Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.01 14:59

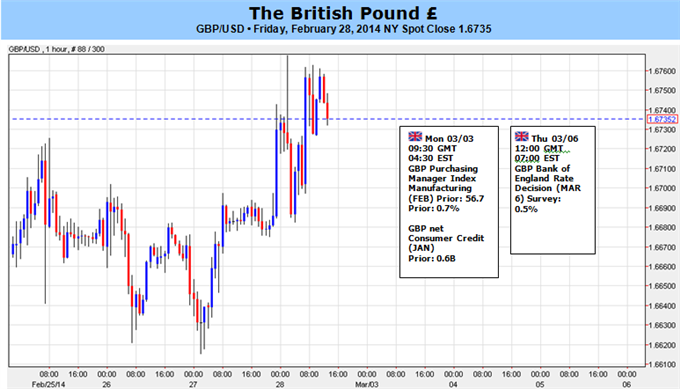

GBPUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for the British Pound: Bullish

- British Pound Will Soon Find Yield, Rate Outlook Guidance

- GBP/USD Quiet as a Mouse; Prepping for Next Move

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.01 15:06

Forex Weekly Fundamentals March 3-7 (based on forexcrunch article)

The US dollar was generally on the back foot, with the euro emerging as the big winner. The all important ECB rate decision is one of four rate decisions and the Non-Farm Payrolls with their build up also stand out in a very busy week. These are the highlights of this week. Here is an outlook on the major events at hand.

- Mario Draghi speaks: Monday, 14:00. ECB President Mario Draghi is scheduled to speak at the European Parliament in Brussels. Draghi may talk about the ongoing growth trend in the Eurozone but may also give clues on the possibility of further rate cuts in the ECB’s next monetary policy meeting in light of better, but still slow inflation. Market volatility is expected. It will be interesting to hear how he sees the surprising rise in inflation. Here is one possible explanation.

- US ISM Manufacturing PMI: Monday, 15:00. U.S. manufacturing activity weakened in January to 51.3 compared to 56.5 in December, amid low inventories. Economists expected a higher reading of 56.2 points. Many blamed weather conditions for the fall in January while some are even optimistic regarding future outlook in 2014. A rise to 52.3 is expected this time.

- Australian rate decision: Tuesday, 0:30. The official rate was maintained at 2.5% after the meeting of the Reserve Bank of Australia board on February, as the RBA shifted to a neutral bias and boosted the Aussie. RBA Governor Glenn Stevens remarked that growth remained below RBA’s projections but is expected to rise this year. The RBA’s decision was widely anticipated by markets in accordance to the current economic conditions. No change in rates od forecast, but the Bank might talk about rising unemployment.

- Australian GDP: Wednesday, 0:30. Australia’s economy expanded less than expected in the third quarter, growing 0.6% compared to 0.7% in the second quarter. The reading was below market forecast of a 0.7% rise. On a yearly base GDP increased 2.6%. Economic growth in Australia remains at low levels and is highly reliant on mining investment. Furthermore, Reserve Bank of Australia Gov. Glenn Stevens reiterated that the Australian dollar was still “uncomfortably high,” making the nation’s exports less competitive in global markets. An expansion rate of 0.7% is predicted now.

- US ADP Non-Farm Payrolls: Wednesday, 13:15. US Private sector job market rose by 175,000 jobs in January according to the ADP National Employment Report. The main contribution to job growth came from the construction industry which added 25,000 jobs. Manufacturing sector narrowed in January with a 12,000 decline following a revised gain of 16,000 in the previous month. A smaller job gain of 159,000 is anticipated now.

- Canadian rate decision: Wednesday, 15:00. The bank of Canada maintained rates at 1.0% and the BOC statement hurt the loonie. Bank of Canada governor Stephen Poloz reiterated that the bank’s key rate will not be changed. A change may be possible only if new information influences this balance of risks. However despite worries about slow inflation, Mr. Poloz remarked that the depreciation of the Canadian dollar may help exporters. The bank expects inflation to return to the 2% target within two years, but the current lo leveled inflation is a downside rise as well as the ongoing elevated household imbalances. Rates are expected to remain unchanged.

- US ISM Non-Manufacturing PMI: Wednesday, 15:00. US service sector picked up in January, advancing to 54.0 from 53.0 in December, amid better business conditions and jobs gain. However the PMI remained below the12-month average of 54.6. New orders edged up 0.5 point to 50.9 and most responders reported improvement in business conditions. A small decline to 53.8 is expected this time.

