Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.01 15:01

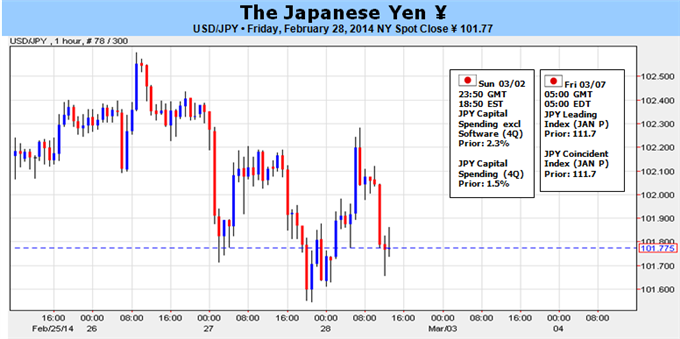

USDJPY Fundamentals (based on dailyfx article)

Fundamental Forecast for Japanese Yen: Bullish

- Yen crosses correlation to S&P 500 collapse – which is the better bellwether for sentiment

- Last week’s data allows for the BoJ to maintain a wait-and-see, but time is running out

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.02 13:23

Forex Fundamentals - Weekly outlook: March 3 - 7

The U.S. dollar ended the week lower against most of the other main

currencies on Friday after data showed that U.S. fourth quarter growth

was revised lower, adding to worries that the Federal Reserve may slow

the pace of reductions to its stimulus program.

Monday, March 3

- Japan is to release data on capital spending. Australia is to publish a report on company operating profits. China is to produce data on service sector activity, as well as a revised reading on the HSBC manufacturing index.

- The U.K. is to release data on manufacturing activity and net lending to individuals, while Switzerland is to publish its SVME index.

- In the euro zone, Spain and Italy are to release data on manufacturing activity. Meanwhile, ECB President Mario Draghi is to speak in the European Parliament in Brussels.

- Canada is to produce data on raw material price inflation.

- The U.S. is to release data on personal spending, while the Institute of Supply Management is to release data on manufacturing activity.

- The RBA is to announce its benchmark interest rate and publish its monetary policy statement, which outlines economic conditions and the factors affecting the bank’s decision.

- Australia is also to publish data on building approvals and the current account. Japan is to produce a report on average cash earnings.

- In the euro zone, Spain is to release data on the change in the number of people unemployed.

- The U.K. is to release data on construction sector activity.

- Australia is to publish data on fourth quarter gross domestic product, the broadest indicator of economic activity and the leading measure of the economy’s health.

- The euro zone is to release data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity. Spain and Italy are to release data on service sector activity.

- The U.K. is to produce data on service sector activity, a leading indicator of economic health.

- The BoC is to announce its benchmark interest rate and publish its monetary policy statement, which outlines economic conditions and the factors affecting the bank’s decision.

- The U.S. is to release the ADP report on private sector job creation, which leads the government’s nonfarm payrolls report by two days. Meanwhile, the ISM is to publish a report service sector activity.

- Australia is to publish data on retail sales and the trade balance, the difference in value between imports and exports.

- Germany is to publish data on factory orders.

- The BoE is to announce its benchmark interest rate.

- Later in the day, the ECB is to announce its benchmark interest rate. The announcement is to be followed by a press conference with President Mario Draghi.

- The U.S. is to publish the weekly report on initial jobless claims and data on factory orders. Canada is to publish a report on building permits and the Ivey PMI.

- RBA Governor Glenn Stevens is to testify before the House of Representatives Economic Committee, in Sydney; his comments will be closely watched.

- The Swiss National Bank is to release data on foreign currency reserves. This data is closely scrutinized for indications of the size of the bank’s operations in currency markets. Switzerland is also to release data on consumer inflation.

- The U.K. is to release data on consumer inflation expectations.

- In the euro zone, Germany is to publish data on industrial production.

- Canada is to publish data on the change in the number of people employed and the unemployment rate, as well as a report on the trade balance.

- The U.S. is to round up the week with the closely watched government data on nonfarm payrolls and the unemployment rate.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.02 13:24

USD/JPY Fundamentals - weekly outlook: March 3 - 7

The dollar fell to two-week lows against the yen on Friday after data

showed that U.S. fourth quarter growth was revised down, while concerns

over tensions in Ukraine and a weaker Chinese yuan also supported safe

haven demand for the yen.

