Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.08 10:36

Forex Fundamentals - Weekly Outlook Mar. 10-14

The US dollar and the Japanese yen were sold off as the market mood

improved. Will we see more falls? Rate decisions in Japan and New

Zealand, US employment and retail figures as well as PPI and Consumer

confidence are the major events on our calendar. Here is an outlook on

the highlights of this week.

- Japanese rate decision: Tuesday. Bank of Japan maintained its monetary policy in February, stating that the economy was moving in line with the central bank’s projections, indicating monetary stimulus will not get bigger. However in case of downside risks, the BOJ will act and adjust its policy. The GDP release showed external demand has weakened in emerging market economies affecting growth, but domestic demand has remained strong. The bank also forecasts that the current account balance will also improve once exports strengthen alongside global recovery.

- US Federal Budget Balance: Wednesday, 18:00. The U.S. government’s deficit continued to decline in January reaching $10.4 billion. The ongoing reduction totaled 36.6% in the first four months from a year ago, signaling further improvement in the nation’s economic condition. The Congressional Budget Office expect deficit to reach $514 billion in the current budget year while last year deficit reached $680.2 billion. The US Senate passed legislation to suspend the debt ceiling until March 16, 2015 eliminating more risk for budget wars. U.S. government’s deficit is expected to reach $223.2 billion.

- NZ rate decision: Wednesday, 20:00. New Zealand’s central bank kept rates unchanged in February but gave a strong hint for a rate hike this month. While inflation has been moderate, inflationary pressures are predicted to rise over the next two years. The RBNZ’s decision followed strong data indicating the economy is growing faster than the central bank had projected, while inflation got closer to the RBNZ’s 2% target. A rate hike to 2.75% is expected this time.

- Australian employment data: Thursday, 0:30. Australia’s unemployment rate worsened in January increasing to 6.0% its highest level in a decade. The Australian economy shed 3,700 jobs due to a turbulent transition away from mining and the jobless rate increased from 5.8% in December, mainly full time positions. Australia is facing an economic transition following the termination of the mining boom, reflected by a big drop in mining related investment. Other sectors in the economy will have to fill in the gap and start contributing to growth. Australia’s unemployment rate is expected to remain unchanged at 6% while the Australian economy is predicted to add 15,300 new jobs.

- US retail sales: Thursday, 12:30. US retail sales edged down in January, amid cold weather Americans spent less on automobiles and clothes following the rise in the end of 2013. Retail sales fell a seasonally adjusted 0.4% after a 0.1 percent drop in December. However, economic slowdowns caused by winter weather are usually transformed to stronger growth once temperatures rise again. Nevertheless economic growth in the first quarter is expected to be well below 2% annual rate compared to the 3.2% rate in the final quarter of 2013. Meanwhile Core retail sales excluding volatile spending on autos, gas and building supplies, remained flat compared with December with a drop in purchases of clothing and furniture because of rising prices. Retail sales are expected to gain 0.3%, while core sales are forecasted to rise 0.2%.

- US Unemployment Claims: Thursday, 12:30. The number of Americans queuing for unemployment benefits fell to a three-month low last week, indicating the US labor market has recuperated from the severe weather. Initial claims for state unemployment benefits declined 26,000 to a seasonally adjusted 323,000, better than the 326,000 projected by analysts. The continuing claims have stayed at higher levels in recent weeks, due to the cold weather preventing some recipients from going out to search for work and causing companies to delay hiring. A rise to 334,000 is expected this time.

- US PPI: Friday, 12:30. U.S. producer prices increased in January, but did not reflect broader price pressures in the economy. The producer price index for finished goods edged up 0.2% on a seasonally adjusted basis, following a 0.4% increase in December. PPI was revised and now includes the wholesale cost of goods and adds services, construction, government purchases and exports for the first time. It now includes a new index that tracks prices of goods and services meant to be sold to consumers. The index, known as personal consumption, rose 0.3%. It’s expected to give a heads up if consumer inflation is about to begin a sharp move up or down. The rise in prices does not indicate any major shift in inflation. Meantime, PPI, excluding the volatile categories of food and energy, edged up 0.2%. Producer prices are expected to gain 0.2%.

- US UoM Consumer Sentiment: Friday, 13:55. Consumer confidence in the US remained unchanged at 81.2 points in February, indicating shoppers remained dormant last month. However economists expected the index to decline to 80.6. However, the figure indicated a worsening mood after December’ release showed a three-year high on a monthly basis. Consumer confidence is expected to rise to 81.9.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.09 16:09

NZD/USD Fundamentals - weekly outlook: March 10 - 14The New Zealand rose to a more than four-month high against its U.S. counterpart on Friday before turning modestly lower, as the release of upbeat U.S. nonfarm payrolls data underlined the view that the Federal Reserve will maintain the current pace of reductions to its stimulus program.