- UK rate decision: Thursday, 12:00. No change is expected from the BOE at this meeting. After presenting the second iteration of forward guidance in February and practically bringing forward rate hike expectations to Q2 2015, the upcoming rate decision could unfortunately turn into a non-event. The meeting minutes will probably have a bigger effect, as they will reflect the members’ thoughts about the recent reports about higher unemployment and lower inflation.

- Eurozone rate decision: Thursday, 12:45, press conference at 13:30. There is a now a low chance that the ECB will lower the lending rate to 0.10-0.15% and set a negative deposit rate of 0.10%. While there is a danger that low inflation might move from the short term to the medium term, and that the ECB could act according to its mandate, as it did in November, the small rise in core inflation gives breathing space to Mario Draghi and company. The high exchange rate of the euro in recent months weighs on exports and lowers prices. With the high exchange rate of the euro, the growing pressure from the IMF and others and the exhaustion of the talk about of negative rates without action, the ECB could have better chances to act.. A negative rate would send the euro tumbling down, while no action would send the euro a bit higher. However, Draghi is more lightly to try to talk the currency down or allow the non-sterilization of bonds in the SMP program before going into the uncharted territory of negative rates.

- US Unemployment Claims: Thursday, 13:30. The number of Americans filing unemployment applications increased unexpectedly by 14,000 last week to 348,000, Cold weather and winter storms slowed economic activity in the two first months of 2014 increasing the amount of unemployment applications. However labor market is expected to climb now that the weather conditions have improved. The number of clain is expected to decline to 336,000.

- Canadian employment data: Friday, 13:30. The Canadian economy recovered 29,400 jobs in January after contracting 44,000 in December, pushing the unemployment rate down to 7.0% from 7.2%. Full-time positions edged up by an estimated 50,500, the largest rise since May. However, 28,300 of the new jobs were in self-employment. The rise shows that the Canadian job market is not entering a downturn trend. The job addition was well above market estimate of 19,700. A job gain of 16,900 is expected and unemployment rate is predicted to remain at 7%.

- US Non-Farm Payrolls and Unemployment rate: Friday, 13:30. US non-farm payrolls gained 113,000 jobs in January far from the 180,000 increase projected by analysts but enough to lower the unemployment rate to 6.6% from 6.7% in December. Labor force participation rate, rose, to 63% from 62.8% in December indicating a positive change. Economists anticipate moderate job growth will continue, enabling the Fed to carry on with their tapering plan. Non-farm payrolls is expected to reach 151,000 while, unemployment rate is expected to remain 6.6%.

- US Trade balance: Friday, 13:30. The U.S. trade deficit widened more than anticipated in December increasing 12 % to $38.7 billion compared to a revised $34.6 billion in November. Exports fell .8 % to $191.3 billion despite a sharp rise in petroleum exports. For all of 2013, the trade deficit reached $471.5 billion, the smallest since 2009. The improvement in US trade deficit also contributed to the fourth quarter GDP of 3.2% annual growth pace. However the slowdown in China raises doubts regarding a sustainable growth in exports in the foreseeable future. U.S. trade deficit is expected to widen further to 39.1 billion.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.03 11:03

2013-03-03 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Manufacturing PMI]

- past data is 56.7

- forecast data is 56.5

- actual data is 56.9 according to the latest press release

if actual > forecast = good for currency (for GBP in our case)

==========

British Manufacturing Sector Growth Quickens In February

U.K. manufacturing sector expanded for the eleventh successive month in February, and to a slightly larger extent than in the prior month, survey data published by Markit Economics and the Chartered Institute of Purchasing and Supply (CIPS) revealed Monday.

The seasonally adjusted manufacturing purchasing managers' index advanced to 56.9 in February from 56.6 in January, which was revised down from 56.7. PMI readings above 50 indicate growth in activity, while those below show contraction. The index has now stayed above the neutral mark for the eleventh straight month.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 43 pips price movement by GBP - Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.04 11:06

2013-03-04 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Construction PMI]

- past data is 64.6

- forecast data is 63.0

- actual data is 62.6 according to the latest press release

if actual > forecast = good for currency (for GBP in our case)

==========

U.K. Construction Growth Moderates In February

The British construction sector expanded notably in February, but the pace of expansion eased since January as adverse weather conditions disrupted activity, survey data from Markit Economics showed Tuesday.

