You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

"As traders, we must focus on what is real in the markets and not simply go by what we feel or what we are told to be true. For sure there may be some of you reading this right now and asking the question of why you should take my word for it either? I say that is good. I am glad you are thinking this way. Don’t take my word for granted. Stay objective and have a great trading week."

Sam Evans

AUDUSD Technical Analysis (based on dailyfx article)

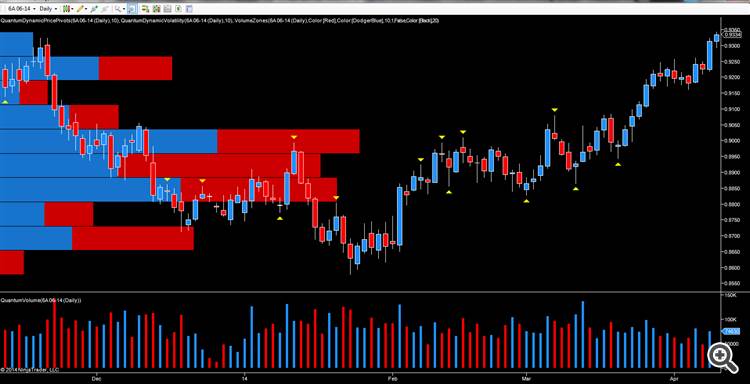

The Aussie dollar continued to build on the bullish momentum of the last few weeks, with the June futures contract closing the session with a wide spread up candle on the daily chart, surging through the 0.9300 region on good volumes. The positive tone has continued overnight and into the early London session with the pair continuing to climb higher to trade at 0.9337 at the time of writing.

Daily :

Yesterday’s price action was significant, following the recent period of sideways consolidation, which saw the pair trading in a narrow range, between 0.9170 to the downside, and 0.9255 to the upside. However, with yesterday’s price action now breaching this short term resistance level, we can expect to see further bullish momentum for the AUD/USD in the short term, particularly if the 0.9350 high of late December 2013 is breached. Below we now have a solid platform of support in place as shown on the volume at price histogram on the daily chart, and provided that volumes remain above average, then we could see a move to test the 0.9600 high of late October in due course.

Weekly :

Moving to the weekly chart, we have a similar picture with an almost perfect double bottom now developing in the timeframe, and adding further

evidence to suggest that the bottom for the pair is now firmly established in the 0.8650 range, and provided the November 2013 high is taken out, then

a return to test parity in the longer term is possible.

Beijing has Narrower Room to Use Policy Tools to Boost Economy, Agency Says

A top economic planning agency has said that China’s room to use policies to boost the economy is getting less and less as it tries to prevent a looming economic slowdown in 2014.

The government rolled out plans last week to reduce taxes for small businesses and speed up railway and affordable housing construction in order to bolster the flagging economy.

“Policy fine-tuning is required to even out economic volatility, but room for the government to influence growth is narrowing,” said the National Development and Reform Commission in a report that analyzes the implementation of China’s 12th five-year plan (2011-2015).

"Against the backdrop of rising local government debt burdens, high debt ratios and rapid money supply growth and excessively large social financing, room for simply using fiscal and monetary policy to manage demand and promote economic growth is getting smaller and smaller," the NDRC added. "Improper operation will exacerbate overcapacity and delay structural adjustments, increase inflationary pressures and accumulate debt risks."

Last year, Beijing rolled out plans to shift the economy from an export and investment-driven one to one that is based on innovation, services and consumption, which it views as more sustainable in the long-run.

A Reuters survey of economists forecast economic growth in the first quarter to average 7.3 percent, a five-year low, which is also less than 7.7 percent growth recorded in 2013.

A huge segment of the market believe that a further decline in economic growth and increasing capital outflows will prompt the central bank to slash the banks’ reserve requirement ratio later in 2014.

2014-04-09 18:00 GMT (or 20:00 MQ MT5 time) | [USD - FOMC Meeting Minutes]

==========

FOMC Meeting Minutes give USD another blow

The FOMC meeting minutes lean to the dovish side, with several members saying the statement overstates the rate rise pace. These are the minutes for the first FOMC meeting under Chair Janet Yellen. In that decision, the Fed dropped the forward guidance and just said that low rates would remain at hand for a long time after the bond buying program (QE) ends. In the accompanying press conference, Yellen surprised by saying that a considerable time is “6 months”. This gave a boost to the greenback. In the meantime, it lost its shine, even thogh nothing has really changed in the big picture of the US economy.

