Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.15 12:44

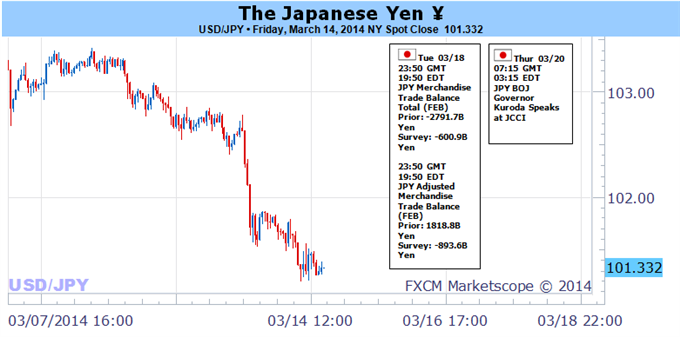

USDJPY Fundamentals (based on dailyfx article)

Fundamental Forecast for Japanese Yen: Bearish

- Japanese Yen rallies sharply as Chinese trade data disappoints, sends Nikkei 225 lower

- Lack of action from Bank of Japan allows the USDJPY to drop to fresh lows

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.16 12:51

Forex Fundamentals - Weekly outlook: March 17 - 21The yen rose against the dollar and the euro on Friday as safe haven demand was bolstered by fears over an economic slowdown in China and tensions over the crisis in Ukraine, ahead of a referendum in Crimea.

Monday, March 17

- The euro zone is to release data on consumer price inflation, which accounts for the majority of overall inflation.

- Canada is to produce data on foreign investments.

- The U.S. is to publish data on manufacturing activity in the Empire State, as well as reports on industrial production and long term securities transactions.

- The Reserve Bank of Australia is to publish the minutes of its latest policy meeting, which contain valuable insights into economic conditions from the bank’s perspective.

- The ZEW Institute is to release its closely watched report on German economic sentiment, a leading indicator of economic health.

- Canada is to publish data on manufacturing sales. Later Tuesday, Bank of Canada Governor Steven Poloz is to speak, his comments will be closely watched.

- The U.S. is to produce data on consumer inflation, in addition to reports on building permits and housing starts.

- Bank of England Governor Mark Carney is to speak at an event in London.

- Japan is to publish data on the trade balance, the difference in value between imports and exports. Meanwhile, Bank of Japan Governor Haruhiko Kuroda is to speak at an event in Tokyo.

- The U.K. is to release official data on the change in the number of people unemployed and the unemployment rate, as well as data on average earnings and public sector borrowing. Meanwhile, the Bank of England is to publish the minutes of its most recent policy setting meeting.

- The ZEW Institute is to publish a report on economic expectations in Switzerland, a leading indicator of economic health.

- Canada is to release data on wholesale sales.

- The Federal Reserve is to announce its federal funds rate and publish economic forecasts for inflation and growth. The Fed statement is to be followed by a press conference with Chair Janet Yellen.

- Later Wednesday, New Zealand is to publish data on fourth quarter gross domestic product, the broadest indicator of economic activity and the leading indicator of economic growth.

- Germany is to release data on producer price inflation.

- BoJ Governor Haruhiko Kuroda is to speak at an event in Tokyo.

- The Swiss National Bank is to announce its libor rate. The bank is also to publish its quarterly monetary policy assessment.

- Political leaders and finance ministers from the EU are to hold the first day of an economic summit in Brussels.

- The U.K. is to release private sector data on industrial order expectations. The U.K. government is to make its annual budget statement.

- The U.S. is to publish the weekly report on initial jobless claims, as well as data on existing home sales and manufacturing activity in the Philadelphia region.

- Markets in Japan are to remain closed for a national holiday.

- The euro zone is to release data on the current account.

- Meanwhile, political leaders and finance ministers from the European Union are to hold the second day of an economic summit in Brussels.

- The U.K. is to produce data on public sector net borrowing.

- Canada is to produce official data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity, as well as data on consumer inflation.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.16 12:52

USD/JPY Fundamentals - weekly outlook: March 17 - 21The yen ended the week at two-week highs against the dollar on Friday, as concerns over slowing growth in China and heightened tensions between the West and Russia over Ukraine underpinned safe haven demand.

