You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

It is related to Ichimoku indicator. I discussed it on the other forum, or just use those links here :

Ichimoku :

About AbsoluteStrength indicator (created by Igorad) so use this one :

Forum on trading, automated trading systems and testing trading strategies

Gold is Reaching at 1270

newdigital, 2013.07.01 21:04

How can we know: correction, or bullish etc (in case of using indicator for example)?

well ... let's take AbsoluteStrength indicator from MT5 CodeBase.

bullish (Bull market) :

bearish (Bear market) :

ranging (choppy market - means: buy and sell on the same time) :

flat (sideways market - means: no buy and no sell) :

correction :

correction in a bear market (Bear Market Rally) :

So, combination of Ichimoku (see my previous posts here) with AbsoluteStrength indicator (this post) together with support/resistance lines (I am using MaksiGen indicator) = my technical analysis here.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.06 16:42

Forex Fundamentals - Weekly outlook: April 7 - 11The dollar pared back gains against the euro on Friday and fell against the yen, despite the latest U.S. employment report indicating that the economic recovery is on track.

The Labor Department reported Friday that the U.S. economy added 192,000 jobs in March, below expectations for jobs growth of 200,000. February’s figure was revised up to 197,000 from a previously reported 175,000. The U.S. unemployment rate remained unchanged at 6.7%, compared to expectations for a tick down to 6.6%.

The data disappointed some market expectations for a more robust reading but indicated that the Federal Reserve is likely to stick to the current pace of reductions to its asset purchase program.

EUR/USD ended Friday’s session down 0.12% to 1.3703, after falling to a five-week low of 1.3673 earlier. For the week, the pair lost 0.52%.

The shared currency remained under pressure after the European Central Bank said Thursday it would use unconventional measures if necessary to stave off the risk of deflation in the euro zone.

ECB President Mario Draghi said the governing council was "unanimous" in its commitment to using all unconventional instruments within its mandate to cope with the risk of low inflation becoming entrenched. He added that the bank discussed the possibility of negative deposit rates. The comments came after the bank left rates on hold at a record low 0.25%.

USD/JPY fell 0.63% to end Friday’s session at 103.27, after hitting session highs of 104.13 immediately following the release of the jobs report.

Elsewhere, the Canadian dollar rose to five-week highs against the greenback, bolstered by a stronger-than-forecast domestic jobs report for March.

Statistics Canada reported that the economy added 42,900 jobs last month, well above the forecast jobs growth of 21,500, while the unemployment rate unexpectedly ticked down to 6.9% from 7.0% in February.

USD/CAD fell 0.51% to settle at 1.0980, after falling to a session low of 1.0955 after the release of the data. For the week, the pair ended down 0.67%.

The Australian and New Zealand dollar were also higher against the greenback on Friday, with AUD/USD settling at 0.9292, not far from the four month peaks of 0.9306 hit earlier in the session. NZD/USD was up 0.63% to 0.8598.

In the week ahead, markets will be focusing on Wednesday’s minutes of the Fed’s most recent policy setting meeting. Monetary policy meetings by the Bank of Japan and the Bank of England will also be closely watched.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, April 7

- Markets in China will be closed for a national holiday.

- The

Swiss National Bank is to publish data on its foreign currency

reserves. This data is closely scrutinized for indications of the size

of the bank’s operations in currency markets. Switzerland is also to

release data on consumer price inflation.

- The Bank of Canada is to publish its quarterly business outlook survey.

Tuesday, April 8- Both Australia and New Zealand are to publish private sector reports on business confidence.

- The

BoJ is to announce its benchmark interest rate and publish its monetary

policy statement, which outlines economic conditions and the factors

affecting the bank’s decision. The announcement is to be followed by a

press conference. Japan is also to publish data on the current account.

- Switzerland

is to release data on retail sales, the government measure of consumer

spending, which accounts for the majority of overall economic activity.

- The U.K. is to release a report on industrial and manufacturing production, a leading indicator of economic health.

- Canada is to produce data on building permits.

Wednesday, April 9- Australia is to release private sector data on consumer sentiment, as well as official data on home loans.

- Both Germany and the U.K. are to produce data on the trade balance, the difference in value between imports and exports.

