Thanks to the author for the interesting article - a good example of traditional TA application.

For practical application, it is necessary to take into account that the figures of traditional thechanalysis are not reliable (unambiguous) patterns,

and additional confirmation of the current price dynamics (both direction and amplitude) is required.

As for the "Head - Shoulders" pattern, its main value is not in determining the direction (it is not a sufficient sign),

but in the formation of a group of fractal (close) resistance levels (which only reduces the probability of breaking these levels in the previous direction).

As for the amplitude of the active price movement, the market itself determines the amplitude, so linking the size of the planned profit to the size of the figure is very risky.

with the size of the figure is very risky.

Thanks again to the author for his work!

Hi.

I´m a newcomer and got the following errors when compiling the code.

ZigZag.mqh provide the errors

'Create' - unexpected token, probably type is missing? ZigZag.mqh 72 10

'Create' - function already defined and has different type ZigZag.mqh 72 10

'Calculate' - unexpected token, probably type is missing? ZigZag.mqh 89 10

'Calculate' - function already defined and has different type ZigZag.mqh 89 10

'AddExtremum' - unexpected token, probably type is missing? ZigZag.mqh 280 10

'AddExtremum' - function already defined and has different type ZigZag.mqh 280 10

Is there anyone with the same error?

Txs.

I have tried EA but 9 errors inmt5 script,

the same in Top bottom EA

Hi Dmitriy,

Very enlightening and challenging article here. I loved the article and your codes but it seems due to mql5 updating.,..there is an error that keeps coming up with the class LimitTakeProfit,...

it says parameters passed as reference,..variable expected on these lines;

Can you help to figure how to resolve this,..

i have gone through the mql5 documentation and i have idea what it means ,..but still cant figure it out.

Thanks.

i solved this already,...i discovered this was probably a deprecated method in mt5

Hi.

I´m a newcomer and got the following errors when compiling the code.

ZigZag.mqh provide the errors

'Create' - unexpected token, probably type is missing? ZigZag.mqh 72 10

'Create' - function already defined and has different type ZigZag.mqh 72 10

'Calculate' - unexpected token, probably type is missing? ZigZag.mqh 89 10

'Calculate' - function already defined and has different type ZigZag.mqh 89 10

'AddExtremum' - unexpected token, probably type is missing? ZigZag.mqh 280 10

'AddExtremum' - function already defined and has different type ZigZag.mqh 280 10

Is there anyone with the same error?

Txs.

Add void just before the function definitions of Create,Calculate and AddExtremum. Cheers

Add void just before the function definitions of Create,Calculate and AddExtremum. Cheers

Dmitriy,

this seems to have a very promising results,

any way to maybe expand on this with your RL librarys and method?

thanks

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

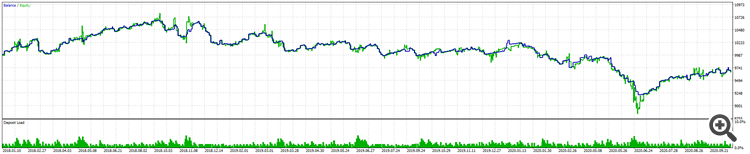

New article Reversal patterns: Testing the Head and Shoulders pattern has been published:

This article is a follow-up to the previous one called "Reversal patterns: Testing the Double top/bottom pattern". Now we will have a look at another well-known reversal pattern called Head and Shoulders, compare the trading efficiency of the two patterns and make an attempt to combine them into a single trading system.

Head and Shoulders and Inverted Head and Shoulders patterns are among the most well-known and widely used graphical patterns. The name of the pattern clearly describes its graphical structure. The Head and Shoulders pattern is formed at the end of the bullish trend and provides sell signals. The pattern itself consists of three consecutive price chart tops. The middle top rises above the two adjacent ones, like a head above the shoulders. The middle top is called the Head, while the adjacent ones are called the Shoulders. The line connecting the bottoms between the pattern tops is called the neckline. The signals of the pattern having its neckline inclined to the left are considered to be stronger. The Inverted Head and Shoulders pattern is a mirrored version of Head and Shoulders indicating a bullish movement.

Most often, the pattern is formed in case of a false breakthrough of the price support/resistance level. Trend-following traders perceive a small correction (left shoulder top) as a good opportunity to increase their position. As a result, the price returns to the current trend and breaks the left shoulder level. After breaking through the current support/resistance level, the weakened trend is stopped by counter-trend traders increasing their positions, which leads to a new correction. A trend reversal is formed and the price falls below the level again (the head is formed). Another attempt to resume the trend demonstrates its weakness, a small movement is formed (the right shoulder). At this point, market participants notice a trend reversal. Trend-following traders exit the market en masse, while counter-trend ones increase their positions. This leads to a powerful movement and the formation of a new trend.

Author: Dmitriy Gizlyk