Young Ho Seo / Profil

- Bilgiler

|

10+ yıl

deneyim

|

62

ürünler

|

1182

demo sürümleri

|

|

4

işler

|

0

sinyaller

|

0

aboneler

|

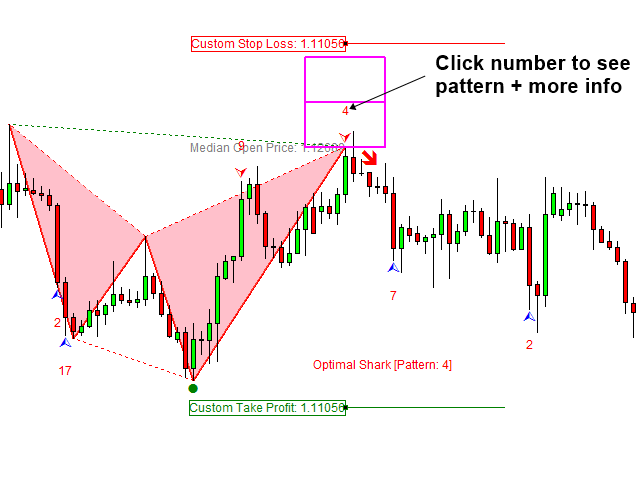

Harmonic Pattern Indicator - Repainting + Japanese Candlestick Pattern Scanner + Automatic Channel + Many more