The construction Purchasing Managers' Index fell less than expected to 62.6 in February from a 77-month high of 64.6 in January. The score was forecast to drop to 63.5.

The index has posted above the 50.0 no-change level in each month since May 2013.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 33 pips price movement by GBP - Construction PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.02 17:38

GBP/USD Fundamentals - weekly outlook: March 3 - 7The pound moved higher against the dollar on Friday after data showed that U.S. fourth quarter growth was revised sharply lower, stoking concerns that the Federal Reserve may slow the rate of reductions to its asset purchase program.

Monday, March 3

- The U.K. is to release data on manufacturing activity and net lending to individuals.

- The U.S. is to release data on personal spending, while the Institute of Supply Management is to release data on manufacturing activity.

- The U.K. is to release data on construction sector activity.

- The U.K. is to produce data on service sector activity, a leading indicator of economic health.

- The U.S. is to release the ADP report on private sector job creation, which leads the government’s nonfarm payrolls report by two days. Meanwhile, the ISM is to publish a report service sector activity.

- The BoE is to announce its benchmark interest rate.

- The U.S. is to publish the weekly report on initial jobless claims and data on factory orders.

- The U.K. is to release data on consumer inflation expectations.

- The U.S. is to round up the week with the closely watched government data on nonfarm payrolls and the unemployment rate.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.05 14:31

2013-03-05 13:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

- past data is 127K

- forecast data is 160K

- actual data is 139K according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

ADP National Employment Report: Private Sector Employment Increased by 139,000 Jobs in February

Private sector employment increased by 139,000 jobs from January to February according to the February ADP National Employment Report(R). Broadly distributed to the public each month, free of charge, the ADP National Employment Report is produced by ADP(R), a leading global provider of Human Capital Management (HCM) solutions, in collaboration with Moody's Analytics. The report, which is derived from ADP's actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 21 pips price movement by USD - ADP Non-Farm Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.06 13:18

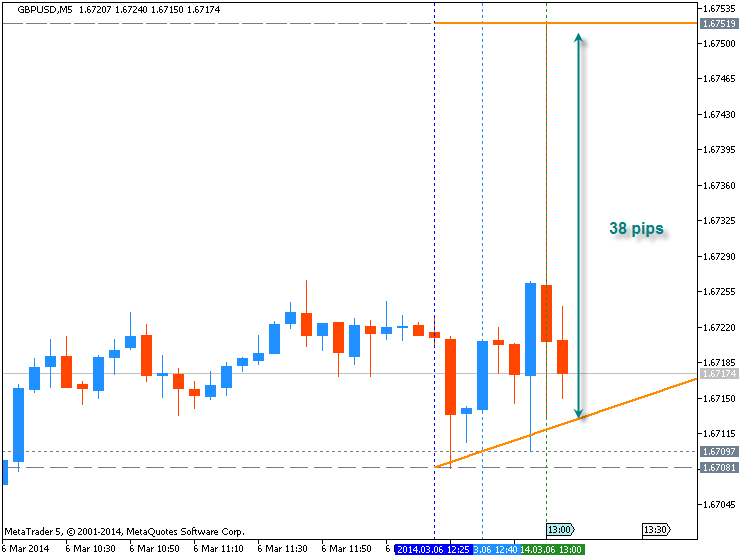

2013-03-06 12:00 GMT (or 13:00 MQ MT5 time) | [GBP - Interest Rate]

- past data is 0.50%

- forecast data is 0.50%

- actual data is 0.50% according to the latest press release

if actual > forecast = good for currency (for GBP in our case)

==========

BoE Leaves Key Rate Unchanged At 0.50%; QE At GBP 375 Bln

The Bank of England decided to retain its historic-low interest rate and the size of quantitative easing at GBP 375 billion on Thursday.

The nine-member Monetary Policy Committee led by Mark Carney voted to keep the key bank rate unchanged at 0.50 percent.

