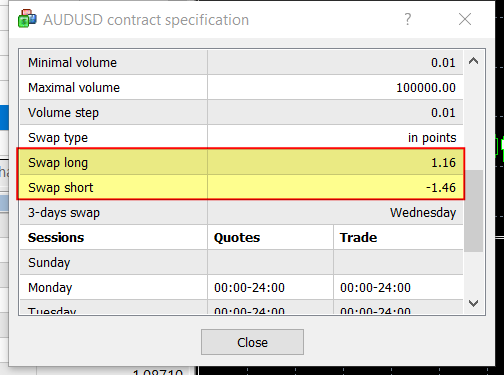

You can check the swap for long and short, and only trade symbols and direction giving a positive value.

By code :

I don't know anything about coding so I am not sure what do those three lines mean. Also I am looking for solution for all trading symbols, including nondefault ones (meaning added upon request to the broker), not just currency pairs. Any solution that doesn't include coding and/or hiring programmer?

I provided you the solution : You can check the swap for long and short !

Here are most likely important three lines: Swap long, Swap short, 3-days swap. What should I do with those three lines towards figuring out if Swap of opened trading position will go into negative value or into positive value? Obviously I wonder what to do with those 3 lines BEFORE entering the position to reach the ultimate goal of this little research which is: do NOT enter the position if Swap is going into negative and further decreasing in negative, regardless if having opened position in profit or loss.

I will try to guess the answer on my own on the question what to do with those three lines: Every Wednesday, even if the Wednesday is holiday ( ! ), at midnight (but which timezone?) the Swap will change: if having Long position opened then it will change in positive value for plus 1.16. If having Short position opened then it will change in negative value for minus 1.46

No, I don't think this is correct. Mainly because in third line says ''3-days'' so I am not sure what does that mean.

Edward010: s ''3-days'' so I am not sure what does that mean

| Swap over the weekend. |

| Swap over the weekend. |

Dear Sir, from which second to which second of which timezone over the weekend? Are you saying from the moment market closes on friday evening to the moment market opens two days later, on sunday, evening? So Swap is increased in positive for 1.16 if having long position opened (or swap is decreased in negative for 1.46 if short position) as soon as market opens on sunday? I am referring to above example.

first problem: But why does it say Wednesday then?

second problem: I have seen many situations where Swap has changed during the business day. How about that?

third problem: Believe it or not, I even saw situation that Swap goes from negative, via 0, to positive of vice versa.

fourth problem: I still need to know, please dear whroeder1, the confirmation if the following is correct from my previous message:

"values in Swap Long and Swap Short Lines are only per 0.01 investment. So if investment is 0.1 then the value 1.16 OR 1.46 needs to be multiplied with 10"

Would appreciate more in detail instructions about those four lines:

volume step (the confirmation if quoted text is correct

swap long

swap short

3-days swap

-

-

FX opens 5pm ET Sunday and ends 5pm ET Friday. Some brokers start after (6pm is common/end before (up to 15 minutes) due to low volatility.

Swap is computed 5pm ET. No swap if no open orders at that time.

Brokers use a variety of timezones. Their local time (with or without DST,) GMT/UTC, GMT+2, NY+7.

Only with NY+7 does the broker's 00:00 equals 5pm ET and the start of a daily bar is the start of a new FX day.

GMT brokers, means there is a 1 or 2 hour D1/H4 bar on Sunday (depending on NY DST,) and a short Friday bar.

GMT+2 is close but doesn't adjust for NY DST.

EET is closer except when their DST doesn't match NY's. Last Sunday of March and 1:00 on the last Sunday of October vs second Sunday in March and return at 2:00 a.m. EDT to 1:00 a.m. EST on the first Sunday in November.

Non-NY+7, means the chart daily bar overlaps the start, and converting broker time to NY time requires broker to GMT to NY timezone conversions.

- If you search the web you will find differing answers. Those are all wrong (half the year) because they do not take NY DST into account (or that it changed in 2007 [important when testing history.])

-

- So Friday 5pm, Saturday 5pm, Sunday 5pm.

You can check the swap for long and short, and only trade symbols and direction giving a positive value.

By code :

Just for Swap a trader can not adopt directions, second positive swap not available always usually both sides negative.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Good day all,

I would like to encourage you if you could please kindly read entire post as I also put effort to describe my problem in best possible way.

Inquiry regarding the Swap value - referring to the actual Swap column located below in MT platform where the list of currently opened trading position is. I did some research about Swap so I can have a basic understanding of it. Therefore there is NO need to tell me what Swap is. My question is different and unable to get information on my own could partially show that I don't have complete understanding of ''Swap''.

Question is: I noticed it is much easier for me (probably for others too) to wait longer period of time, e.g. months, perhaps even entire year, for opened position to come from current loss to current profit if Swap is positive and increasing. Obviously increasing in positive value. If it was negative and further decreasing (obviously decreasing in negative value) then I am all the time worried whether or not the trend, after coming from current lose to 0.00 (no profit no loss), will further go so much into the wanted direction that it will cover negative and still decreasing value of Swap so I could close the position in profit and not profit deducted by negative Swap resulting in a loss instead of profit. My question: Is there anything I could do BEFORE entering the position, regardless of its type, to protect myself from Swap and to make sure that the Swap will be positive and increasing (obviously increasing in positive value)?

To describe the issue even better, I will create example with completely random numbers (please pay attention to minus/plus because they are most important in showing my question based on random example):

Current Loss: -3500.04 EUR

Current Swap at the time of current loss -3500.04 EUR: -2.11 EUR

Time needed for current loss to come to 0.00 EUR: 10 months

Swap at 0.00 EUR (no profit no loss of opened position): -236.29 EUR

Time still in opened position to get some profit so I didn't wait 10 months for nothing: 5 days

Current profit of opened position: +212.11 EUR

Swap at current profit +212.11 EUR: -241.15 EUR

Here you see example where my question has highest possible severity. The minimum required increase of profit is 29.05 EUR (the difference between 241.15 and 212.11 plus 0.01 so it comes in profit) and plus some extra cents to protect*** myself that current market price would ''jump'' to the unwanted direction at exact microsecond of closing the position. That would result into a loss so such protection*** is required. What I just said is minimum requirement in order to close opened position in profit. Obviously then expectation can be increased saying: I had to wait 10 months and 5 days. Instead of wanting to close position with few cents profit, I want higher profit.

On this example you can see in practice why I am asking this question. What could happen is that trend will never, or at least in next few years not, go so far into the wanted direction to make needed profit of 29.05 EUR so negative Swap can be covered. There is a huge risk of trend reversal and I would waste 10 months and 5 days of waiting.

So to repeat my question again: What could I do, BEFORE opening the position, to make sure that the Swap will go into positive value and all the time increasing in positive? If getting myself negative calculation/research feedback on doing this, I may change my mind and not open the position. This would be partial protection from aspect of Swap just in case if the trend, after entering position, goes into unwanted direction.

Your reply with solution would be highly appreciated.

Have a great day!