Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.21 18:42

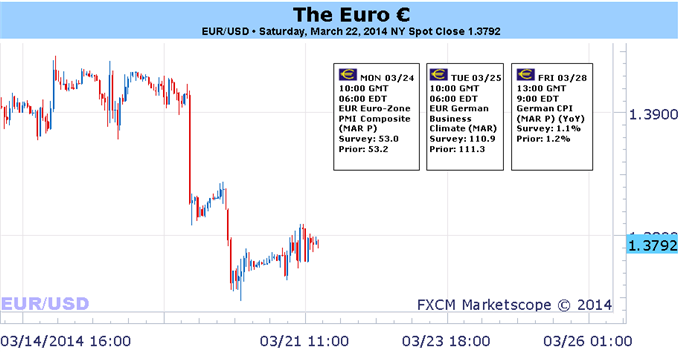

Forex Weekly Outlook Mar. 24-28The US dollar had a successful week, rising against most currencies thanks to a hawkish move from the Federal Reserve. German Ifo Business Climate, Inflation data in the UK, US consumer sentiment and housing data as well as jobless claims are the highlight events . Here is an outlook on the main market-movers this week.

- German Ifo Business Climate: Tuesday, 9:00. German business sentiment edged up in February to 111.3 from 110.6 in January. The release was better than the 110.7 predicted by analysts. The rise suggests that economic recovery is continuing to improve despite some weak figures in exports and industrial output. The survey shows retailers are more satisfied with current economic conditions and consumer spending is rising. A small decline to 110.9 is predicted this time.

- UK inflation data: Tuesday, 9:30. Inflation in the UK fell in January to 1.9% from 2.0% in the previous month due to lower tobacco prices. The rate declined below the Bank of England's 2% target for the first time in more than four years. In the first half of 2013 inflation nearly reached 3.0% but descended in the second half of the year. Prime minister David Cameron commented that this fall in inflation is further evidence that UK’s economic plan is working. Low inflation enables future planning without surprises. Another decline to 1.7% is anticipated now.

- US CB Consumer Confidence: Tuesday, 14:00. Americans were more pessimistic about the US economy in February according to the Conference Board survey. Consumer confidence declined to 78.1 from 79.4 in January, contrary to predictions for 80.2 points. The Expectations Index, fell to 75.7 points in February from 80.8 January's 80.8. Responders were concerned over the short-term outlook for business conditions, jobs, and earnings. Meanwhile, current conditions assessment has improved. Consumer confidence is expected to improve to 78.7.

- US New Home Sales: Tuesday, 14:00. New U.S. home acquisitions edged up to a 468,000 annualized pace in January, exceeding forecasts of a 406,000 reading. This five year high release was preceded by 427,000 in December, indicating the housing sector remains strong despite recent falls, even in the midst of unusually cold weather. If the job market continues to improve, the housing sector would return to solid growth. Home sales are expected to reach 447K this time.

- US Durable Goods Orders: Wednesday, 12:30. Orders for long-lasting U.S. goods excluding transportation unexpectedly climbed 1.1% in January following a 1.9% plunge in December, suggesting factory activity may yet improve despite recent falls. However, durable goods fell 1.0% in January after posting a 4.3% fall in the previous month. Nevertheless, the harsh weather conditions had a big role in the recent industrial decline. The manufacturing sector is expected to do better in the coming months. A small rise of 0.3% is anticipated this time.

- US Unemployment Claims: Thursday, 12:30. US jobless claims rose less than expected last week, increasing 5,000 to 320,000 Analysts expected claims to reach 327,000. The four-week moving average declined by 3,500 to 327,000. Continuing claims increased to 2,889,000, compared to a downwardly revised 2,848,000 recorded a week earlier. The better than expected release suggests the weak Non-farm payrolls release was a onetime event affected by the cold weather. Jobless claims are expected to reach 326,000.

- US Pending Home Sales: Thursday, 14:00. Contracts to buy existing U.S. homes edged up 0.1% in January after a 5.8 drop caused by unusual winter storms, harsh weather and limited inventory. This small scale rise was less than the 2.9 climb anticipated by analysts. Nevertheless, conditions are expected to improve in the coming months despite tight credit conditions. A further rose of 0.2% is expected now.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.23 07:34

EURUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Euro: Neutral

-

The Euro has had a rocky few days after ECB President Draghi warned on Euro strength.