Wednesday, March 12

- The RBNZ is to announce its benchmark interest rate and publish its monetary policy statement, which outlines economic conditions and the factors affecting the bank’s decision. The announcement is to be followed by a press conference.

- RBNZ Governor Graeme Wheeler is to testify before the Finance and Expenditure Select Committee, in Wellington.

- The U.S. is to release data on retail sales and import prices, in addition to the weekly government report on initial jobless claims.

- The U.S. is to round up the week with data on producer price inflation and preliminary data from the University of Michigan on consumer sentiment.

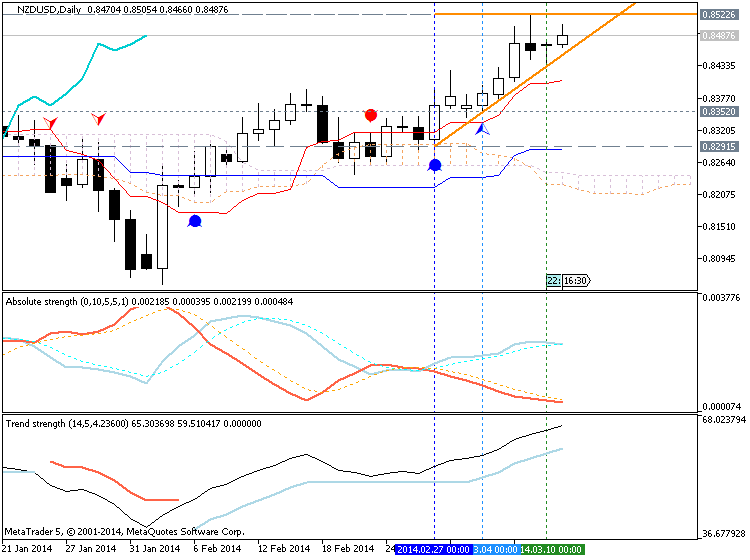

If not so we may see the ranging market condition within bullish on D1.

Price did not break 0.8503 resistance on D1 timeframe. Besides, there is new resistance level for this timeframe : 0.8522

So, the price should break this 0.8522 from below to above to continue bullish market condition (for now - we see flat on D1).

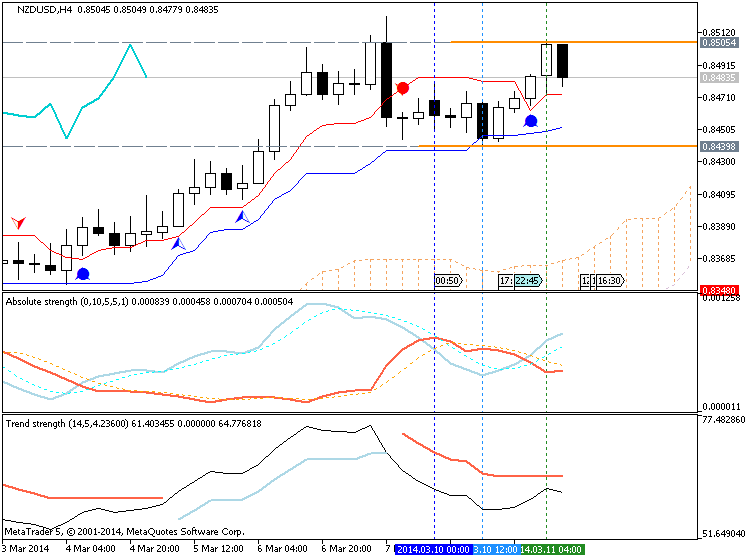

By the way, there is new situation for H4 as well : 0.8505 as new resistance level. Some people may say : "it is not really important - 0.8505 or 0.8503 ... but as we see from the chart - it is the dilemma:

- price will break this 0.8505 to continue uptrend, or

- the price will be ranging between 0.8505 and 0.8439 (for ranging market condition within bullish trend)

It means - if the price will break this level on close H4 bar so we may see the continuation of the bullish trend.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.12 17:47

Trading the News: Reserve Bank of New Zealand Interest Rate Decision (based on dailyfx article)

- Reserve Bank of New Zealand to Raise Rates for First Time Since 2010

- Markets Pricing 98% Chance for 25bp Rate Hike According to OIS

According to a Bloomberg News survey, all of the 15 economists polled

see the Reserve Bank of New Zealand (RBNZ) raising the benchmark

interest rate by 25bp in March, and the central bank may look to

normalize monetary policy throughout 2014 as the pickup in economic

activity raises the outlook for growth and inflation.

