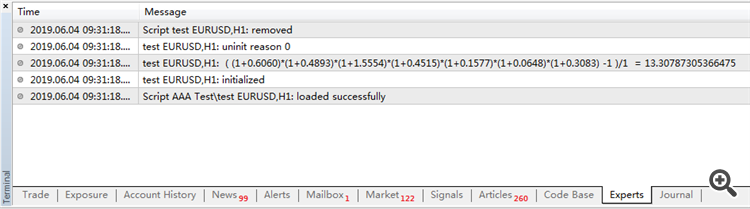

To calcualte the growth rate is just a question in middle school.

Suppose the initial number is 1.

After Jun, the sum = 1+1*0.6060 = 1*(1+0.6060)

After Jul,the sum = (1+0.6060)*(1+0.4893)

After Aug,the sum = (1+0.6060)*(1+0.4893)*(1+1.5554)

......

After Dec,the sum = (1+0.6060)*(1+0.4893)*(1+1.5554)*(1+0.4515)*(1+0.1577)*(1+0.0648)*(1+0.3083)

The YTD of 2018 = ( (1+0.6060)*(1+0.4893)*(1+1.5554)*(1+0.4515)*(1+0.1577)*(1+0.0648)*(1+0.3083) -1 )/1 = 13 .31

Yes, growth rate is calculated on an accumulative basis.

Problem with that...

start with $100 and increase by 50% in 1 month

balance=$150, profit $50

withdraw the $50 profit so that the balance is $100 again

increase by 50% in the next month

balance=$150, profit $50

So total profit for 2 months is $100. That's a 100% increase on the original balance.

Growth, however will be calculated to 125%

start with $100 and increase by 1000% in 1 month

balance=$200, profit $100

withdraw the $100 profit so that the balance is $100 again

increase by 100% in the next month

balance=$200, profit $100

So total profit for 2 months is $200. That's a 200% increase on the original balance.

Growth, however will be calculated to 300%

If you again withdraw the profit and make 100% the next month

total profit will be $300, a 300% increase on the original balance.

Growth, however will be calculated to 700%

The calculated growth does not reflect the actual performance.

The other trick that some signal providers will use.

Start with $100 and open a trade using maximum leverage.

As the trade goes into loss, deposit funds to avoid a margin call

maybe deposit an additional $100

maybe deposit a further $100 to support the trade

maybe deposit another $100 as loss increases

Then, if fortune smiles, trade bounces back and makes $100 profit

Now this trade has needed a total of $400 to support it, yet all that will be taken into account is the balance when it opened. So growth for that trade will be 100%.

That is so wrong!

The calculated growth does not reflect the actual performance.

--- I agree with you.

The other trick that some signal providers will use.

Start with $100 and open a trade using maximum leverage.

As the trade goes into loss, deposit funds to avoid a margin call

maybe deposit an additional $100

maybe deposit a further $100 to support the trade

maybe deposit another $100 as loss increases

Then, if fortune smiles, trade bounces back and makes $100 profit

Now this trade has needed a total of $400 to support it, yet all that will be taken into account is the balance when it opened. So growth for that trade will be 100%.

That is so wrong!

To calcualte the growth rate is just a question in middle school.

Suppose the initial number is 1.

After Jun, the sum = 1+1*0.6060 = 1*(1+0.6060)

After Jul,the sum = (1+0.6060)*(1+0.4893)

After Aug,the sum = (1+0.6060)*(1+0.4893)*(1+1.5554)

......

After Dec,the sum = (1+0.6060)*(1+0.4893)*(1+1.5554)*(1+0.4515)*(1+0.1577)*(1+0.0648)*(1+0.3083)

The YTD of 2018 = ( (1+0.6060)*(1+0.4893)*(1+1.5554)*(1+0.4515)*(1+0.1577)*(1+0.0648)*(1+0.3083) -1 )/1 = 13 .31

Keith Watford:

...

Now this trade has needed a total of $400 to support it, yet all that will be taken into account is the balance when it opened. So growth for that trade will be 100%.

That is so wrong!

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hi there,

I would appreciate if anybody can explain the mechanism of the attached Growth rate.

How is it derived and calculated?

Is the attached 17116% growth rate is accurate?

Thank you