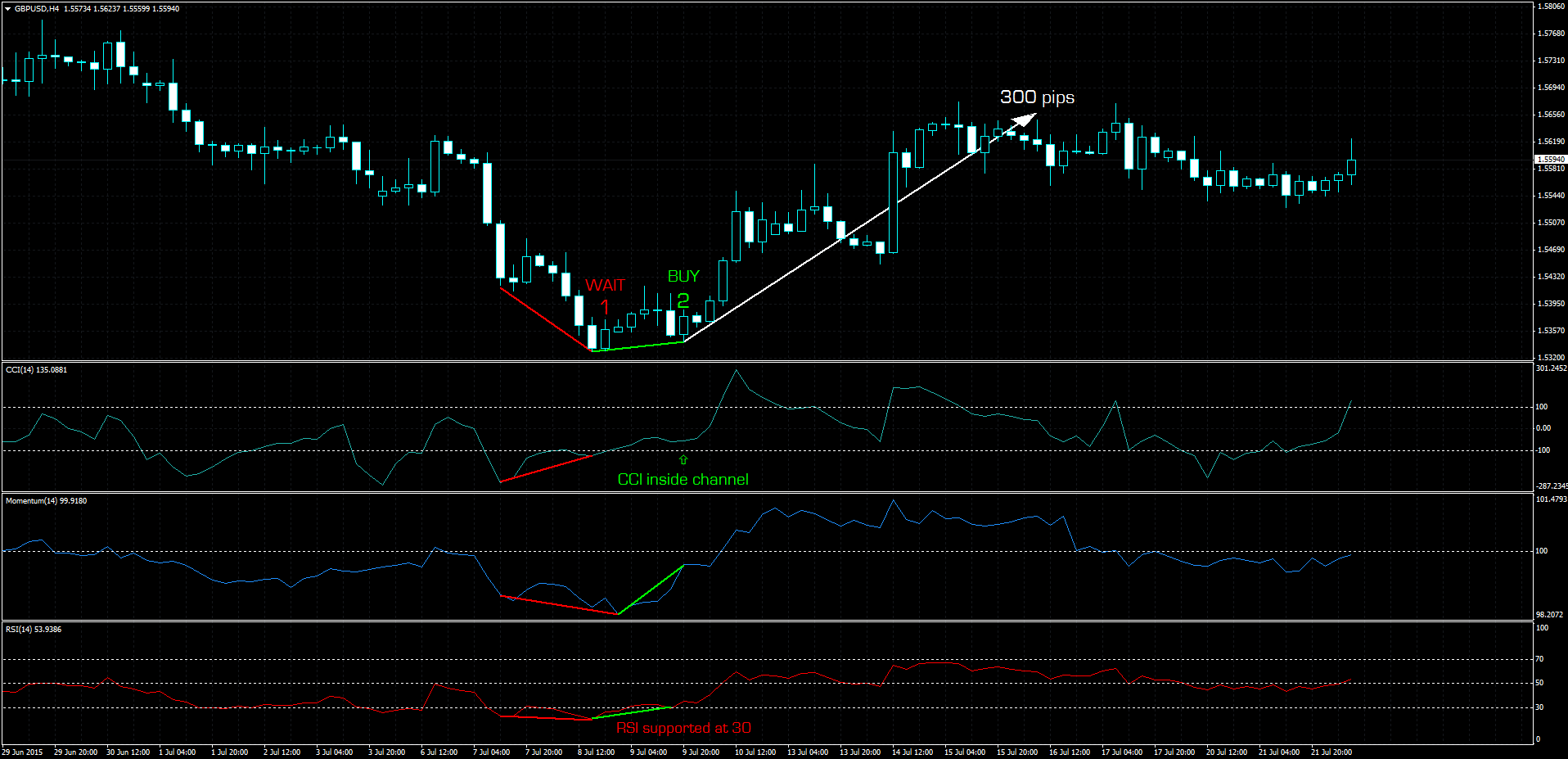

Just another example on GBPUSD H4 chart:

You can enter on 1 or next candle, but...

