You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

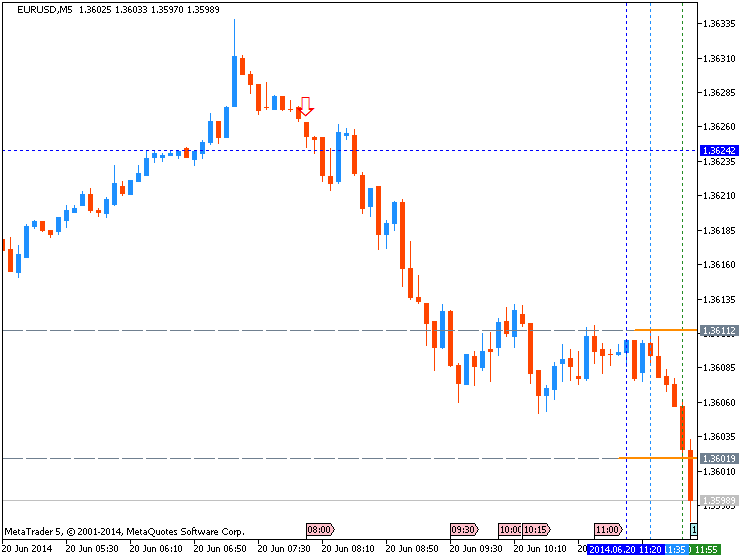

EUR/USD - Euro Shrugs Off Weak German PPI

EUR/USD is firm on Friday, as the pair is back above the 1.36 line, after some gains earlier in the week. On the release front, German PPI posted its third consecutive decline, as Eurozone inflation indicators continue to falter. There was better news from Eurozone Current Account, which improved in May. Although US markets are open on Friday, there are no releases on the schedule, so traders should be prepared for a quiet day from the pair.

Eurozone inflation rates continued to look dismal in May, as German PPI posted another decline, coming in at -0.2%. The manufacturing inflation index has failed to post a gain in 2014, pointing to weakness in the German manufacturing sector. The ECB lowering rates earlier in the month, declaring that the moves were intended to bolster weak growth and inflation levels in the region. However, we'll have to wait for the June inflation data to see if the ECB's moves push inflation to higher levels. If not, the euro could lose ground against the dollar. Earlier in the week, German ZEW Economic Sentiment lost ground, although somewhat surprisingly, the same Eurozone indicator showed improvement. We'll get a look at Eurozone Consumer Confidence later on Friday. The markets are expecting another weak reading in May.

On Wednesday, the Federal Reserve continued to taper to its QE program, reducing the scheme by $10 billion, to $35 billion/month. If all goes as planned, the Fed could wind up QE in the fall. The Fed also hinted that interest rates will continue to stay low for the foreseeable future, which likely means that we won't see any rate hikes before the first quarter of 2015. With regard to economic activity, the Fed noted that the recovery is continuing, but it reduced its forecast of economic growth to 2.1-2.3%, down from an earlier forecast of around 2.9 percent. The bottom line? There were no dramatic items in the Fed statement, with one analyst describing current Fed policy as "steady as she goes". The US dollar has responded with losses against its major rivals, and the euro has added about 70 points this week and pushed across the 1.36 line.

EUR/USD TechnicalChart USD/CNY 1-Yr Update: Consolidation prevails

20 Jun USD/CNY 1-Yr NDF Daily

01::22 GMT - Starting the new day on a consolidative tone and ability to clear the 6.2415 resistance will revive upmove from 6.2010 low towards 61.8% mark at 6.2421 ahead of 6.2445. On the downside, dip below 6.2255 support will jeopardise this 1-1/2 week upmove. [W.T]

R5: 6.2526 9 Jun high

R4: 6.2507 30 May low, break

R3: 6.2445 6 Jun low

R2: 6.2421 61.8% of 6.2675-6.2010 drop

R1: 6.2415 18 Jun high

S1: 6.2255 17 Jun low

S2: 6.2220 12 Jun high

S3: 6.2127 13 Jun low

S4: 6.2040 11 Jun low

S5: 6.2010 10 Jun low

How to Develop Forex Trading Skills

Foreign exchange is the most liquid financial market because it involves trading currencies on a global level. It includes individuals, banks, corporations and governments, and is not solely for investment. News at the national level directly impacts the currencies, and it takes some time to develop Forex skills on the technical and fundamental level. However, if you intend to trade in the Forex market, it is important to gain a strong understanding of these skills. The amount of leverage used in Forex trading can create large losses off one mistake.

Step 1Find a broker that offers a practice account. Even before depositing money, make sure you check fee structures and other requirements because you do not want to practice on an interface you will exclude later due to high fees. Also, decide if you want a U.S. firm that offers a maximum of 20:1 leverage, or an international firm that can offer up to 500:1 leverage. That means you can get $20 of trading power for every $1 deposited, or $500 for ever $1 respectively.

Step 2

Open a paper trading account with the amount of leverage you want to use. If you are using an international account, only use 500:1 if you plan on using that amount of leverage for real. Also, set your starting cash to what you would use.

Step 3

Get used to the interface and the tools available, as they can differ greatly from what a stock trader would be used to, or even a different Forex brokerage. Knowing how to place the correct orders quickly is critical.

Step 4

While getting used to the interface, read books and articles that discuss Forex strategies, then try them out on a practice account. Do not just finish the book and move on to the next one. Familiarize yourself with the material you are reading.

Step 5

Familiarize yourself with both the fundamental and technical aspects of trading. The technical analysis in Forex is similar to stocks. The fundamental side is trickier because you are analyzing each country in a Forex pair because all trades in Forex involve the relative value between two currencies, such as the U.S. dollar vs. the euro. Also, the global economy weighs on both countries, and you have to decide the effect on each, then compare them relative to one another. Focusing on only one side of trading like some people do in stocks is less effective in the Forex market due to its scale and the volatility that comes with leverage. You cannot choose just technical analysis or just fundamental analysis because both have significant short-term and long-term impacts.

Step 6

Get used to the trading schedule because the Forex market is a global market, and is open 24 hours a day, five days a week. In the U.S., that runs from Sunday night to Friday, with deviations depending on your specific location. Trade your paper account as realistically as you would your real money. You do not want to be away from your computer when you have open positions unless you are using a long-term strategy with a significant cushion of cash free in your account to absorb drawdowns, which are declines in value of your account that could trigger a margin call. In Forex, a margin call will liquidate your positions right away if your account value drops fast enough unless you can deposit money right away.

Step 7

Once you can handle the schedule and the difficulty of profitably trading foreign exchange, you can deposit money and start trading for real. Practicing with a paper account is critical for skills-building because learning by doing is the most effective way to learn. Eventually, real money must be used to learn proper money management and hone your skills further.

Tips

High leverage is tempting, but less leverage can create a better trading environment with less account volatility. Using 10:1 leverage is usually enough.

Warnings

The high amount of leverage available in Forex trading is a benefit and a curse. Gains can come quickly, but so can losses; volatility is magnified, with small movements in the currency amounting to large gains or losses.

Most people who get into Forex trading blow a couple of accounts, which means you lose all the money you deposited.

EUR/USD at Trendline; USD/CAD Breaks Support (based on forexminute article)

A main theme in the forex market this week was the USD softening after the FOMC. Let’s see how that manifested in the EUR/USD. Today, Strong retail sales and hot inflation data from Canada is boosting the Loonie. Let’s take a look at the USD/CAD.

EUR/USD rallied this week after putting in a price bottom last week. There was broad USD-weakness after the FOMC event risk, and the EUR/USD popped up from the price bottom, only to stalled at 1.3643. As we get into the 6/20 session, we see that traders faded the pair down to a rising trendline. A break below 1.3550 should clear the trendline and the moving averages in the 4H chart. If the RSI also dips below 40, then we could be looking at a bearish continuation signal, refocusing traders on the 1.35 handle and the 1.3476 low on the year. Above 1.3560, the pair remains bullish in the very short-term, with upside toward 1.3676 June high.

USD/CAD is blasting through consolidation support today after very hot inflation and*retail sales data from Canada. The CPI in May came in at 0.5% on the month, and 2.3% on the year. This was a pick up from April’s reading and also beat most economists’*forecasts. Retail sales also grew 1.1% in April, faster than the 0.1% in March. Economists had forecast a 0.4% growth.

As both inflation and demand data moved higher and beat estimates, USD/CAD fell below its recent consolidation support at 1.0815. The dip is also breaking below the 200-day SMA. The 1.0737 pivot might provide some short-term support. But as long as price is below 1.09, there is downside risk toward the low on the year near 1.06, and the Dec. 2013 low at 1.0560.

EUR/USD hold key Gann level (based on dailyfx article)

- EUR/USD remains in a sideways to higher range above the 4th square root relationship of the year’s low near 1.3520

- Our broader bias is negative on the Euro while below 1.3755

- A daily close under 1.3520 is needed to confirm a resumption of the broader decline

- The end of the month is the next cycle turn window of importance for the exchange rate

- A move through 1.3755 is needed to shift the broader trend bias to positive

Weekly EUR/USD Strategy: Like the short side while under 1.3755.USD/JPY nearing important break (based on dailyfx article)

- USD/JPY is in consolidation mode above the 101.55 61.8% retracement of the May/June range

- Our broader bias is negative in the rate while below 102.80

- A close under 101.55 should signal a resumption of the broader decline

- The end of the month is the next turn window of significnance for the rate

- Only strength over 102.80 will turn us positve on USD/JPY

Weekly USD/JPY Strategy: We like tactical short positions in USD/JPY while below 102.80.End of month important for Gold (based on dailyfx article)

- XAU/USD broke above key Gann resistance at 1286 this week

- Our broader trend bias is now higher in the metal

- A resistance cluster at 1321 needd to be overcome to prompt the next push higher

- The end of the month looks to be the next turn window of importance

- A daily close under 1286 would turn us negative on Gold again

Weekly XAU/USD Strategy: Like buying on weakness against 1286.GE Wins France’s Support for Alstom Merger

France picked General Electric to form a partnership with Alstom on Friday, dismissing a joint bid by Siemens and Mitsubishi Heavy Industries. However, the France government said the agreement needed some work and it would acquire a 20% stake in the firm.

France’s Economy Minister Arnaud Montebourg said he had invoked a recently-created state order to dismiss the two existing offers in their current forms, saying they didn’t address strategic interests of the country. Montebourg said he had submitted new demands to GE chief executive Jeff Immet.

The decision brought to a conclusion weeks of uncertainty around one of the toughest industrial battles in Europe in years, although it’s still not known what form the alliance will take, which GE hopes will allow it entry to new energy markets.

“The points we have raised with General Electric are precise and technical but necessary,” Montebourg is quoted by Reuters as telling reporters after two days of discussions with chiefs of the three bidders, President Francois Hollande and senior ministers.

The minister added that France required a deal that ascertained energy independence, creation of employment within the domestic market and the keeping of core decision making hubs in France.

He said the overture from Siemens and Mitsubishi Heavy Industries was “very serious”, having supported it himself, but the government of France had already made its decision.

Montebourg admitted that GE would buy Alstom’s high-stakes gas turbine unit and talks would follow regarding the nature of partnerships in other sectors of the energy industry including nuclear and renewable.

France is poised to hold the highest number of Alstom shares, as a single entity, after buying a 20% stake out of the 29% held by Bouygues in the company.

But according to the New York Times, the deal may confirm foreign-investor concerns that the current French regime is not ready for a free market and to make policy changes needed to revamp the country’s stalled economy.

GBPUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Pound: BullishThe British Pound extended the advance from earlier this month, with the GBP/USD climbing to a fresh yearly high of 1,7062, and the bullish sentiment surrounding the sterling may gather pace in the week ahead should we see a growing number of Bank of England (BoE) officials show a greater willingness to normalize monetary policy sooner rather than later.

Even though the BoE Minutes showed a unanimous vote to retain the current policy at the June 5 meeting, the official statement sounded more hawkish this time around as the central bank talked up the risk for a rate hike in 2014. Indeed, there appears to be a growing dissent within the Monetary Policy Committee (MPC) as voting-member Ian McCafferty argues that the central bank should start to normalize monetary policy before the output gap is ‘fully’ closed, and we may see a larger rift at the July 10 meeting as the board anticipates a faster recovery in the second-half of this year.

With the BoE scheduled to testify on its May inflation report next week, the fresh batch of central bank rhetoric may further boost the appeal of the British Pound, and the GBP/USD may continue to carve higher-highs & higher-lows during the summer months should Governor Mark Carney lay out a more detailed exit strategy. With that said, the growing deviation in the policy outlook will be another theme to watch as the Federal Reserve remains in no rush to move away from its zero-interest rate policy (ZIRP), and we may see the British Pound appreciate throughout the second-half of the year as interest rate expectations for the U.K. pick up.

As a result, the next topside object for the GBP/USD comes in around 1.7110-20 (78.6% Fibonacci expansion), and we will retain a bullish outlook for the pair as price & the Relative Strength Index (RSI) retain the upward trend from earlier this year.