This is an example of concepts and simple algorithms that we can work, based on chess. We are far way from a real game against the market. Anyway, I think this can help as brainstorming.

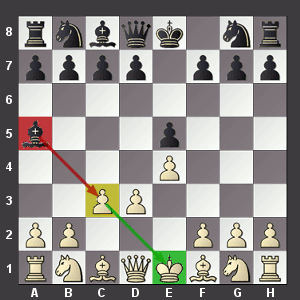

The Block TacticA Block is a defensive tactic. If your pieces have come under attack and you can't move that piece from its current position, or don't want to do that, you can block the attack with another piece, such as a Pawn (as pictured below).

The Block Tactic: Applying this tactic in Trading Systems

We can use the same tactic in trading systems, if we figure out some risky market conditions.

For instance, you can block your trading system from some kind of economic calendar news, that in some way will impact your strategy.

Most of the traders are blind about news, and some of them use the news as a trading style.

But how much use a block algorithm to avoid news risk, like the Chess Block Tactic?

interesting idea. lets discuss!

i cannot see direct connection and usage as:

1) as far as i know, all or most of chess programs are working on brute force principle:

a) checking position against the library (of openings mostly)

b) evaluating of each possible position is done by weighting position of chess pieces against the board fields

c) additional logic is used only where it can be well described, like checkmate with two bishops

so chess programs do not have games intelligence algorithm included, they are just evaluating possible positions and based on that evaluation choose the move.

2) blockings, attackings etc. are terms used to describe the strategy to beginners. Masters are not considering this elements, but are seeking for position where they will have strategic advantage which will put them in position where the opponent will not be able to defend itself from loss.

interesting idea. lets discuss!

i cannot see direct connection and usage as:

1) as far as i know, all or most of chess programs are working on brute force principle:

a) checking position against the library (of openings mostly)

b) evaluating of each possible position is done by weighting position of chess pieces against the board fields

c) additional logic is used only where it can be well described, like checkmate with two bishops

so chess programs do not have games intelligence algorithm included, they are just evaluating possible positions and based on that evaluation choose the move.

2) blockings, attackings etc. are terms used to describe the strategy to beginners. Masters are not considering this elements, but are seeking for position where they will have strategic advantage which will put them in position where the opponent will not be able to defend itself from loss.

graziani, thanks for sharing, your ideas are very welcome.

Yes, you are right, the connections are complex, but I believe we can evolve in these directions. Let's discuss and try to find the connections, if they really exists.

About your analysis, I see it as (please correct if I'm wrong):

1) Analysis about building chess games. This is very good, since being rich of algorithms, and we can explore too.

2) Analysis about chess tactics and strategies.

Well, in this sense, I totally agree about 1), and see several similar building blocks when we compare chess systems with trading systems. For instance, a) checking position against the library, there are several strategies that do that, mainly using candle patterns. This is just an example, I see great points to discuss on all your items.

About 2), you are right about the concept and strategic vision, but we can explore tactical and strategic levels, right? So, my idea is using popular terms of easy advice about complex tactics, for instance grand masters like Kasparov can create complex blocking strategies for their opponents. But it would be nice have the concepts, ideas and terms you think are correct, so please go ahead.

From your great explanation at 2), maybe we can see a connection between bad vision of chess beginners and traders beginners. Can traders beginners seek for a trading position that they will have strategic advantage? And how many traders think of that?

Thanks again.

I believe that there are several tatics and strategies from Chess game that can be adapted to a trading system.

So I decided create this topic to join some Chess game strategies with trading systems.

I have similar topics in other languages, but they are focused in general games (Portuguese) and soccer (Spanish).

But if you like chess, let's try "play" together against the market! But take care, market is a grand master as well as Garry Kasparov and Magnus Carlsen playing together against us!

The idea here in this topic is just study Chess, so the specific topic rules are:

1) Follow the Forum rules;

2) The main idea is bring tactics and strategies from Chess that in some way could be modeled in trading algorithms;

3) It's possible bring some board pictures (for instance, with arrows or graphical description) to easy understanding or any other pictures and videos to ilustrate your ideas;

I really don't see how you can use (even adapted) some tactics or strategies from Chess to trading. They are very different things in several ways :

- Chess is a game implying 2 persons (or 1 computer and 1 person), who are playing one after another each turn. Trading 1 person or computer against a market (a lot of person/computer) who are playing everyone at the same time.