CCI < -100

RSI < 30

There's no clear divergence on RSI and Momo...

Better entry on point 2 (24H later):

CCI > -100

RSI supported at 30

All indicators rising

I'm studying some charts and it seems that everytime this setup is forming, something's gonna happen...

300 pips in this case.

Nice thread

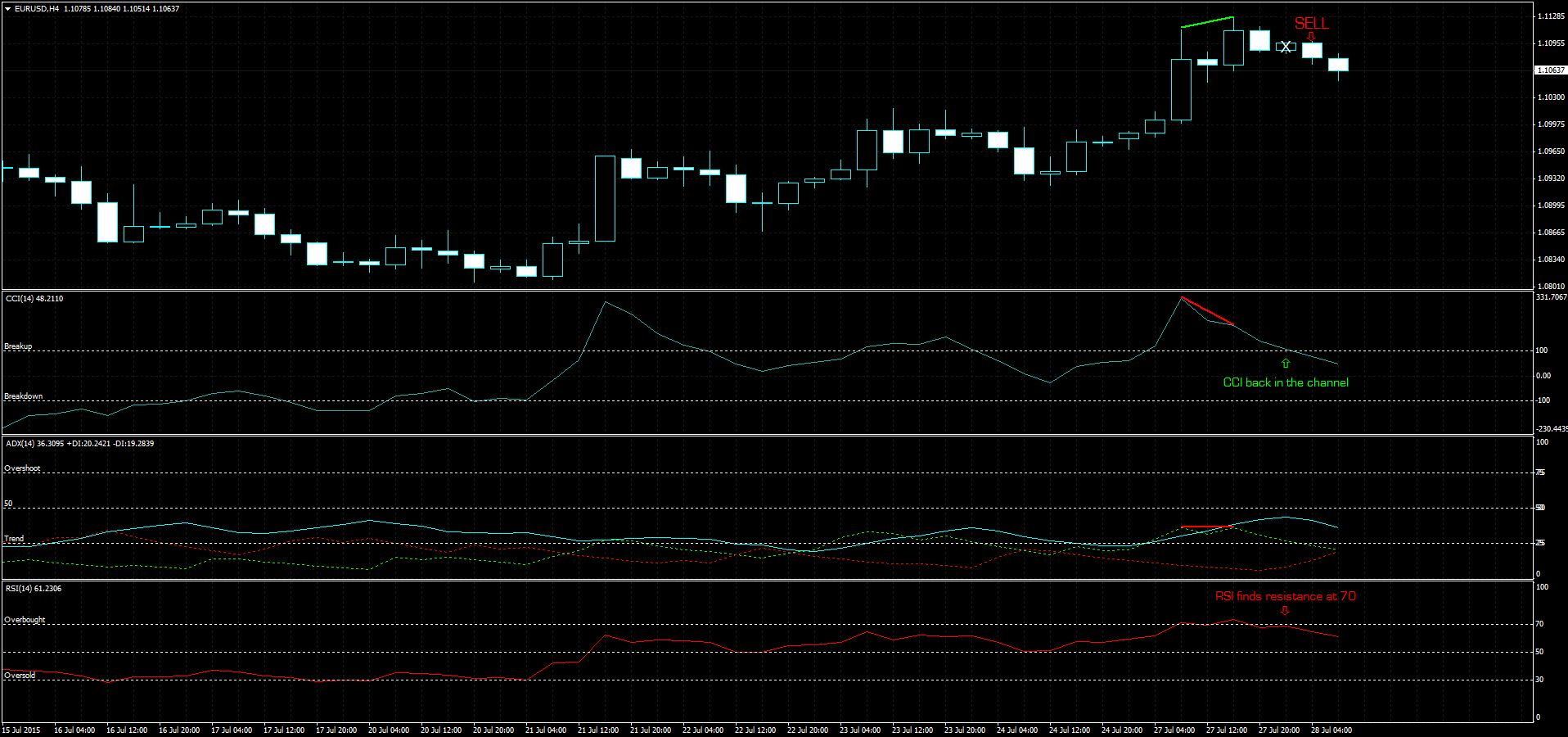

Another way to apply the same concepts, this time using ADX too...

