Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.02 13:23

Forex Fundamentals - Weekly outlook: March 3 - 7

The U.S. dollar ended the week lower against most of the other main

currencies on Friday after data showed that U.S. fourth quarter growth

was revised lower, adding to worries that the Federal Reserve may slow

the pace of reductions to its stimulus program.

Monday, March 3

- Japan is to release data on capital spending. Australia is to publish a report on company operating profits. China is to produce data on service sector activity, as well as a revised reading on the HSBC manufacturing index.

- The U.K. is to release data on manufacturing activity and net lending to individuals, while Switzerland is to publish its SVME index.

- In the euro zone, Spain and Italy are to release data on manufacturing activity. Meanwhile, ECB President Mario Draghi is to speak in the European Parliament in Brussels.

- Canada is to produce data on raw material price inflation.

- The U.S. is to release data on personal spending, while the Institute of Supply Management is to release data on manufacturing activity.

- The RBA is to announce its benchmark interest rate and publish its monetary policy statement, which outlines economic conditions and the factors affecting the bank’s decision.

- Australia is also to publish data on building approvals and the current account. Japan is to produce a report on average cash earnings.

- In the euro zone, Spain is to release data on the change in the number of people unemployed.

- The U.K. is to release data on construction sector activity.

- Australia is to publish data on fourth quarter gross domestic product, the broadest indicator of economic activity and the leading measure of the economy’s health.

- The euro zone is to release data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity. Spain and Italy are to release data on service sector activity.

- The U.K. is to produce data on service sector activity, a leading indicator of economic health.

- The BoC is to announce its benchmark interest rate and publish its monetary policy statement, which outlines economic conditions and the factors affecting the bank’s decision.

- The U.S. is to release the ADP report on private sector job creation, which leads the government’s nonfarm payrolls report by two days. Meanwhile, the ISM is to publish a report service sector activity.

- Australia is to publish data on retail sales and the trade balance, the difference in value between imports and exports.

- Germany is to publish data on factory orders.

- The BoE is to announce its benchmark interest rate.

- Later in the day, the ECB is to announce its benchmark interest rate. The announcement is to be followed by a press conference with President Mario Draghi.

- The U.S. is to publish the weekly report on initial jobless claims and data on factory orders. Canada is to publish a report on building permits and the Ivey PMI.

- RBA Governor Glenn Stevens is to testify before the House of Representatives Economic Committee, in Sydney; his comments will be closely watched.

- The Swiss National Bank is to release data on foreign currency reserves. This data is closely scrutinized for indications of the size of the bank’s operations in currency markets. Switzerland is also to release data on consumer inflation.

- The U.K. is to release data on consumer inflation expectations.

- In the euro zone, Germany is to publish data on industrial production.

- Canada is to publish data on the change in the number of people employed and the unemployment rate, as well as a report on the trade balance.

- The U.S. is to round up the week with the closely watched government data on nonfarm payrolls and the unemployment rate.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.03 08:05

2013-03-03 01:45 GMT (or 02:45 MQ MT5 time) | [CNY - HSBC Final Manufacturing PMI]

- past data is 49.5

- forecast data is 48.5

- actual data is 48.5 according to the latest press release

if actual > forecast = good for currency (for CNY in our case)

==========

HSBC confirms China manufacturing index at seven-month low

Chinese manufacturing activity contracted in February at its worst rate in seven months, British banking giant HSBC said Monday, the latest data indicating trouble in the world's number two economy.

Chinese manufacturing activity contracted in February at its worst rate in seven months, British banking giant HSBC said Monday, the latest data indicating trouble in the world's number two economy.

HSBC said its final purchasing managers' index (PMI) for China, which tracks manufacturing activity in factories and workshops, fell to 48.5 last month.

It was a slight increase on the flash PMI of 48.3 the bank released 11 days ago, but it remained the weakest reading since July when the figure stood at 47.7, according to the bank's data.

The index is a closely watched gauge of the health of the Asian economic powerhouse. A reading above 50 indicates growth, while anything below signals contraction.

In January, the index showed contraction for the first time in six months to hit 49.5.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 10 pips price movement by CNY - HSBC Final Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.03 15:32

2013-03-03 13:30 GMT (or 14:30 MQ MT5 time) | [CAD - RMPI]

- past data is 1.8%

- forecast data is 1.0%

- actual data is 2.6% according to the latest press release

if actual > forecast = good for currency (for CAD in our case)

==========

Canadian RMPI rises 2.6% in January

Canada's raw materials price index rose for the second consecutive month in January, official data showed on Monday.