Monday, March 17

- The U.S. is to publish data on manufacturing activity in the Empire State, as well as reports on industrial production and long term securities transactions.

- The U.S. is to produce data on consumer inflation, in addition to reports on building permits and housing starts.

- Japan is to publish data on the trade balance, the difference in value between imports and exports. Meanwhile, Bank of Japan Governor Haruhiko Kuroda is to speak at an event in Tokyo; his comments will be closely watched.

- The Federal Reserve is to announce its federal funds rate and publish economic forecasts for inflation and growth. The Fed statement is to be followed by a press conference with Chair Janet Yellen.

- BoJ Governor Haruhiko Kuroda is to speak at an event in Tokyo.

- The U.S. is to publish the weekly report on initial jobless claims, as well as data on existing home sales and manufacturing activity in the Philadelphia region.

- Markets in Japan are to remain closed for a national holiday.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.17 17:25

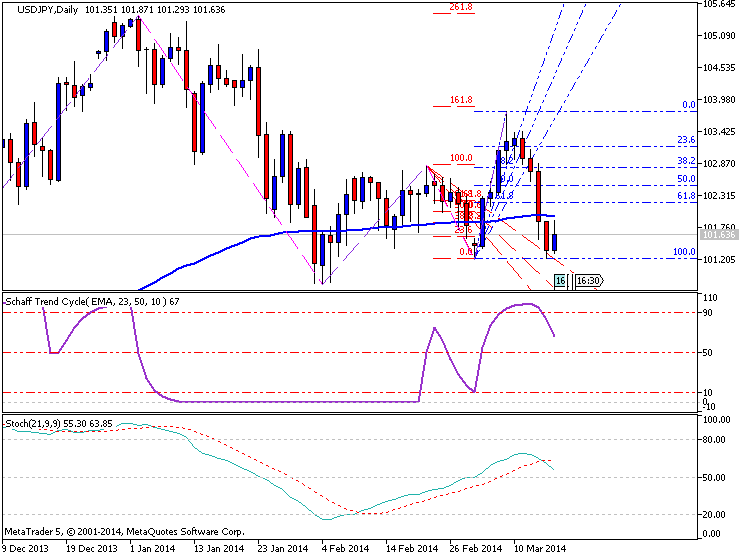

USDJPY Technical Analysis March 17 2014 (based on fxstreet article)

The USD/JPY

continues to trade near the top of today range, although it has pulled

back slightly from highs after failing to break above the 101.85 area.

The

USD/JPY came under strong pressure last week amid risk aversion and

dropped more than 200 pips before finding support at the 101.20 zone on

Friday. The pair recovered Monday but with the bounce capped by the

101.90 zone, it was confined to a phase of consolidation. At time of

writing, the USD/JPY is trading at the 101.60 zone, recording a 0.3%

gain on the day.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.19 06:44

2013-03-18 23:50 GMT (or 00:50 MQ MT5 time) | [JPY - Trade Balance]

- past data is -1.82T

- forecast data is -0.89T

- actual data is -1.13T according to the latest press release

if actual > forecast = good for currency (for JPY in our case)

==========

Japan Trade Deficit Y800.3 Billion

Japan posted a merchandise trade deficit of 800.309 billion yen in February, the Ministry of Finance said on Wednesday - sliding into the red for the 19th consecutive month.

The headline figure missed forecasts for a shortfall of 600.9 billion yen following the downwardly revised record deficit of 2,791.7 billion yen in January (originally 2,789.97 billion yen).

Exports were up 9.8 percent on year - also shy of expectations for 12.5 percent following the 9.5 percent increase in the previous month.

Exports to China surged 27.7 percent on year to 1,074.853billion yen, while exports to all of Asia were up 12.5 percent on year to 3,102.072billion yen.

Exports to the United States added 5.6 percent on year to 1,063.575 billion yen, while exports to the European Union climbed an annual 13.9 percent to 609.548 billion yen.

Imports added an annual 9.0 percent versus forecasts for 7.2 percent following the 25.1 percent spike a month earlier.