- The midweek EURUSD triangle was resolved after the FOMC rate decision.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.24 07:22

2013-03-24 01:45 GMT (or 02:45 MQ MT5 time) | [CNY - Flash Manufacturing PMI]

- past data is 48.5

- forecast data is 48.7

- actual data is 48.1 according to the latest press release

if actual > forecast = good for currency (for CNY in our case)

==========

China Manufacturing PMI Hits Eight-Month Low - HSBC

China's manufacturing sector fell deeper into contraction in March, the latest flash PMI from HSBC and Markit Economics revealed on Monday. The index came in with a seasonally adjusted score of 48.1, touching an eight-month low.

The headline figure is down from 48.5 in February, and it was well shy of forecasts for 48.7 - and it moves the index further below the mark of 50 that separates expansion from contraction.

Among the key components of the survey, the output index sank to 47.3 from 48.8 in the previous month - hitting an 18-month low.

Among other components, new orders, work backlogs, output prices, input prices and quantity of purchases all continued to contract at an accelerating rate.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 7 pips price movement by CNY - Flash Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.24 09:28

2013-03-24 08:00 GMT (or 09:00 MQ MT5 time) | [EUR - French Manufacturing PMI]- past data is 49.7

- forecast data is 49.8

- actual data is 51.9 according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

==========

French Private Sector Expands For First Time In 5 MonthsThe French private sector returned to growth in March for the first time since last October, flash survey data from Markit Economics showed Monday.

The flash composite output index rose to 51.6 from 47.9 in February. A score above 50 indicates expansion and the latest reading signals the fastest growth in 31 months.

Expansion was broad-based across the service and manufacturing sectors. The services activity index climbed to 51.4, a 26-month high, from 47.2 in February. The reading was expected to rise to 47.8. Similarly, the manufacturing PMI improved more than expected to 51.9, a 33-month high, from 49.7 in the prior month. The score was forecast to rise to 49.8.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 27 pips price movement by EUR - French Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.24 10:04

2013-03-24 08:30 GMT (or 09:30 MQ MT5 time) | [EUR - German Manufacturing PMI]- past data is 54.8

- forecast data is 54.6

- actual data is 53.8 according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

==========

Expansion In German Private Sector Slows In March

Germany's private sector growth slowed in March from a 33-month high but the pace of expansion remained marked, preliminary survey data from Markit Economics showed Monday.

The flash composite output index dropped to 55.0 from February's 33-month high of 56.4. Nonetheless, a reading above 50 indicates expansion.

The easing in the rate of activity growth was broad-based, with both manufacturers and service providers indicating weaker expansions than seen in February.

The flash services activity index slipped more-than-expected to 54.0 from 55.9 in February. The score was forecast to fall to 55.5.

Likewise, the flash manufacturing PMI came in at 53.8, down from 54.8 in February and below the expected reading of 54.5.

"Although the rate of expansion in activity eased to a three-month low, growth in the three months to March was the joint-strongest since mid-2011," Oliver Kolodseike, economist at Markit said.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 27 pips price movement by EUR - German Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.24 19:52

Fundamental indicators explained (based on dailyfx article)

United Kingdom Consumer Price Index (YoY) (FEB)Inflation figures out of the U.K. remain key for price action in GBP crosses moving forward as the Bank of England continues to remain quiet as prices rise towards the 2.5% YoY level floated by Carney as possible ‘threshold’ for any rate increases. The savvy leader of the BoE (and former head of the Bank of Canada) has likely remained silent as to not further fuel speculations of rate increases sooner rather than later. Any further official speculation would add even more fundamental fuel to the GBP’s rise. Higher inflation figures reported on Tuesday would likely support the Sterling while those that meet or beat expectations may leave GBP crosses relatively unchanged as we have seen before.

JPY National Consumer Price Index (YoY) (FEB)Japanese data and even developments out of the Bank of Japan have failed to move Yen crosses over the last few weeks as some of the equity/yen correlations have broken down. Nevertheless, inflation data out of Japan gives key insight into whether the BoJ is on target with its goal of achieving 2% CPI by expanding its monetary base dramatically. If inflation expectations miss expectations, we will have to see comments from the BoJ eventually, even as the central bank remains relatively silent as the fiscal house attempts to get the sales tax and corporate tax changes in order. A failure to do so could lead to instability in Japanese confidence, but of course price action as of late continues to remain market sentiment in equity and bond markets.