What’s Expected:

Time of release: 03/12/2014 20:00 GMT, 16:00 EDT

Primary Pair Impact: NZD/USD

Expected: 2.75%

Previous: 2.50%

Forecast: 2.75%

Why Is This Event Important:

Indeed, RBNZ Governor Graeme Wheeler may sound a more hawkish this time

around amid the ongoing threat of an asset-bubble, and interest rate

decision may spur fresh highs in the New Zealand dollar should the

central bank show a greater willingness to implement a series of rate

hike over the coming months.

How To Trade This Event Risk

Bullish NZD Trade: RBNZ Raises Rates & Pledges to Normalize Further in 2014

- Need green, five-minute candle following a hawkish statement to consider a long NZDUSD trade

- If market reaction favors a long trade, buy NZDUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from cost; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

- Need red, five-minute candle to favor a short NZD/USD trade

- Implement same strategy as the bullish New Zealand dollar trade, just in opposite direction

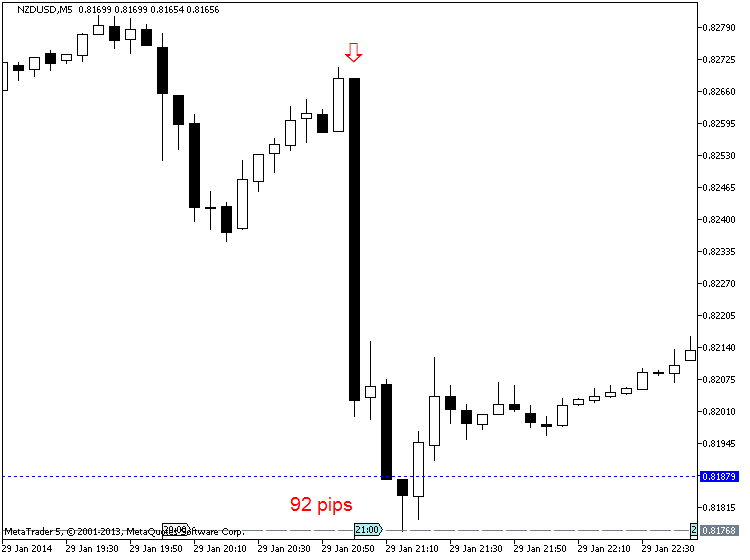

January 2014 Reserve Bank of New Zealand Interest Rate Decision :

Potential Price Targets For The Rate Decision

- Stuck in Wedge/Triangle Formation From 2011; Bullish Breakout on Tap?

- Relative Strength Index Preserves Bearish Trend Dating Back to November

- Interim resistance: 0.8540-50 (50.0% expansion)

- Interim support: 0.8220 (38.2% retracement) to 0.8230 (38.2% retracement)

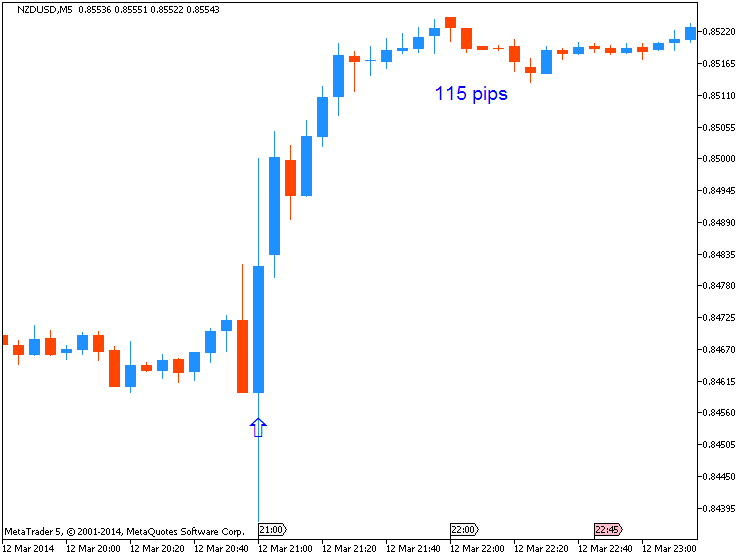

NZDUSD M5 : 115 pips price movement by NZD - Interest Rate

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.14 08:49

Trading the News: USD - Michigan Consumer Sentiment (based on dailyfx article)- U. of Michigan Confidence to Improve for Second Consecutive Month

- Has Held Above 80 for the Last Three-Month; High of 85.1 in 2013

A further pickup in the U. of Michigan Confidence survey may prop up the

U.S. dollar ahead of the Fed’s March 19 meeting as it raises the

prospects for a stronger recovery in 2014.