Imports from Asia gained 772 percent on year to 2,749.544 billion yen, while imports from China alone collected an annual 5.72 percent to 1,185.620 billion yen.

Imports from the United States jumped 20.8 percent on year to 579.923 billion yen, while imports from the European Union jumped 15.4 percent to 646.886 billion yen.

The adjusted trade balance registered a deficit of 1,133.2 billion yen, missing forecasts for a shortfall of 907 billion yen following the upwardly revised 1,763 billion yen deficit in January (originally 1,818.8 billion yen).

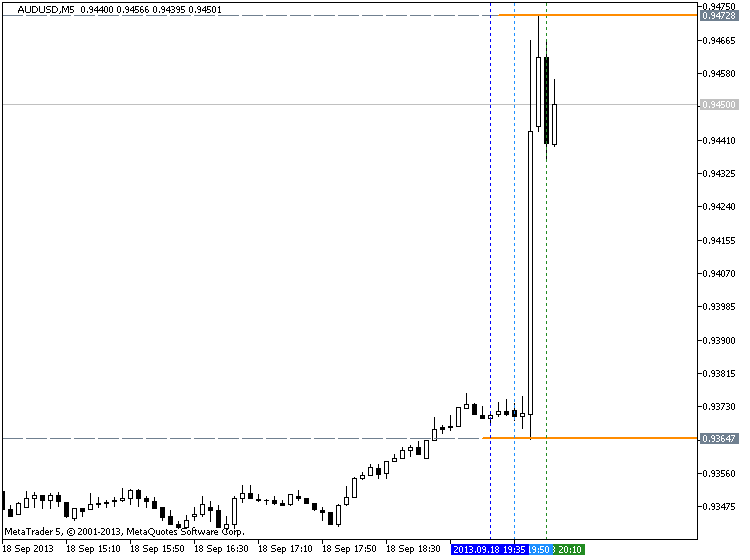

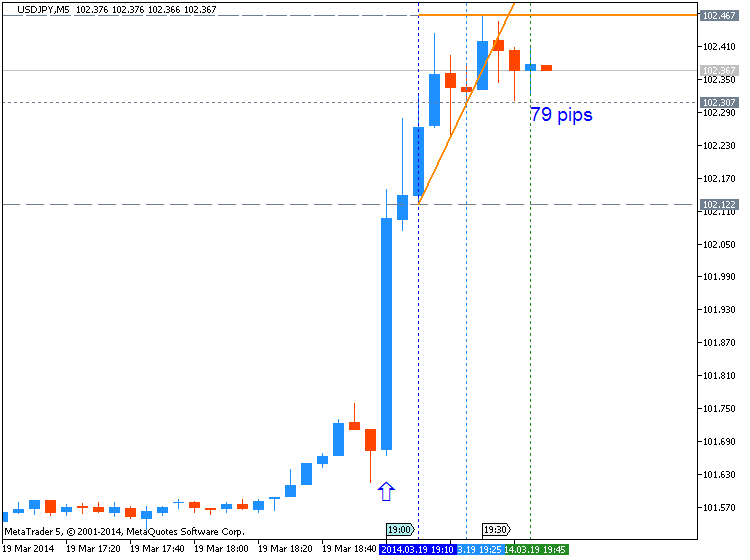

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDJPY M5 : 9 pips price movement by JPY - Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.19 16:58

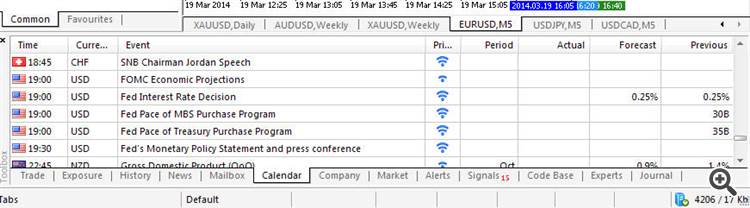

EURUSD Fundamentals 19.03.2014 (based on dailyfx article)

Trading the News: Federal Open Market Committee Meeting

- Federal Open Market Committee (FOMC) to Deliver Another $10B Taper.

- Fed Chair Janet Yellen to Hold Press Conference at 18:30 GMT.

Indeed, the Federal Open Market Committee (FOMC) is

widely anticipated to reduce its asset-purchase by another $10B in

March, but the market reaction may not be as clear cut as the previous

rate decisions as market participants expect a material shift in the

policy outlook.

Why Is This Event Important:

Indeed, a growing number of Fed officials have

highlight a new ‘qualitative’ approach for monetary as the jobless rate

approaches the 6.5% threshold for unemployment, while a dovish twist to

the central bank’s forward guidance may heighten the bearish sentiment

surrounding the greenback as it drags on interest rate expectations.

How To Trade This Event Risk

Bullish USD Trade: FOMC Cuts Another $10B & Sees Greater Scope to Normalize

- Need red, five-minute candle following the release to consider a short EUR/USD trade

- If market reaction favors a long dollar trade, short EUR/USD with two separate position

- Place stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish USD Trade: Fed Implements Dovish Twist to Forward Guidance

- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in opposite direction

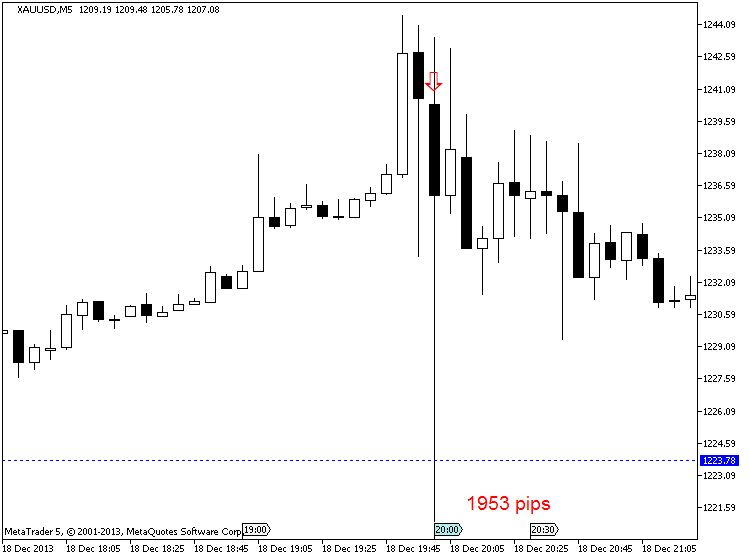

XAUUSD M5 : 1953 pips price movement by USD - Federal Funds Rate news event :

AUDUSD by USD - Federal Funds Rate news event :

EURUSD by USD - Federal Funds Rate news event :

Federal Open Market Committee Meeting :

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Chinkou Span line of Ichimoku indicator is crossing historical price on open bar from above to below which is indicating breakdown within primary bearish on D1 timeframe.

If Chinkou Span line will cross the price on close bar, if the price will break 101.39 support on D1 timeframe and 101.20 support level on H4 timeframe so we may see the breakdown to be continuing (good to open sell trade).

If not so we will see the ranging market condition within primary bearish on D1.

UPCOMING EVENTS (high/medium impacted news events which may be affected on USDJPY price movement for this coming week)

2013-03-18 12:30 GMT (or 13:30 MQ MT5 time) | [USD - Building Permits]

2013-03-18 23:50 GMT (or 00:50 MQ MT5 time) | [JPY - Trade Balance]

2013-03-19 04:30 GMT (or 05:30 MQ MT5 time) | [JPY - All Industries Activity]

2013-03-19 05:00 GMT (or 06:00 MQ MT5 time) | [JPY - BOJ Gov Speech]

2013-03-19 18:00 GMT (or 19:00 MQ MT5 time) | [USD - Federal Funds Rate]

2013-03-20 07:15 GMT (or 08:15 MQ MT5 time) | [JPY - BOJ Gov Speech]

2013-03-20 14:00 GMT (or 15:00 MQ MT5 time) | [USD - Philadelphia Fed Manufacturing Survey]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on USDJPY price movementSUMMARY : bearish

TREND : breakdown

Intraday Chart