In a report, Statistics Canada said the raw materials purchase price index increased by a seasonally adjusted 2.6% in January, blowing past expectations for a 1% gain.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 19 pips price movement by CAD - RMPI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.04 06:37

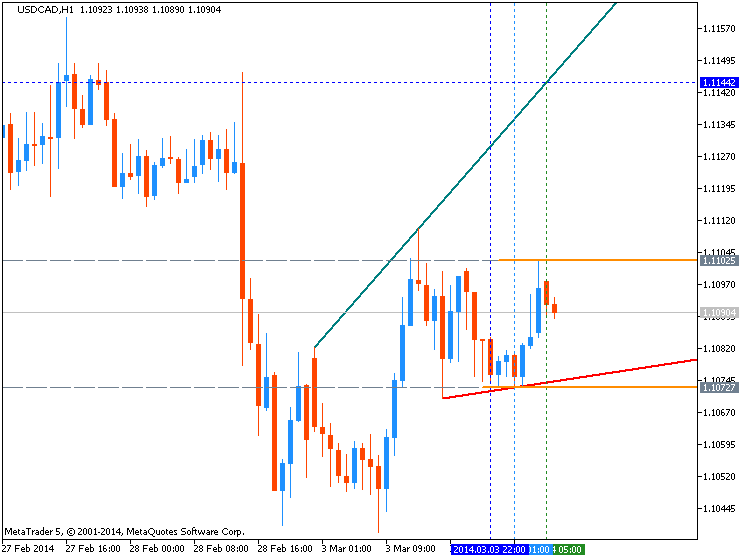

USDCAD Technicals (based on dailyfx article)

- USD/CAD Technical Strategy: Flat

- Support: 1.1053-61 (Feb 25 low, 14.6% Fib exp.), 1.0909 (Feb 19 low)

- Resistance: 1.1155 (23.6% Fib exp.), 1.1194 (Feb 21 high), 1.1223 (Jan 31 high)

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.02 14:22

USD/CAD Fundamentals - weekly outlook: March 3 - 7

The Canadian dollar ended Friday’s session higher against the U.S.

dollar, after data showed that the Canadian economy grew more than

forecast in the final three months of 2013, while U.S. growth was

revised lower.

Monday, March 3

- Canada is to produce data on raw material price inflation.

- The U.S. is to release data on personal spending, while the Institute of Supply Management is to release data on manufacturing activity.

- The BoC is to announce its benchmark interest rate and publish its monetary policy statement, which outlines economic conditions and the factors affecting the bank’s decision.

- The U.S. is to release the ADP report on private sector job creation, which leads the government’s nonfarm payrolls report by two days. Meanwhile, the ISM is to publish a report service sector activity.

- The U.S. is to publish the weekly report on initial jobless claims and data on factory orders.

- Canada is to publish a report on building permits and the Ivey PMI.

- Canada is to publish data on the change in the number of people employed and the unemployment rate, as well as a report on the trade balance.

- The U.S. is to round up the week with the closely watched government data on nonfarm payrolls and the unemployment rate.

Forum on trading, automated trading systems and testing trading strategies

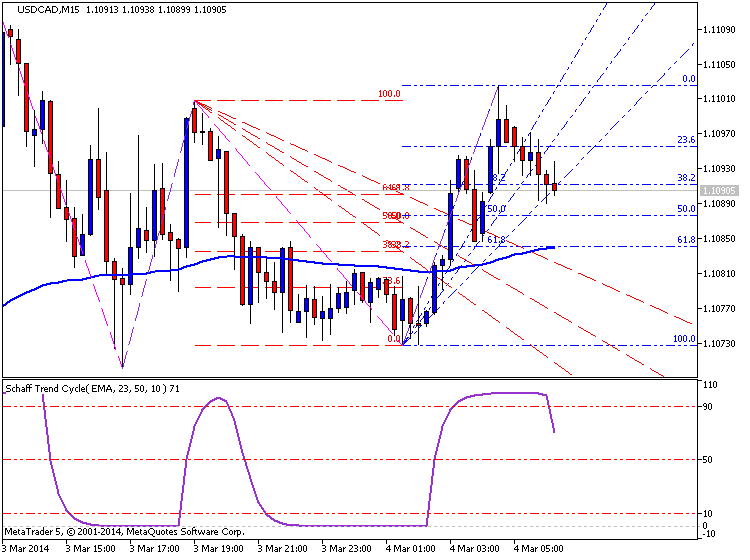

newdigital, 2014.03.05 14:31

2013-03-05 13:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

- past data is 127K

- forecast data is 160K

- actual data is 139K according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

