Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.26 14:21

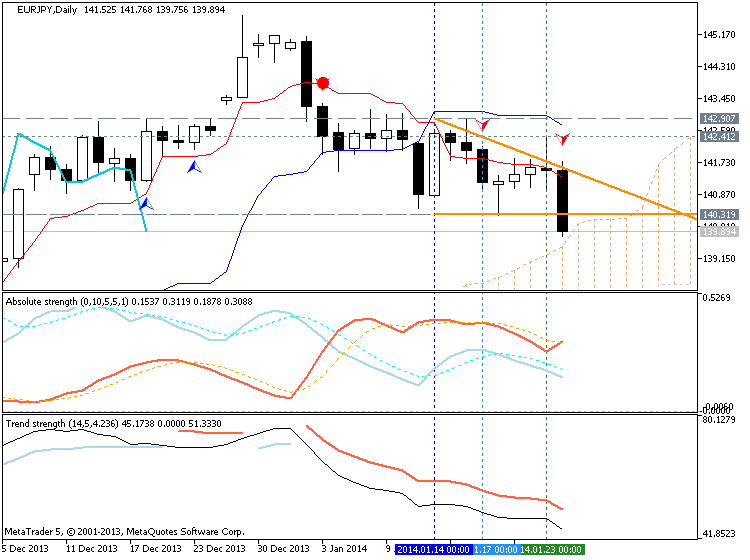

EUR/JPY Weekly Fundamental Analysis January 27 – 31, 2014 Forecast (based on fxempire.com article)

The EUR/JPY ended up lower for the week as the yen once again became a

safe haven after traders abandoned equities are lackluster earnings

data. The pair closed at 139.88 easing from the weekly high of 142.41

after the Bank of Japan held rates and stimulus at their monthly

meeting. “There’s definitely some nervousness. The world is suffering

from the emerging markets’ flu,” said Michael James, managing director

of equity trading at Wedbush Securities in Los Angeles. Worries over

China’s growth surfaced after a disappointing manufacturing number

spurred the S&P 500′s 0.9 percent drop on Thursday.

China’s efforts to contain a “financial excesses” won’t be positive for

growth, Gibbs said. The next major psychological level for Aussie is the

2010 low near 80 cents, he said.

The China Banking Regulatory Commission’s order did not mention concerns

that a 3 billion yuan (US$496 million) trust product distributed by

Industrial & Commercial Bank of China may default after a coal miner

that borrowed the funds collapsed, said the people, who asked not to be

identified. Regional CBRC offices were told to also closely monitor

risks from trust and wealth management products, they said.

The German IFO business climate for industry and trade will likely

increase further in January as suggested by both the PMI composite and

the ZEW economic sentiment. We expect the IFO business climate index to

increase for the third consecutive month, to 110.2 after 109.5 in

December. Our expectation is based on a continuous improvement in

business expectations in the manufacturing industry since April 2013.

Traders expect both the current conditions index and the expectations

index to have increased (from 111.6 to 111.9 and from 107.4 to 108.1

respectively). Similarly, the European Commission’s Economic Sentiment

Indices should post a further broad-based improvement in January as the

recovery gathers momentum in several countries, including Germany or

Spain.

Just about EURJPY using Ichimoku

It was breakdown on H4 timeframe (Chinkou Span line crossed historical price from above to below) and the price was stopped near 139.75 support.

D1 timeframe - price crossed 140.31 support from above to below on open bar and trying to break Sinkou Span line to be turned from bullish to bearish market condition. If price will crossed 140.31 support and Sinkou Span A line so we may see ranging market condition within primary bearish.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Support : 139,063

Resistance: 140,625

Trend Inversion:142,7029 (AMA Indicator)