EUR German Consumer Price Index (YoY) (MAR P)These preliminary figures for German inflation data will be closely watched by market participants, especially in the context of EUR/USD just below 1.40 and as Draghi of the European Central Bank remains almost overconfident in his assessments of EU prospects. If we see a miss here, it will add to fundamental pressure on the Euro and pressure as well on the ECB to eventually take some sort of action. On the other hand, if we do see developments out of Russia that include any hint of natural gas supply disruptions, disinflation worries would likely be something of the past as higher prices would help boost CPI levels. Nevertheless, this is the sort of inflation not welcomed by consumers or the ECB. Although equity markets continue to brush off worries of geopolitical tensions, those trading Euro and Yen crosses should not be complacent, especially as forex markets have proved to respond most logically to macro developments.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.25 07:03

Fundamental indicators explained (based on dailyfx article)

- News events can help us decipher an economy’s strength

- GDP, CPI and Employment figures can change the demand of a currency

- Fundamental traders look to pair currencies from a strong economy to a weaker one

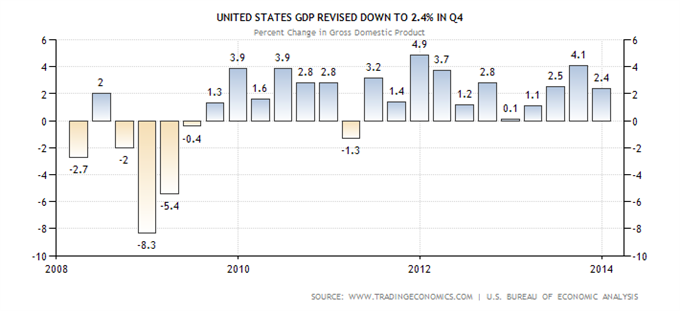

GDP

First we have the Gross Domestic Product (GDP). The GDP growth rate looks specifically at changes in growth patterns of an economy by tabulating household consumption, government spending, domestic investment’s, and net exports for a country. As growth increases it means an economy is expanding and can cause a high demand for a nation’s currency as that currency is needed to make new purchases. As well, a contraction or slowdown in growth can have the opposite effect.

Ultimately this growth (or lack of it) causes inflationary pressures in the market place. With central banks looking to potentially change monetary policy due to these results GDP announcements can become volatile events.

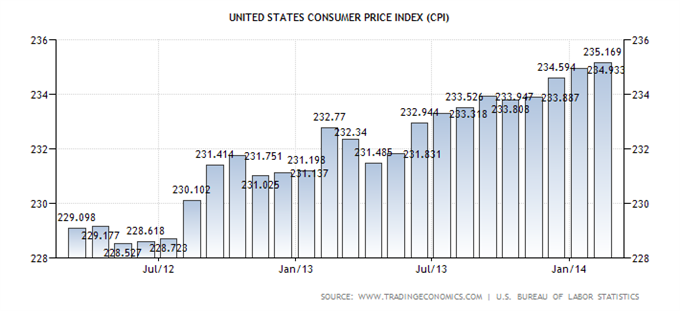

CPI

Next, we will look at the Consumer Price Index (CPI). CPI is another

economic indicator that is released on a monthly basis by most major

economies. It is designed to give a timely glimpse into current

inflation levels in an economy. Inflation tracked through CPI looks

specifically at purchasing power and the rise of prices of goods and

services. If prices are rising drastically this can be signs of growth

as well as rising inflation.

In most scenarios, if CPI is released lower than expected, normally this would influence Reserve Banksto consider stimulating the economy by opting for lower interest rates or commit to new open market operations to increase the money supply. Conversely a higher CPI reading suggests an inflating economy. This would give cause for increasing current interest rates and thus affect demand for a currency.

Employment Figures

Lastly fundamental traders should monitor employment figures to get a

bearing on the strength or weakness of an underlying economy. A booming

economy will offer many employment opportunities and drive down

unemployment figures. As business contracts, the opposite is true. As

unemployment rises, it can have a devastating effect on an underlying

economy.