Classic divergences, CCI comes back in the channel and RSI finds resistance at 70. SELL!

Good subject.I am interested in divergence trading too. I see you that you use standard period for indicators that's also good.Beacuse there is nothing related to periods maybe you can find some x period work for x time but in the end when it stops working it will cost you.No need to waste time for try to find perfect period.I try and that's my experience about it.So for me try to find a way to trade with standard periods beacuse herds use standard settings too  Also divergence trading is very slick subject try to filter some signals.Lastly use 2 timeframe for divergence trading for example h1 and h4 or m1 and m5..I mean one timeframe is less and 3 timeframe is more.both makes you confused.

Also divergence trading is very slick subject try to filter some signals.Lastly use 2 timeframe for divergence trading for example h1 and h4 or m1 and m5..I mean one timeframe is less and 3 timeframe is more.both makes you confused.

lastly now my divergence strategy gives sell signal on ukoil..I am a little late. it gives at 44.92 now price is 44.84 i think it may drop to 44.5xxx..Another important hint i think it is a general hint for all kind of strategies.We should not take signals between sessions i mean when the volatility is low

Another sell on ukoil 50.45 it may drop to 49.8x while big guys taking their profit we can harvest some pips

if it will pass last swing high 50.56 i will close it.Nothing is %100 in this game. With the help of soft martingale(it is a spreadsheet in somewhere in this forum) it is doing good.

Re: Trading Strategy based on Indicators Divergence Good subject.I am interested in divergence trading too. I see you that you use standard period for indicators that's also good.Beacuse there is nothing related to periods maybe you can find some x period work for x time but in the end when it stops working it will cost you.No need to waste time for try to find perfect period.I try and that's my experience about it.So for me try to find a way to trade with standard periods beacuse herds use standard settings too

Also divergence trading is very slick subject try to filter some signals.Lastly use 2 timeframe for divergence trading for example h1 and h4 or m1 and m5..I mean one timeframe is less and 3 timeframe is more.both makes you confused.

Also divergence trading is very slick subject try to filter some signals.Lastly use 2 timeframe for divergence trading for example h1 and h4 or m1 and m5..I mean one timeframe is less and 3 timeframe is more.both makes you confused.I agree. Market makers do simple things, use classic indicators and standard periods.

Trading divergences is one of the most secure way to trade, because they watch them!

... and never understimate RSI! I did and I was wrong.

I agree. Market makers do simple things, use classic indicators and standard periods.

Trading divergences is one of the most secure way to trade, because they watch them!

... and never understimate RSI! I did and I was wrong.Thnx for the advice.Generally I only understimate the underestimatetor  . i tried many of them and yes RSI is a good one.

. i tried many of them and yes RSI is a good one.

Thnx for the advice.Generally I only understimate the underestimatetor

. i tried many of them and yes RSI is a good one.

. i tried many of them and yes RSI is a good one.I am also using the RSI Indicator as it is giving me good trading performance and this way i can use it in my trades easily

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hi,

still seeking the perfect trading system...

today I want to suggest a simple strategy based on price-indicators divergence.

[H4 Divergence]

#Currency

Any

#Timeframe

H4

#Indicators

CCI (14)

Momentum (14)

RSI (14)

#Trading Conditions

Look for any divergence on chart and monitoring situation...

#BUY

Minimum trading conditions:

-Divergence on 2 of 3 indicator

-CCI > or = -100

-RSI > or = 30

#SELL

Minimum trading conditions:

-Divergence on 2 of 3 indicator

-CCI < or = 100

-RSI < or = 70

#Entry Point

To identify an entry point you can look at H1 chart instead of H4, using MTF indicators and setting Timeframe on 240.

Enter after H1 candle close.

#Stop Loss, Trailing Stop and Take Profit

Do what you want

EXAMPLE

Template:

3i-CCI-Mom-RSI.tpl

I appreciate any suggestion.

Thanks.