You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

USDCAD moves higher in early trade (based on nasdaq article)

The U.S. dollar was higher against its Canadian counterpart on Tuesday, as the greenback regained some strength after weakening broadly due to Friday's disappointing report on U.S. employment.

USD/CAD hit 1.2522 during early U.S. trade, the pair's highest since April 3; the pair subsequently consolidated at 1.2519, gaining 0.30%.

The pair was likely to find support at 1.2405, the low of March 26 and resistance at 1.2654, the high of April 2.

USDCAD drops to 1-month lows in early trade (based on investing.com article)

The U.S. dollar dropped to one-month lows against its Canadian counterpart on Wednesday, as demand for the greenback weakened broadly before the highly-anticipated minutes of the Federal Reserve's latest policy meeting.

USDCAD hit 1.2388 during early U.S. trade, the pair's lowest since February 25; the pair subsequently consolidated at 1.2421, declining 0.68%.

The pair was likely to find support at 1.2309, the low of January 22 and resistance at 1.2524, Tuesday's high.

Market participants were eyeing the Fed's upcoming meeting minutes for indications on the central bank's next policy moves after Friday's downbeat jobs data fuelled uncertainty over the timing of a rate hike.

The Labor Department reported Friday that the U.S. economy added 126,000 new jobs in March, less than half of February’s gain and the smallest increase since December 2013.

The loonie was higher against the euro, with EURCAD shedding 0.28% to 1.3486.

Also Wednesday, data showed that retail sales in the euro zone fell 0.2% in February, in line with market expectations. On a year-over-year basis, retail sales rose 3.0% also in line with forecasts.

New York Fed President William Dudley and Fed Governor Jerome Powell on Wednesday sketched out scenarios in which the central bank could make an initial move earlier than many now expect and then proceed in a slow and gradual manner on further rate increases.

Yet, minutes of the Fed's March meeting showed there was a wide divergence of views among policymakers, suggesting no consensus on the timing of a move.

"The final arbiter will be the data, recent data argued for delayed rate lift-off. A June 18 rate lift-off is now being priced as quite a slim chance," said David de Garis, senior economist at NAB.

Still, the chance of a hike at all this year is a stark contrast to Europe and Japan where quantitative easing has years to run. So dollar bulls took heart and bid up the dollar index to a one-week high of 98.197, further away from Monday's trough of 96.329. It last stood at 98.063.

The euro slipped to $1.0784 and was now more than 2 percent lower from this week's peak of $1.1036 set on Monday.

USDCAD range break looming? (based on dailyfx article)

The USD/CAD range continues. The exchange rate teased the market again yesterday as a break of the 1.2830-1.2350 range looked all but inevitable following the move below the trendline connecting the February lows around 1.2435. It clearly was not meant to be, however, as the pair reversed sharply from just above the February lows to trade back towards the middle of the range this morning. Our view on the rate remains generally the same as last week. The wide range reversal on some of the highest volume in years after the FOMC last month is a clear potential negative, but until or unless we convincingly break the range lows at 1.2350 there is really little reason to read too much into this situation and waste precious mental capital. A daily settlement over 1.2830 would obviously turn the outlook much more positive.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video April 2015

newdigital, 2015.04.10 08:03

Multi-Month Consolidation Holds Ahead of Key Data (based on forexminute article)

USDCAD is squaring up within a multi-month consolidation range as we approach key fundamental data, especially Friday's Canadian employment data.

if actual > forecast (or previous data) = good for currency (for CNY in our case)

[CNY - CPI] = Change in the price of goods and services purchased by consumers. Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to respond by raising interest rates.

==========

China CPI steadies, but sends mixed signals

“China kicked off economic reports for the month of March in decent fashion, as CPI held steady at 1.4% beating consensus by a decimal and PPI declines stopped accelerating for the first time in 8 months.”

“Sequentially, CPI fell 0.5% after rising 1.2% in Feb, but YTD CPI edged up to 1.2% from 1.1%. Non-food component was unchanged at 0.9%.”