While there are a variety of employment statistics that can be tracked

one of the most watched is the Non Farm Payroll (NFP) figure released in

the United States. This event shows new jobs added to the workforce

outside of the agricultural sector and shows the strength of the US

economy. As this number is released fundamental traders will watch for

opportunities to buy or sell currencies coupled with the dollar.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.25 10:49

2013-03-25 09:00 GMT (or 10:00 MQ MT5 time) | [EUR - German Ifo Business Climate]- past data is 111.3

- forecast data is 111.0

- actual data is 110.7 according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

==========

German Business Sentiment Falls More Than Forecast

Germany's business confidence declined more than expected in March, reports said citing a monthly survey from Ifo institute on Tuesday.

The business sentiment index dropped to 110.7 from 111.3 in February, when the score was expected to fall to 110.9.

Meanwhile, assessment of current conditions improved to 115.2 from 114.4 in the prior month. Economists had forecast the index to rise marginally to 114.5.

The expectations index fell to 106.4 in March from 108.3 a month ago. The score was seen at 107.7.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 17 pips price movement by EUR - German Ifo Business Climate news event

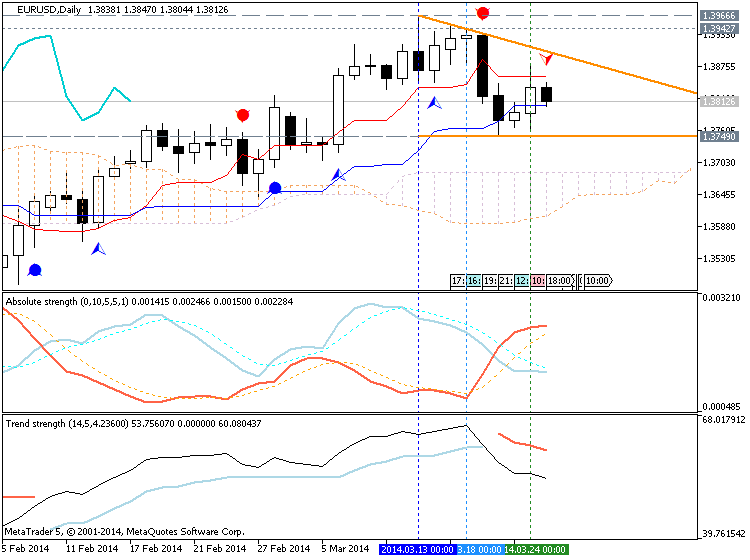

newdigital:

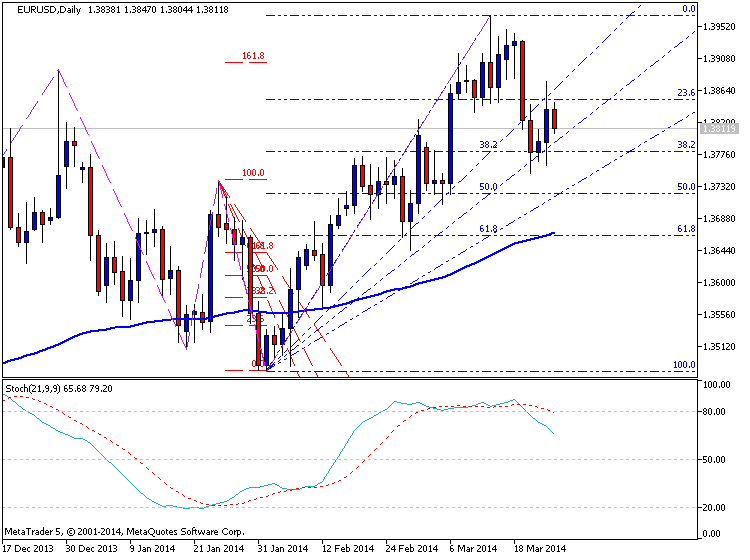

If D1 price will break 1.3749 support level on close bar from above to below so we may see the secondary correction within the primary bullish to be continuing (good to open sell trade.

If not so EURUSD D1 price will be on ranging market condition floating between 1.3749 support and 1.3966 resistance levels.

- Recommendation for long: n/a

- Recommendation to go short: watch the price for breaking 1.3749 support level on close D1 bar for possible sell trade

- Trading Summary: bullish

1.3749 support was not broken yet so the correction is still going on but on ranging way :

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.25 13:55

Mixed Markets Look To Draghi, US Data For Clarity (based on forexminute article)

European markets look strong on Tuesday despite mixed economic data, and

US index futures are up pre-trade ahead of a raft of key fundamental

data releases.