ADP National Employment Report: Private Sector Employment Increased by 139,000 Jobs in February

Private sector employment increased by 139,000 jobs from January to February according to the February ADP National Employment Report(R). Broadly distributed to the public each month, free of charge, the ADP National Employment Report is produced by ADP(R), a leading global provider of Human Capital Management (HCM) solutions, in collaboration with Moody's Analytics. The report, which is derived from ADP's actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 8 pips price movement by USD - ADP Non-Farm Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

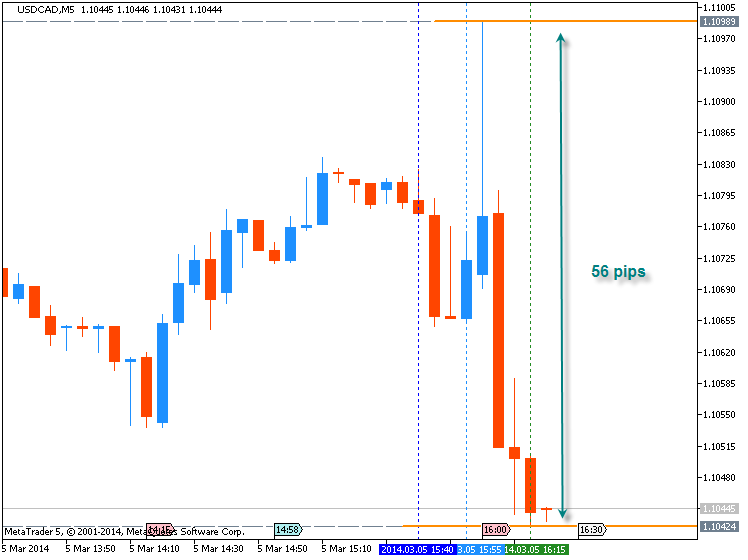

newdigital, 2014.03.05 16:27

2013-03-05 15:00 GMT (or 16:00 MQ MT5 time) | [CAD - Interest Rate]

- past data is 1.00%

- forecast data is 1.00%

- actual data is 1.00% according to the latest press release

if actual > forecast = good for currency (for CAD in our case)

==========

Bank of Canada leaves interest rate unchanged at 1%

The Bank of Canada left its benchmark interest rate unchanged in March in a widely expected decision and repeated language from its January policy statement on Wednesday.

In its sixth meeting under the helm of Governor Stephen Poloz, the BoC said it was leaving its overnight cash rate unchanged at 1%, in line with expectations.

“With inflation expected to be well below target for some time, the downside risks to inflation remain important,” said a statement accompanying the announcement.

The BoC judged “that the balance of risks remains within the zone for which the current stance of monetary policy is appropriate. The timing and direction of the next change to the policy rate will depend on how new information influences this balance of risks.”

USDCAD M5 : 56 pips price range movement by CAD - Interest Rate news event :

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.06 16:12

2013-03-06 15:00 GMT (or 16:00 MQ MT5 time) | [CAD - Ivey PMI]

- past data is 56.8

- forecast data is 53.5

- actual data is 57.2 according to the latest press release

if actual > forecast = good for currency (for CAD in our case)

==========

Canadian Ivey PMI rises to 4-month high of 57.2 in February

Canada's Ivey purchasing managers’ index expanded at a faster rate than expected in February, easing concerns over the country’s economic outlook, industry data showed on Thursday.

In a report, the Richard Ivey School of Business said its purchasing managers’ index rose to 57.2 last month from a reading of 56.8 in January. Analysts had expected the index to decline to 54.0 in February.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 36 pips price movement by CAD - Ivey PMI news event

Forum on trading, automated trading systems and testing trading strategies

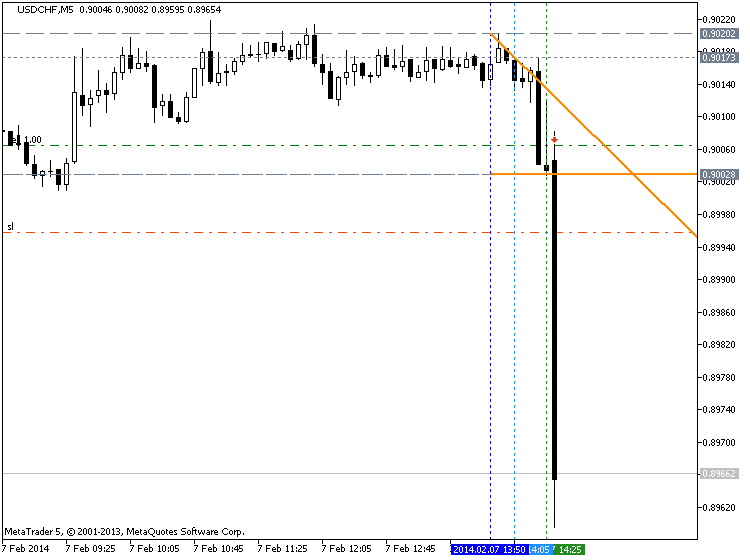

newdigital, 2014.03.07 10:25

Trading the News: U.S. Non-Farm Payrolls (based on dailyfx article)