GBPUSD M5 : 38 pips price movement by GBP - Interest Rate news event :

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.06 16:28

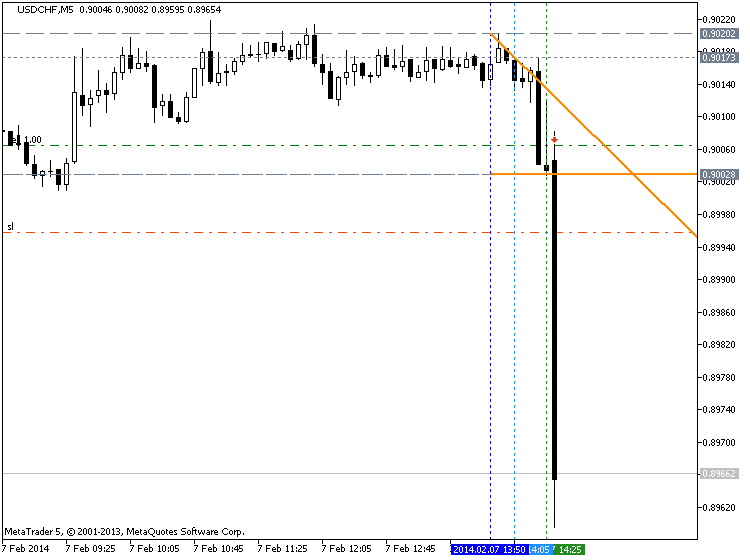

2013-03-06 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

- past data is 349K

- forecast data is 338K

- actual data is 323K according to the latest press release

if actual < forecast = good for currency (for USD in our case)

==========

U.S. Weekly Jobless Claims Drop To Three-Month Low

In an upbeat sign for the labor market ahead of tomorrow's monthly jobs report, the Labor Department released a report on Thursday showing that first-time claims for U.S. unemployment benefits fell by more than expected in the week ended March 1st.

The report said initial jobless claims dropped to 323,000, a decrease of 26,000 from the previous week's revised figure of 349,000. Economists had expected jobless claims to dip to 338,000 from the 348,000 originally reported for the previous week.

With the bigger than expected decrease, jobless claims fell to their lowest level since hitting 305,000 in the last week of November.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 46 pips price movement by USD - Unemployment Claims news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.07 10:25

Trading the News: U.S. Non-Farm Payrolls (based on dailyfx article)

The U.S. Non-Farm Payrolls report may prop up the dollar as the economy

is expected to add another 150K jobs in February, and a pickup in

employment may instill a bullish outlook for the greenback as the

Federal Reserve is widely anticipated to discuss another $10B taper at

the March 19 meeting.

What’s Expected:

Time of release: 03/07/2014 13:30 GMT, 8:30 EST

Primary Pair Impact: EURUSD

Expected: 150K

Previous: 113K

Forecast: 100K to 150K

Why Is This Event Important:

However, the recent slowdown in economic activity certainly raises the risk of seeing another weaker-than-expected NFP print, and a dismal result may heighten the bearish sentiment surrounding the reserve currency as it limits the Fed’s scope to normalize monetary policy sooner rather than later.

How To Trade This Event Risk

Bullish USD Trade: NFP Increases 155K+; Unemployment Holds at 6.6%

- Need to see red, five-minute candle following the print to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

January 2014 U.S. Non-Farm Payrolls :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 55 pips price movement by USD - Non-Farm Payrolls news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Price is continuing with primary bullish market condition after flat on D1 timeframe trying to break 1.6741 resistance.

W1 timeframe : the price is ranging between 1.6822 resistance and 1.6251 support with primary bullish.

H4 timeframe : bullish trend is continuing with 1.6768 resistance level

If the price will break 1.6741 resistance on D1 close bar so the primary bullish will be continuing (good to open buy trade).

If not so we may see the ranging market condition within bullish on D1.

UPCOMING EVENTS (high/medium impacted news events which may be affected on GBPUSD price movement for this coming week)

2013-03-03 01:45 GMT (or 02:45 MQ MT5 time) | [CNY - HSBC Final Manufacturing PMI]

2013-03-03 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Manufacturing PMI]

2013-03-03 13:30 GMT (or 14:30 MQ MT5 time) | [USD - PCE]

2013-03-03 15:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

2013-03-04 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Construction PMI]

2013-03-05 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Services PMI]

2013-03-05 13:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

2013-03-05 15:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]

2013-03-06 12:00 GMT (or 13:00 MQ MT5 time) | [GBP - Interest Rate]

2013-03-06 13:15 GMT (or 14:15 MQ MT5 time) | [USD - FOMC Member Dudley Speech]

2013-03-07 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on GBPUSD price movementSUMMARY : bullish

TREND : bullish

Intraday Chart