Starting in Europe, the FTSE is currently trading at 6,596.13, a 1.16%

(75.75-point) premium to the day's open. The gain sees the index break

through Thursday/Friday highs, and despite a Monday afternoon selloff

that broke Friday lows. Leading the charge is home improvement retailer

Kingfisher plc (KGF.L), up 7.06% at 435.20 on a positive earnings

surprise.

The gains in the UK come as the ONS reports better than expected retail

price index data, with the core headline figure coming in at 0.7% versus

a forecast 0.5%. Consumer price index (CPI) came in as expected, with

the YoY figure at 1.7% and the MoM figure at 0.5%. Producer price index

(PPI) data missed expectations, the headline input MoM figure reported

at -0.4% versus a forecasted 0.3%.

In Germany, the DAX 30 is up 1.66% at 9,340.36. Heading into European

lunch, the day's biggest gainer is kidney dialysis company Fresenius

Medical Care AG & Co. KGAA (FME.DE), currently up 3.51% at 50.26. As

with its UK counterpart, the DAX's gains follow mixed data. German

business expectations missed expectations, reported at 106.4 versus a

forecast of 107.6; current assessment beat expectations of 114.6,

reported at 115.2; and IFO business climate index disappointed, reported

at 110.7 versus a forecast of 111.0.

In the US, S&P 500 futures are up 0.33% at 1,855.65, while NQ100

futures are up 0.31% at 3,622.30, approximately one hour before the US

markets open.

The gains likely come in anticipation of better than expected

fundamental US data releases, with the day's headliners being CB

consumer confidence, forecast at 78.6, and new home sales, forecast at

445K, a 4.9% decline on previous data.

Traders and investors will also look to ECB President Mario Draghi for

insight into Eurozone monetary policy, with his bimonthly speech

scheduled for 16:00 GMT on Tuesday.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The price is on bullish correction within primary bullish since the middle of last week trying to break 1.3749 support level on D1 timeframe.

H4 timeframe - the flat for the second day : it was market rally within primary bearish for to days from now. H4 price is trying to break trend line together with 1.3765 support for bearish trend to be continuing.

W1 timeframe - the correction is just started on open W1 bar.

If D1 price will break 1.3749 support level on close bar from above to below so we may see the secondary correction within the primary bullish to be continuing (good to open sell trade.

If not so EURUSD D1 price will be on ranging market condition floating between 1.3749 support and 1.3966 resistance levels.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2013-03-24 01:45 GMT (or 02:45 MQ MT5 time) | [CNY - Flash Manufacturing PMI]

2013-03-24 08:00 GMT (or 09:00 MQ MT5 time) | [EUR - French Manufacturing PMI]

2013-03-24 08:30 GMT (or 09:30 MQ MT5 time) | [EUR - German Manufacturing PMI]

2013-03-24 09:00 GMT (or 10:00 MQ MT5 time) | [EUR - Manufacturing PMI]

2013-03-24 13:45 GMT (or 14:45 MQ MT5 time) | [USD - Manufacturing PMI]

2013-03-25 02:00 GMT (or 03:00 MQ MT5 time) | [CNY - CB Leading Index]

2013-03-25 14:00 GMT (or 15:00 MQ MT5 time) | [USD - Consumer Confidence]

2013-03-25 14:00 GMT (or 15:00 MQ MT5 time) | [USD - New Home Sales]

2013-03-26 07:00 GMT (or 08:00 MQ MT5 time) | [EUR - GfK German Consumer Climate]

2013-03-26 12:30 GMT (or 13:30 MQ MT5 time) | [USD - Durable Goods Orders]

2013-03-27 12:30 GMT (or 13:30 MQ MT5 time) | [USD - GDP]

2013-03-27 14:00 GMT (or 15:00 MQ MT5 time) | [USD - Pending Home Sales]

2013-03-28 12:30 GMT (or 13:30 MQ MT5 time) | [USD - PCE Price Index]

2013-03-28 13:55 GMT (or 14:55 MQ MT5 time) | [USD - Michigan Consumer Sentiment Index]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movementSUMMARY : bullish

TREND : correction

Intraday Chart