“Analysts are split on the implications of the latest inflation data - some see the report as beginning of stabilization that would diminish the need for PBoC to ease aggressively, while others do not see the release sufficiently significant to alter the increasingly more regular easing path.”

“Investors will monitor lending, M2 money supply, and Trade figures expected over the next few trading sessions.”

AUDIO - How To Capitalize On A Market Drop with Josip Causic (based on fxstreet article)

Spurred by a listener question about how to short the S&P 500, Merlin Rothfeld and Josip Causic break down the various methods to achieve the same goal. The duo breaks down the pros and cons of 4 different approaches to making money should the markets drop. They also talk about current market conditions and volatility.

AUDIO - Buy or Hold?! Housing Markets with Diana Hill (based on fxstreet article)

The residential market is heating up, leading to some bidding wars in various parts of the country. This has led many to inquire about selling their homes too! Is it the right choice? Tune in and listen to real estate expert, Diana Hill offer her thoughts on inventories, interest rates, and market data.

Forex Weekly Outlook Apr. 13-17 (based on forexcrunch article)

The US dollar managed to stage a recovery after the previous blows, especially against the majors. A busy week awaits traders with US inflation and consumer data as well as rate decisions in Canada and the euro-zone among other events. Here is an outlook on the highlights of this week.

US data began recovering and the dollar followed. The ISM Non-Manufacturing PMI was OK and JOLTs beat expectations. But it was the meeting minutes that provided the greenback with the biggest push: they revealed that in March, some members talked about hiking in June. Despite the known fact about the existence of hawks and the timing of the meeting before the weak NFP, the greenback soared. It probably remains the cleanest shirt in the dirty pile. Elsewhere, Greek worries weighed on the euro, elections worries hurt the pound and the yen also slid. The Aussie stood out, enjoying yet another “no change” decision by the RBA.

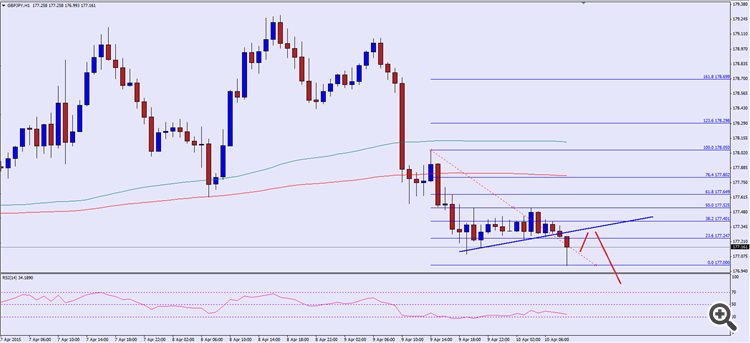

GBPJPY Crushed As Yen Gains (based on countingpips article)

The British pound was seen trading lower against the Japanese yen, as the latter one was bid across the board. Plus, the British also weakened in the short term igniting downside reaction in GBPUSD, GBPJPY. There are a few major releases lined up in the UK, including the industrial production data and the manufacturing report. The UK Industrial Production measuring outputs of the UK factories and mine will be released by the National Statistics. The forecast is lined up for an increase of 0.3% in February 2015, compared to the previous decline of 0.1%. Let us see how the outcome shapes and affects the British Pound moving ahead.

There was a minor bullish trend line formed on the hourly chart of the GBPJPY pair, which was broken recently by sellers. There was a sharp downside reaction after the break and the pair was seen testing the 177.00 area. The British pound buyers managed to protect losses around the mentioned area and it is currently correcting higher. However, it faces the same trend line as resistance, which is also coinciding with the 23.6% fib retracement level of the last drop from the 178.05 high to 177.00 low. The hourly RSI is well below the 50 level signalling more losses in the near term. Moreover, the 100 and 200 simple moving averages on the way up are also barriers for the pair.

If the GBPJPY continues to move lower from the current levels, then a break below the recent low could take it towards 176.46