- Later Wednesday, the Federal Reserve is to publish what will be the closely watched minutes of its latest policy meeting.

Thursday, April 10- New Zealand is to release private sector data on manufacturing activity.

- Australia

is to release data on the change in the number of people employed and

the unemployment rate, in addition to private sector data on inflation

expectations.

- Japan is to produce a report on core machinery orders.

- The BoE is to announce its benchmark interest rate.

- Canada is to publish data on new house price inflation.

- In the U.S., the Labor Department is to release its weekly report on initial jobless claims.

Friday, April 11Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.06 16:47

AUDUSD Fundamentals - weekly outlook: April 7 - 11The Australian dollar ended Friday’s session at a five-month high against its U.S. counterpart, as traders reassessed their expectations for how quickly the Federal Reserve will roll back its stimulus program following the release of disappointing U.S. employment data.

AUD/USD rose to 0.9306 on Friday, the pair’s highest since November 21, before subsequently consolidating at 0.9292 by close of trade on Friday, up 0.66% for the day and 0.47% higher for the week.

The pair is likely to find support at 0.9204, the low from April 3 and resistance at 0.9332, the high from November 21.

The Labor Department reported Friday that the U.S. economy added 192,000 jobs in March, below expectations for jobs growth of 200,000. February’s figure was revised up to 197,000 from a previously reported 175,000.

The U.S. unemployment rate remained unchanged at 6.7%, compared to expectations for a tick down to 6.6%.

The data disappointed some market expectations for a more robust reading but indicated that the Federal Reserve is likely to stick to the current pace of reductions to its asset purchase program.

The Aussie drew additional support from hopes that China will implement economic stimulus measures in the near-term to shore up slowing growth.

The Asian nation is Australia’s biggest trade partner.

Meanwhile, in Australia, official data released Thursday showed that retail sales rose 0.2% in February, less than the expected 0.3% increase.

A separate report showed that Australia's trade surplus narrowed to A$1.20 billion in February, from A$1.39 billion in January. Analysts had expected the trade surplus to narrow to A$0.82 billion in February.

The data came after the Reserve Bank of Australia held its benchmark interest rate unchanged at a record low of 2.50% at the conclusion of its policy meeting on Tuesday.

Commenting on the decision, RBA Governor Glenn Stevens said borrowing costs were likely to remain low for an extended period of time.

Data from the Commodities Futures Trading Commission released Friday showed that speculators significantly reduced their bearish bets on the Australian dollar for the third consecutive week in the week ending April 1.

Net shorts totaled 4,880 contracts, compared to net shorts of 20,527 in the preceding week.

In the week ahead, market players will be focusing on Wednesday’s minutes of the Fed’s most recent policy setting meeting for further clues on the future course of monetary policy.

Australian employment data scheduled for Thursday will also be closely-watched.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, April 7

- Markets in China will be closed for a national holiday.

Tuesday, April 8- Australia is to publish private sector reports on business confidence.

Wednesday, April 9- Australia is to release private sector data on consumer sentiment, as well as official data on home loans.

- Later Wednesday, the Federal Reserve is to publish what will be the closely watched minutes of its latest policy meeting.

Thursday, April 10- Australia is to release data on the change in the

number of people employed and the unemployment rate, in addition to

private sector data on inflation expectations.

- In the U.S., the Labor Department is to release its weekly report on initial jobless claims.

Friday, April 11Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.08 17:41

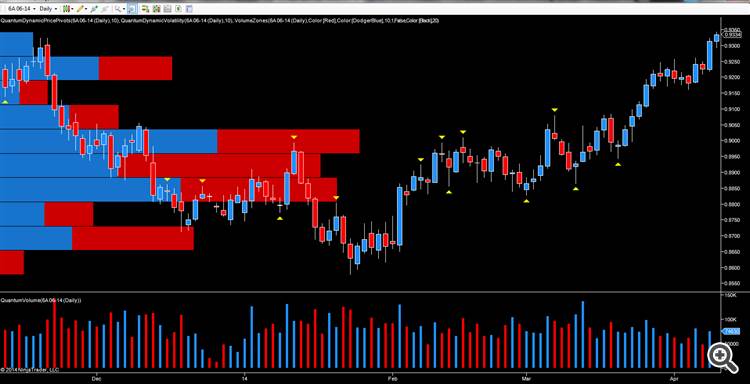

AUDUSD Technical Analysis (based on dailyfx article)

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.09 07:47

2014-04-09 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Home Loans]

if actual > forecast = good for currency (for AUD in our case)

==========

Australia Home Loans Rise 2.3% In February

The total number of home loans issued in Australia was up a seasonally adjusted 2.3 percent on month in February, the Australian Bureau of Statistics said on Wednesday - standing at 52,460.