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

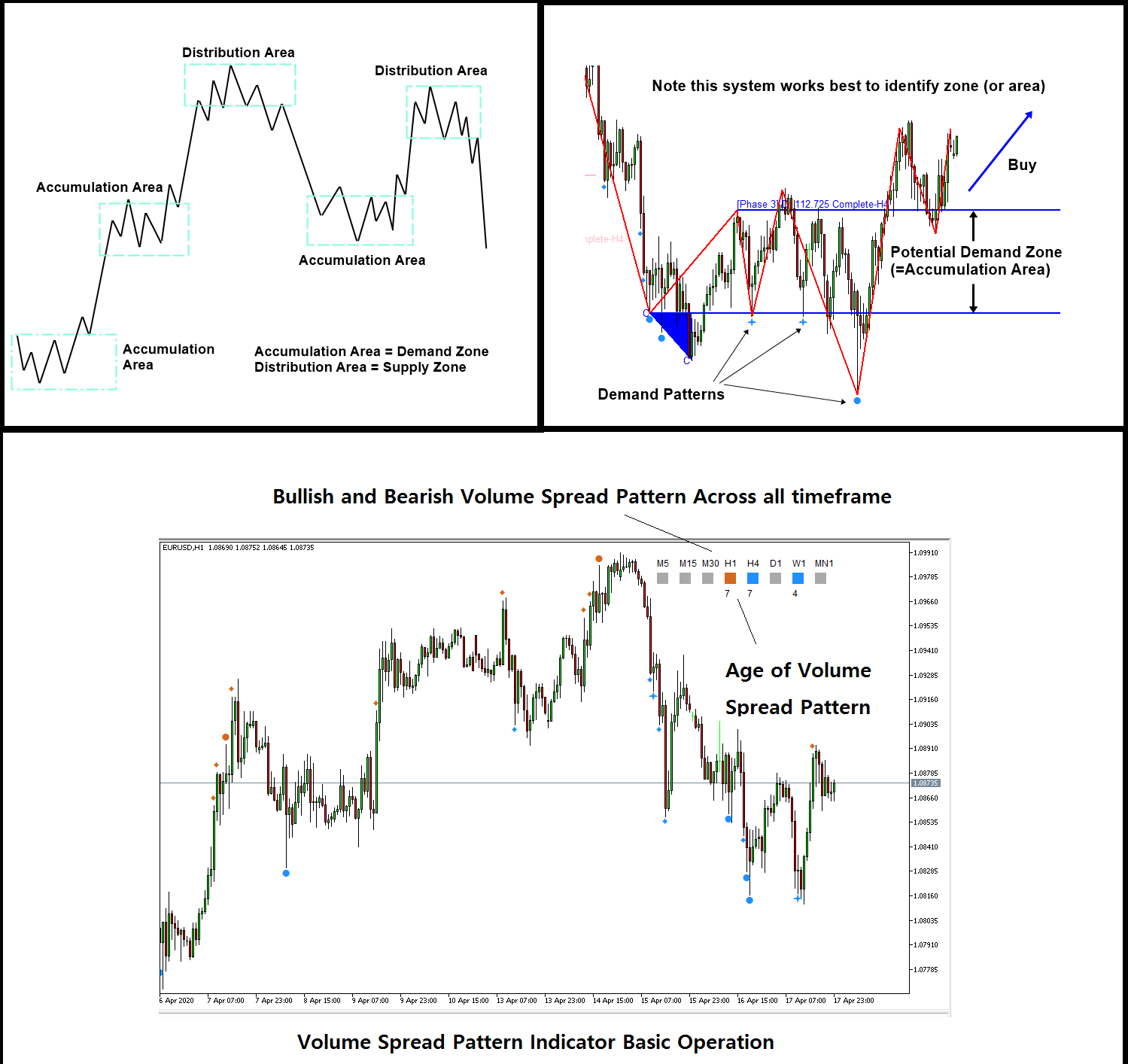

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

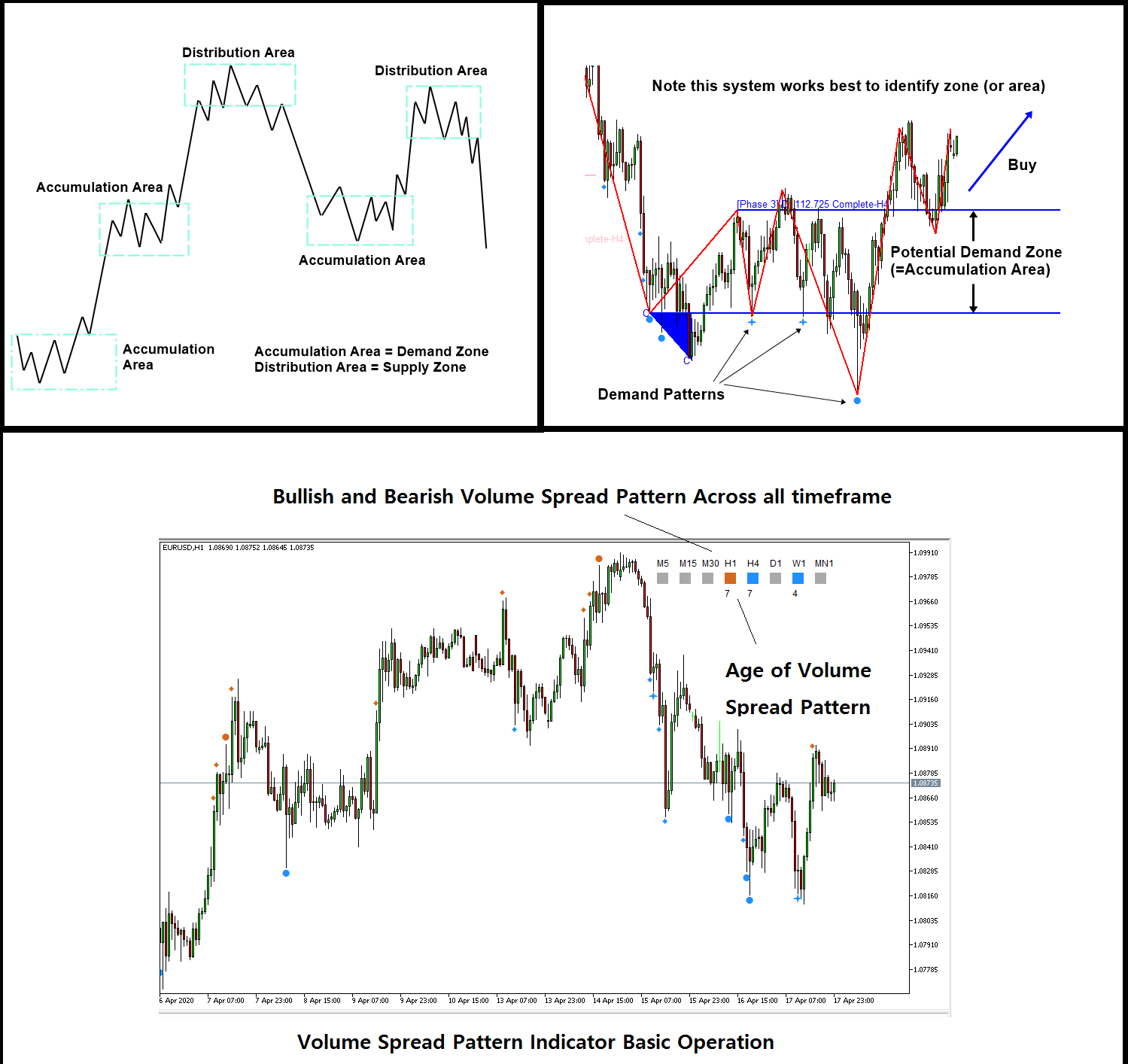

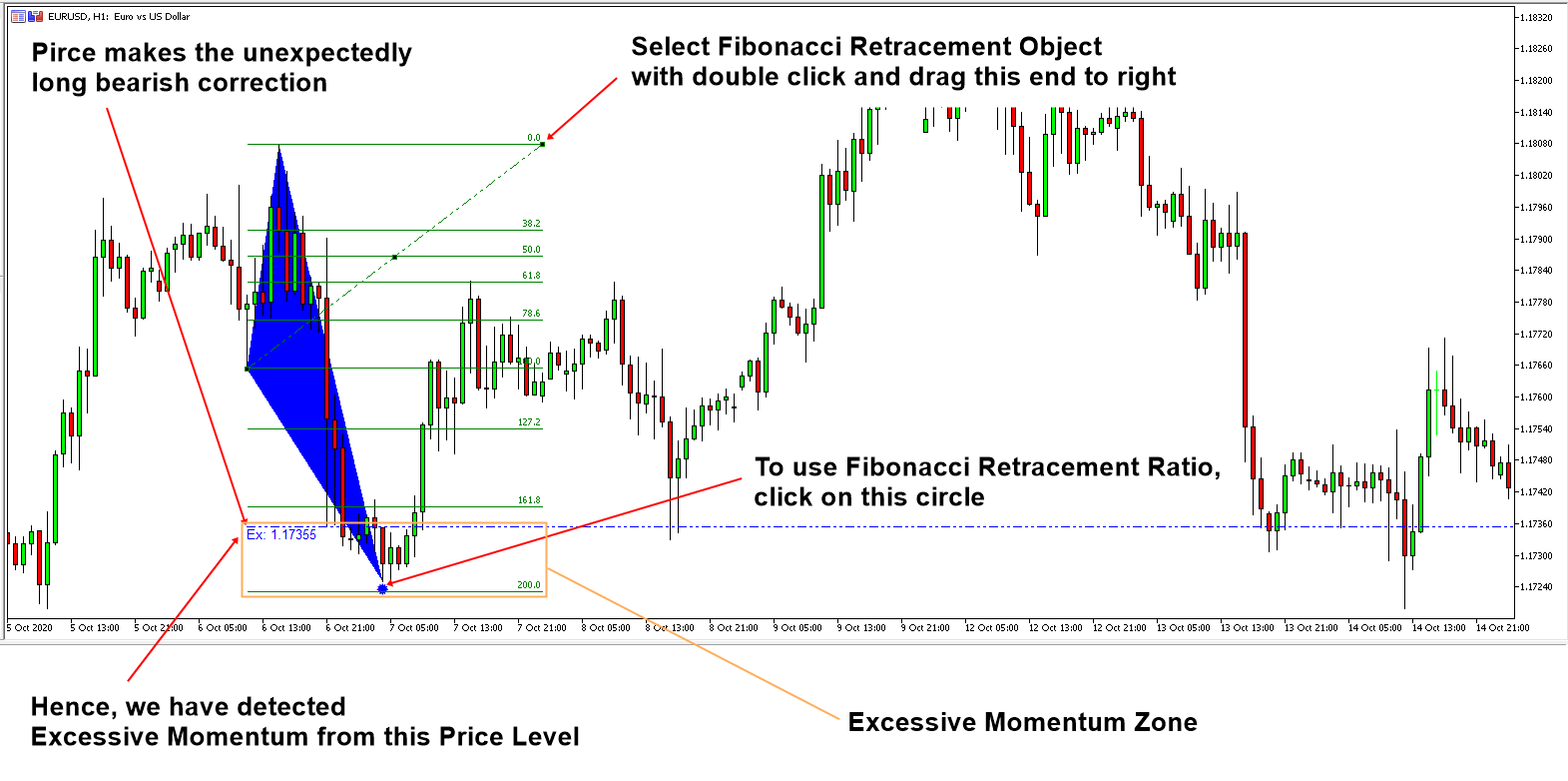

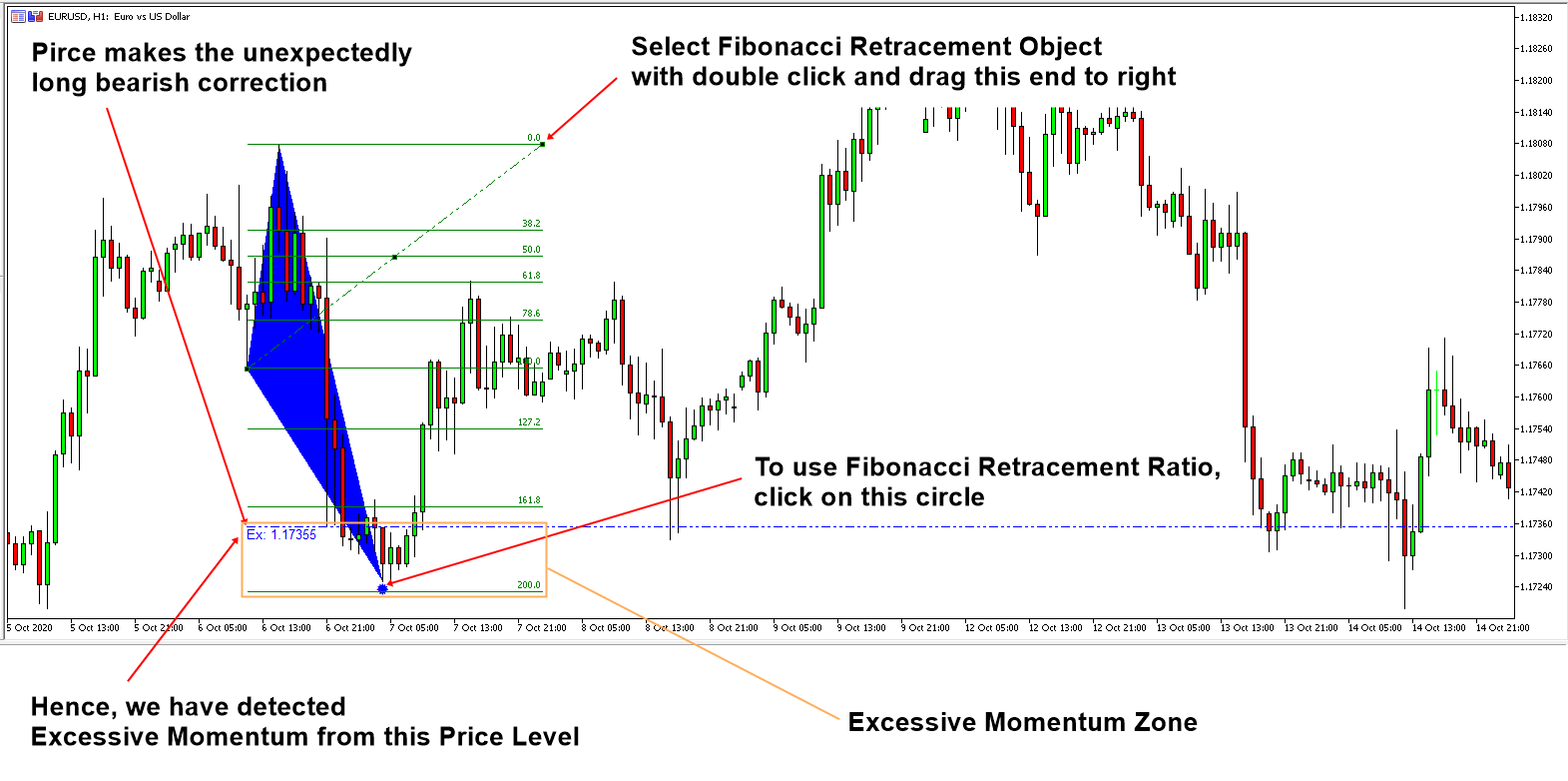

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

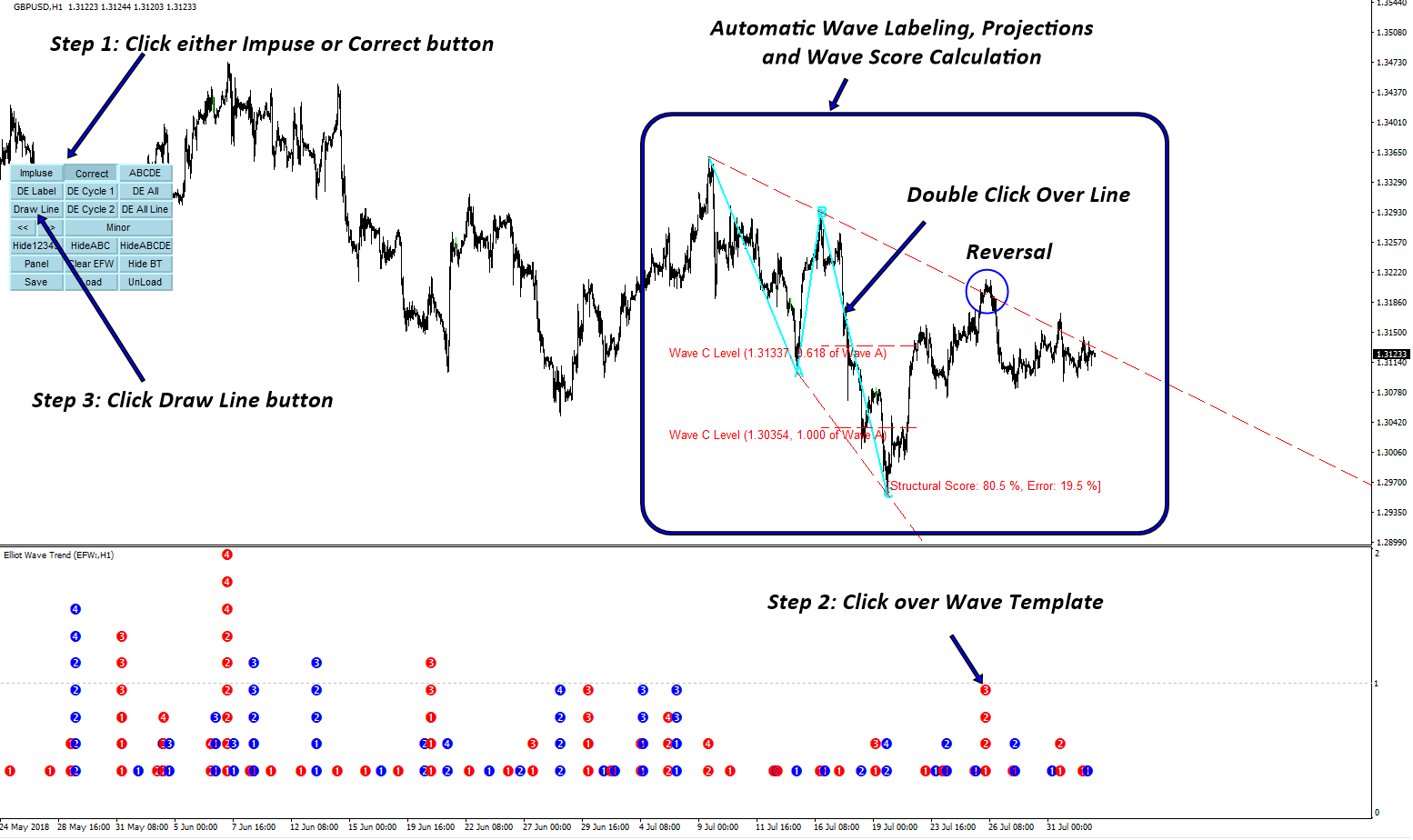

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

Young Ho Seo

Manual For Pairs Trading Indicator

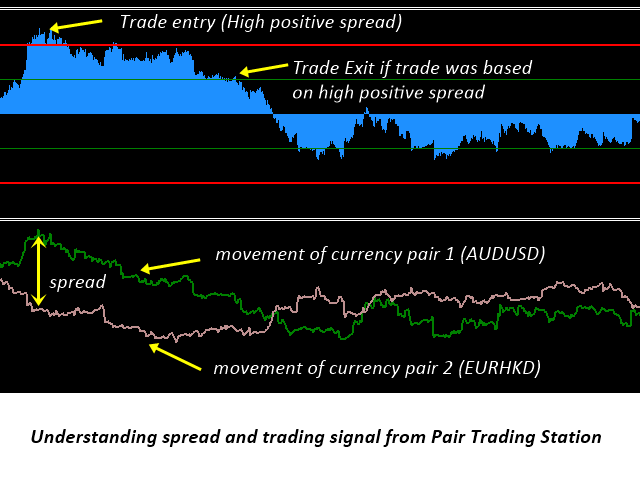

Pair Trading Station is a powerful Pairs Trading Indicator that uses the correlation and spread analysis. Pairs trading is also known as the statistical arbitrage as it involves buying undervalued asset and selling overvalued asset at the same time. Pair Trading in Forex can be best described as taking the hedge position of buying and selling two highly correlated instruments at the same time. However, pairs trading can be used to predict the turning point. For example, it is possible to only take one buy or sell position only. When you take one position, you can use the pair trading signal as the primary confirmation and then you can use other secondary confirmation techniques to accomplish your trading decision. On the other hands, you can use the pair trading signal as the secondary confirmation techniques and then you can use your other technical or fundamental analysis as the primary confirmation. One thing you have to note here is that your other techniques to be used together with our pair trading signal should be based on the mean reversion trading because pair trading is based on the mean reversion trading principle too.

You can have a look at this manual from the link. This manual was written for Pairs Trading Station. This manual focuses on taking the hedging position between buying and selling two highly correlated instruments. The manual includes how to use the basic features of Pairs Trading station like buttons and input settings. In addition, it also teach you how to interpret the spread for your trading. As we have mentioned before, once you can interpret the spread, then you can combine the spread analysis with other secondary confirmation techniques.

https://algotrading-investment.com/2015/11/14/introduction-to-pair-trading-station_ati/

In addition, you can watch this YouTube Video titled as How to use Pairs Trading Station

https://youtu.be/fAE9pByxZDA

Here is the landing page for Pairs Trading Station in MetaTrader 4 and MetaTrader5.

https://algotrading-investment.com/portfolio-item/pair-trading-station/

https://www.mql5.com/en/market/product/3303

https://www.mql5.com/en/market/product/3304

Pair Trading Station is a powerful Pairs Trading Indicator that uses the correlation and spread analysis. Pairs trading is also known as the statistical arbitrage as it involves buying undervalued asset and selling overvalued asset at the same time. Pair Trading in Forex can be best described as taking the hedge position of buying and selling two highly correlated instruments at the same time. However, pairs trading can be used to predict the turning point. For example, it is possible to only take one buy or sell position only. When you take one position, you can use the pair trading signal as the primary confirmation and then you can use other secondary confirmation techniques to accomplish your trading decision. On the other hands, you can use the pair trading signal as the secondary confirmation techniques and then you can use your other technical or fundamental analysis as the primary confirmation. One thing you have to note here is that your other techniques to be used together with our pair trading signal should be based on the mean reversion trading because pair trading is based on the mean reversion trading principle too.

You can have a look at this manual from the link. This manual was written for Pairs Trading Station. This manual focuses on taking the hedging position between buying and selling two highly correlated instruments. The manual includes how to use the basic features of Pairs Trading station like buttons and input settings. In addition, it also teach you how to interpret the spread for your trading. As we have mentioned before, once you can interpret the spread, then you can combine the spread analysis with other secondary confirmation techniques.

https://algotrading-investment.com/2015/11/14/introduction-to-pair-trading-station_ati/

In addition, you can watch this YouTube Video titled as How to use Pairs Trading Station

https://youtu.be/fAE9pByxZDA

Here is the landing page for Pairs Trading Station in MetaTrader 4 and MetaTrader5.

https://algotrading-investment.com/portfolio-item/pair-trading-station/

https://www.mql5.com/en/market/product/3303

https://www.mql5.com/en/market/product/3304

Young Ho Seo

Introduction to Price Pattern Scanner

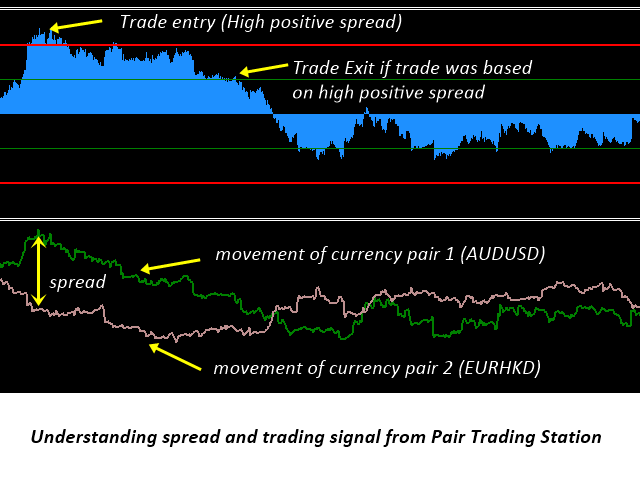

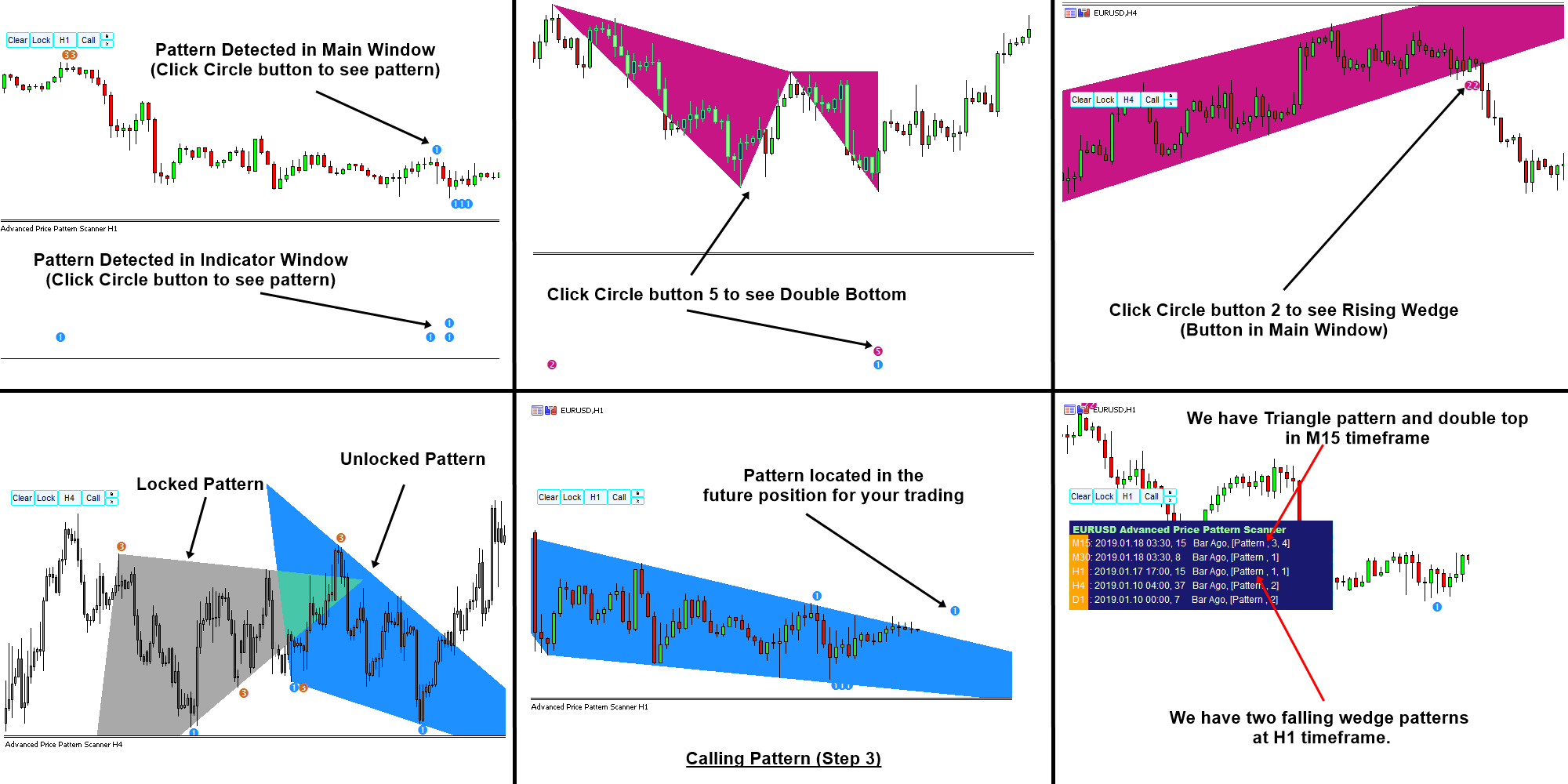

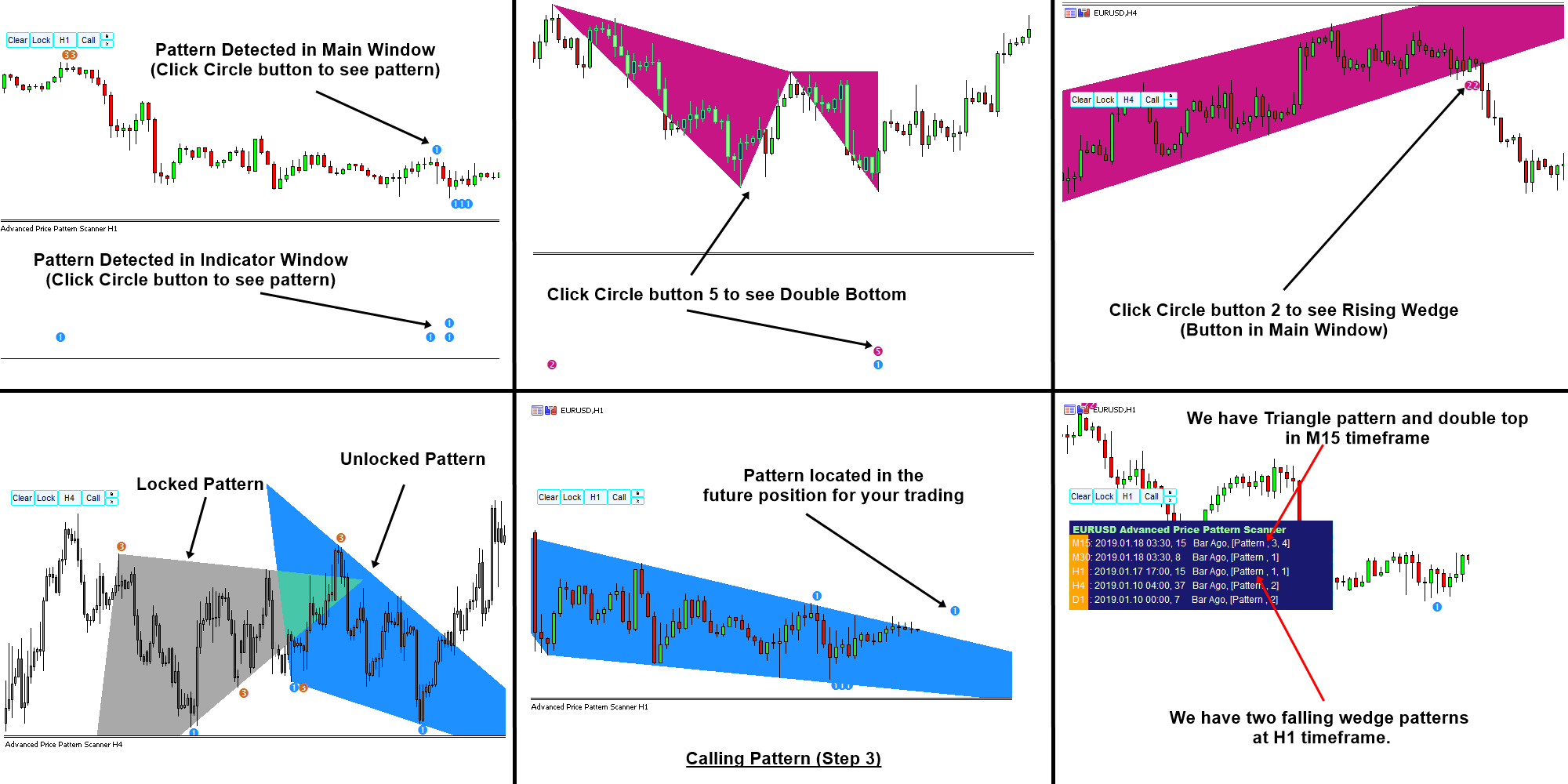

Price Pattern Scanner is the automatic pattern scanner that can detect the price pattern and chart pattern like triangle pattern, falling wedge pattern and rising wedge pattern and so on. Triangle, falling wedge, and rising wedge patterns occurs when the volatility of the market are gradually reduced. Normally, before some important news like Non-Farm Payroll or Unemployment Rate release, you can observe triangle, falling wedge, and rising wedge patterns frequently. Triangle, falling wedge, and rising wedge patterns are the sign of the high volatility in the future. At the same time, triangle, falling wedge, and rising wedge patterns indicates the increase in natural orders in the market. In another words, after triangle, falling wedge, and rising wedge pattern, we can observe some good trendy movement, which we can use for the potential entry.

Chart Pattern MT4 and Chart Pattern MT5 contains the highly sophisticated pattern detection algorithm. In addition, this price pattern scanner is non repainting pattern scanner. However, we have designed it in the easy to use and intuitive manner. Chart Pattern MT4 and Chart Pattern MT5 will show all the patterns in your chart in the most efficient format for your trading.

Detectable Price Patterns

Following pattern can be detected.

1) Triangle (Pattern Code = 0)

2) Falling Wedge (Pattern Code = 1)

3) Rising Wedge (Pattern Code = 2)

4) Double Top (Pattern Code = 3)

5) Double Bottom (Pattern Code = 4)

6) Head and Shoulder (Pattern Code = 5)

7) Reverse of Head and Shoulder (Pattern Code = 6)

8) Cup and Handle or Cup with Handle (Pattern Code = 7)

9) Reverse of Cup and Handle or Cup with Handle (Pattern Code = 8)

————————————————————————————-

Main Functionality

1) Pattern Detection in Indicator Window: Detected Patterns are located in the indicator window for your market analysis. To view or hide, just click the Circle button in the indicator window.

2) Pattern Detection in Main Window: Detected patterns are also located in the main window for your market analysis. To view or hide, just click the circle button in the main window.

3) Call Patterns: You can also call any patterns at the desired location in your chart. To access Call Pattern feature, click call button. Now you will have pointer in your chart. Move the pointer anywhere in your chart to located patterns, then click “Call” button again. You will see patterns corresponding to the location of pointer.

4) Multiple Timeframe Pattern Detection: You can also scan above patterns across different timeframe from one indicator. You can also switch on and off any specific timeframe per your need. Please note that Multiple Timeframe Pattern Detection requires much heavier computation.

5) Pattern Locking: You can also lock any patterns in your chart for your future use. Just click over Lock button to lock patterns in your chart.

———————————————————————————————–

Here is a Simple Video Tutorial for Chart Pattern MT4 and Chart Pattern MT5.