- On each turn there dozens of possibilities of movement in Chess. At each time they are only 2 possibilities for the market to move up or down.

- In trading you have spread (and/or commission/fee), it's an important component of the "game". What can be the equivalent in Chess ?

- Trading implies "playing" with your money which leads to an other component of the "game" : psychology. Of course in Chess psychology can play an important role too, but there is no money implied (at least directly). The psychology of 1 against 1 game compared to 1 against the market, seems fundamentally different to me. Obviously if 1 computer is implied, there is no psychology.

Anyway, it may be an interesting discussion and I am curious to see where that can lead.

I believe that there are several tatics and strategies from Chess game that can be adapted to a trading system.

Good point, interesting debate!

I think so, there are certain similarities between chess and trading, but from a very, very, abstract view, IMHO.

(1) For us humans, chess is something like a deterministic chaotic system, just like human behavior.

From this point, however, equivalences between chess/trading strategy (and tactics) are rather subjective! For example, for me, such trading strategies would be about hypothesizing about current economic scenarios that may trigger major price movements. In this sense, the public debt of western countries is the Queen, world corruption is a rook (there are many countries blocked because of this), social revolutions are another rook, the next mini ice age is a bishop, etc., etc.

I really don't see how you can use (even adapted) some tactics or strategies from Chess to trading. They are very different things in several ways :

- Chess is a game implying 2 persons (or 1 computer and 1 person), who are playing one after another each turn. Trading 1 person or computer against a market (a lot of person/computer) who are playing everyone at the same time.

The second one is the reality, i.e., our power to create a brainstorming. To explain this, I created an utopic scenario where Kasparov, Soros, Buffet and Carlsen are in a meeting room talking about strategies.

What can we expect as a trading ideas for Soros and Buffet after this utopic fantastic meeting? My intuition says: too much. So why don't try, since probably we have here great chess players (not my case).

figurelli:

...

The second one is the reality, i.e., our power to create a brainstorming. To explain this, I created an utopic scenario where Kasparov, Soros, Buffet and Carlsen are in a meeting room talking about chess/trading tactics and strategies.

What can we expect as a trading ideas for Soros and Buffet after this utopic fantastic meeting? My intuition says: too much. So why don't try, since probably we have here great chess players (not my case).

...

Maybe, after this meeting, Soros and Buffet will come back to home with no new ideas (lost of business time), but, as you stated before, it may be an interesting discussion and I am curious too to see where that can lead.

Isn't that real? As far as I know, many chess software use huge databases (Karpov, Kasparov, Carlsen, Polgar) to take human decisions. So your EA could store those experts' thoughts and predictions. You mean this?

laplacianlab, thanks for sharing and be here, I do agree with you, but my idea was bring a way to prove the concept that this topic is valid.

The idea is: this meeting is not impossible and who knows with absolute certainty the results of this meeting?

So let's try to do something near this, since these famous guys are very busy ;-)

I see...but after 8 posts, I still no have any new idea to apply to trading

Anyway, please read again the second post (Block Tactics) and the application to trading news blocking.

Looks simple, but I use this with text mining algorithms in real time, and works fine.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

If you like chess, what about a match where you play against the Market?

But take care, Market is a Grandmaster as strong as Garry Kasparov and Magnus Carlsen playing together against us!

I believe that there are several tatics and strategies from Chess game that can be adapted to a trading system.

So I decided create this topic to join some Chess game strategies with trading systems.

I have similar topics in other languages, but they are focused in general games (Portuguese) and soccer (Spanish).

The idea here in this topic is study chess tactics and strategies and find a way to address them to the market.

And, why not (my dream), play the first match against the Market in near future !!!

The topic rules are:

1) Follow the Forum rules;

2) Forget the paradigms ;-)

3) Don't forget that the main result here must be chess tactics and strategy ideas that we can code, anyway conceptual/abstract ideas are welcome, since they can help we address the dream.

4) Any information regarding the connection between Chess and Trading, that can help are welcome too, like News, Articles, Books, Algorithms, Ideas, etc.

5) At 01/22/2014 I proposed a dream architecture, as pictured below. This will be relevant to reverse engineer the chess tactics and strategies. Anyway, anyone can propose a new dream architecture, that must address these 3 steps: