- Do you prefer to risk a fixed lot size or a percent of equity, balance or margin? Why?

- Experts: ThreeBreaky

- Which one do you prefer Martingale, Hedging or A Grid System?

Please, could you explain how "Fixed Risk Percent" works?

Hi Chadobot,

Happy New Year.

"Fixed Risk Percent" is a money management module available inside wizard. Below related article

https://www.mql5.com/en/articles/171

I have created an expert with this module and it works as same of "Minimum Allowed Trade Volume". I have also tried different percent values from 1% through 100%, different balances and leverages and always opens position with 0.01 lots.

- 2011.01.11

- MetaQuotes Software Corp.

- www.mql5.com

Hi Chadobot,

Happy New Year.

"Fixed Risk Percent" is a money management module available inside wizard. Below related article

https://www.mql5.com/en/articles/171

I have created an expert with this module and it works as same of "Minimum Allowed Trade Volume". I have also tried different percent values from 1% through 100%, different balances and leverages and always opens position with 0.01 lots.

Thanks Rosiman! Good article. Happy New Year.

See also.

- www.mql5.com

Thanks Rosiman! Good article. Happy New Year.

Well you can never be 100% right in Forex. You can make money by either or both ways-

- Greater Risk Reward ratio: Your wins are greater than your losses. At 2:1 Reward to risk ratio you can be profitable even if you are right 34% of the time.

- Greater win ratio. If your win rate is 70% you can be profitable at Reward to risk ratio of 1:2

Only thing you need to be careful of is your emotions and best way to control them is lot sizing. 2% loss per trade- You can still think logically even if you have 10 losses in row

10% loss per trade, you feel really bad with first loss. 2nd loss will make you rebellion, you want to get it back from the market ASAP. 3rd loss you are crazy now and its do or die.

Lets assume you sail through and you get it all back, but next time believe me the risk you are taking would be substabtial. That's why we have brokes in Forex not in a day but in a month or so.

(3)

3 people have not burned down their deposit yet. But no worries, the inevitable will finally come...

26% Fixed Trade Lots

(10)

5% Minimal Allowed Trade Volume(2)

... and 12 people greatly undermine their earning potential by using the fixed lot.

This survey quite clearly shows one most common mistake made by traders / investors - they do not focus on the proper money management, which is the key to success - yes, not the countless indicators or the brand new strategy that earned 1,000,000$ in 3 months (and will go bankrupt in the next 3 months).

As neerajmadan wisely said above:

"Only thing you need to be careful of is your emotions and best way to control them is lot sizing. 2% loss per trade- You can still think logically even if you have 10 losses in row"

This is in line with what I have once verified - I have executed a research on lot sizing effects on thousands of random trade results - the bottom line is that the maximum risk that you could take on a single transaction is up to 3% (you could possibly increase it to approx. 10% after several trades by proper position sizing approach - but not martingale!).

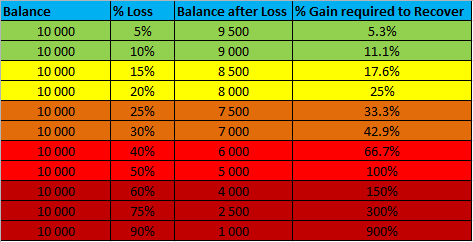

And there is still one more very important yet simple point which people often overlook - the above rule of limited % risk per trade has another important implication. With 2% risk per trade, after 10 losses in a row you are 20% down from you initial capital, but it is still possible that you will fully recover as you need 25% gain to do that - and this is quite close to the loss that you incurred. 25-30% is a boundary value of drawdown which still gives some chances of recovering - but below 30% drawdown, there is usually no chance. See below table for a simple example.

Well you can never be 100% right in Forex. You can make money by either or both ways-

- Greater Risk Reward ratio: Your wins are greater than your losses. At 2:1 Reward to risk ratio you can be profitable even if you are right 34% of the time.

- Greater win ratio. If your win rate is 70% you can be profitable at Reward to risk ratio of 1:2

Only thing you need to be careful of is your emotions and best way to control them is lot sizing. 2% loss per trade- You can still think logically even if you have 10 losses in row

10% loss per trade, you feel really bad with first loss. 2nd loss will make you rebellion, you want to get it back from the market ASAP. 3rd loss you are crazy now and its do or die.

Lets assume you sail through and you get it all back, but next time believe me the risk you are taking would be substabtial. That's why we have brokes in Forex not in a day but in a month or so.

I agree. Since I follow the primary trend and have adopted the "fixed margin percent" as money management my winning average is between 25 and 40% but with an average balance of winning trades three times higher than the average balance of losses. This means that finally my experts are able to make profits run and cut the losses.

Also my strategy is inside the table attached from Enigma71fx which I find very interesting to compare a strategy system.

- 2012.07.09

- MetaQuotes Software Corp.

- www.mql5.com

Might not be the most secure but I am using the Fixed Trade Lots.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use