YouTube: https://www.youtube.com/watch?v=A1-IUr6u5Tg

Below are the links to Chart Pattern MT4 and Chart Pattern MT5.

https://algotrading-investment.com/portfolio-item/chart-pattern/

https://www.mql5.com/en/market/product/84567

https://www.mql5.com/en/market/product/84568

You can also use this product together with Peak Trough Analysis tool to yield better profit. Peak Trough Analysis is free tool for everyone. Below is how to download this free peak trough analysis indicator.

https://algotrading-investment.com/2019/08/29/how-to-download-peak-trough-analysis-tool/

YouTube Video about Triangle Pattern, Falling Wedge, Rising Wedge Pattern

YouTube Link: https://youtu.be/exefn_QM7ik

Price Pattern Scanner is the automatic pattern scanner that can detect the price pattern and chart pattern like triangle pattern, falling wedge pattern and rising wedge pattern and so on. Triangle, falling wedge, and rising wedge patterns occurs when the volatility of the market are gradually reduced. Normally, before some important news like Non-Farm Payroll or Unemployment Rate release, you can observe triangle, falling wedge, and rising wedge patterns frequently. Triangle, falling wedge, and rising wedge patterns are the sign of the high volatility in the future. At the same time, triangle, falling wedge, and rising wedge patterns indicates the increase in natural orders in the market. In another words, after triangle, falling wedge, and rising wedge pattern, we can observe some good trendy movement, which we can use for the potential entry.

Chart Pattern MT4 and Chart Pattern MT5 contains the highly sophisticated pattern detection algorithm. In addition, this price pattern scanner is non repainting pattern scanner. However, we have designed it in the easy to use and intuitive manner. Chart Pattern MT4 and Chart Pattern MT5 will show all the patterns in your chart in the most efficient format for your trading.

Detectable Price Patterns

Following pattern can be detected.

1) Triangle (Pattern Code = 0)

2) Falling Wedge (Pattern Code = 1)

3) Rising Wedge (Pattern Code = 2)

4) Double Top (Pattern Code = 3)

5) Double Bottom (Pattern Code = 4)

6) Head and Shoulder (Pattern Code = 5)

7) Reverse of Head and Shoulder (Pattern Code = 6)

8) Cup and Handle or Cup with Handle (Pattern Code = 7)

9) Reverse of Cup and Handle or Cup with Handle (Pattern Code = 8)

————————————————————————————-

Main Functionality

1) Pattern Detection in Indicator Window: Detected Patterns are located in the indicator window for your market analysis. To view or hide, just click the Circle button in the indicator window.

2) Pattern Detection in Main Window: Detected patterns are also located in the main window for your market analysis. To view or hide, just click the circle button in the main window.

3) Call Patterns: You can also call any patterns at the desired location in your chart. To access Call Pattern feature, click call button. Now you will have pointer in your chart. Move the pointer anywhere in your chart to located patterns, then click “Call” button again. You will see patterns corresponding to the location of pointer.

4) Multiple Timeframe Pattern Detection: You can also scan above patterns across different timeframe from one indicator. You can also switch on and off any specific timeframe per your need. Please note that Multiple Timeframe Pattern Detection requires much heavier computation.

5) Pattern Locking: You can also lock any patterns in your chart for your future use. Just click over Lock button to lock patterns in your chart.

———————————————————————————————–

Here is a Simple Video Tutorial for Chart Pattern MT4 and Chart Pattern MT5.

YouTube: https://www.youtube.com/watch?v=A1-IUr6u5Tg

Below are the links to Chart Pattern MT4 and Chart Pattern MT5.

https://algotrading-investment.com/portfolio-item/chart-pattern/

https://www.mql5.com/en/market/product/84567

https://www.mql5.com/en/market/product/84568

You can also use this product together with Peak Trough Analysis tool to yield better profit. Peak Trough Analysis is free tool for everyone. Below is how to download this free peak trough analysis indicator.

https://algotrading-investment.com/2019/08/29/how-to-download-peak-trough-analysis-tool/

YouTube Video about Triangle Pattern, Falling Wedge, Rising Wedge Pattern

YouTube Link: https://youtu.be/exefn_QM7ik

Young Ho Seo

Trading Tips for Newbie in Forex and Stock Market

In this article, we cover some trading tips for newbie staring Forex and Stock market. We will use the Q & A approach to share the useful information for newbie. Below the questions and answers will explain the key elements of successful trading in Forex and Stock market.

What is trading in Forex and Stock Market ?

Trading is a profit seeking operation with buying and selling the financial asset like a currency, stock or cryptocurrency. Profit seeking in long run is often based on materializing the regularities in the financial market. If anyone made money from the market in long run, this means that the market was not random, at least to them. In another words, you have found some sort of regularities in the market. Some people call these regularities as correlation, pattern, trend, wave, volatility, holes in the financial market, or many other names. But they are all regularities regardless of how you call them. Even you are doing some sort of arbitrage trading, you are still making use of some regularities that are known to few people. For example, in this case, you have found a pattern that some place selling the finanical asset cheaper than the other place or the other way around. Typically, this sort of arbritage information in financial market can be found using positive or negative correlation between two brokers or two exchange.

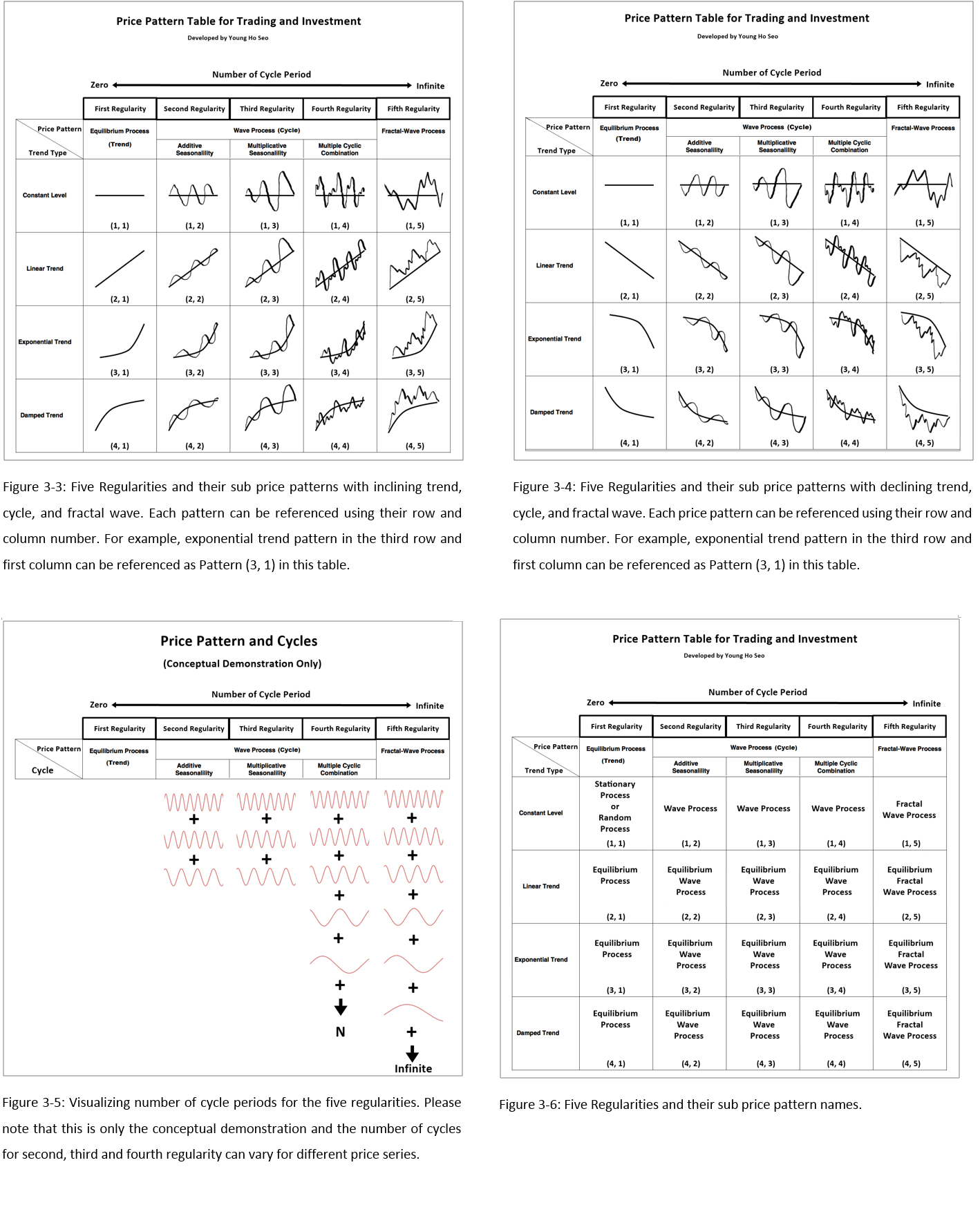

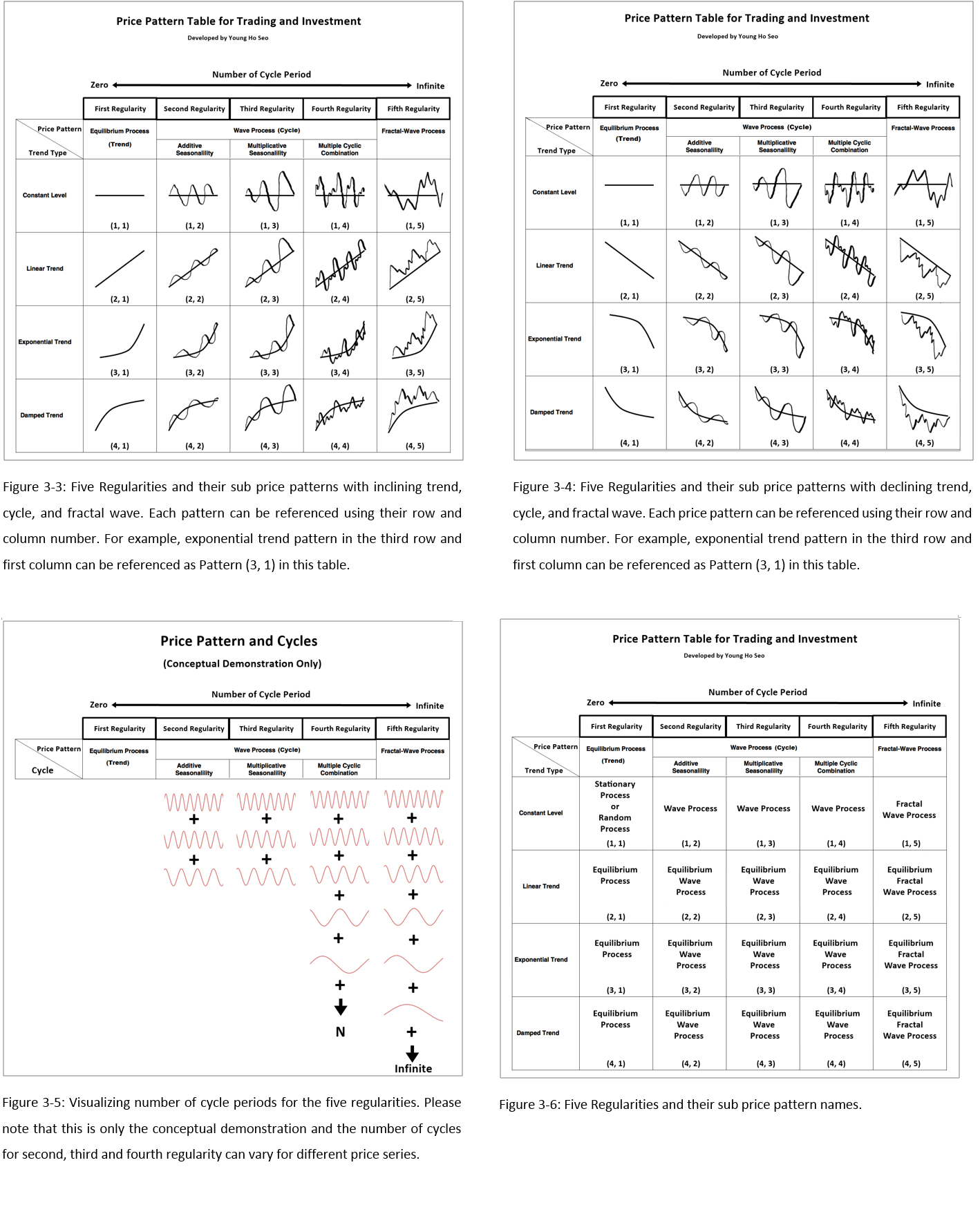

What are the regularities you should know for live trading ?

There are regularities from simple to complex in the financial market. To make your life simple, I have gathered five most occurring and most important regularities for trader in the price pattern table. They are Trend, Seasonality, Cycles, Fractal Wave and Correlation. Typically each trading strategy around Forex and Stock trading is designed to capture one of these five regularities. The best way to understand these regularities is to visualize the market using the chart. Typically, the candlstick chart is used mostly in Forex and Stock trading. When we use the candlestick chart, we can see these regularities in the chart. We can make a buy or sell decision based on our understanding of the market.

How to capture these regularities for profit ?

To visualize the market and to understand the regularities in the market, it is important to understand your tools. Depending on the tools, you may or may not able to identify the specific regularties existing in the market. If the market consists of a simple regularty, then you may not need any tool. However, this is very unlikely in the modern financial market. In addition, you need to understand why a particular tool is designed. Any tools used in the financial market has some assumption around the tool. When the assumption of the tool does not fit for the market, the tool can fail. Before blindly applying any technical indicator like MACD, CCI, RSI, etc, you need to ask how these tools are constructed and what the purpose of these tools are. This is the most important question for the successful trading. For example, the price action, price pattern and chart pattern are the direct price analysis. The main assumption of the direct price analysis is based on the endless zig zag movement of the price, also known as the fractal wave.

Read entire article about Trading Tips for Newbie from the link below.

https://algotrading-investment.com/2019/05/06/trading-tips-for-newbie-in-forex-and-stock-market/

Any further tips on improving profit ?

Trade with deep decision making instead of superficial decision making. It is the quality matter and not quantity. It is useless that you trade fast reckless. Many number of trade will not guarantee your success. Even for one trade, put the quality piece of information technically (from chart) and fundamentally (from surrounding market environment) together.

If you are looking for the tools for the direct price analysis like the price action, price pattern and chart pattern, then visit our website. Our website provides the best tools geared up for the price action, price pattern and chart pattern. Our products include the technical indicator, expert adviser, inter-market analysis tools and pattern scanner making the best use of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave, Supply Demand Analysis, Volume Spread Analysis and Market Volatility. MetaTrader product range includes the Harmonic Pattern Indicator, Elliott Wave Indicator, Momentum Indicator, Volume Spread Analysis, Support Resistance Indicator, Supply Demand Indicator, Pairs Trading Indicator, Renko Chart Indicator, Volitility Indicator and Expert Advisors.

https://www.mql5.com/en/users/financeengineer/seller#products

https://algotrading-investment.com/

In this article, we cover some trading tips for newbie staring Forex and Stock market. We will use the Q & A approach to share the useful information for newbie. Below the questions and answers will explain the key elements of successful trading in Forex and Stock market.

What is trading in Forex and Stock Market ?

Trading is a profit seeking operation with buying and selling the financial asset like a currency, stock or cryptocurrency. Profit seeking in long run is often based on materializing the regularities in the financial market. If anyone made money from the market in long run, this means that the market was not random, at least to them. In another words, you have found some sort of regularities in the market. Some people call these regularities as correlation, pattern, trend, wave, volatility, holes in the financial market, or many other names. But they are all regularities regardless of how you call them. Even you are doing some sort of arbitrage trading, you are still making use of some regularities that are known to few people. For example, in this case, you have found a pattern that some place selling the finanical asset cheaper than the other place or the other way around. Typically, this sort of arbritage information in financial market can be found using positive or negative correlation between two brokers or two exchange.

What are the regularities you should know for live trading ?

There are regularities from simple to complex in the financial market. To make your life simple, I have gathered five most occurring and most important regularities for trader in the price pattern table. They are Trend, Seasonality, Cycles, Fractal Wave and Correlation. Typically each trading strategy around Forex and Stock trading is designed to capture one of these five regularities. The best way to understand these regularities is to visualize the market using the chart. Typically, the candlstick chart is used mostly in Forex and Stock trading. When we use the candlestick chart, we can see these regularities in the chart. We can make a buy or sell decision based on our understanding of the market.

How to capture these regularities for profit ?

To visualize the market and to understand the regularities in the market, it is important to understand your tools. Depending on the tools, you may or may not able to identify the specific regularties existing in the market. If the market consists of a simple regularty, then you may not need any tool. However, this is very unlikely in the modern financial market. In addition, you need to understand why a particular tool is designed. Any tools used in the financial market has some assumption around the tool. When the assumption of the tool does not fit for the market, the tool can fail. Before blindly applying any technical indicator like MACD, CCI, RSI, etc, you need to ask how these tools are constructed and what the purpose of these tools are. This is the most important question for the successful trading. For example, the price action, price pattern and chart pattern are the direct price analysis. The main assumption of the direct price analysis is based on the endless zig zag movement of the price, also known as the fractal wave.

Read entire article about Trading Tips for Newbie from the link below.

https://algotrading-investment.com/2019/05/06/trading-tips-for-newbie-in-forex-and-stock-market/

Any further tips on improving profit ?

Trade with deep decision making instead of superficial decision making. It is the quality matter and not quantity. It is useless that you trade fast reckless. Many number of trade will not guarantee your success. Even for one trade, put the quality piece of information technically (from chart) and fundamentally (from surrounding market environment) together.

If you are looking for the tools for the direct price analysis like the price action, price pattern and chart pattern, then visit our website. Our website provides the best tools geared up for the price action, price pattern and chart pattern. Our products include the technical indicator, expert adviser, inter-market analysis tools and pattern scanner making the best use of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave, Supply Demand Analysis, Volume Spread Analysis and Market Volatility. MetaTrader product range includes the Harmonic Pattern Indicator, Elliott Wave Indicator, Momentum Indicator, Volume Spread Analysis, Support Resistance Indicator, Supply Demand Indicator, Pairs Trading Indicator, Renko Chart Indicator, Volitility Indicator and Expert Advisors.

https://www.mql5.com/en/users/financeengineer/seller#products

https://algotrading-investment.com/

Young Ho Seo

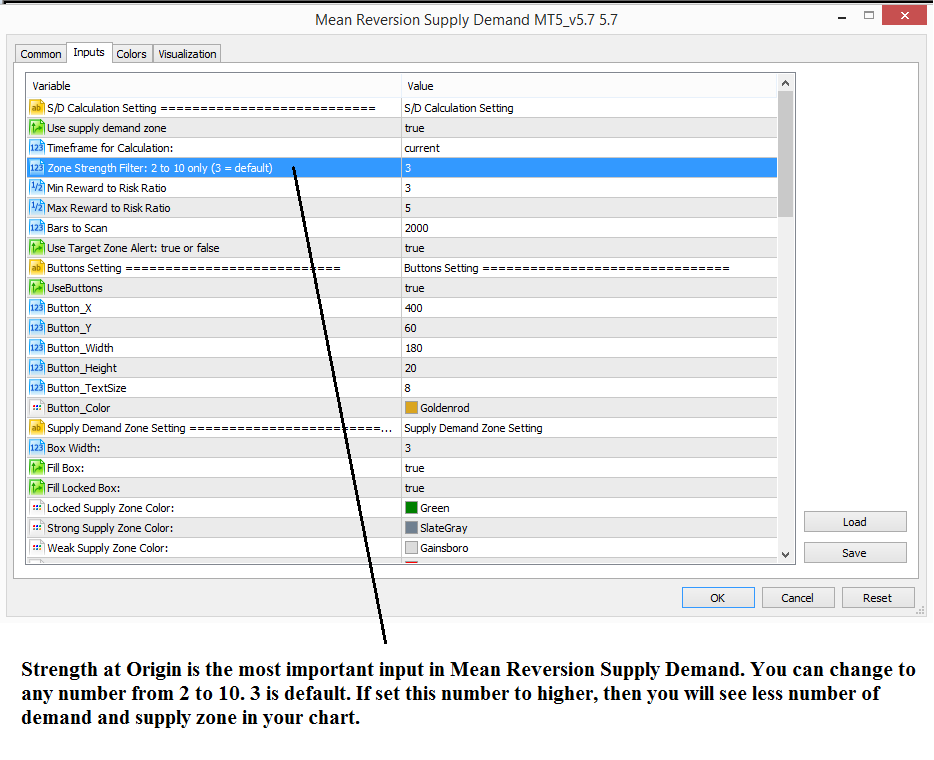

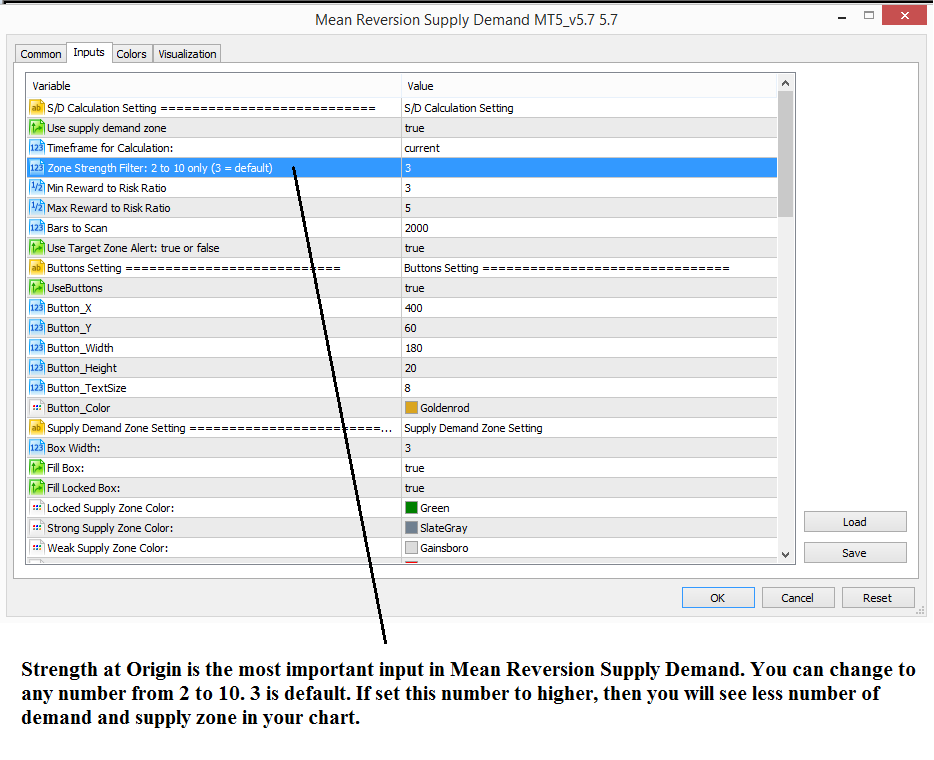

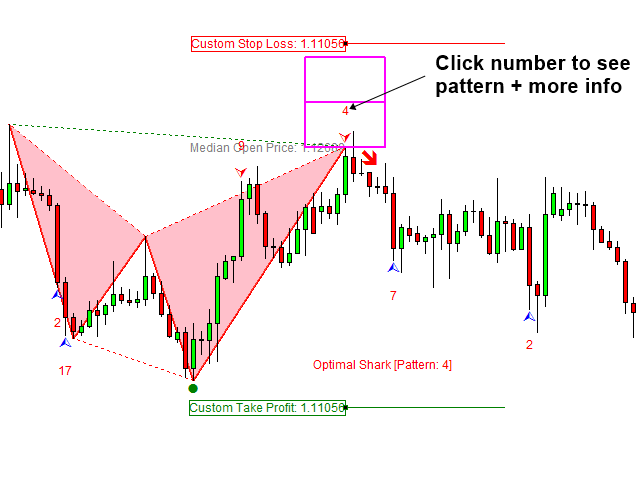

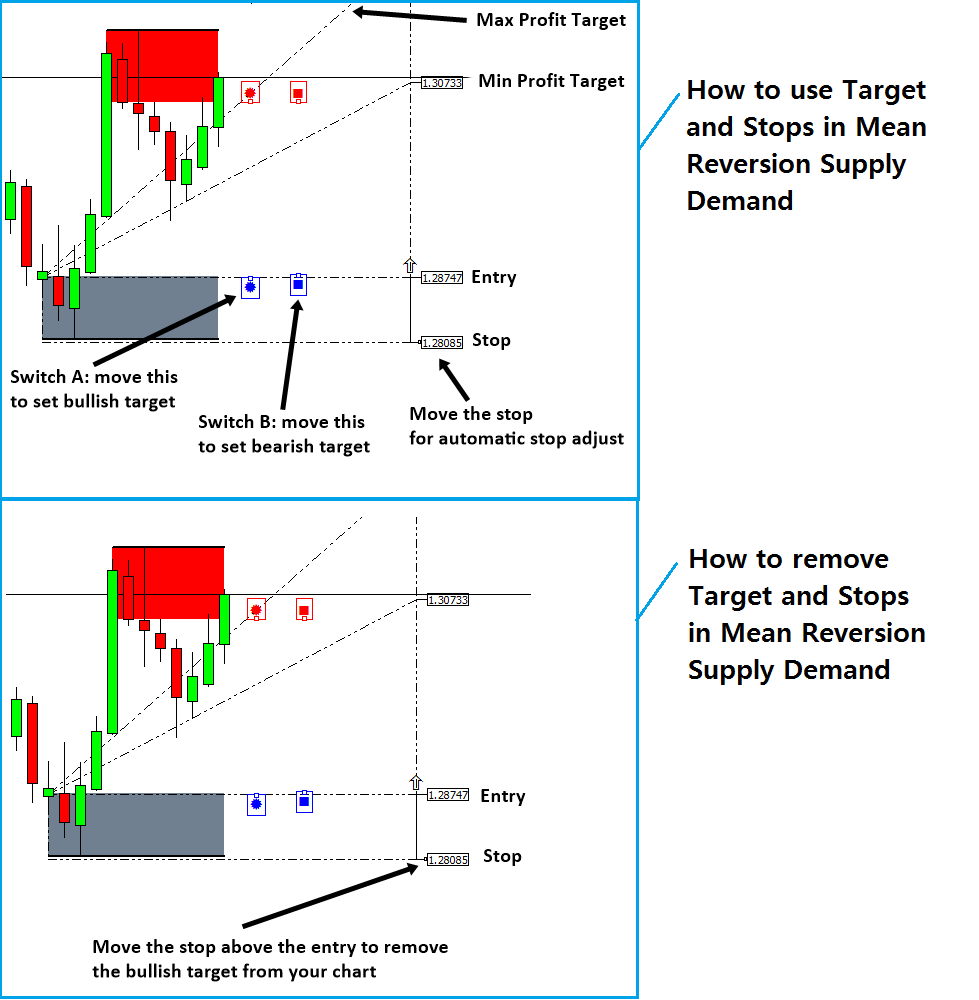

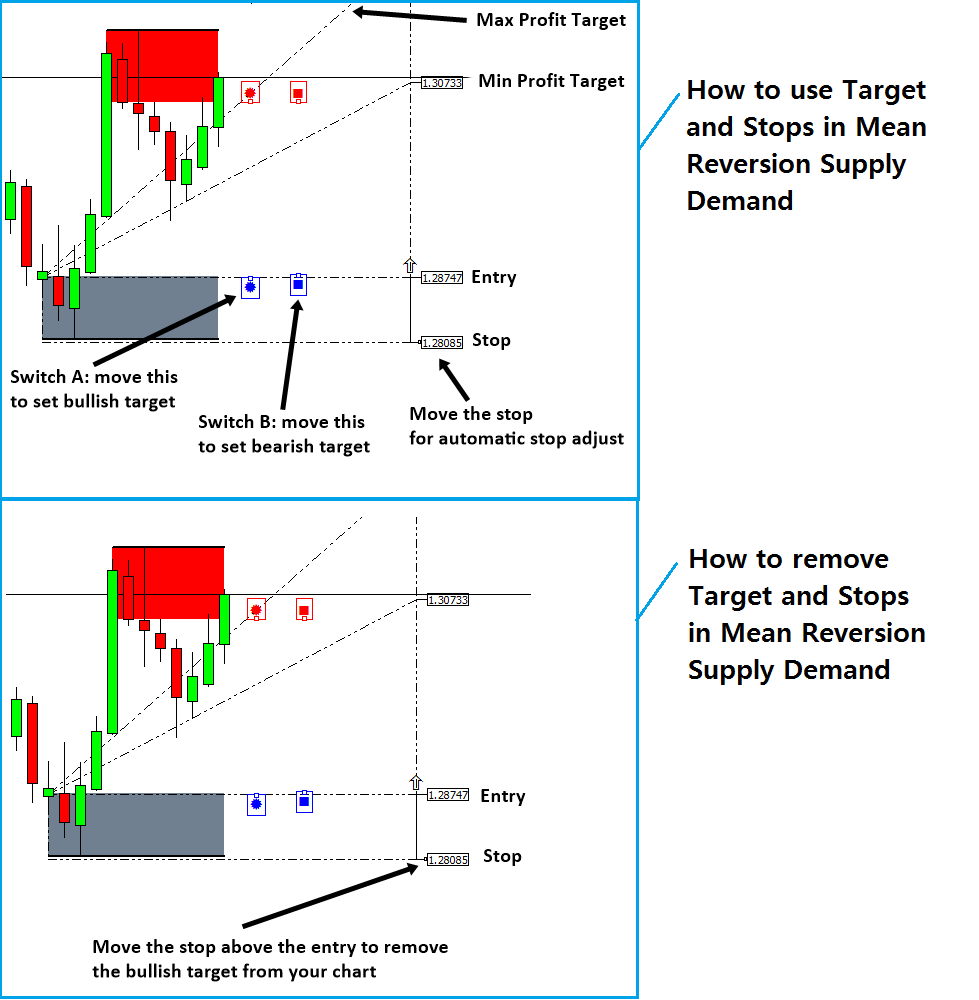

Mean Reversion Supply Demand Analysis

Mean reversion is a science to explain the turning point in Forex and Stock market. Mean reversion also provides a great explanation behind the Supply Demand Analysis. This article provides some guide for mean reversion supply demand indicator. Mean Reversion Supply Demand is an excellent tool to trade the supply and demand zone in Forex and Stock market. You can use the tool with multiple timeframe analysis. In addition, it can detect the trading zone where you can set stop loss and take profit target at most efficient price. Simply speaking, any support and resistance trader can use this Mean Reversion Supply Demand Indicator. Even any chart pattern or price pattern trader can use this Mean Reversion Supply Demand Indicator.

Mean Reversion Supply Demand indicator has “Strength at Origin” input. This input is the same and corresponding input described by Sam Seiden. You can consider the Strenth at Origin as the speed of the price movement. Therefore, “Strength at Origin” input can be range from 2 to 10. Higher the number you choose, you will filter out the less obvious supply and demand pattern. However, with higher number of Strength at origin, you will see less number of supply demand zone to trade as you are applying more strict filter. This means that you will see less number of supply and demand trading zone when you use Strength at Origin = 8 comparing to Strength at Origin = 3.

If you are new to the supply demand analysis, then it might good to choose the Strengh at Origin to 5 or more. However, if you are using any secondary confiramtion, then you can use the Strengh at Origin 2 or 3. Of course, if you know what you are doing, then you can always choose any Strength at Origin as you wish.

Below is some other guidelines for Mean Reversion Supply Demand. Please read this guides for your own goods:

https://algotradinginvestment.wordpress.com/2017/03/13/simple-instruction-of-mean-reversion-supply-demand/

https://algotradinginvestment.wordpress.com/2017/12/23/mean-reversion-supply-demand-shown-hidden-timeframe-button/

https://algotradinginvestment.wordpress.com/2018/01/25/mean-reversion-supply-demand-multiple-timeframe-analysis/

Here are link to Mean Reversion Supply Demand:

https://www.mql5.com/en/market/product/16851

https://www.mql5.com/en/market/product/16823

https://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand/

Mean reversion is a science to explain the turning point in Forex and Stock market. Mean reversion also provides a great explanation behind the Supply Demand Analysis. This article provides some guide for mean reversion supply demand indicator. Mean Reversion Supply Demand is an excellent tool to trade the supply and demand zone in Forex and Stock market. You can use the tool with multiple timeframe analysis. In addition, it can detect the trading zone where you can set stop loss and take profit target at most efficient price. Simply speaking, any support and resistance trader can use this Mean Reversion Supply Demand Indicator. Even any chart pattern or price pattern trader can use this Mean Reversion Supply Demand Indicator.

Mean Reversion Supply Demand indicator has “Strength at Origin” input. This input is the same and corresponding input described by Sam Seiden. You can consider the Strenth at Origin as the speed of the price movement. Therefore, “Strength at Origin” input can be range from 2 to 10. Higher the number you choose, you will filter out the less obvious supply and demand pattern. However, with higher number of Strength at origin, you will see less number of supply demand zone to trade as you are applying more strict filter. This means that you will see less number of supply and demand trading zone when you use Strength at Origin = 8 comparing to Strength at Origin = 3.

If you are new to the supply demand analysis, then it might good to choose the Strengh at Origin to 5 or more. However, if you are using any secondary confiramtion, then you can use the Strengh at Origin 2 or 3. Of course, if you know what you are doing, then you can always choose any Strength at Origin as you wish.

Below is some other guidelines for Mean Reversion Supply Demand. Please read this guides for your own goods:

https://algotradinginvestment.wordpress.com/2017/03/13/simple-instruction-of-mean-reversion-supply-demand/

https://algotradinginvestment.wordpress.com/2017/12/23/mean-reversion-supply-demand-shown-hidden-timeframe-button/

https://algotradinginvestment.wordpress.com/2018/01/25/mean-reversion-supply-demand-multiple-timeframe-analysis/

Here are link to Mean Reversion Supply Demand:

https://www.mql5.com/en/market/product/16851

https://www.mql5.com/en/market/product/16823

https://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand/

Young Ho Seo

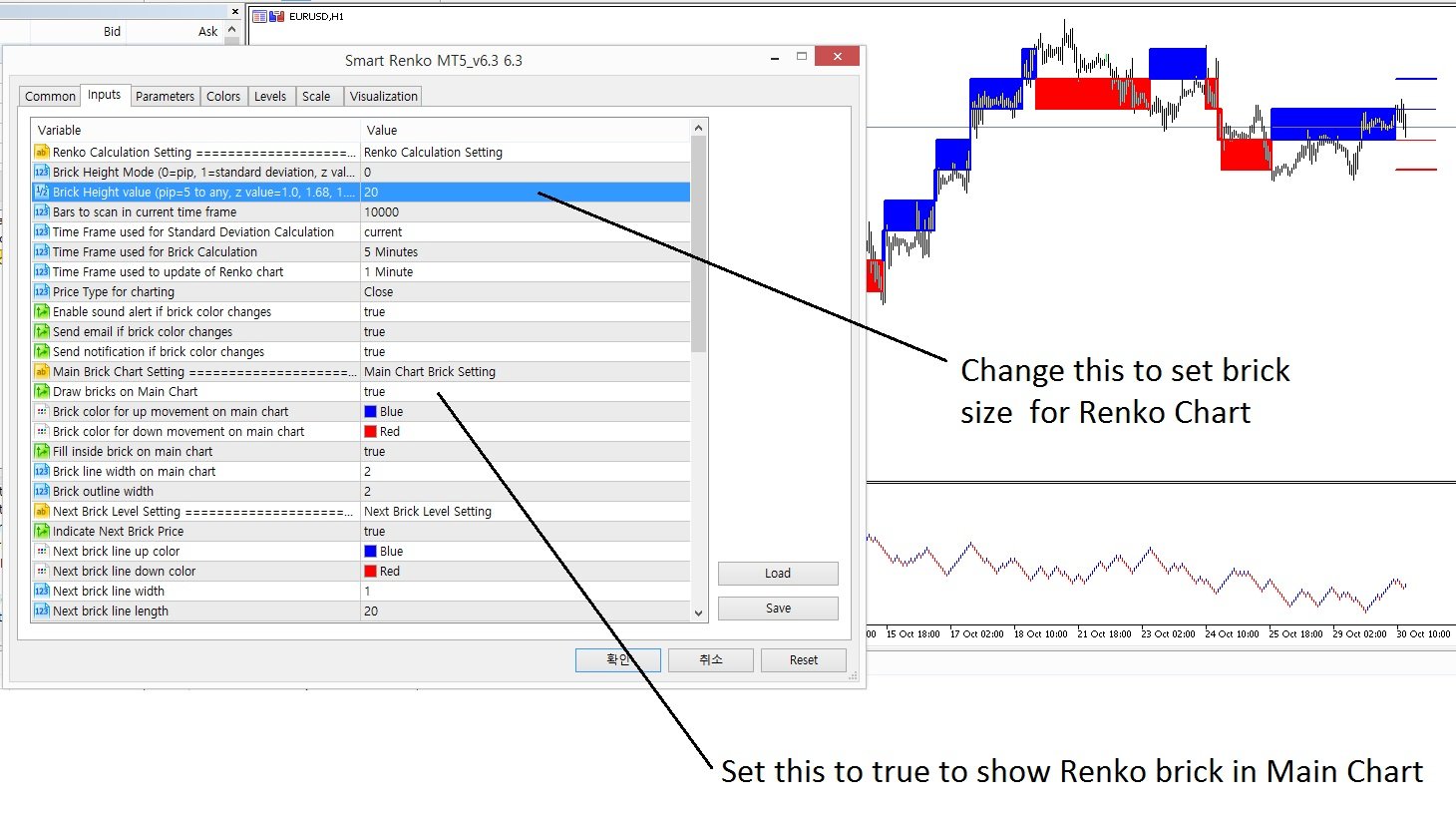

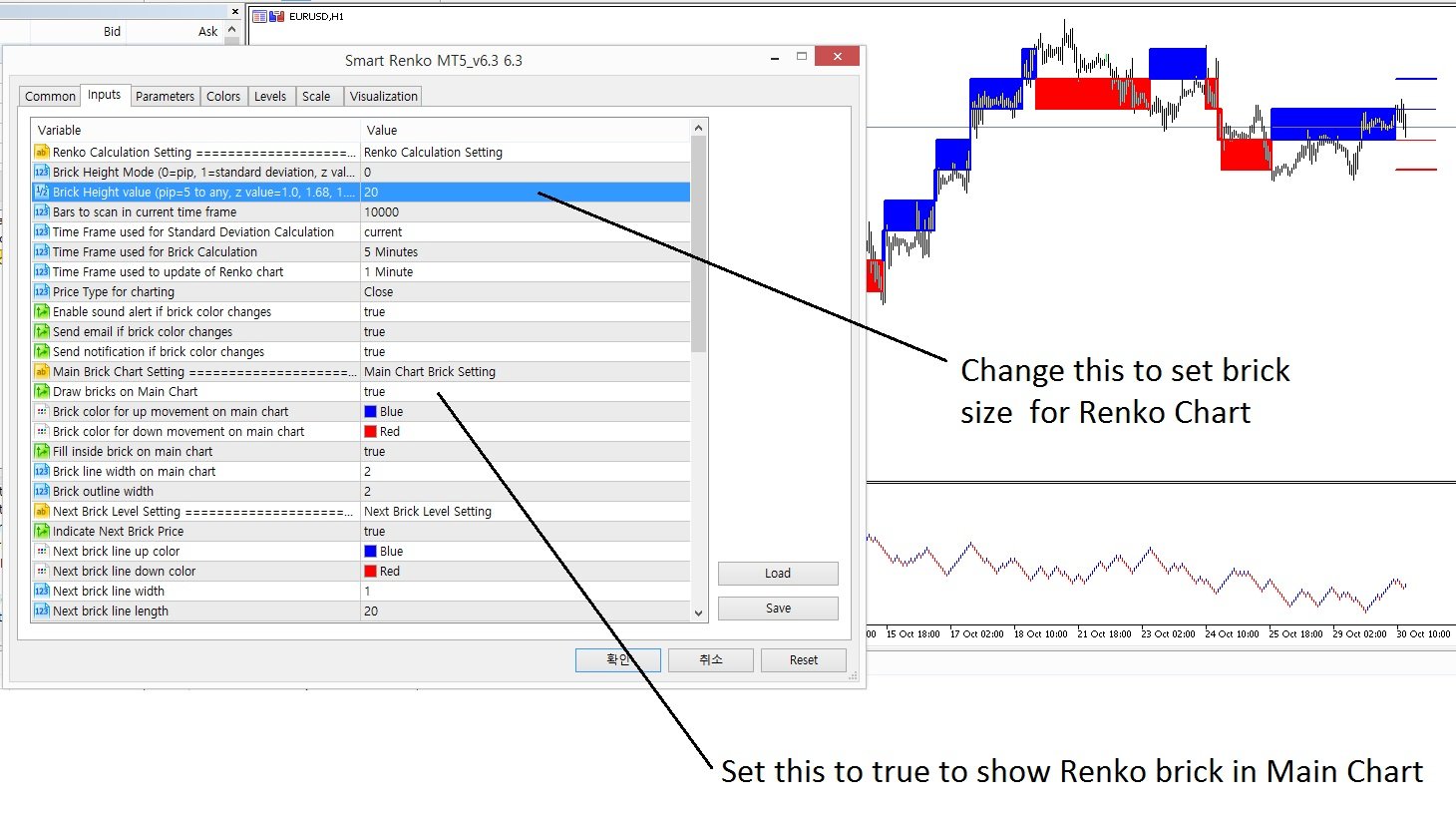

Smart Renko Chart

Renko chart is a popular tool to trade with the price action in Forex and Stock market. Renko Chart is the visualization technique, which does not use the fixed time interval but it uses the fixed price height. It is useful tool to recognize price action, price pattern and chart pattern from Forex and Stock chart. We created a powerful tool called Smart Renko for Price Action Trader. Here we will explain how to use Smart Renko Chart in brief. Smart Renko is a hybrid tool between renko chart and candlestick chart. Smart Renko provides the spread view of the renko bricks on the candle stick chart and then it also keeps the normal renko chart on the bottom. The advantage of Smart Renko is that you can use the analysis of renko chart together with the analysis of candlestick chart at the same time. You can get the best out of the both world.

The important point before using any Renko chart is about the brick height. This also appies to the Smart Renko Chart too. Just like normal renko chart, Smart Renko chart need to decide the good number for brick height. From my experience, you can the brick height near the 1 standard deviation. However, you must use the brick height in the round number because standard deviation might come in decimal numbers. So be sure to round up those decimal numbers into good integer numbers.

Another consideration is that your brick height should be in the factor of 10, 100 or 1000 pips for your trading. That means that using 5, 10, 20, 25, 50, 100, or 1000 brick height is the most effective price height for your trading. From my experience, these factored number can serve better for your brick height. If you do not choose sensible brick height, then you might not able to see anything on your charts. So be sure to choose the sensible brick height.

Finally do not forget that in Smart Renko, your analysis in Renko chart can be transferred to Main chart by double clicking over the Trend lines.

If you want to dig deeper, please google on renko chart. You will see a lot of articles about Renko charts and how to trade with them.

https://www.mql5.com/en/market/product/9911

https://www.mql5.com/en/market/product/9944

https://algotrading-investment.com/portfolio-item/smart-renko/

In addition, some feature of Smart Renko is built inside the Price Breakout Pattern Scanner. Hence, you can use the automated Pattern Scanner together with Smart Renko Chart inside the Price Breakout Pattern Scanner. Price Breakout Pattener cotains two tools in one techncial indicator. In addition, Price Breakout Pattern Scanner provides the 52 Japanese candlestick patterns to assit your trading decision. Here are the links for the Price Breakout Pattern Scanner.

https://www.mql5.com/en/market/product/4859

https://www.mql5.com/en/market/product/4858

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

YouTube Video about Smart Renko Chart

YouTube Link: https://youtu.be/EMAxFHbNziM

Renko chart is a popular tool to trade with the price action in Forex and Stock market. Renko Chart is the visualization technique, which does not use the fixed time interval but it uses the fixed price height. It is useful tool to recognize price action, price pattern and chart pattern from Forex and Stock chart. We created a powerful tool called Smart Renko for Price Action Trader. Here we will explain how to use Smart Renko Chart in brief. Smart Renko is a hybrid tool between renko chart and candlestick chart. Smart Renko provides the spread view of the renko bricks on the candle stick chart and then it also keeps the normal renko chart on the bottom. The advantage of Smart Renko is that you can use the analysis of renko chart together with the analysis of candlestick chart at the same time. You can get the best out of the both world.

The important point before using any Renko chart is about the brick height. This also appies to the Smart Renko Chart too. Just like normal renko chart, Smart Renko chart need to decide the good number for brick height. From my experience, you can the brick height near the 1 standard deviation. However, you must use the brick height in the round number because standard deviation might come in decimal numbers. So be sure to round up those decimal numbers into good integer numbers.

Another consideration is that your brick height should be in the factor of 10, 100 or 1000 pips for your trading. That means that using 5, 10, 20, 25, 50, 100, or 1000 brick height is the most effective price height for your trading. From my experience, these factored number can serve better for your brick height. If you do not choose sensible brick height, then you might not able to see anything on your charts. So be sure to choose the sensible brick height.

Finally do not forget that in Smart Renko, your analysis in Renko chart can be transferred to Main chart by double clicking over the Trend lines.

If you want to dig deeper, please google on renko chart. You will see a lot of articles about Renko charts and how to trade with them.

https://www.mql5.com/en/market/product/9911

https://www.mql5.com/en/market/product/9944

https://algotrading-investment.com/portfolio-item/smart-renko/

In addition, some feature of Smart Renko is built inside the Price Breakout Pattern Scanner. Hence, you can use the automated Pattern Scanner together with Smart Renko Chart inside the Price Breakout Pattern Scanner. Price Breakout Pattener cotains two tools in one techncial indicator. In addition, Price Breakout Pattern Scanner provides the 52 Japanese candlestick patterns to assit your trading decision. Here are the links for the Price Breakout Pattern Scanner.

https://www.mql5.com/en/market/product/4859

https://www.mql5.com/en/market/product/4858

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

YouTube Video about Smart Renko Chart

YouTube Link: https://youtu.be/EMAxFHbNziM

Young Ho Seo

Harmonic Pattern Guide

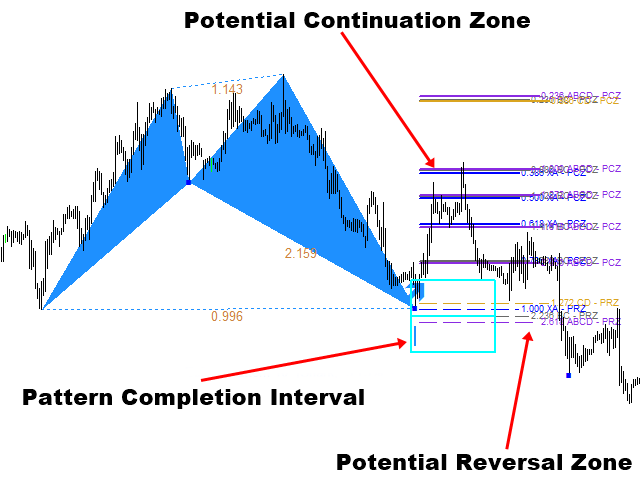

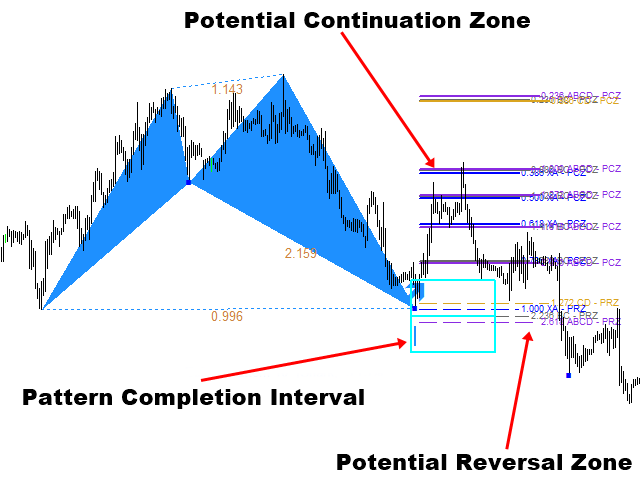

Guide to Precision Harmonic Pattern Trading is a good book to get the trading guide for Harmonic Pattern. Here is some information about the book.

Book Title: Guide to Precision Harmonic Pattern Trading

Book Subtitle: Mastering Turning Point Strategy for Financial Trading

This book will explain the Harmonic Pattern Trading in practical approach. Book will explain how to predict the turning point uisng Harmonic Pattern like Gartley Pattern, Butterfly Pattern, Bat Pattern, Crab Pattern, Cypher Pattern, 5-0 Pattern and so on for currency or stock market. The book also explain the ratio framework used in Harmonic Pattern. The book will also demonstrate the possible price trajectory around the point D of Harmonic Pattern. The book also touches the order managment and risk management in detail when you trade with Harmonic Pattern. The book will describe How to use Pattern Completion Zone, Potential Reversal Zone and Potential Continuation Zone at your advantage for your turning point prediction. If you want to use harmonic pattern, this is a must read book.

This book is available from various book distributors on the internet including Google Play Book, Scribd, Amazon, Kobo, Apple and so on.

Google Play: https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

Scribd: https://www.scribd.com/book/394041109/Guide-to-Precision-Harmonic-Pattern-Trading

Apple Books: https://itunes.apple.com/us/book/id1444526074

Amazon.com: https://www.amazon.com/dp/B01MRI5LY6

Barnes & Noble: https://www.barnesandnoble.com/w/guide-to-precision-harmonic-pattern-trading-young-ho-seo/1129937788?ean=2940156276585

Rakuten kobo: https://www.kobo.com/ww/en/ebook/guide-to-precision-harmonic-pattern-trading

In addition, you can find free trading education from the link below. If you want to improve your day trading, then you can use this trading education. Learn how to maximize your profit in Forex and Stock Market with this free trading education.

https://algotrading-investment.com/2019/07/23/trading-education/

If you are looking for Harmonic Pattern Indicator or Harmonic Pattern Scanner, you can find a good one from the website below. In fact, this website provides many tools and indicators related to Price Action, Price Pattern and Chart Pattern.

https://algotrading-investment.com

https://www.mql5.com/en/users/financeengineer/seller#products

Guide to Precision Harmonic Pattern Trading is a good book to get the trading guide for Harmonic Pattern. Here is some information about the book.

Book Title: Guide to Precision Harmonic Pattern Trading

Book Subtitle: Mastering Turning Point Strategy for Financial Trading

This book will explain the Harmonic Pattern Trading in practical approach. Book will explain how to predict the turning point uisng Harmonic Pattern like Gartley Pattern, Butterfly Pattern, Bat Pattern, Crab Pattern, Cypher Pattern, 5-0 Pattern and so on for currency or stock market. The book also explain the ratio framework used in Harmonic Pattern. The book will also demonstrate the possible price trajectory around the point D of Harmonic Pattern. The book also touches the order managment and risk management in detail when you trade with Harmonic Pattern. The book will describe How to use Pattern Completion Zone, Potential Reversal Zone and Potential Continuation Zone at your advantage for your turning point prediction. If you want to use harmonic pattern, this is a must read book.

This book is available from various book distributors on the internet including Google Play Book, Scribd, Amazon, Kobo, Apple and so on.

Google Play: https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

Scribd: https://www.scribd.com/book/394041109/Guide-to-Precision-Harmonic-Pattern-Trading

Apple Books: https://itunes.apple.com/us/book/id1444526074

Amazon.com: https://www.amazon.com/dp/B01MRI5LY6

Barnes & Noble: https://www.barnesandnoble.com/w/guide-to-precision-harmonic-pattern-trading-young-ho-seo/1129937788?ean=2940156276585

Rakuten kobo: https://www.kobo.com/ww/en/ebook/guide-to-precision-harmonic-pattern-trading

In addition, you can find free trading education from the link below. If you want to improve your day trading, then you can use this trading education. Learn how to maximize your profit in Forex and Stock Market with this free trading education.

https://algotrading-investment.com/2019/07/23/trading-education/

If you are looking for Harmonic Pattern Indicator or Harmonic Pattern Scanner, you can find a good one from the website below. In fact, this website provides many tools and indicators related to Price Action, Price Pattern and Chart Pattern.