What’s Expected:

Time of release: 03/14/2014 13:55 GMT, 9:55 EDT

Primary Pair Impact: EURUSD

Expected: 82.0

Previous: 81.6

Forecast: 80.0 to 83.0

Why Is This Event Important:

Indeed, positive developments coming out of the U.S. economy may heighten bets of seeing another $10B reduction in the asset-purchase program, but an unexpected decline in household sentiment may drag on interest rate expectations as Fed Chair Janet Yellen pledges to retain the zero-interest rate policy even after achieving the 6.5% threshold for unemployment.

How To Trade This Event Risk

Bullish USD Trade: Consumer Confidence Climbs to 82.0 or Higher

- Need to see red, five-minute candle following the release to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The Release

- Stalls at Trendline Support, 61.8% Fib Expansion- Higher High in Place?

- Break of Bullish RSI Momentum to Highlight Near-Term Correction

- Interim Resistance: 1.3960-70 (61.8% expansion)

- Interim Support: 1.3600 Pivot to 1.3620 (23.6 retracement)

Previous USD - Michigan Consumer Sentiment :

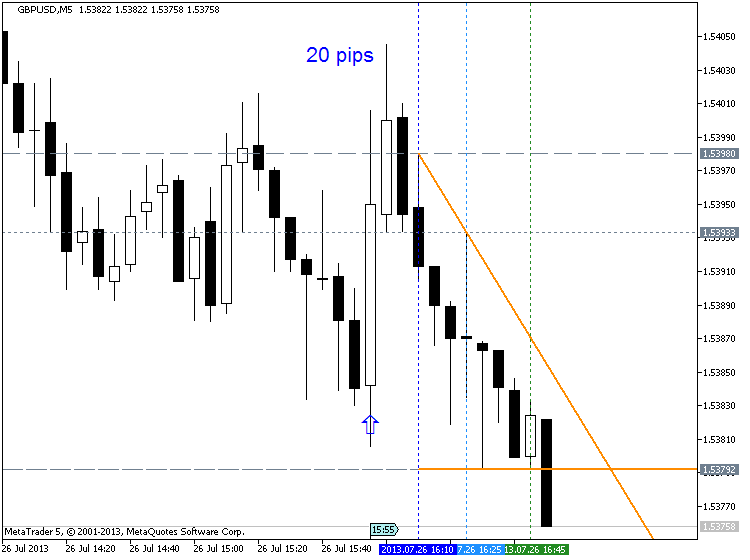

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

NZDUSD M5 : 26 pips price movement by USD - Michigan Consumer Sentiment news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The price on W1, D1 and H4 timeframe are on bullish market condition :

- W1 : price is breaking 0.8432 resistance on open bar for breakout to be continuing

- D1 : price is on bullish and next target is 0.8503

- H4 : price is ranging between 0.8522 resistance and 0.8444 support

If the price will break 0.8503 resistance on D1 close bar so the primary bullish will be continuing (good to open buy trade).If not so we may see the ranging market condition within bullish on D1.

UPCOMING EVENTS (high/medium impacted news events which may be affected on NZDUSD price movement for this coming week)

2013-03-09 21:45 GMT (or 22:45 MQ MT5 time) | [NZD - Manufacturing Sales]

2013-03-12 20:00 GMT (or 21:00 MQ MT5 time) | [NZD - Interest Rate]

2013-03-13 01:10 GMT (or 02:10 MQ MT5 time) | [NZD - RBNZ Gov Speaks]

2013-03-13 05:30 GMT (or 06:30 MQ MT5 time) | [CNY - Industrial Production]2013-03-13 05:30 GMT (or 06:30 MQ MT5 time) | [CNY - Retail Sales]

2013-03-13 12:30 GMT (or 13:30 MQ MT5 time) | [USD - Retail Sales]

2013-03-13 21:30 GMT (or 22:30 MQ MT5 time) | [NZD - Business NZ PMI]

2013-03-14 12:30 GMT (or 13:30 MQ MT5 time) | [USD - PPI]

2013-03-14 13:55 GMT (or 14:55 MQ MT5 time) | [USD - Michigan Consumer Sentiment]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on NZDUSD price movement

SUMMARY : bullish

TREND : bullish

Intraday Chart