Monday, March 3

- Japan is to release data on capital spending.

- The U.S. is to release data on personal spending, while the Institute of Supply Management is to release data on manufacturing activity.

- Japan is to produce a report on average cash earnings.

- The U.S. is to release the ADP report on private sector job creation, which leads the government’s nonfarm payrolls report by two days. Meanwhile, the ISM is to publish a report service sector activity.

- The U.S. is to publish the weekly report on initial jobless claims and data on factory orders.

- The U.S. is to round up the week with the closely watched government data on nonfarm payrolls and the unemployment rate.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.05 14:31

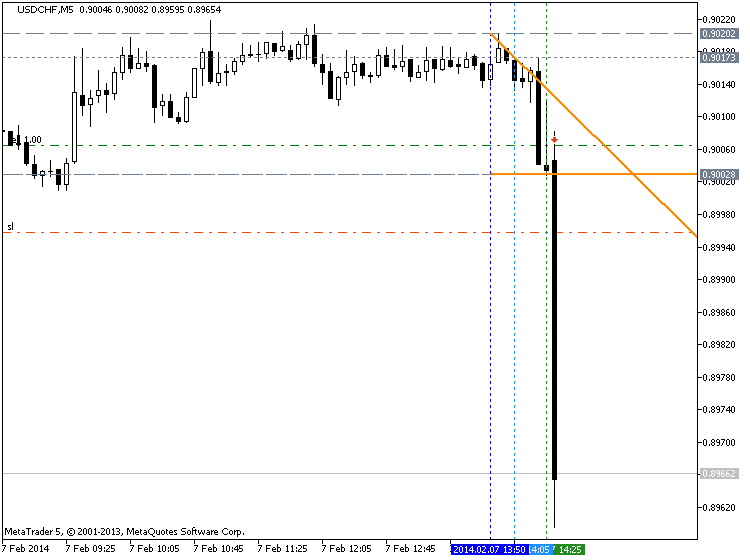

2013-03-05 13:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

- past data is 127K

- forecast data is 160K

- actual data is 139K according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

ADP National Employment Report: Private Sector Employment Increased by 139,000 Jobs in February

Private sector employment increased by 139,000 jobs from January to February according to the February ADP National Employment Report(R). Broadly distributed to the public each month, free of charge, the ADP National Employment Report is produced by ADP(R), a leading global provider of Human Capital Management (HCM) solutions, in collaboration with Moody's Analytics. The report, which is derived from ADP's actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDJPY M5 : 12 pips price movement by USD - ADP Non-Farm Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

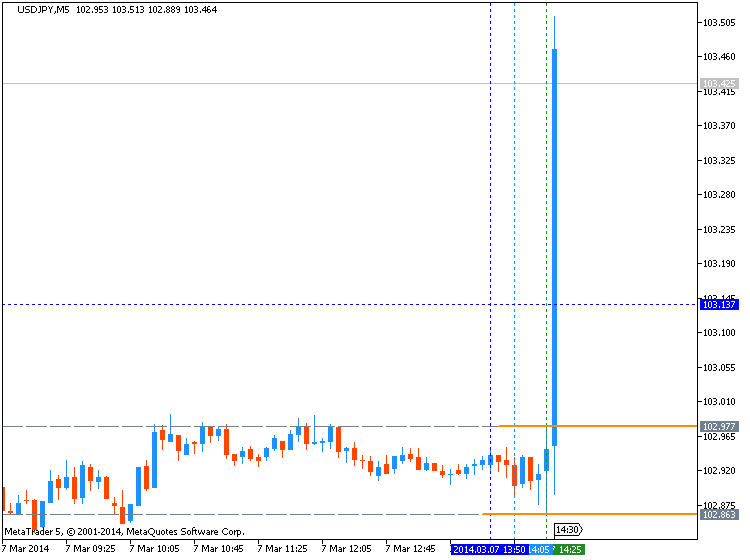

newdigital, 2014.03.06 16:28

2013-03-06 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

- past data is 349K

- forecast data is 338K

- actual data is 323K according to the latest press release

if actual < forecast = good for currency (for USD in our case)

==========

U.S. Weekly Jobless Claims Drop To Three-Month Low

In an upbeat sign for the labor market ahead of tomorrow's monthly jobs report, the Labor Department released a report on Thursday showing that first-time claims for U.S. unemployment benefits fell by more than expected in the week ended March 1st.

The report said initial jobless claims dropped to 323,000, a decrease of 26,000 from the previous week's revised figure of 349,000. Economists had expected jobless claims to dip to 338,000 from the 348,000 originally reported for the previous week.

With the bigger than expected decrease, jobless claims fell to their lowest level since hitting 305,000 in the last week of November.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDJPY M5 : 31 pips price movement by USD - Unemployment Claims news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.07 07:56

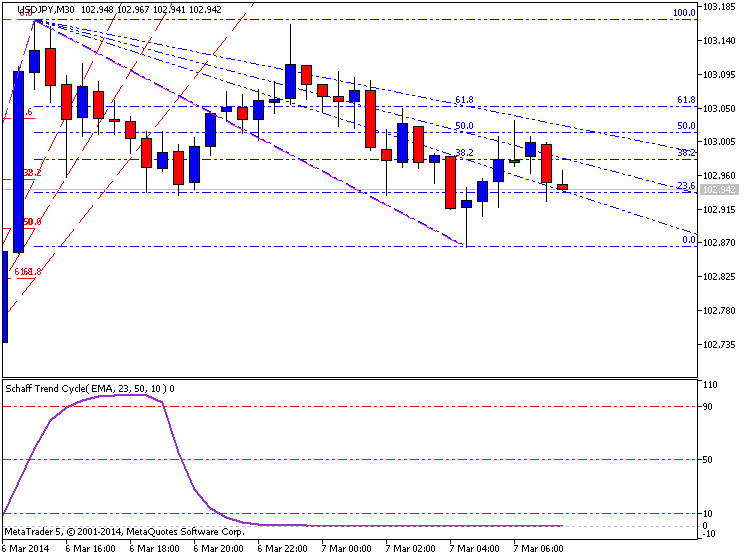

USDJPY Technical Analysis (based on dailyfx article)

- USD/JPY Technical Strategy: Flat

- Support: 102.93 (23.6% Fib exp.)

- Resistance 102.98 (38.2% Fib exp.)

Prices are too close to relevant resistance at this point to justify a long position on risk/reward grounds. On the other hand, attempting to re-enter short without a defined downward reversal signal seems premature.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.07 10:25

Trading the News: U.S. Non-Farm Payrolls (based on dailyfx article)

The U.S. Non-Farm Payrolls report may prop up the dollar as the economy

is expected to add another 150K jobs in February, and a pickup in

employment may instill a bullish outlook for the greenback as the

Federal Reserve is widely anticipated to discuss another $10B taper at

the March 19 meeting.

What’s Expected:

Time of release: 03/07/2014 13:30 GMT, 8:30 EST

Primary Pair Impact: EURUSD

Expected: 150K

Previous: 113K

Forecast: 100K to 150K

Why Is This Event Important:

However, the recent slowdown in economic activity certainly raises the risk of seeing another weaker-than-expected NFP print, and a dismal result may heighten the bearish sentiment surrounding the reserve currency as it limits the Fed’s scope to normalize monetary policy sooner rather than later.

How To Trade This Event Risk

Bullish USD Trade: NFP Increases 155K+; Unemployment Holds at 6.6%

- Need to see red, five-minute candle following the print to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

January 2014 U.S. Non-Farm Payrolls :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDJPY M5 : 70 pips price movement by USD - Non-Farm Payrolls news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Price is below Ichimoku cloud/kumo for primary bearish to be continuing trying to break 101.66 support level on D1 timeframe.

If the price will break 101.66 support on D1 close bar so the primary bearish may be continuing (good to open sell trade).If not so we may see the ranging market condition within primary bearish on D1.

UPCOMING EVENTS (high/medium impacted news events which may be affected on USDJPY price movement for this coming week)

2013-03-03 01:45 GMT (or 02:45 MQ MT5 time) | [CNY - HSBC Final Manufacturing PMI]

2013-03-03 13:30 GMT (or 14:30 MQ MT5 time) | [USD - PCE]

2013-03-03 15:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

2013-03-05 13:30 GMT (or 14:30 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

2013-03-05 15:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]

2013-03-06 13:15 GMT (or 14:15 MQ MT5 time) | [USD - FOMC Member Dudley Speech]

2013-03-07 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on USDJPY price movement

SUMMARY : bearish

TREND : bearish

Intraday Chart