https://algotrading-investment.com

https://www.mql5.com/en/users/financeengineer/seller#products

Young Ho Seo

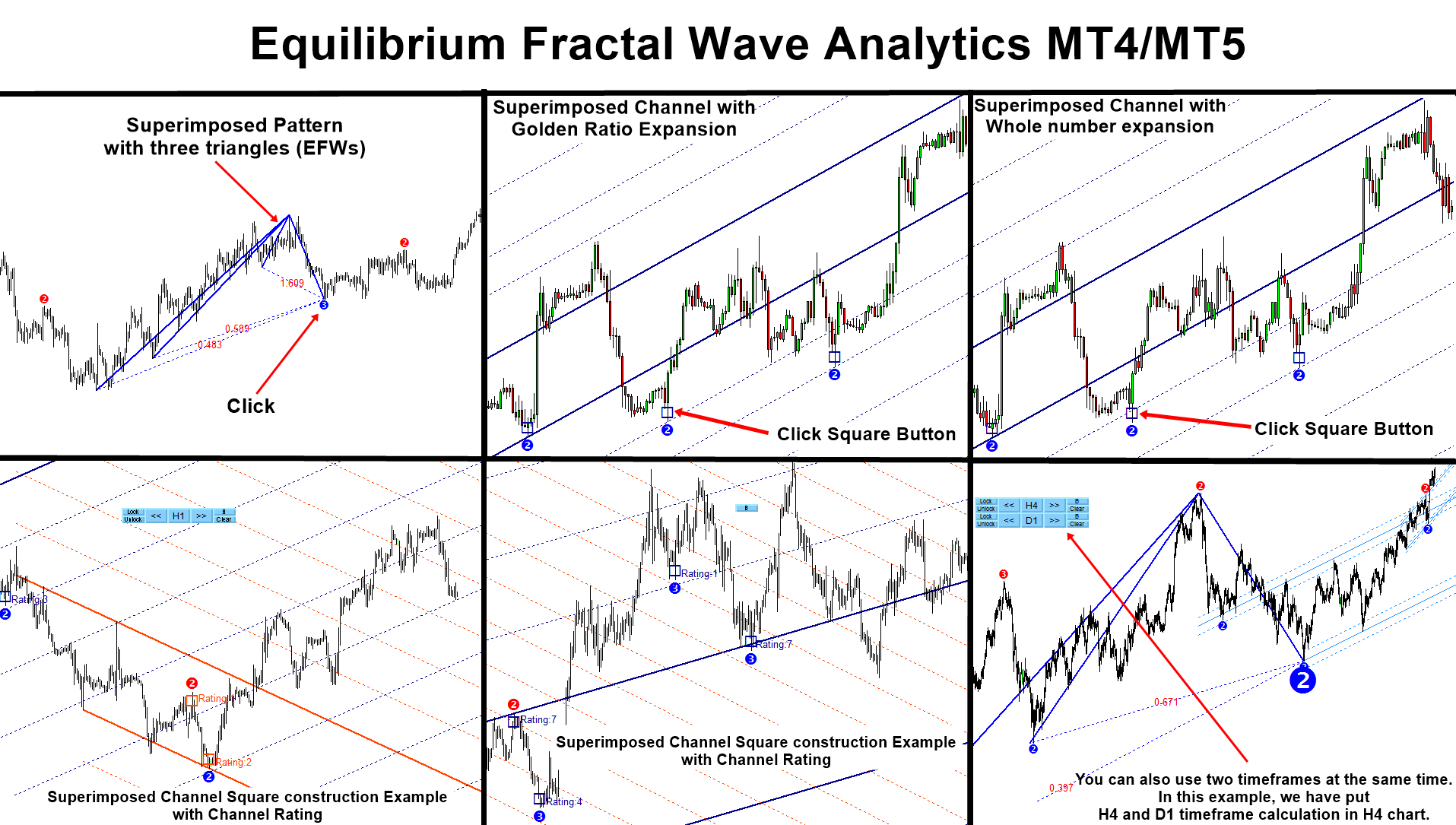

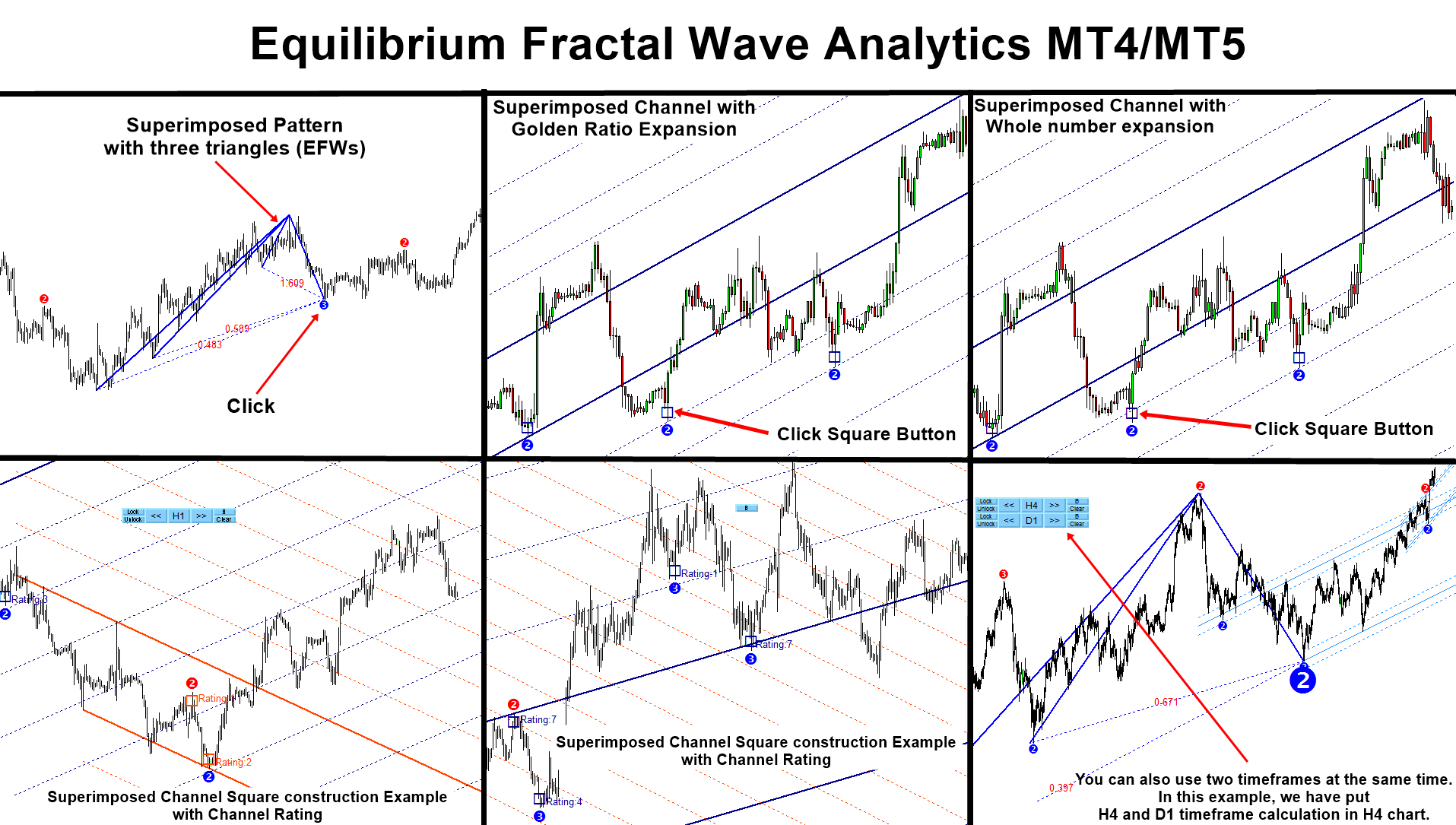

Introduction to Equilibrium Fractal Wave Analytics

EFW Analytics was designed to accomplish the statement “We trade because there are regularities in the financial market”. EFW Analytics is a set of tools designed to maximize your trading performance by capturing the repeating fractal geometry, known as the fifth regularity in the financial market. The functionality of EFW Analytics consists of three parts including:

1. Equilibrium Fractal Wave Index: exploratory tool to support your trading logic to choose which ratio to trade

2. Superimposed Pattern Detection as turning point analysis

3. Superimposed Channel for market prediction with Golden ratio expansion

4. Superimposed Channel for market prediction with whole number expansion

5. Equilibrium Fractal Wave (EFW) Channel detection

6. Superimposed Channel Rating (Higher rating = higher predictive power)

EFW Analytics provide the graphic rich and fully visual trading styles. In default trading strategy, you will be looking at the combined signal from Superimposed pattern + EFW Channel or Superimposed pattern + Superimposed Channel. In addition, you can perform many more trading strategies in a reversal and breakout mode. You can also run two different timeframes in one chart to enforce your trading decision. Sound alert, email and push notification are built inside the indicator.

Below is the link to the EFW Analytics:

https://algotrading-investment.com/portfolio-item/equilibrium-fractal-wave-analytics/

https://www.mql5.com/en/market/product/27703

https://www.mql5.com/en/market/product/27702

EFW Analytics was designed to accomplish the statement “We trade because there are regularities in the financial market”. EFW Analytics is a set of tools designed to maximize your trading performance by capturing the repeating fractal geometry, known as the fifth regularity in the financial market. The functionality of EFW Analytics consists of three parts including:

1. Equilibrium Fractal Wave Index: exploratory tool to support your trading logic to choose which ratio to trade

2. Superimposed Pattern Detection as turning point analysis

3. Superimposed Channel for market prediction with Golden ratio expansion

4. Superimposed Channel for market prediction with whole number expansion

5. Equilibrium Fractal Wave (EFW) Channel detection

6. Superimposed Channel Rating (Higher rating = higher predictive power)

EFW Analytics provide the graphic rich and fully visual trading styles. In default trading strategy, you will be looking at the combined signal from Superimposed pattern + EFW Channel or Superimposed pattern + Superimposed Channel. In addition, you can perform many more trading strategies in a reversal and breakout mode. You can also run two different timeframes in one chart to enforce your trading decision. Sound alert, email and push notification are built inside the indicator.

Below is the link to the EFW Analytics:

https://algotrading-investment.com/portfolio-item/equilibrium-fractal-wave-analytics/

https://www.mql5.com/en/market/product/27703

https://www.mql5.com/en/market/product/27702

Young Ho Seo

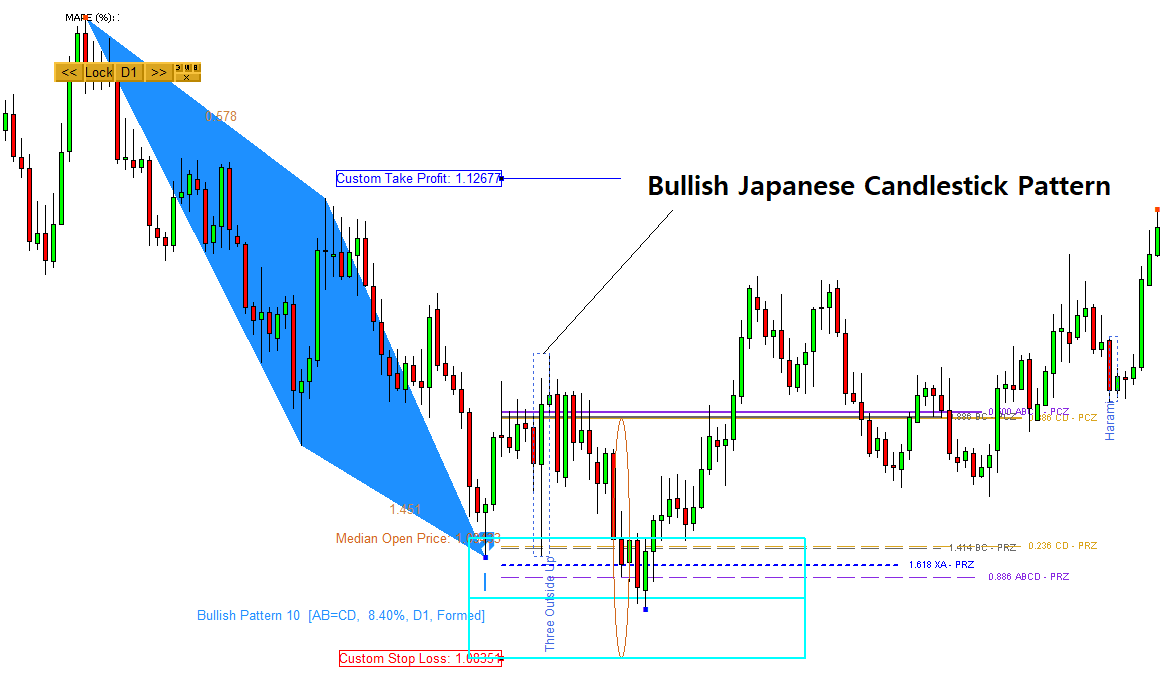

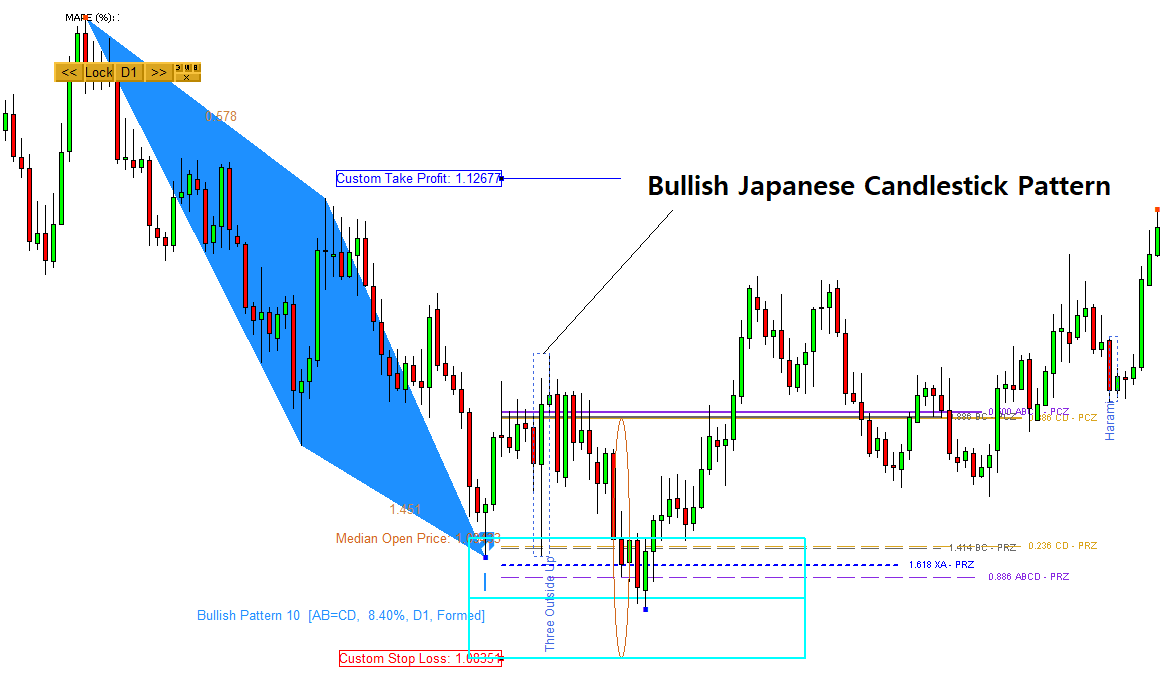

Japanese Candlestick Pattern with Harmonic Pattern

Japanese candlestick pattern can be a great supplementary tool when you trade with Harmonic Pattern. Reversal candlestick patterns can predict a change in price direction. Continuation candlestick patterns can predict an extension in the current price direction. Japanese candlestick pattern provides visual insight for buying and selling momentum of the current market. Then Harmonic Pattern helps you to identify the location of the potential turning point in your chart. Hence, combining both of them can increase the success rate of your trading.

Harmonic Pattern Plus is the powerful harmonic pattern indicator with the capability to detect Japanese Candlestick Patterns together. Properly used, this tool can yield excellent trading results. One of the trading system built inside Harmonic Pattern Plus is the Japanese Candlestick Pattern as well as Harmonic Pattern. Japanese Candlestick Pattern can provide both entry and exit signal for traders. Hence, many traders use them as the secondary confirmation techniques.

In the trading community, Japanese candlestick patterns were the favorite trading tool of many traders. Hence, Harmonic Pattern Plus provides you the opportunity to combine the Japanese candlestick pattern with Harmonic Pattern Trading setup. Harmonic Pattern Plus can detect 52 different Japanese candlestick patterns. These Japanese candlestick patterns include “Hammer”, “Doji Star”, “Harami”, “Inverted Hammer”, “Break away” and so on. They are categorized under five categories including one, two, three, four and five candlestick patterns in Harmonic Pattern Plus.

To use Japanese candlestick patterns, you have to enable the candlestick pattern from Harmonic Pattern Plus. See the attached screenshot firstly. You can enable this function from the inputs tab in your MetaTrader after the Harmonic Pattern Plus is attached to any of your chart. Then you can switch on and off the individual category of patterns according to your preferences. For example, you can only use two or three candlestick patterns if you wish. From our observation, the Japanese candlestick patterns made up from two or three bars are more accurate than the Japanese candlestick pattern made up from one bar. Since you can check the historical pattern, you should be able to test your strategy with these Japanese candlestick patterns if you wish. In addition, you can also receive sound alert, email and push notification when new Japanese candlestick patterns are detected.

Although the Harmonic Pattern Plus is the repainting indicator, it is still at the affordable price with tons of powerful features for Forex trading. At the same time, it is non lagging indicator too. If you do not mind the repainting, then you can choose the Harmonic Pattern Plus. You will find the many additional features inside Harmonic Pattern Plus beside the Harmonic Pattern and Japanese Candlestick Pattern detection. For example, pattern completion interval can be used for the trading risk management and automatic channel can be used to find better reversal and trend following opportunity and many more. We hope this short article was helpful for you to understand how to unlock the Japanese Candlestick patterns from Harmonic Pattern Plus. We wish you the best trading experience in Forex market.

Below is the landing page for Harmonic Pattern Plus with Japanese Candlestick Pattern Features.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

If you must use non repainting and non lagging Harmonic Pattern Indicator, then you can also use X3 Chart Pattern Scanner. X3 Chart Pattern Scanner also provides Japanese Candlestick Pattern and Harmonic Pattern. In addition, you have the possibility to use Elliott Wave Pattern and other Chart Patterns. X3 Chart Pattern Scanner can cost more, due to its unique features.

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

YouTube About Japanese Candlestick Pattern with Harmonic Pattern

YouTube Link: https://youtu.be/YnMJyXZvjFM

Japanese candlestick pattern can be a great supplementary tool when you trade with Harmonic Pattern. Reversal candlestick patterns can predict a change in price direction. Continuation candlestick patterns can predict an extension in the current price direction. Japanese candlestick pattern provides visual insight for buying and selling momentum of the current market. Then Harmonic Pattern helps you to identify the location of the potential turning point in your chart. Hence, combining both of them can increase the success rate of your trading.

Harmonic Pattern Plus is the powerful harmonic pattern indicator with the capability to detect Japanese Candlestick Patterns together. Properly used, this tool can yield excellent trading results. One of the trading system built inside Harmonic Pattern Plus is the Japanese Candlestick Pattern as well as Harmonic Pattern. Japanese Candlestick Pattern can provide both entry and exit signal for traders. Hence, many traders use them as the secondary confirmation techniques.

In the trading community, Japanese candlestick patterns were the favorite trading tool of many traders. Hence, Harmonic Pattern Plus provides you the opportunity to combine the Japanese candlestick pattern with Harmonic Pattern Trading setup. Harmonic Pattern Plus can detect 52 different Japanese candlestick patterns. These Japanese candlestick patterns include “Hammer”, “Doji Star”, “Harami”, “Inverted Hammer”, “Break away” and so on. They are categorized under five categories including one, two, three, four and five candlestick patterns in Harmonic Pattern Plus.