That beat forecasts for an increase of 1.5 percent following the flat reading in January.

Investment lending climbed 4.4 percent on month to A$10.737 billion after falling 3.7 percent in the previous month.

The total value of housing loans gained 2.9 percent to A$27.644 billion.

MetaTrader Trading Platform Screenshots

AUDUSD, M5, 2014.04.09

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 35 pips price movement by AUD - Home Loans news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.09 16:58

AUDUSD Technical Analysis (based on dailyfx article)

The Aussie dollar continued to build on the bullish momentum of the last few weeks, with the June futures contract closing the session with a wide spread up candle on the daily chart, surging through the 0.9300 region on good volumes. The positive tone has continued overnight and into the early London session with the pair continuing to climb higher to trade at 0.9337 at the time of writing.

Daily :

Yesterday’s price action was significant, following the recent period of sideways consolidation, which saw the pair trading in a narrow range, between 0.9170 to the downside, and 0.9255 to the upside. However, with yesterday’s price action now breaching this short term resistance level, we can expect to see further bullish momentum for the AUD/USD in the short term, particularly if the 0.9350 high of late December 2013 is breached. Below we now have a solid platform of support in place as shown on the volume at price histogram on the daily chart, and provided that volumes remain above average, then we could see a move to test the 0.9600 high of late October in due course.

Weekly :

Moving to the weekly chart, we have a similar picture with an almost perfect double bottom now developing in the timeframe, and adding further

evidence to suggest that the bottom for the pair is now firmly established in the 0.8650 range, and provided the November 2013 high is taken out, then

a return to test parity in the longer term is possible.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.10 06:55

AUDUSD Technical Analysis 10.04.2014 morning (based on dailyfx article)

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.10 08:00

2014-04-10 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Employment Change]

if actual > forecast = good for currency (for AUD in our case)

==========

Australia March Jobless Rate Falls To 5.8%Australia posted a seasonally adjusted unemployment rate of 5.8 percent in March, the Australian Bureau of Statistics said on Thursday.

That handily beat forecasts for 6.1 percent, and it was down from 6.0 percent in February.

The Australian economy gained 18,100 jobs in March 18,100 to 11,553,200 - blowing away expectations for a gain of 2,500 following the upwardly revised jump of 48,200 in the previous month (originally 47,300).

Full-time employment decreased 22,100 to 8,029,100 and part-time employment increased 40,200 to 3,524,000.

Unemployment decreased 29,900 (4.0 percent) to 713,200. The number of unemployed persons looking for full-time work decreased 16,700 to 509,800 and the number of unemployed persons only looking for part-time work decreased 13,300 to 203,400.

The participation rate was 64.7 percent - in line with forecasts but down from the upwardly revised 64.9 percent a month earlier (originally 64.8 percent).

Aggregate monthly hours worked increased 8.0 million hours (0.5 percent) to 1,617.2 million hours.

MetaTrader Trading Platform Screenshots

AUDUSD, M5, 2014.04.10

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 59 pips price movement by AUD - Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.10 21:09

AUD/USD holds above 0.9400

Even though the AUD/USD has seen intraday volatility, the pair continues to trade above 0.9400, close to multi-month highs during the New York session.

The Aussie climbed to a fresh 5-month high of 0.9460 Thursday, underpinned by much better than expected Australian employment figures which offset falling stocks weigh. With dips contained by the 0.9400 mark, the AUD/USD has managed to hold onto gains and it is presently at 0.9420, up 0.3% on the day.

AUD/USD technical levels

In terms of technical levels, next resistances are seen at 0.9460 (Apr 10 high), 0.9480 (Nov 8 high) and 0.9500 (psychological level). On the flip side, supports are seen at 0.9400 (intraday level), 0.9370 (Apr 10 low) and 0.9334 (Apr 9 low).