Hello all,

I'm new.

You can tell that I'm new, right? Please to meet you all. My, it's a hundred years too early for me to appear before all of you wise folks, but here I am, wishing to ask a burning question, so if I may...

"Programming in MQL4 is fun, but can you, one day, rest your ballooning butt on the beach and let your trusty brainchild humming half a world away making you a living?"

Well, there goes my daydreaming mind. May be it was the goal that some of you started with, hmm, but how realistic is it to you now? Is it even in the slightest, tiniest, skinniest realistic?

I've been investing for three years now, if you could call the act of amassing blue-chip stocks and hold them steadfast a viable investing strategy. I, however, wanted to experiment a bit more and came across this love-hate relationship with the concept of automated trading. In my mind I was drooling with the prospect of being free, hell, I could even quit this lifeless job and hours! Yes, that's the ultimate deal! Ah, no, but Mr. Cynic inside of me started to question the viability of such dangerous proposition, citing numerous reasons why it and other investors say that such plan would not work. Finally I took hold of my chair and mustered up all of my courage to start filling this screen in desperation, hoping to snap up some invaluable insight from those who are really living, breathing in the thick of it all.

So... what can you really expect? What must I prepare? What must I be beware of?

I'm happy to be shot down to Earth, but I wouldn't mind a glimpse of hope either!

Thanks for your time. It's ninety nine years now, I hope.

I'll shut up.

Ben

Hallow..Ben.. follow your heart... My Son.. be true to your self..If the job and life style you lead.. is destroying your SOUL..GET out.. Best Dan.

Statistics: Probability of a win * Expected return - Probability of Loss * Expected loss has to be grater than zero. If you can make this true then using careful compound interest in three years (or less depending on how big a return your system gives) your dream can come true - If it was easy there would be a lot of rich traders, its simple but NOT EASY! - the fault always lies with traders psycology or the process/system was not researched well enough - AND s**t happens so it still needs work, it needs enthusiasm, it needs commitment, it needs persistance, it needs consistancy.

If the dream is sold cheap like only $97 then its highly probably does not work. If its expensive you will find you could have learned it by constant reaserch and reading up how other sucessful people did it, the way they did it is there for anybody to read - people just have to teak it and make it their own and then for some reason it then doesn't work!

NEVER use money you can NOT afford to lose. Gambling is very very hard to take emotionally, sometimes the statistics have an unusually long run of losses which has a lot of people doing crazy things but if you are persistant and consistant and know that the past data is profitable then just keep going. First rule of gambling :Never use money you can NOT afford to lose. Repeat this rule everyday and every time you gamble. The second rule of gambling, treat it as a business. Business's fail because they did not do enough reasearch into the market or what is happening in the market. The same is true of Forex trading (gambling).

Live trading is different to Demo trading but use Demo trading to prove that you can stick to the rules, not care if the trade wins or loses as you know from backtesting that over many many trades you will eventually get to where you want to be and the plan that you put together will work if you remain consistant and persistant and you don't go changing because you started off badly.

If this is not you or you can't stand the idea of losing money then don't trade.

Hello all,

"Programming in MQL4 is fun, but can you, one day, rest your ballooning butt on the beach and let your trusty brainchild humming half a world away making you a living?"

RaptorUK:

, if you have a system that really works it should work on anything . . IMO.

Yep should work on any currency pair.

Hi Nihonsuki, I wish to make choices for myself based on what is best for me. I currently choose to code in mql4 because I believe that doing this is best for me right now. The choice is mine alone. Currently I believe that I care about myself more than anyone else cares about me. I wish to write my own destiny with the time that I have been given, to live before I have no time left. Perhaps you've always known what is best for you, but have not yet fully accepted your role of being the captain of your own ship. I do not believe an "outsider" (anyone except for yourself) can truly answer a question that only you can answer. Just my 2 cents.

Thank you n' best of luck.

I'll try to keep this one short. Read this short Article. While reading, this caught my interest "However, the 2 trading reports refer to exactly the same strategy, which is a winning one by the way." My taught was how could he had known that. And then at the end he show that it's a SixSided-Dice-Game where [Roll_1=Lose_1], [Roll_2=Lose_2]. [Roll_3=Neutral], [Roll_4=Win_1], [Roll_5=Win_2], [Roll_6=Win_3]. Now even I who suck at math can tell that Winning have the Edge. It wouldn't matter how many_times or how_long this game [humm, humm system] was played. Heck, the more the better.

Have another look at one of my Topic. In the above example, its not hard to see that someone is getting screwed. However, when it comes to spreads, people start pretending they're blind.

I've long been asking the question, "how many trades does it take to validate a system statistical numbers". I think I finally have the answer. And it's infinite. It should work XXX-Billion number of times just like the Dice-Game above. Here's a question a Trader might ask, my system only places 1_Trade_Per_Day or Less, where am I suppose to get the Billion Trials from. The answer = Monte_Carlo Simulations.