To use Japanese candlestick patterns, you have to enable the candlestick pattern from Harmonic Pattern Plus. See the attached screenshot firstly. You can enable this function from the inputs tab in your MetaTrader after the Harmonic Pattern Plus is attached to any of your chart. Then you can switch on and off the individual category of patterns according to your preferences. For example, you can only use two or three candlestick patterns if you wish. From our observation, the Japanese candlestick patterns made up from two or three bars are more accurate than the Japanese candlestick pattern made up from one bar. Since you can check the historical pattern, you should be able to test your strategy with these Japanese candlestick patterns if you wish. In addition, you can also receive sound alert, email and push notification when new Japanese candlestick patterns are detected.

Although the Harmonic Pattern Plus is the repainting indicator, it is still at the affordable price with tons of powerful features for Forex trading. At the same time, it is non lagging indicator too. If you do not mind the repainting, then you can choose the Harmonic Pattern Plus. You will find the many additional features inside Harmonic Pattern Plus beside the Harmonic Pattern and Japanese Candlestick Pattern detection. For example, pattern completion interval can be used for the trading risk management and automatic channel can be used to find better reversal and trend following opportunity and many more. We hope this short article was helpful for you to understand how to unlock the Japanese Candlestick patterns from Harmonic Pattern Plus. We wish you the best trading experience in Forex market.

Below is the landing page for Harmonic Pattern Plus with Japanese Candlestick Pattern Features.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

If you must use non repainting and non lagging Harmonic Pattern Indicator, then you can also use X3 Chart Pattern Scanner. X3 Chart Pattern Scanner also provides Japanese Candlestick Pattern and Harmonic Pattern. In addition, you have the possibility to use Elliott Wave Pattern and other Chart Patterns. X3 Chart Pattern Scanner can cost more, due to its unique features.

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

YouTube About Japanese Candlestick Pattern with Harmonic Pattern

YouTube Link: https://youtu.be/YnMJyXZvjFM

Young Ho Seo

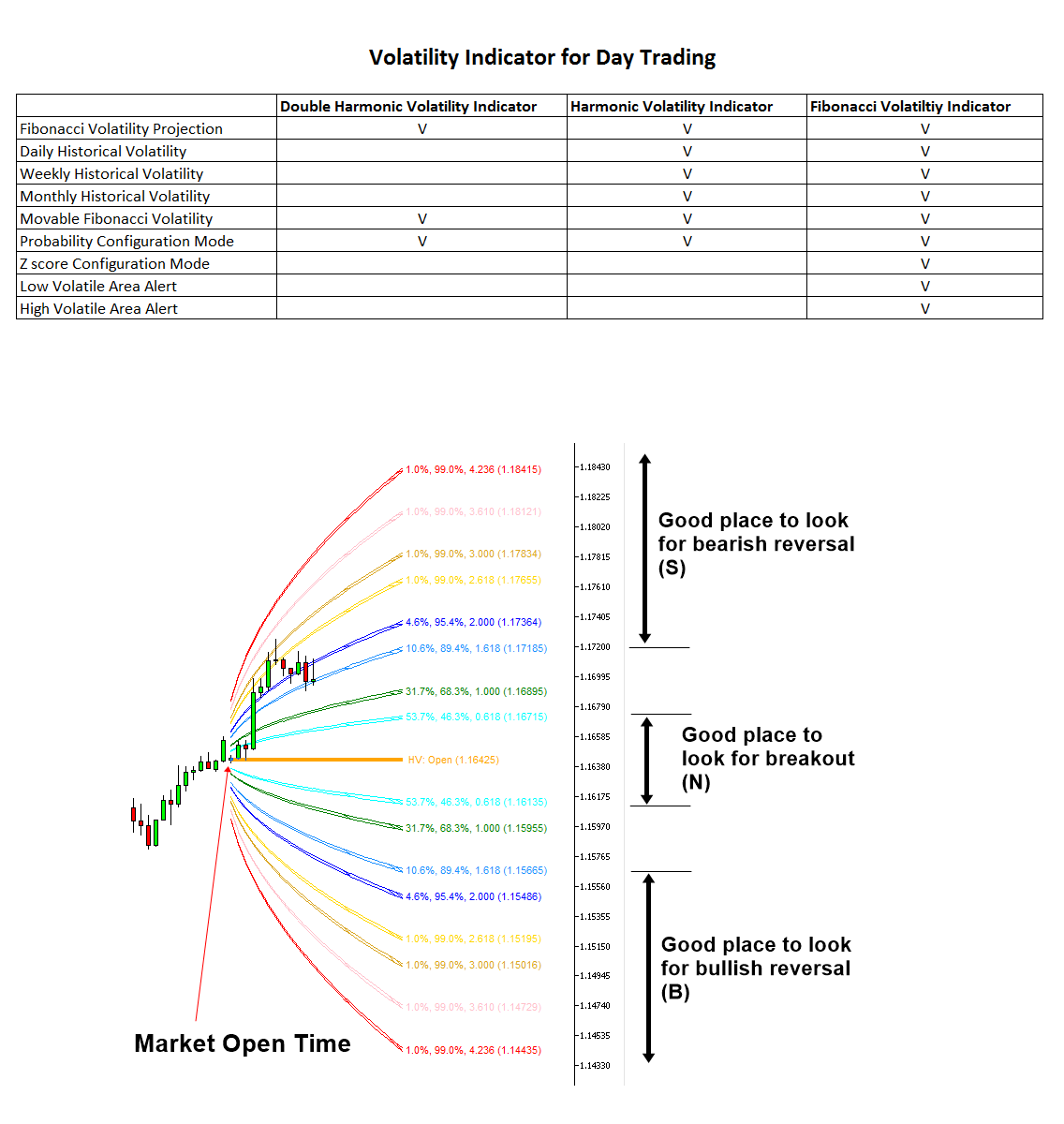

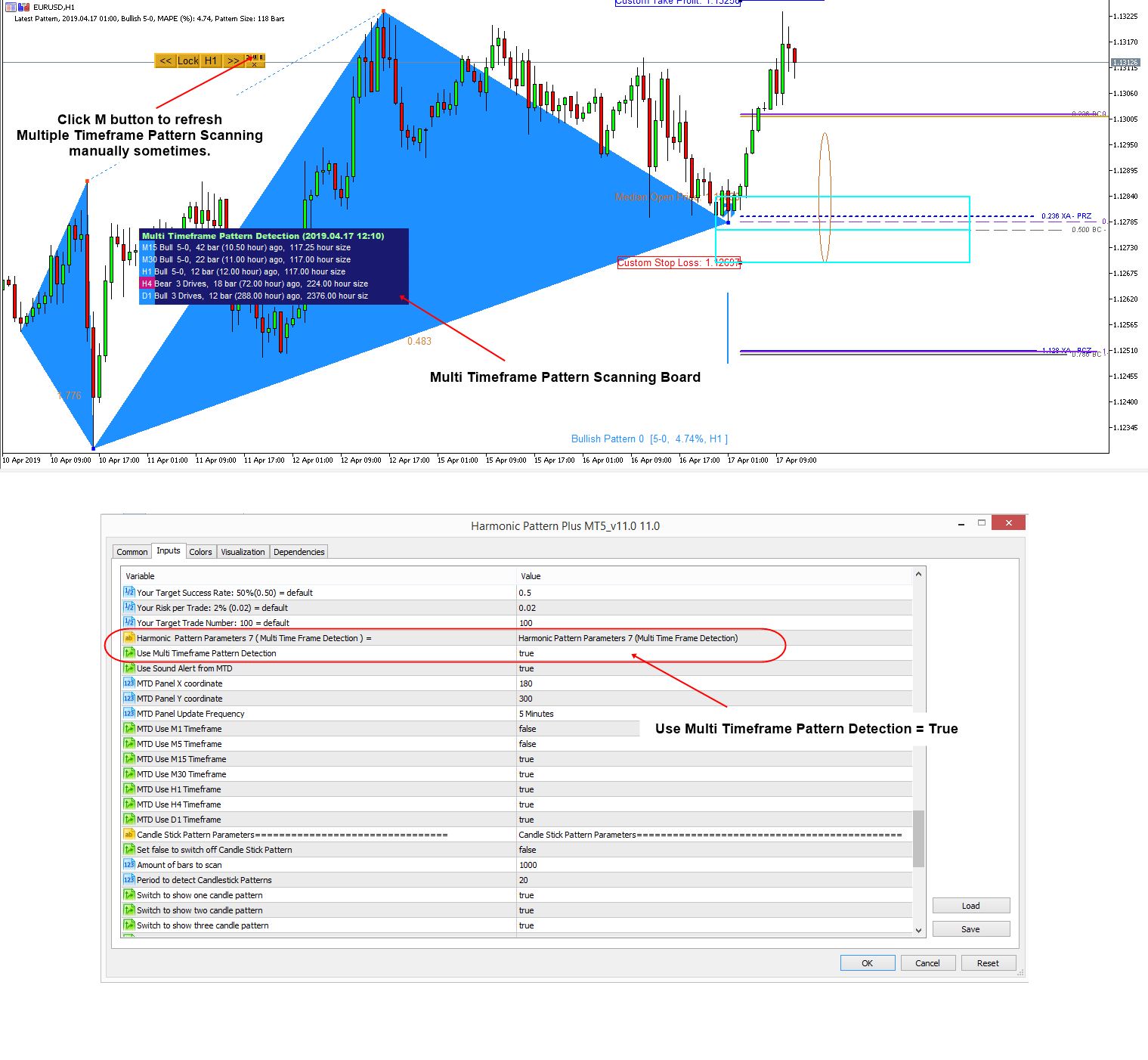

Volatility Indicator List for Day Trading

Volatility indicator can help you to detect any statistical advantage for your trading. Especially, if you are trading with Price Action and Price Patterns, then we recommend to use the Volatility indicator together with your strategy. We provide the advanced volatility indicators for MetaTrader 4 and MetaTrader 5 platform.

Fibonacci Volatility Indicator

Fibonacci Volatility indicator can provide the market volatility in visual form in your chart for your trading. You can use Daily, Weekly, Monthly and Yearly Volatility for your trading. The most important application of this Volatility indicator is to detect the potential breakout area, potential bullish reversal area and potential bearish reversal area. When you want to visualize the Volatility for your trading, this is the best tool available in the market. Additionally, you can also use the Movable Volatility indicator too.

https://www.mql5.com/en/market/product/52671

https://www.mql5.com/en/market/product/52670

https://algotrading-investment.com/portfolio-item/fibonacci-volatility-indicator/

Harmonic Volatility Indicator

Harmonic Volatility indicator also provides the market volatility in visual form in your chart for your trading. This tool can be used to visualize the Daily, Weekly, Monthly and Yearly Volatility. The difference between Harmonic Volatility indicator and Fibonacci Volatility indicator is that you can only use Probability Configuration mode in the Harmonic Volatility indicator whereas in the Fibonacci Volatility indicator you can access both Probability Configuration and Z Score configuration. This is cheaper than Fibonacci Volatility indicator.

https://www.mql5.com/en/market/product/29008

https://www.mql5.com/en/market/product/29004

https://algotrading-investment.com/portfolio-item/harmonic-volatility-indicator/

Double Harmonic Volatility Indicator

This is the cheapest Volatility indicator. This indicator is specialized in the Movable Volatility indicator mostly. Hence, if you only need the Movable Volatility indicator and you want to have more cost effective tool, then use this. However, if you want to have more choice in the Volatility visualization, then use either Harmonic Volatility indicator or Fibonacci Volatility indicator.

https://www.mql5.com/en/market/product/23779

https://www.mql5.com/en/market/product/23769

https://algotrading-investment.com/portfolio-item/double-harmonic-volatility-indicator/

GARCH improved Nelder Mead – Free indicator

This is free Volatility indicator that implements the Generalized Autoregressive Conditional Heteroskedasticity (GARCH) methods with Nelder Mead algorithm. This is bit of experimental indicator to realize the GARCH (1,1) model. Hence, we provide this indicator for free. It would be interesting to see how this Volatility indicator works for your trading.

https://www.mql5.com/en/market/product/6918

https://www.mql5.com/en/market/product/6910

https://algotrading-investment.com/portfolio-item/garch-improved-nelder-mead/

Volatility indicator can help you to detect any statistical advantage for your trading. Especially, if you are trading with Price Action and Price Patterns, then we recommend to use the Volatility indicator together with your strategy. We provide the advanced volatility indicators for MetaTrader 4 and MetaTrader 5 platform.

Fibonacci Volatility Indicator

Fibonacci Volatility indicator can provide the market volatility in visual form in your chart for your trading. You can use Daily, Weekly, Monthly and Yearly Volatility for your trading. The most important application of this Volatility indicator is to detect the potential breakout area, potential bullish reversal area and potential bearish reversal area. When you want to visualize the Volatility for your trading, this is the best tool available in the market. Additionally, you can also use the Movable Volatility indicator too.

https://www.mql5.com/en/market/product/52671

https://www.mql5.com/en/market/product/52670

https://algotrading-investment.com/portfolio-item/fibonacci-volatility-indicator/

Harmonic Volatility Indicator

Harmonic Volatility indicator also provides the market volatility in visual form in your chart for your trading. This tool can be used to visualize the Daily, Weekly, Monthly and Yearly Volatility. The difference between Harmonic Volatility indicator and Fibonacci Volatility indicator is that you can only use Probability Configuration mode in the Harmonic Volatility indicator whereas in the Fibonacci Volatility indicator you can access both Probability Configuration and Z Score configuration. This is cheaper than Fibonacci Volatility indicator.

https://www.mql5.com/en/market/product/29008

https://www.mql5.com/en/market/product/29004

https://algotrading-investment.com/portfolio-item/harmonic-volatility-indicator/

Double Harmonic Volatility Indicator

This is the cheapest Volatility indicator. This indicator is specialized in the Movable Volatility indicator mostly. Hence, if you only need the Movable Volatility indicator and you want to have more cost effective tool, then use this. However, if you want to have more choice in the Volatility visualization, then use either Harmonic Volatility indicator or Fibonacci Volatility indicator.

https://www.mql5.com/en/market/product/23779

https://www.mql5.com/en/market/product/23769

https://algotrading-investment.com/portfolio-item/double-harmonic-volatility-indicator/

GARCH improved Nelder Mead – Free indicator

This is free Volatility indicator that implements the Generalized Autoregressive Conditional Heteroskedasticity (GARCH) methods with Nelder Mead algorithm. This is bit of experimental indicator to realize the GARCH (1,1) model. Hence, we provide this indicator for free. It would be interesting to see how this Volatility indicator works for your trading.

