Hi, I would like to know on what time period are you using the EA?

Thank you.

Hi, I would like to know on what time period are you using the EA?

Thank you.

Dear PCWalker,

In the attached Zip you can find the HTML test result, open it ,looking at the top of the page in EA parameters you can find out whats the time frame used for test.

Thank you

Suresh

India

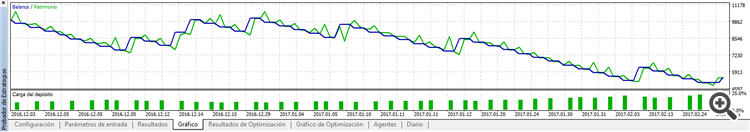

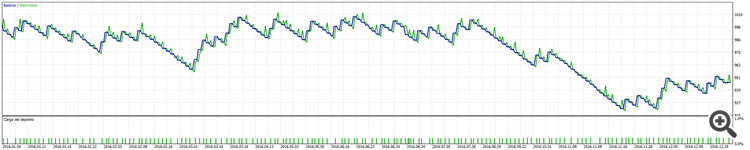

Good morning .....okey, this Advisor works better than the original(https://www.mql5.com/en/articles/497) but I still had to make a slight change in the code due to the "unsupported request fill" error.

I had to leave it as shown in this image on line 317 (and 278 as well).

You also have to go back to OPTIMIZE because it shows lossy.

- 2013.01.18

- Dmitriy Parfenovich

- www.mql5.com

Good morning .....okey, this Advisor works better than the original(https://www.mql5.com/en/articles/497) but I still had to make a slight change in the code due to the "unsupported request fill" error.

I had to leave it as shown in this image on line 317 (and 278 as well).

You also have to go back to OPTIMIZE because it shows lossy.

Hello,

this EA is not the second part of any other EA and therefore there is no "original". The one you indicate is based on MA and is by a certain Dimitriy Parfenovich, and as you can see, this one is based on Bollinger Bands and is by Surubabs Suresh Kakkatil.

In any case the creator of the one you indicate collaborated with the latter, but nothing more, there are no second parts or originals, they are creations from scratch and totally different and independent.

Regarding the possible "bug" ... that depends on the broker where you test it, as each broker has a form and / or limit on the execution of orders, etc.. That is, we are not talking about a problem, that is why the EA is open and gives the possibility to choose the execution mode.

Greetings!

Edit: I attach the version without warnings and with #property strict. Tried and tested. Regarding the optimisation, that's up to each one, as the intention is not to create a profitable EA, just to demonstrate a theory, among others.

I found what seems a little mistake in your code.

The variable "x_min" and "x_max" should to refers to min and max of Bollinger Bands Width and not to Upper/Lower Bands or Middle.

Yet in the expression, is missing a single parenteses after (x_min + x_minn): inputs[i*2]=(((iBands_Upperbuf[i] - iBands_Lowerbuf[i]) / iBands_Basebuf[i]) - (x_min+x_minn) ) * (d2-d1)) / ((x_maxx+x_max) - (x_min+x_minn)) + d1;

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Bollinger Band width calculation with Neural Network using:

This Expert Advisor works with Neural Network method

Author: surubabs