Swedish Crown Falls as Central Bank Hints at Lowering Interest Rates

The Swedish crown plunged 0.5 percent against the euro after Riksbank said it will cut interest rates soon, as the market awaits local inflation figures this Thursday. The crown fell past 9 crowns a euro to trade at 9.0027.

"This message from the Riksbank has changed the picture and the euro will probably extend upward from here," an unnamed head of foreign exchange with a Scandinavian bank told Reuters. "Inflation tomorrow is the key now. It seems unlikely that we'll get a strong number - the data set implies that inflation will be fairly weak. I think around 9.03 would be first resistance for more gains for the euro."

Despite the expanding economy, Swedish inflation remains very low, giving central bank officials a lot of headache. This also comes at a time when household borrowing is very high and the crown has fallen 2 percent since mid-March.

"If we continue to see more bad economic news out of Sweden then of course it’s hard to say," another dealer told Reuters. "But I think the Riksbank has given us room to push the euro another five to seven figures higher depending on inflation tomorrow."

The euro also held steady against most currencies, which analysts attributed to China’s move to rebalance its forex reserves after it purchased billions of dollars in March in order to weaken the renminbi.

The currency remained slightly unchanged against the dollar at $1.3800. The dollar fell by at least 1 yen to trade at 101.55 yen on Tuesday, before recovering on Wednesday to 102.04 yen. The euro also rose 0.2 percent to trade at 140.77 yen.

AUDUSD Technical Analysis 10.04.2014 morning (based on dailyfx article)

Ignore Momentum Advice -- Buy Real Growth Stocks (based on Forbes article)

“They” are at it again, trying to trip up our investment plans. A deluge of articles warns that “momentum” investing (i.e., investors chasing performance) created a bubble-like environment that is now popping. The conclusion? Run from growth, and focus on dividends and safety.

Disclosure: Holdings include five stocks mentioned below – Chevron CVX +1.1%, DR Horton DHI +0.46%, General Electric GE +0.78%, Genesee & Wyoming and Merck & Co MRK +3.74%.

That great advice for April 2000 and April 2009 is terrible for April 2014. The rehabilitation and rebuilding of the broken U.S. economy and financial system is done. Likewise, stock market participation and valuations are back to normal. In this environment, “value” (i.e., low P/E or high dividend yield) stocks offer neither superior return potential nor better risk protection.

How to invest in this environment

Focus on the right kind of growth. The description, “growth stocks,” carries two meanings: (1) stocks of faster growing companies, and (2) faster rising stocks. The growth to look for is the first – at the company level. If the company delivers, the stock price will follow suit.

Look beyond the fastest growing companies. Since growth can occur anywhere, do not focus only on hot growth areas like technology (nor should we, for diversification reasons).

For valuation, look to estimated earnings and expect to pay up. The forward P/E ratio is Wall Street’s primary measure. Importantly, for faster growing companies in this market, P/Es generally will be higher. If not, be sure there is a good reason why the growth stock is also a value stock.

Ignore dividend yield. Plenty of growing companies pay dividends, so a diversified growth portfolio can have a decent yield. The key is to focus on the growth outlook, first and foremost, and let the dividend yield fall out of the process.

Examples of non-momentum companies with good growth potential

These five companies show that good growth potential exists outside of high growth industries:

Importantly, none qualifies as a momentum stock – yet – as the relative performance shows:

The bottom line

The momentum stock sell-off does not mean we need to run from growth stocks. The best 2014 strategy is quite the opposite. Owning stocks of companies that have fast (not fastest) growth prospects. This growth approach can create a diversified portfolio with a decent dividend yield.

2014-04-10 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Employment Change]

if actual > forecast = good for currency (for AUD in our case)

==========

Australia March Jobless Rate Falls To 5.8%Australia posted a seasonally adjusted unemployment rate of 5.8 percent in March, the Australian Bureau of Statistics said on Thursday.

That handily beat forecasts for 6.1 percent, and it was down from 6.0 percent in February.

The Australian economy gained 18,100 jobs in March 18,100 to 11,553,200 - blowing away expectations for a gain of 2,500 following the upwardly revised jump of 48,200 in the previous month (originally 47,300).

Full-time employment decreased 22,100 to 8,029,100 and part-time employment increased 40,200 to 3,524,000.

Unemployment decreased 29,900 (4.0 percent) to 713,200. The number of unemployed persons looking for full-time work decreased 16,700 to 509,800 and the number of unemployed persons only looking for part-time work decreased 13,300 to 203,400.