https://www.mql5.com/en/market/product/6918

https://www.mql5.com/en/market/product/6910

https://algotrading-investment.com/portfolio-item/garch-improved-nelder-mead/

Young Ho Seo

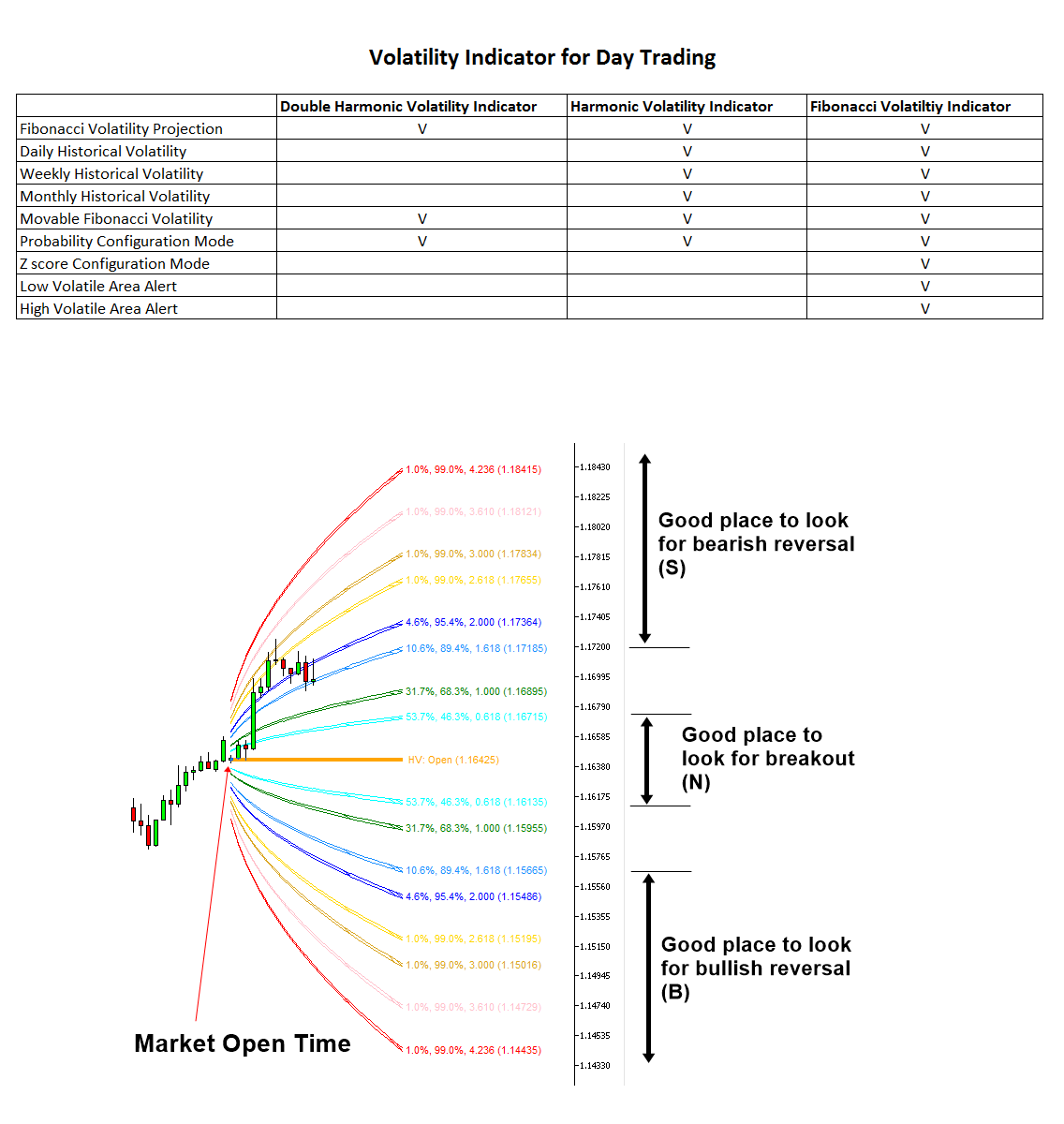

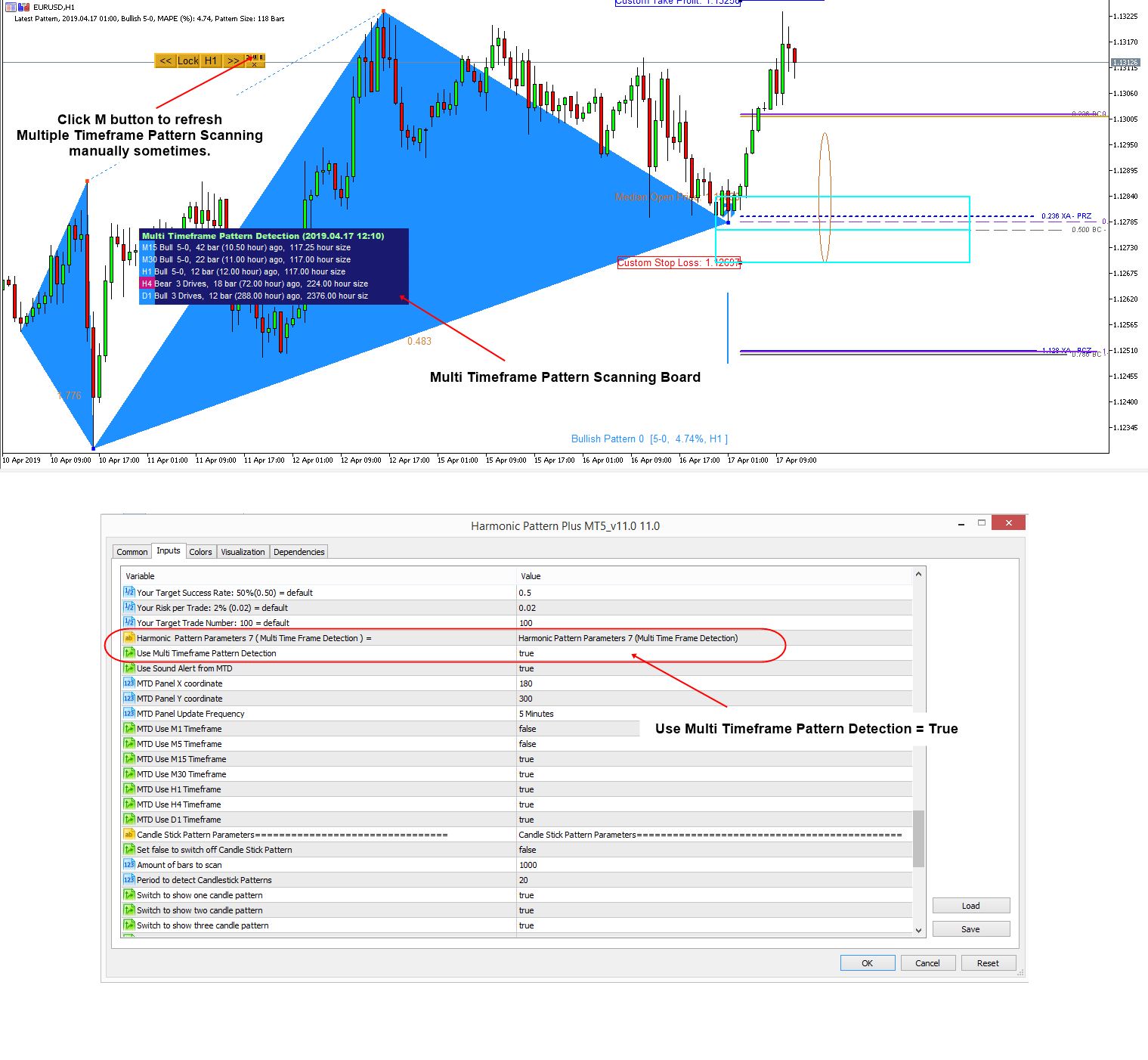

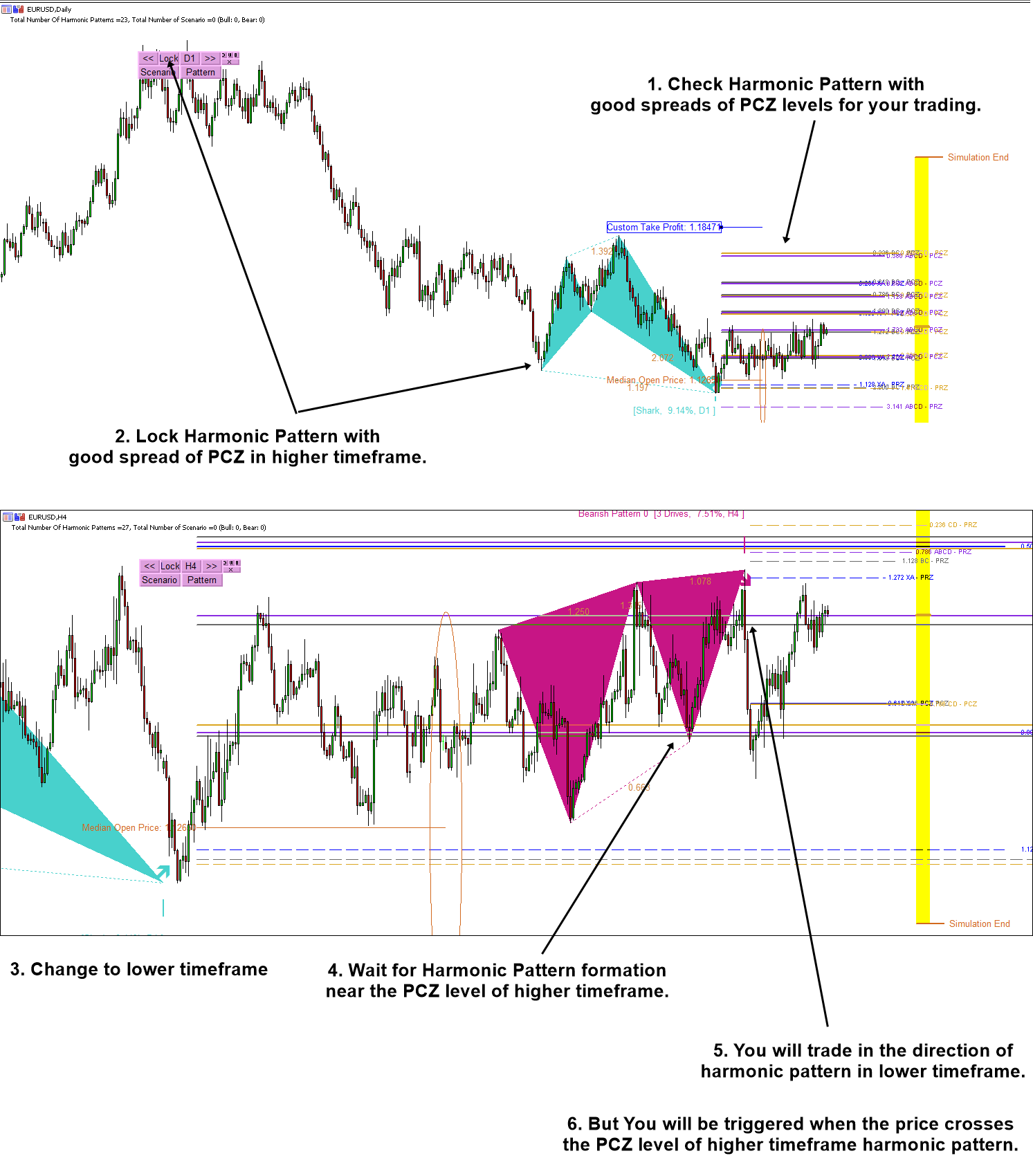

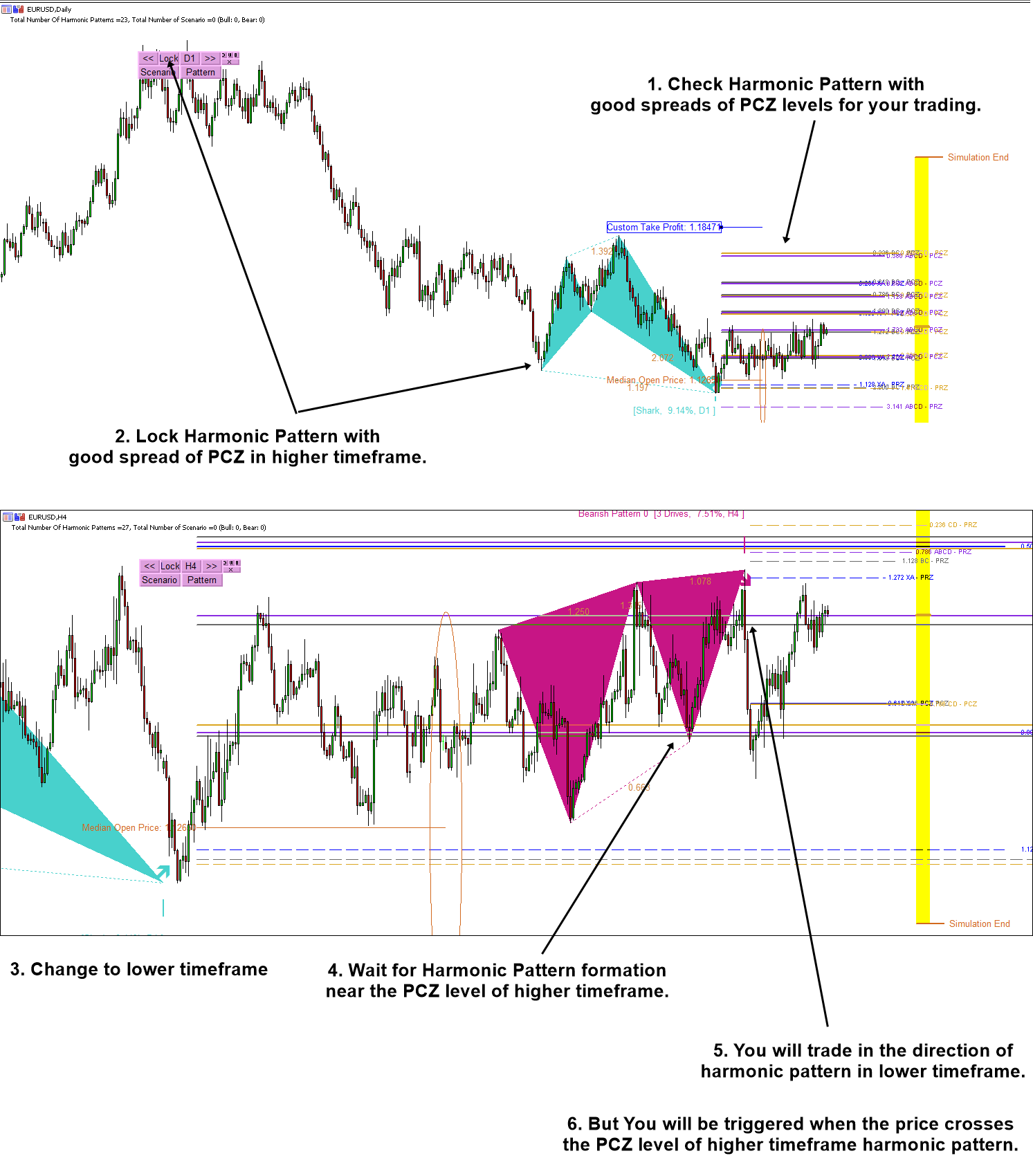

Multiple Timeframe Scanning for Harmonic Pattern

Multiple Timeframe Scanning or multiple timeframe analysis is a convenient feature when you want to trade with Harmonic Pattern. It allows you to alert the latest harmonic pattern across all timeframe. It is handy that you can view all these patterns in one place. Here is simple screenshot showing you how to enable Multiple Timeframe Pattern Scanning in your Harmonic Pattern Plus and Harmonic Pattern Scenario Planner. Just enable Use Multiple Timeframe Pattern Detection = true in your input setting. That is all. Even if you attach one indicator per symbol only, you can still tell if any Harmonic Pattern is formed in another timeframe.

There is small “M” button in your chart in case you want to refresh multiple timeframe pattern scanning manually. If you are using MetaTrader 5 platform, then you might need this sometimes when data is not fully loaded in your MetaTrader. Especially, in MetaTrader 5 platform, it can take sometime to load data on lower and higher timeframe. However, once they are loaded, you should be able to see the patterns detected across all timeframe. In fact, this longer data loading is done because MetaTrader 5 platform is loading tick by tick data, which is really heavy for your CPU and Memory and this can not be controlled by the indicator. Hence, we can not blame the platform builder anyway as they tried to do something good intentionally in their end. Since in MetaTrader 4, they only load Open, High, Low and close price, the data loading time is pretty fast and not noticeable most of time. Please have a look at the YouTube video to understand the multiple timeframe analysis better with Harmonic Pattern.

Please watch YouTube video for full explanation: https://youtu.be/fgPxxBVzER0

Link to Harmonic Pattern Plus

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

Link to Harmonic Pattern Scenario Planner

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

Multiple Timeframe Scanning or multiple timeframe analysis is a convenient feature when you want to trade with Harmonic Pattern. It allows you to alert the latest harmonic pattern across all timeframe. It is handy that you can view all these patterns in one place. Here is simple screenshot showing you how to enable Multiple Timeframe Pattern Scanning in your Harmonic Pattern Plus and Harmonic Pattern Scenario Planner. Just enable Use Multiple Timeframe Pattern Detection = true in your input setting. That is all. Even if you attach one indicator per symbol only, you can still tell if any Harmonic Pattern is formed in another timeframe.

There is small “M” button in your chart in case you want to refresh multiple timeframe pattern scanning manually. If you are using MetaTrader 5 platform, then you might need this sometimes when data is not fully loaded in your MetaTrader. Especially, in MetaTrader 5 platform, it can take sometime to load data on lower and higher timeframe. However, once they are loaded, you should be able to see the patterns detected across all timeframe. In fact, this longer data loading is done because MetaTrader 5 platform is loading tick by tick data, which is really heavy for your CPU and Memory and this can not be controlled by the indicator. Hence, we can not blame the platform builder anyway as they tried to do something good intentionally in their end. Since in MetaTrader 4, they only load Open, High, Low and close price, the data loading time is pretty fast and not noticeable most of time. Please have a look at the YouTube video to understand the multiple timeframe analysis better with Harmonic Pattern.

Please watch YouTube video for full explanation: https://youtu.be/fgPxxBVzER0

Link to Harmonic Pattern Plus

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

Link to Harmonic Pattern Scenario Planner

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

Young Ho Seo

Optimized Harmonic Pattern

Have you ever thought that you could optimize the ratio of each Harmonic Pattern to improve your profit ? In real world trading, each currency or stock can behave differently with different dominating Fibonacci ratios. In addition, we can not assume that one harmonic pattern structure will work best across all currencies and stocks. Hence, there comes the idea of Optimizing the ratio of Harmonic Pattern. For example, you could modify or tune the ratio of Gartley Pattern, Butterfly Pattern, Bat Pattern, Crab Pattern, Cypher Pattern, 5-0 Pattern and so on for each currency or stock if you wish. Or you can modify or tune each Harmonic Pattern to get the overall performance better across all currencies and stocks. It is even better if you can apply the same idea when you trade with Elliott Wave patterns too.

To optimize each Harmonic pattern, you need a tool to visualize the true performance of each Harmonic Pattern through the historical data. It is better if you can see the historical performance directly from your chart without using any other complicated tools or tester or etc.

With X3 Chart Pattern Scanner, you can check the historical performance of Harmonic Pattern for any symbol immediately when you attach it to the chart. This sort of feature is very powerful but unique to X3 Chart Pattern Scanner. For example, You can not check the historical performance of Harmonic Pattern with repainting Harmonic pattern indicator. Since X3 Chart Pattern Scanner is non repainting, non lagging, synced between historical and live pattern, this is possible.

You can trade with optimized strategy in live trading. With X3 Chart Pattern Scanner, you can get the practical performance insight for each Harmonic pattern in few weeks with the historical information. This is really good to learn through your tool direclty and to trade with the same tool. Optimized Harmonic Pattern is a great way of improving your profit. With X3 Chart Pattern Scanner, you can modify or tune each Harmonic Pattern to optimize their trading performance using historical data. You can simply modify the ratio of each Harmonic Pattern in input setting. Below is the link to Non Repainting and Non Lagging Harmonic Pattern and Elliott Wave Pattern Indicator.

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

This Youtube video will explain some features of X3 Chart Pattern Scanner, the non repainting, non lagging harmonic pattern and Elliott Wave pattern indicator. Please watch the video to find out more about the non repainting Harmonic Pattern indicator.

YouTube: https://www.youtube.com/watch?v=uMlmMquefGQ&feature=youtu.be

YouTube: https://www.youtube.com/watch?v=2HMWZfchaEM

YouTube: https://youtu.be/x-ZIipaG4Hg

Have you ever thought that you could optimize the ratio of each Harmonic Pattern to improve your profit ? In real world trading, each currency or stock can behave differently with different dominating Fibonacci ratios. In addition, we can not assume that one harmonic pattern structure will work best across all currencies and stocks. Hence, there comes the idea of Optimizing the ratio of Harmonic Pattern. For example, you could modify or tune the ratio of Gartley Pattern, Butterfly Pattern, Bat Pattern, Crab Pattern, Cypher Pattern, 5-0 Pattern and so on for each currency or stock if you wish. Or you can modify or tune each Harmonic Pattern to get the overall performance better across all currencies and stocks. It is even better if you can apply the same idea when you trade with Elliott Wave patterns too.

To optimize each Harmonic pattern, you need a tool to visualize the true performance of each Harmonic Pattern through the historical data. It is better if you can see the historical performance directly from your chart without using any other complicated tools or tester or etc.

With X3 Chart Pattern Scanner, you can check the historical performance of Harmonic Pattern for any symbol immediately when you attach it to the chart. This sort of feature is very powerful but unique to X3 Chart Pattern Scanner. For example, You can not check the historical performance of Harmonic Pattern with repainting Harmonic pattern indicator. Since X3 Chart Pattern Scanner is non repainting, non lagging, synced between historical and live pattern, this is possible.