In my Opinion, most people do Monte_Carlo Simulations wrong. They take a Test_Report with something like [Win][Loss][Win] [Loss][Win][Loss][Win][Loss][Win][Loss][Win]. 6-Wins and 5-Loses. They randomize the series to see how bad things could get. But I think such test is pointless. The edge is already Locked-In and if you really wanna know how bad things could get then place the Losses before the Wins. It's the exact same Trades which happened when/where they happened but just shuffled around.

If you really want a Billion Trial Monte-Carlo Test. Then I only came to 2_Conclusion, 1: Make the Entries Random or 2: Generate 1-Billion Random Charts. I'll highly recommend 1. Think about it, if you wanted to know the probability of Heads on a Coin-Toss, and you sucked at math like I do. You could write a code which Flips a Coin a couple of billion times in Random fashion. You wouldn't flip the Coin say 9-times and duplicate the results a Billion-times and say Ah-ha heads comes up more times than tails.

Sorry, I couldn't keep it short as intended :). What was the question again? Oh, yeah sure it's worth it, when you stop believing in the conventional ways of doing things and start thinking creatively.

@ ubzen: I read the article and enjoyed reading it. thanks for posting!

Thank you.

Think about it, if you wanted to know the probability of Heads on a Coin-Toss, and you sucked at math like I do. You could write a code which Flips a Coin a couple of billion times in Random fashion. You wouldn't flip the Coin say 9-times and duplicate the results a Billion-times and say Ah-ha heads comes up more times than tails.

Sorry, I couldn't keep it short as intended :). What was the question again? Oh, yeah sure it's worth it, when you stop believing in the conventional ways of doing things and start thinking creatively.

Yep, you did this already https://www.mql5.com/en/forum/137889 kind of . . . :-)

I'll post some interesting data a little later . . .

I made some small mods to your code and ran it on EURUSD.

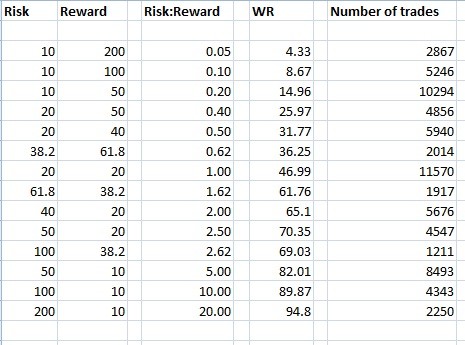

I ran the EA on EURUSD from 1st May 2009 to 20th July 2011, on M15, the spread was 1.0 pips for all runs. The varied number of trades is dependant on the size of the trade, a bigger trade takes longer to hit TP or SL and therefore fewer trades are taken in the same period of time.

You will see from the graph that the WR is purely driven by the R:R, this Coin Toss can be made to have a WR of 95%.

So what is the point of all this ? if your Method's WR and R:R lie close to the line you will not make money as your Method's WR is driven just by the R:R . . . how can you determine this ? change your R:R arbitrarily, test your method on a few hundred pulls, if your new R:R and WR are still on the line then you have just proven your method is not so good.

Of course don't forget to factor in trade size and spread . . . take your average win size and average loss size,

Average Loss : Average Win gives you your overall R:R.

Nice work! RaptorUK. Now where have I seen a chart like this before. Here. [Zero Return Curve]. Man look at the implications of the Safety Curve. Check-Out where the Safety_Curve Arrow points. Getting into the Safety-Zone @ that location would require a Win% of about 55 and Average-Win 2x-Greater-than the Average-Loss. Good-Luck with that.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hello all,

I'm new.

You can tell that I'm new, right? Please to meet you all. My, it's a hundred years too early for me to appear before all of you wise folks, but here I am, wishing to ask a burning question, so if I may...

"Programming in MQL4 is fun, but can you, one day, rest your ballooning butt on the beach and let your trusty brainchild humming half a world away making you a living?"

Well, there goes my daydreaming mind. May be it was the goal that some of you started with, hmm, but how realistic is it to you now? Is it even in the slightest, tiniest, skinniest realistic?

I've been investing for three years now, if you could call the act of amassing blue-chip stocks and hold them steadfast a viable investing strategy. I, however, wanted to experiment a bit more and came across this love-hate relationship with the concept of automated trading. In my mind I was drooling with the prospect of being free, hell, I could even quit this lifeless job and hours! Yes, that's the ultimate deal! Ah, no, but Mr. Cynic inside of me started to question the viability of such dangerous proposition, citing numerous reasons why it and other investors say that such plan would not work. Finally I took hold of my chair and mustered up all of my courage to start filling this screen in desperation, hoping to snap up some invaluable insight from those who are really living, breathing in the thick of it all.

So... what can you really expect? What must I prepare? What must I be beware of?

I'm happy to be shot down to Earth, but I wouldn't mind a glimpse of hope either!

Thanks for your time. It's ninety nine years now, I hope.

I'll shut up.

Ben.