The participation rate was 64.7 percent - in line with forecasts but down from the upwardly revised 64.9 percent a month earlier (originally 64.8 percent).

Aggregate monthly hours worked increased 8.0 million hours (0.5 percent) to 1,617.2 million hours.

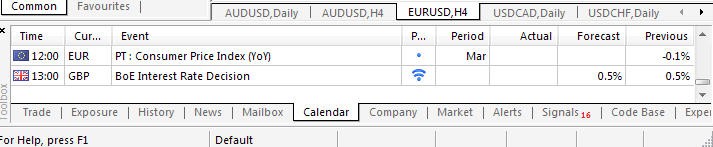

Trading the News: Bank of England (BoE) Interest Rate Decision (based on dailyfx article)

The Bank of England (BoE) interest rate decision may generate fresh highs in the GBP/USD should we see a growing number of central bank officials show a greater willingness to normalize monetary policy sooner rather than later.

Why Is This Event Important:

Indeed, BoE Governor Mark Carney argued the first rate hike may come before the general election in May 2015 amid the stronger recovery in the U.K., and a further shift in the policy outlook should continue to heighten the bullish sentiment surrounding the British Pound as the central bank moves away from its easing cycle.

Sticky prices paired with the pickup in household & business activity may push the BoE to adopt a more hawkish tone for monetary policy, and the policy meeting may trigger a bullish reaction in the GBP/USD should the central bank lay out a more detailed exit strategy.

However, the BoE may merely reiterate the policy statement from the March 6 meeting as the central bank continues to assess the margin of slack in the real economy, and the British Pound may face a near-term correction should the MPC meeting drag on interest rate expectations.

How To Trade This Event Risk

Bullish GBP Trade: BoE Sounds More Hawkish/Lays Out Detailed Exit Strategy

- Need green, five-minute candle following the meeting to consider a long British Pound trade

- If market reaction favors a bullish sterling trade, long GBP/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish GBP Trade: MPC Talks Down Interest Rate Expectations- Need red, five-minute candle to favor a short GBP/USD trade

- Implement same setup as the bullish British Pound trade, just in reverse

Potential Price Targets For The ReleaseGBP/USD Daily Chart

GBP/USD H4 Chart

Bank of England (BoE) Interest Rate Decision March 2014

GBPUSD M5 : 38 pips range price movement by GBP - Interest Rate news event :

The Bank of England interest rate decision came and went once again in its usual fashion. As has become the norm, a quick spike in GBP was followed by an equally fast pullback. As this meeting does not proceed the ECB, we may see greater follow through, especially in the EURGBP cross.

China Shares Surge Sharply on Shanghai-Hong Kong Investment Rule

China stocks edged up to a near two-month peak after the China Securities Regulatory Commission announced it was going to permit cross-border stock trading between markets in Hong Kong and Shanghai.

The Shanghai Composite Index closed at 2,134.3 points after adding 1.4%. The CSI300 of top A-share firms listed in Shanghai and Shenzhen jumped 1.6%. Both stocks added to their highest since February 20.Securities firm’s stocks increased on the announcement, as the CSI300 financial sub-index surged to levels last witnessed late last year.

China’s Ping An Insurance rose 1.7%, as CITIC Securities Co. Ltd added 9.7%, their highest percentage gain in a single day since November 18, with CITIC trading its highest volume of shares since October 2010. Sinolink Securities Co Ltd increased 5.2%.

According to Wall Street Journal, the rule will be implemented on a trial basis, whereby, mainland traders will be allowed to buy or sell shares of pre-determined firms in Hong Kong while letting their Hong Kong-based counterparts trade select stocks of firms listed in Shanghai, China’s securities regulatory authority said on Thursday in a joint statement with its equivalent authority in Hong Kong.

"Policies launched by Beijing, including state-owned enterprises reform and the allowing of the issuance of preferred stocks to raise capital, would boost investor interest in blue chips," said analyst Deng Wenyuan of Soochow Securities.

However, property stocks sunk on reports by the National Development and Reform Commission (NDRC) that property debt may bring about broad-based financial risks, raising concerns over the financing of China’s real estate market, Reuters reports.

The CSI300 gauge for property stocks was down 0.9% at the close of trading, after sinking 1.6% earlier in the day.

The CSRC said it will take up to six months for China to get ready for the official launch of the trial.