The U.S. Non-Farm Payrolls report may prop up the dollar as the economy

is expected to add another 150K jobs in February, and a pickup in

employment may instill a bullish outlook for the greenback as the

Federal Reserve is widely anticipated to discuss another $10B taper at

the March 19 meeting.

What’s Expected:

Time of release: 03/07/2014 13:30 GMT, 8:30 EST

Primary Pair Impact: EURUSD

Expected: 150K

Previous: 113K

Forecast: 100K to 150K

Why Is This Event Important:

However, the recent slowdown in economic activity certainly raises the risk of seeing another weaker-than-expected NFP print, and a dismal result may heighten the bearish sentiment surrounding the reserve currency as it limits the Fed’s scope to normalize monetary policy sooner rather than later.

How To Trade This Event Risk

Bullish USD Trade: NFP Increases 155K+; Unemployment Holds at 6.6%

- Need to see red, five-minute candle following the print to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

January 2014 U.S. Non-Farm Payrolls :

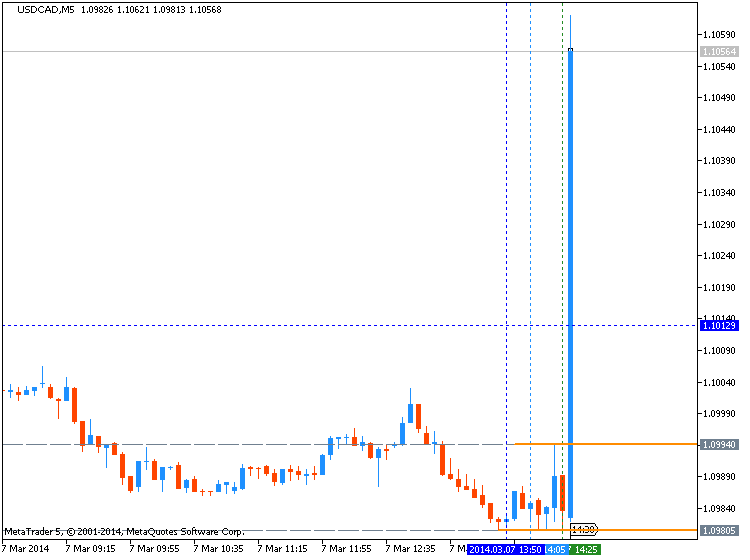

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 94 pips price movement by USD - Non-Farm Payrolls news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is above Ichimoku cloud/kumo and Sinkou Span A for primary bullish market condition. Chinkou Span line of Ichimoku indicator crossed historical price on open bar from above to below which is indicating the possible correction within primary bullish on the near future.

If the price will break 1.1053 support on D1 close bar from above to below so we may see good resistance on D1 close bar so we may see good breakdown (good to open sell trade)If not so we may see the ranging market condition within primary bullish on D1.

UPCOMING EVENTS (high/medium impacted news events which may be affected on USDCAD price movement for this coming week)

2013-03-03 01:45 GMT (or 02:45 MQ MT5 time) | [CNY - HSBC Final Manufacturing PMI]

2013-03-03 13:30 GMT (or 14:30 MQ MT5 time) | [CAD - RMPI]

2013-03-03 15:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

2013-03-05 15:00 GMT (or 16:00 MQ MT5 time) | [CAD - Interest Rate]

2013-03-06 13:30 GMT (or 14:30 MQ MT5 time) | [CAD - Building Permits]

2013-03-06 15:00 GMT (or 16:00 MQ MT5 time) | [CAD - Ivey PMI]

2013-03-06 16:30 GMT (or 17:30 MQ MT5 time) | [CAD - Gov Council Member Speech]

2013-03-07 13:30 GMT (or 14:30 MQ MT5 time) | [CAD - Trade Balance]

2013-03-07 13:30 GMT (or 14:30 MQ MT5 time) | [CAD - Employment Change]

2013-03-07 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on USDCAD price movement

SUMMARY : bullish

TREND : correction

Intraday Chart