Let say i wana constuct an ea based on one single indicator and action taken when it crosses 50

Take profit and stop loss also at 40pips,any other pips may do my point is that they are constant,a constant roof and bottom level

Lets just set the buy or long tradein this case,backtest result 30% win.

Does that means if i set the trade in different direction at same point of entry will make the winning rate 70%?

doesnt seem so,backtest result is still 30%,

i dont see any other factors involved as the roof and bottom level are constant,so does the point of entry, based on the first back test, 30% reach 40pips in the other direction first,y the reversal of trade doesnt take the 70%?

please guide me if you know the answer,thank you

Not at all. Mainly because you have to take account of the spread. Buy open at ask price and close at bid price. Sell open at bid price and close at ask price. A winning trade (buy) will not be necessarily a losing on reversal (sell).

And a losing trade (buy) will not be necessarily a winning one if reversed (sell).

See here for more information on what'is spread and how it work.

How do you suggest i should set the pips to count in the spread?as i really dont understand spread that detailly, just for instance for buy trade, set roof higher or lower,set floor higher or lower,let say of my initial 40 pips,to make the distance to floor and roof equal,and estimation would be adequate,thanks

So even i have to take in consideration of the spread when i open the trade and also when i close the trade as it may fluctuate

Hey,thanks a lot i learn a lot of more practical implementation of spread in think topic of yours instead.

Didnt realised its the same topic,just at different page,lol,sorry.

Well bro, i think it is a good way of thought to reverse engineer from the point i stated here, you got a statistic of 30% to 70% ,by applying your knowledge of spread and other knowledge,i think you can help reverse engineer it. What improvement would you suggest for us to be in the 70%

With my knowledge of spread currently, i would suggest we add 4 pips,as per we predict the spread,if floating,for at least eur/usd,

For buy, we add the 4pips to stop loss,do you think it is enough to get us in the 70%?

However, i think spread is not the only thing acting here

Rethink my question, the sl and tp are constant,so does the chart flow and even the spread,as back test is based on historical statistic.

Let see the problem as this,you are given a fixed chart, with my given condition we are winning 30%,but if we buy the other direction at the same point as entry,with all other things constant, why are we not in the 70%, need better explanation,or you may explain more to support ur spread theory,though spread is already constant as a historical data here.

I seriously think spread is not the key to it.

Rethink my question, the sl and tp are constant,so does the chart flow and even the spread,as back test is based on historical statistic.

Let see the problem as this,you are given a fixed chart, with my given condition we are winning 30%,but if we buy the other direction at the same point as entry,with all other things constant, why are we not in the 70%, need better explanation,or you may explain more to support ur spread theory,though spread is already constant as a historical data here.

Please don't make post after post after. You can edit your first (of the serie), and add to it. Place your mouse in first comment, and click on Edit link which appear on bottom-right corner. I have edit it for you.

Well. Your idea is not new and is not working. I am trying to find reference for you. Also, I don't have a "spread theory" :-), all your read in mentionned topic from me are facts.

I seriously think spread is not the key to it.

Rethink my question, the sl and tp are constant,so does the chart flow and even the spread,as back test is based on historical statistic.

Let see the problem as this,you are given a fixed chart, with my given condition we are winning 30%,but if we buy the other direction at the same point as entry,with all other things constant, why are we not in the 70%, need better explanation,or you may explain more to support ur spread theory,though spread is already constant as a historical data here.

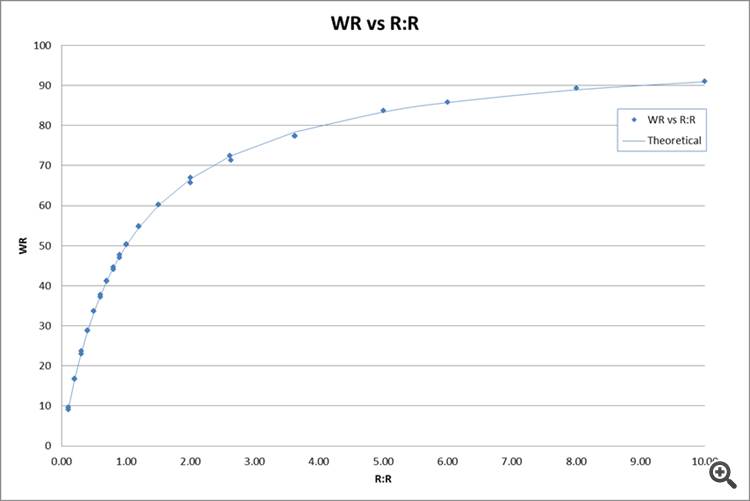

Take a look at this chart, it shows the relation between Win rate (WR) and Risk:Reward (R:R), in this case the spread was 0 and uses a simulated coin toss with an even number of Long and Short trades taken at random with no attempt to predict the direction of the market. You will see for a 50:50 R:R scenario the WR is 50%.

You said TP and SL are 40 pips, did you mean 40 pips or 40 points ? Yo need a figure that is at last 10 times the spread or the spread will play a big part in your results.

The question here is, with the provided historical data, shown if for the set tp and sl,i would win only 30% of the trade,let say in the scanario you provided above, i bought head which will give me 50% win,and if i buy tail i will get the other half,but in forex,even i buy opposite direction its still 30% instead of 70

Actually i deduced something from what i tried, 30% win if buy,30% win if sell, and the remaining mysterious 40% which is unpredictable,my point is yhere are such 3 entities. Figure out the 40%

40 pips,maybe i shud use 100 instead,i still dont get the thing u try to show me,coin toss is 50:50 i know,even without the chart.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Take profit and stop loss also at 40pips,any other pips may do my point is that they are constant,a constant roof and bottom level

Lets just set the buy or long tradein this case,backtest result 30% win.

Does that means if i set the trade in different direction at same point of entry will make the winning rate 70%?

doesnt seem so,backtest result is still 30%,

i dont see any other factors involved as the roof and bottom level are constant,so does the point of entry, based on the first back test, 30% reach 40pips in the other direction first,y the reversal of trade doesnt take the 70%?

please guide me if you know the answer,thank you